ABSTRACT

Tropical fruits are getting more and more popular in Japan. Historically banana is the top imported product in Japan. Due to local production of tropical fruits such as mango, Japanese consumers have more chances to purchase tropical fruits. According to the government's statistics of fruits import, dragon fruit does not appear on the list as its current imported quantity is much less than that of others. In the case of vegetables, lots of varieties of tomatoes are distributed in Japan. Primary value of popular tomato is its brix, which is one of the preferences of Japanese consumers. In order to meet those demands, Japanese growers are developing new varieties to make their business profitable. Distributors are promoting those high value products as “fruit tomato.” In terms of distribution, JA, Japan Agricultural Cooperatives, has been handling fruits and vegetables in the local market in Japan. This conventional distribution system is still a major channel in Japan, however, imported materials are mainly procured by large trading companies and those products are distributed through distributors. In both cases, distribution channel takes longer to reach the consumers. Although banana is the top imported tropical fruit in Japan, avocado shows remarkable growth record in the last decade. Compounded annual growth rate of avocado import is more than 10%. Major reason for this growth is that variety of recipe is introduced to consumers and longer shelf life supports lead time of product distribution in Japan. Based on the current situation of popular fruits and vegetables, key success factor to develop dragon fruit market in Japan is to control quality, brix, shelf life, distribution channel and price.

Keywords: Quality control, brix, shelf life, market development, distribution, promotion, nutrition

INTRODUCTION

Historically, bananas have been the top imported tropical fruit in Japan and it has played a significant role in the importation of fruits in the country. In the last 10 years, domestic mango production in Miyazaki prefecture was getting popular in Japan and this has also contributed to the development of the mango market. It was produced under temperature control in winter season, therefore, the cost is much higher than that of imported materials. On the other hand, avocado import has been growing and stable market is created in Japan. Avocado is currently a commodity product in Japan. If we look at dragon fruit, the imported materials from Vietnam are sold in the market, however, the quantity is much smaller than that of other tropical fruits. In order to develop the Japan market, marketing strategies are needed to attract consumers. In this paper, several successful cases are introduced that are all applicable to the development of the dragon fruit market. The survey in this paper was conducted by the government database, Japan tropical fruit market research and literature published in Japan. In terms of financial data for imported fruit volume and/or value, the information was extracted from the database as well as reports provided by the government office and associated organizations. With respect to agricultural market conditions, distribution channels etc. were referred to literature published in Japan. In this report, market survey was conducted to provide the real situation in the market place which will affect consumers’ decision making.

MATERIALS AND METHODS

This survey was conducted by the research in the market place in Japan, literature published in Japan and government database. In terms of financial data for imported fruit volume and/or value, the information was extracted from database as well as reports provided by government office and other related organizations. With regard to agricultural market conditions, distribution channels etc. were referred to literature published in Japan. In this report, market survey was conducted to provide the real situation in the market place which will affect consumers’ decision making. In terms of price information, the data was extracted from market place as well as available e-commerce market information.

RESULTS AND DISCUSSIOINS

Tropical fruit industry overview in Japan

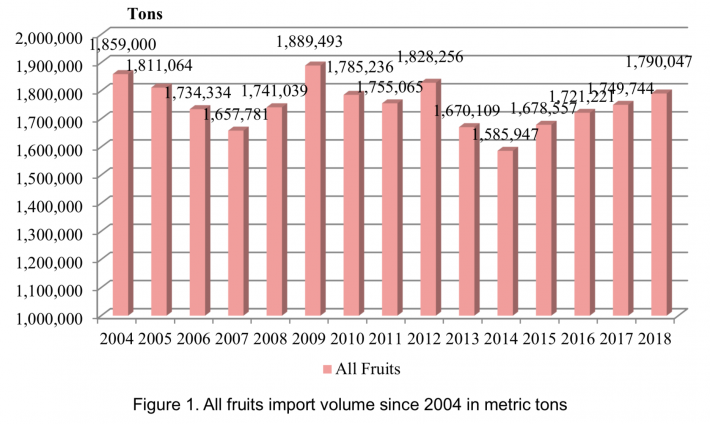

The table below below shows the volume trend of imported fruits since 2004. All fruits imported volume has been fluctuating since 2004. Although current volume is lower level of last 10 years, the volume is still more than 1,600,000 metric tons. It represents significant volume of fruits which are imported to Japan.

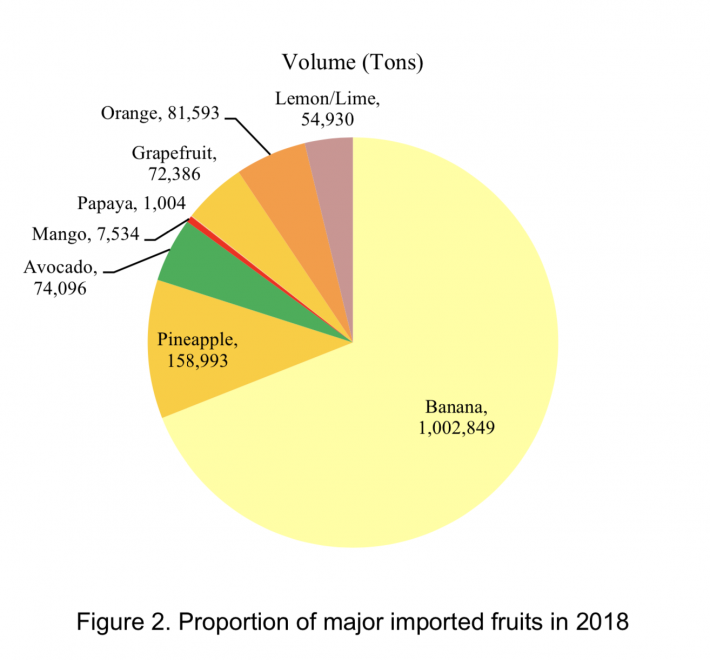

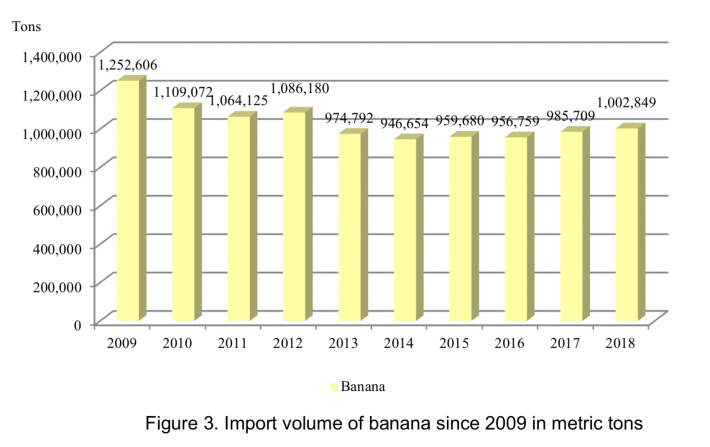

In the category of imported fruits, banana covers significant part of entire volume. As far as tropical fruits are concerned, banana has a significant part of the volume. This is due primarily to the fact that banana is available all- year round, reasonable price, easy to eat, etc. The volume has been declining in recent years, but this is in line with the general trend of all imported fruits in Japan. Pineapple ranks second in terms of largest volume, but it is 19.6% of the banana volume. Other major imported fruits are mainly belonging to the citrus families.

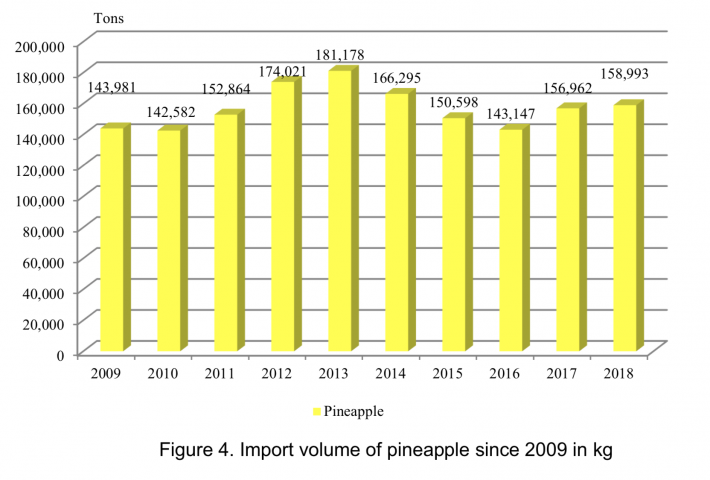

Second major imported tropical fruit is pineapple and the market is stable in the last 10 years, although the volume is much lower than banana.

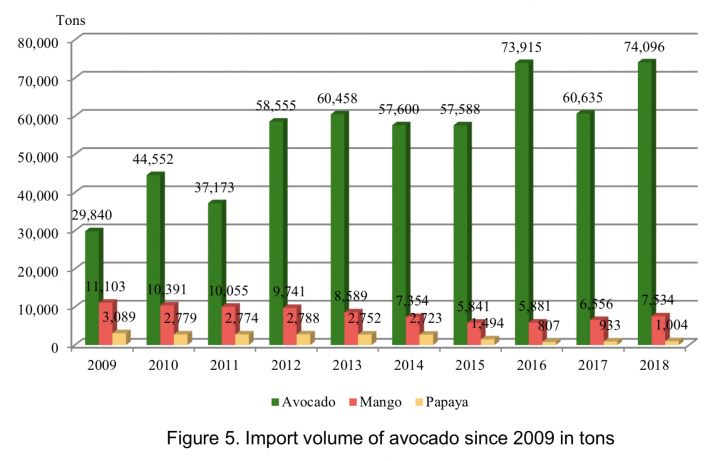

The following chart represents three typical tropical fruits in Japan. Avocado is increasing due to the variety of recipe. In the last 10 years, avocado shows significant increase in the Japanese market. Key drivers for this growth are due primarily to variety of recipe and nutrition. Market penetration of avocado has been done through marketing activities mostly initiated by suppliers as well as recognition of value of avocado by consumers.

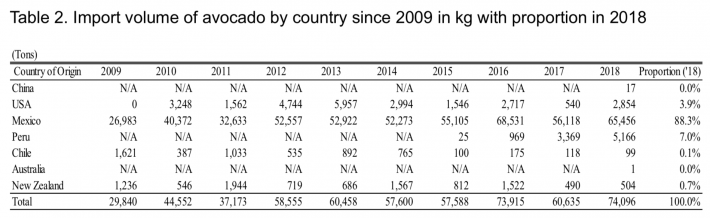

At the same time, local production is challenging due to avocado’s sensitivity for cold temperature and this situation results in high dependency on imported products. Currently local producer is limited in Japan, even though some prefectures are focused strategically on avocado, there is also production on mandarine orange field, which has been considered as traditional domestic fruit. Based on the current condition, majority of avocado consumption is supported by imported materials.

In terms of variety, cavendish ranks first for banana. Major reason is that the product is available all- year round, it has a reasonable price, easy to eat, etc. These factors are making banana popular in Japan. At the same time, functionality or nutrition, i.e., “Polyphenol”, etc. is also a driver to generate a big demand. Due to variety of other products, the volume has declined.

After the introduction to Japan, imported volume of avocado has been increasing significantly. It appears that the reason is similar to that of banana, which has something to do with nutrition. According to the nutrition facts, avocado contains vitamin E. In addition, avocado has a variety of recipes to cook. Therefore, consumers can use this material for their daily meals. From the growers stand point, avocado planting is getting popular as the product demand is increasing.

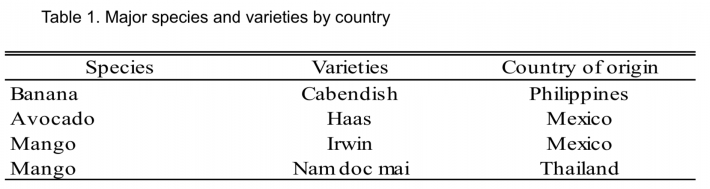

The avocados which are distributed in Japan are mainly imported from Mexico and the variety is Haas. Mango is not increasing although mango related processed foods are very typical e.g. cake, pudding, syrup, etc. In Japan, domestic mango has been popular after Miyazaki prefecture developed local brand. The resale price is around JPY 8,000 – 10,000 per piece (approx. US$ 76.19 – 95.24 at 1US$ = 105JPY). The success factor is to promote to Japanese customers by presenting their appearance and taste. The President of Miyazaki prefecture himself promoted this original brand on a TV program and it boosted the sales in the domestic market. Papaya volume is not so significant. Normally at the supermarket, matured papaya is sold. Okinawa area has variety of recipe for fresh papaya, however, in other areas, fresh papaya recipe is not so popular. The following represents major varieties of banana, avocado and mango. Due to the expansion of direct trading by supermarket, the varieties are increasing.

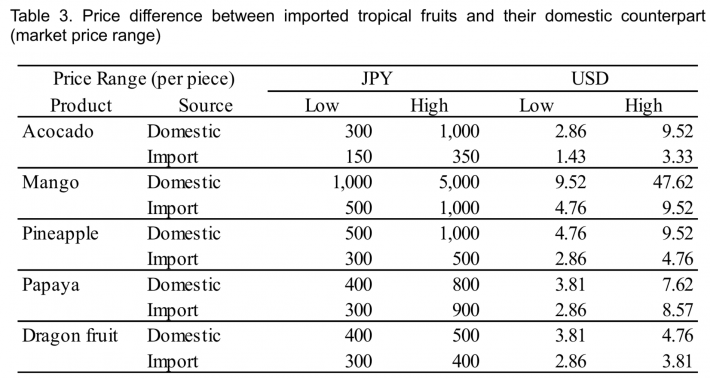

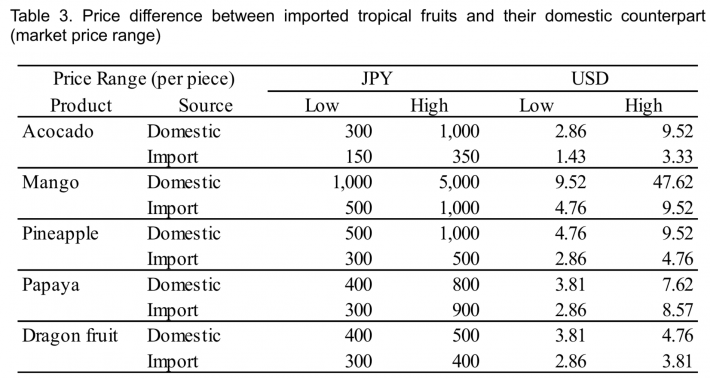

For instance, popular mango variety is Irwin due to the fact that this variety fits Japanese preference. However, premium supermarket promotes other varieties imported from Thailand e.g. nam doc mai, mahachano, etc. Tropical fruits are imported to Japan through the year. If we look at the supermarket, we can easily find banana (Philippines), pineapple (Hawaii), avocado (Mexico), mango (Brazil), etc. The following table represents major seasons for domestic tropical fruits in Okinawa. To export tropical fruits to the Japanese market, these seasons need to be considered to compete along with other domestic products. The following table represents a comparison of major tropical fruits available in the Japanese market. In this analysis, quality difference is not considered among domestic products. In the currency conversion, Japanese Yen is converted to US$ at 1/105.

Imported products are not necessarily more expensive than domestic products. For instance, avocado is cheaper than domestic product. One factor is the zero tariff and this can be an advantage of imported avocado’s promotion. In the case of pineapple, domestic one is sold at JPY300 (approx. US$2.86 at 1US$ = 105JPY) at direct retail shop at Ishigaki island of Okinawa. This price is slightly lower than that of Philippines’ one sold at premium supermarket in Tokyo. However, domestic product at Ishigaki island is a commodity product compared to the Philippines’ high value product. For instance, papaya (2 pieces package) imported from Philippines is sold at JPY398 (US$3.79) vs. Ishigaki island’ (one piece) is at around JPY350-650 (US$3.33 – 6.19 at 1US$ = 105JPY). Domestic mango price is still high due primarily to warming cost at green house except Okinawa area (e.g. Miyazaki). At the premium supermarket, discounted price of domestic mango (variety is Irwin) is JPY1,990 (US$18.95 at 1US$= 105JPY). The following pictures show imported dragon fruit at premium supermarkets in Tokyo and domestic one at the local market in Okinawa. The retail price of imported one is JPY298 (apprx. US$2.84 at 1US$ = 105JPY), which is much lower than that of domestic one. Price of domestic dragon fruit is JPY400-500 (approx. US$3.81-4.76 at 1US$ = 105JPY). This is due to production volume of dragon fruit in Japan is small.

In terms of processed tropical fruit, popular product is canned pineapple and it has been distributed in Japan since the 1960s to 1970s In the case of pineapple, domestic canned pineapple was produced in Okinawa in the 1960s. Due to free trade momentum, regulation of frozen pineapple imported to Japan was released in the 1970s The other case of processed food is bottled coconut oil. At the supermarket in Tokyo, three types of products are sold – regular coconut oil, organic coconut oil and virgin coconut oil. Retail price is JPY790, JPY 1,600 and JPY1,980. Variety of imported mango has been varied and not only Irwin from Brazil but also nam doc mai and mahachano from Thailand are available at premium supermarket. Currently durian is also available at the local retail shop in Tokyo. The price of one durian is JPY2,500 (approx. US$23.81 at 1US$ = 105JPY). Currently, trading volume of durian is small, however, as there is a demand in Japanese market, durian can be a competitive tropical fruit product from exporters’ stand point. In addition, local production is not so easy even in Okinawa, therefore, there is no competition with local producers in Japan.

Market situation of dragon fruit business in Japan

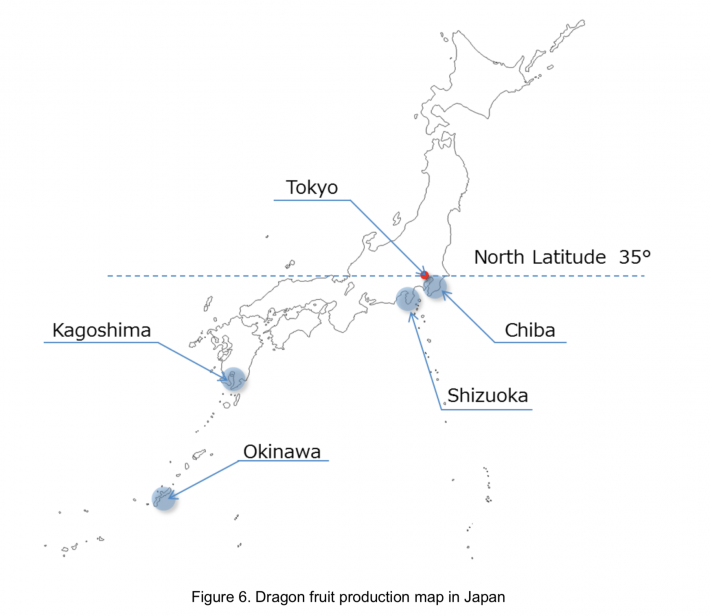

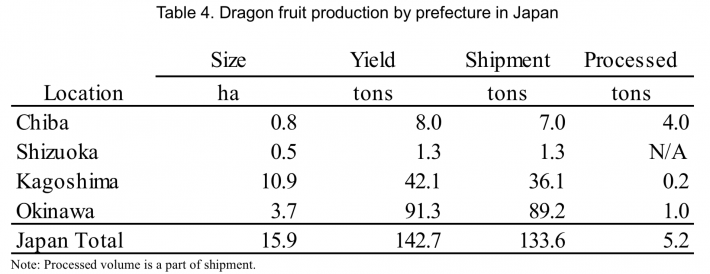

Dragon fruit is being distributed in the Japanese market, however, the quantity is much smaller than other top 10 products. Due to its lower volume, detailed information such as import volume as well as import value of dragon fruit, varieties, etc. are not available. Local production of dragon fruit is limited to a couple of prefectures. The following are the places where the heavy concentration of dragon fruit production are in Japan.

Current consumption of dragon fruit is small in the Japanese market, however, it shows there is a potential market for this product depending upon the value of this fruit. Based on the nature of the product, dragon fruit is a commodity just like avocado. Key success factor is to add value in the product. This topic is also covered in the section of Best practices of the fruit industry in Japan. Dragon fruit is already distributed in Japan through trading companies. In order to expand the dragon fruit market, branding is important to make consumers recognize the product. Major influencer in Japan is women and particularly the younger generation is creating trend to make products grow. Those customers are contributors. In order to develop the dragon fruit market in Japan, the following has to be addressed:

- Food safety

- High quality both in appearance and brix to keep price

- Cold chain to keep quality

- Minimal distribution channel to keep margin

- Dragon fruit value to convince customers of its health benefits

Recent trend of agriculture in Japan

Currently, domestic producers can supply various tropical fruit which is produced in a warming green house. For instance, mango is produced even in Hokkaido, which is most northern part in Japan. Additionally, global warming trend is gradually affecting fruit production in Japan. Planting areas of mandarin orange, apple, cherry, etc. is shifting to northern part of Japan. Major agricultural newspaper introduces farmers’ activities for tropical fruits planting in Japan. On the other hand, some farmers are intended to generate more profits, therefore, those farmers are developing their own market and making more profit. If we look at the growth of the avocado market, long shelf life, variety of recipe and nutrition are the keys for success. The Ministry of Agriculture, Forestry and Fishery (MAFF) is recommending risk management for food safety based on scientific approach. They mentioned that ideal steps are collection and analysis of food safety information. One other thing we need to consider is that many Japanese consumers prefer domestic products.

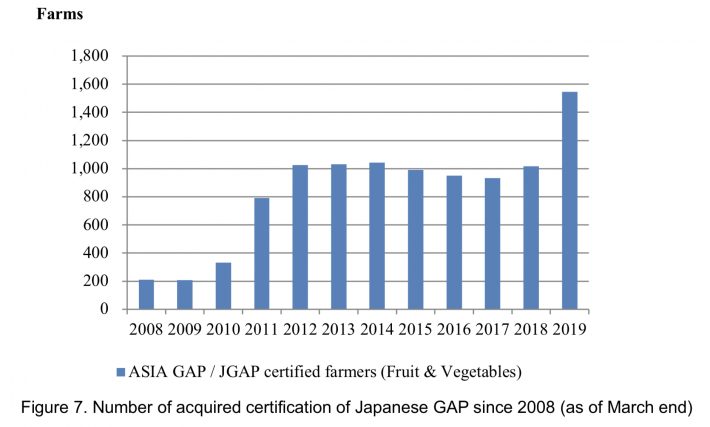

The following data shows the proportion is increasing in the last three years. In order to improve food safety, the number of farmers in Japan who adopt GAP is increasing. This certification is to assure that the farm is well managed in terms of cultivation, production and house keeping at the farmer’s site. It generated reliability for the goods produced by that farmer and consumers look at this certification as one criterion. Although global GAP is the most popular, Japanese GAP is being well known by farmers is Japan. According to the report published by Ministry of Agriculture, Forestry and Fishery (MAFF), the number of producers have been adopting GAP. In addition, the report recommended that farmers should adopt GAP in order to pursue food safety. They mentioned that GAP is pretty important particularly in the production process. They also explained that GAP adoption leads not only to food safety but labor safety, competitiveness, quality improvement, management improvement and efficiency. In the case of Japan, GAP certification has been varied from farmers union, local government, distributors and other private groups. Therefore, MAFF implemented a guideline in 2010 to clarify common platform of GAP.

This situation means Japanese growers are recognizing that Japanese GAP certification will add more value on their products from a distribution perspective. For instance, general merchandising store in Japan is promoting food by disclosing visible information of producers with certification i.e. Organic JAS (Japanese Agricultural Standard). Given the fact that more than 2500 locations have already adopted GAP certification and it has been common process among agriculturists in Japan, imported fruits should also have GAP certification in the exporting country.

Food communication project (FCP) was developed by Ministry of Agriculture, Forestry and Fishery (MAFF) in order to improve reliability of food. The purpose of this project is to visualize the food supply chain and to provide information to consumers related to stakeholders in the supply chain process. As of May 28, 2018, 1,998 organizations participated in this initiative. According to the concept of FCP, food suppliers should comply with factory audit process, public relations, etc. to present credibility, which will convince consumers that the food is reliable. This initiative has been modified to be in line with global standard of Global Food Safety Initiative (GFSI).

Distribution channels in Japan

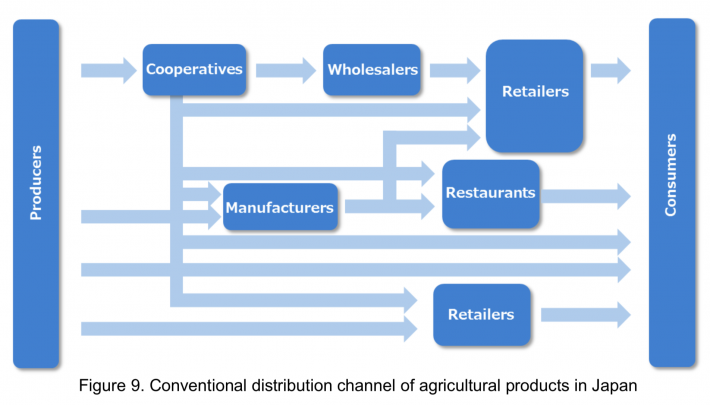

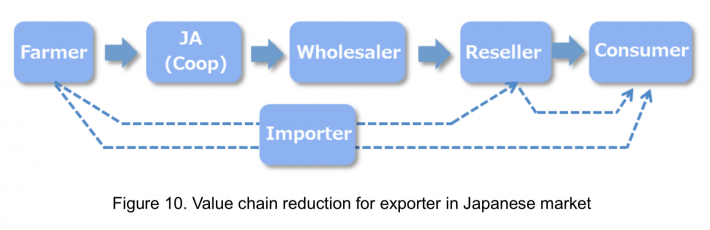

Historically the Japanese market has been controlled by Japan cooperatives. This organization has been purchasing products from growers and maintains product quality. In the case of Japan, long distribution channel is a challenge for fresh fruits.

Conventionally distribution channels in Japan primarily consist of Co-op with market and direct distribution channels by wholesalers. Co-op has been providing variety of support to farmers not only for cultivation but also for financing for daily operations. From the farmers’ perspective, the Co-op has an important value as they are the sole purchaser as well as distributor of agricultural goods. Additionally, financial support is provided. Therefore, small-sized farmers still rely on the Co-op system. Recently big supermarket is procuring products directly from the farmers. The reduction of supply chain process can provide consumers with fresh foods. It also guarantees that the products are produced by reliable growers which are visible to consumers. From a financial stand point, value chain reduction can generate more profits to suppliers.

Other distribution channels are local farmers markets located in each prefecture in Japan. At this point in time, more than 15,000 markets exist. Major network is a market place network along with national routes, managed by Ministry of Land and Transportation. This network is called by “Michi no eki”. This facility normally has gas station, restaurant, café, gardening shop as well as farmers market, which is sourced from local production area.

In order to develop the distribution channel of tropical fruit, original approach for market access is needed other than conventional distribution such as JA (Japan Agricultural Cooperative). Additionally, it is important to establish direct relationship with market or resellers to develop direct distribution channel to earn profit. This approach is able to seek opportunities to develop profitable and sustainable distribution channel.

Currently more and more growers are trying to promote their products via internet shop. Given the fact that more and more consumers search products via internet, the research for e-commerce of tropical fruit is also necessary.

Import conditions

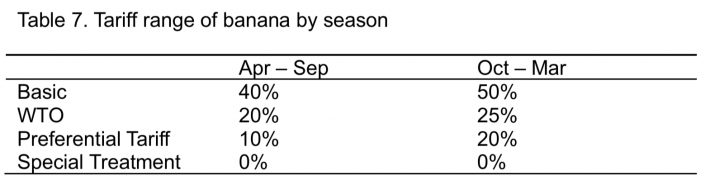

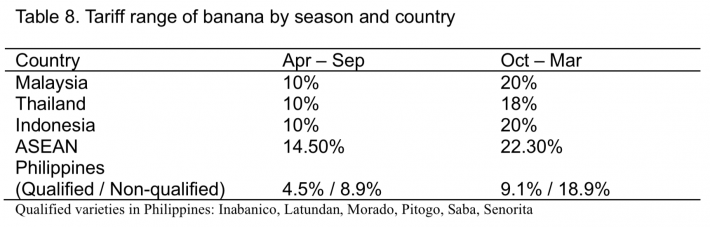

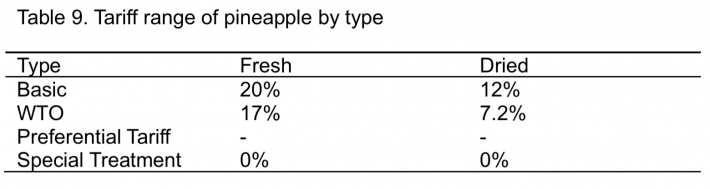

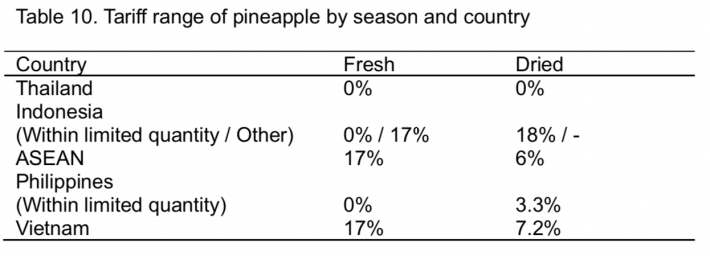

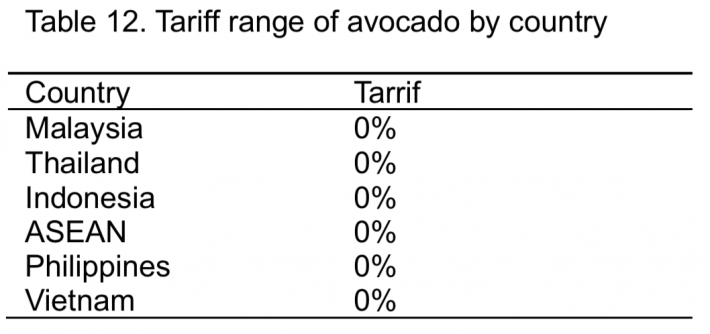

The following tables show tariff range by major crop for year-round and seasonal production of dragon fruit. The tariff varies from crop to crop and country to country as there are special treatments between Japan and other exporting countries. The difference of tariff can be an advantage of retail price of imported tropical fruits. The possible impact of specific products can be seen in the price difference section.

For other tropical fruits such as guava, mango and mangosteen, tariff is the same as avocado. There is no description whether the product is fresh or dried.

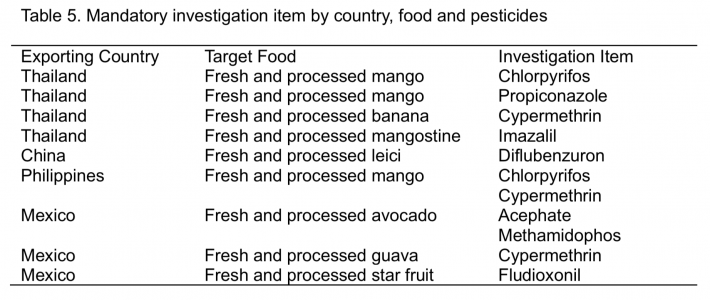

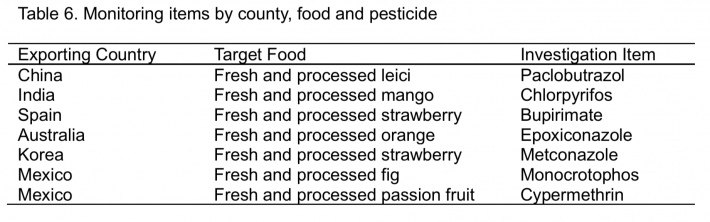

In terms of phytosanitary requirement, there was an amendment of fumigant usage for imported fruit. Due to revision of the Food Sanitation Law in 2003, positive list was developed in 2006 in order to prevent food distribution if the residual value of pesticide is exceeding the criterion. New standard was developed for fumigants such as methyl bromide, hydrocyanic acid and aluminum phosphide. For the pesticides which were listed in the above initiative, Food Safety Committee developed Acceptable Daily Intake (ADI) for pesticide according to the investigation by Ministry of Agriculture, Forestry and Fishery (MAFF) as well as evaluation of residual value by Ministry of Health, Labor and Welfare (MHLW). Residue criterion was determined by the ADI. In 2011, there was an amendment of Phytosanitary Law to be in accordance with international rule. Additionally, positive list was implemented to be able to conduct pest risk analysis. Japan has been participating in the implementation for International Standards for Phytosanitary Measures (ISPM). In 2013, Ministry of Health, Labor and Welfare (MHLW) announced that investigation should be conducted for specific fruits. With respect to monitoring, frequency is 30% for imported document submissions. In addition, traders who violated the rule need to perform self-investigation. This task continues for one year or up to 60 investigations.

Supply chain management

Optimazation of supply chain is a key to deliver fresh fruits from the source location to the market. In order to keep the freshness of dragon fruit, air shipment will be necessary to transport to Japan. This means air freight needs to be managed within product price. Location of Vietnam has a benefit as the distance is shorter than that of Brazil, for mango, and Mexico for avocado.

Packaging is an important aspect to distribute products in the Japanese market. Same as domestic products, fresh fruits are carefully packed and controlled by high level of quality. With respect to packaging, most of consumer products are contained in a clean package. At the same time, source location is indicated. At the premium supermarkets in Japan, local fruits and tropical fruits are sold together, therefore, customers can easily compare the products from various stand points. In the case of tropical fruits, some domestic products are also available so that attractiveness is an important factor for promoting import materials.

Customer-oriented strategy is shown at the packaging style of imported tropical fruit at famous premium supermarkets located in Tokyo. GMO papaya from Hawaii is packed in a plastic bag by one piece. Mangosteen from Thailand is packed with foam bag with five pieces. These appearances show consumers high quality, safe and premium products. At the same premium supermarket, avocado is carefully wrapped with foam bag and sold at JPY228 per piece, which is approx. US$2.17 (at 1US$ = 105JPY).

If you look at the domestic fruit, high value grape is wrapped with a foam bag and packed in a plastic case with a paper base. Grape is a sensitive product so that high value one is treated with care. Retail price for this product is JPY890 – JPY990 (approx.US$8.48 – US$9.43 at 1US$ = 105JPY). Japanese customers are very specific about quality and safety. These factors are much more important than price competitiveness. Ministry of Agriculture, Forestry and Fishery (MAFF) reported initiatives related to food safety and risk management processes.

Consumers’ preferences

Japanese consumers prefer clean and safe products. Farmers are very sensitive to ship products to the market as the appearance is one of important criteria for food distribution in Japan. If there are some damages, the price significantly goes down. In addition, Japanese local fruits are carefully grown and packed to deliver to the consumers. Appearance is one of the keys to attract Japanse consumers. At the same time, Japanese find lots of value of fruits on high brix. At the retail shop, high brix is emphasized as this is one of key values of fruit in Japanese market. Particularly after the disaster in 2011, Japanese consumers are more and more food safety conscious. The criteria are radiation level, treatment by agrochemical and chemical fertilizers, etc. Tracking system and visibility are necessary in order to penetrate into Japanese consumer market. Therefore, food safety is also an important aspect.

After the disaster happened in March 2011, Japanese consumers are much conscious about radiation effect and source location of the products. To meet those customers focus, food suppliers are conducting investigation of radiation level, disclosing traceability of the products such as producer, location, chemical usage, etc. Another case is mandarin orange from Australia. 6 pieces are sold at JPY398 (approx. US$3.79 at 1US$ = 105JPY). Product related information is provided on the tags and it says some chemicals are used. This action is one of disclosure of the production processes to consumers. Due to this situation, many consumers can easily search product information and evaluation. In addition, rumors can easily be spread to many people, therefore, suppliers activities are always watched by the consumers. When the products are imported to Japan, post-harvest treatment is one of key successful factors. At the same time, Japanese consumers are specific for the chemical treatment, contained chemical level needs to as minimal as possible and it has to be disclosed to make the product reliable.

Best practices in Japan’s fruit industry

In the fruit market in Japan, kiwi fruit is would be the best practice in terms of marketing. One famous brand is promoting a couple of varieties. This brand has lots of exposures in the market place. In order to aquire costomers’ interest, promotional activities are necessary. If we look at avocado, Japanese consumers have a variety of recipes to enjoy this fruit. It is imported as tropical fruit, currently it is used for cooking. Some Japanese prefer to eat avocado with soy source and “wasabi,” which is traditional spicy paste used for sushi. Given the fact that new recipes have been developed in Japan, tropical fruit suppliers need to provide information on how to cook, how to eat, etc. More importantly, suppliers have to sell recipes, not the material.

Traditional popular tropical fruits are also sold at high value. Banana from Philippines and Ecuador is packed on a single piece basis or a couple of pieces. Pineapples from the Philippines are packed in a plastic bag and advertised as “high brix.” There are fruit gift shops in the big cities and major department stores have a premium fruit shop. At those shops, most of the demands are social gifts by corporation and/or individuals. Due to the nature of customers’ purchasing purposes, retail price are high compared to premium supermarkets. According to the website of popular fruit gift shop (“Sembikiya”), domestic melons and/or mangoes are sold at around JPY5,000 - 10,000 (approx. US$47.62 – US$95.24 at 1US$ = 105JPY). At the premium supermarket, most of the customers are housewives. It appears that the purpose of the purchase is for daily use or for special occasions rather than as gifts. The retail price is lower than that of fruit gift shop, but the price is still higher than that of the regular market. If the product quality meets consumers’ needs, growers and/or suppliers are able to earn more profit. For instance, Mexican avocado is sold at more than US$2 at premium super market. Japanese consumers are more and more food safety conscious particularly after the disaster in 2011. Tracking system and visibility are necessary in order to penetrate into Japanese consumer market. This situation would be a burden to exporters to Japanese market, yet high quality and safe products can be accepted at higher value to the demanding consumers, which is positive to growers. In order to pursue these initiatives, the following aspects will be needed:

- Quality control by farmers to attract consumers in high value market

- Post-harvest treatment to maintain good quality while transportation

- Providing valuable information to consumers

From different perspective, marketing effort is an important factor to make tropical fruits more popular in Japan. In addition to functionality and nutrition of tropical fruit, promotional activity is a key element in order to penetrate the product into the Japanese market. In order to promote the products efficiently, media strategy needs to be developed such as social network system. Visibility in production process is also critical to assure quality control. At the same time, traceability is to convince safety-conscious customers.

CONCLUSION

Based on the current situation of the tropical fruit industry in Japan, key successful factors are to define dragon fruit position in the tropical fruit market in Japan. In order to make this happen, best practices of popular imported fruits in Japan need to be applied to dragon fruit. If this business development process is completed, it is anticipated that dragon fruit will be exposed to the market place and attract demanding customers in Japan. In order to develop dragon fruit business in Japan, promotional activities need to be managed properly. There are different types of promotions depending on the fruits. For instance, bananas have been the top the tropical fruit market in Japan. Banana is a typical commodity product; however, premium product is also developed by high quality and high brix. In the case of avocado, import volume has been significantly increased due to variety of recipe and nutrition. Avocado market has been developed without specific suppliers’ promotion. One other typical case is kiwi fruit. This product is promoted by one single brand and the brand name was established. In terms of product positioning, due to the nature of dragon fruit, product position is assumed to be imported mango and papaya. Depending upon the quality, premium grade can be developed in the market. Although banana and avocado are commodities in the Japanese market, premium product is also available with higher brix, higher quality, etc. For supply chain, due to the nature of the fresh fruits optimization of supply chain needs to be focused. Air shipment can keep freshness of the product but the cost will be added on the product price. In order to make a profitable business, efficient supply chain management should be the key. In quality control, because of the consumers’ preferences, higher level of quality control is important to develop the market in Japan. It means stable quality control will sustain customers and will acquire new customers. At the same time, quality assurance is critical in order to supply quality material to high value market in Japan, quality assurance is important when material is produced in Vietnam. In terms of distribution in Japan, most of local fruits are distributed through cooperatives network, but the margin for growers are limited compared to direct distribution. In order to make a profit, direct distribution needs to be considered. The dragon fruit industry will be established in Japan under a robust and dynamic marketing strategy activities emphasizing nutrition, quality control to increase brix and supply chain to support the fruit shelflife.

REFERENCES

Ministry of Agriculture, Forestry and Fishery. 2013. Report for food, agriculture and farm, 2013. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2014. Report for food, agriculture and farm, 2014. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2015. Report for food, agriculture and farm, 2015. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2016. Report for food, agriculture and farm, 2016. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2017. Report for food, agriculture and farm, 2017. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2018. Report for food, agriculture and farm, 2018. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2018. Report for food, agriculture and farm, 2014. Nikkei Insatsu Publications (Japan). pp. 40-122.

Ministry of Finance. 2014. Annual data for imported materials. http://www.customs.go.jp/toukei/info/tsdl.htm.

Almanac of Tropical Fruits. 2009. Foundation of Marine Exhibition Memorial Park. Publications of Marine Exhibition Memorial Park Foundation (Japan). pp. 144-146.

Association of fruit importation. 2014. Annual data for imported fruits. http://www.fruits-nisseikyo.or.jp/index.html.

Yoshiko Kagawa. 2012. Food nutrition content 2012. Women College of Nutrition Publications (Japan). pp. 88-89.

Japan GAP Association. 2012. Public guidebook for JGAP. Publications of Japan GAP Association. pp. 2-31, 102-135.

Hironori Yagi. 2010. A book for understanding of agriculture by professional. Natsume Publications (Japan). pp. 144-151.

Kimie Tsukuba. 2009. To better understand for agricultural trend and structures. Shuwa System Publications (Japan). pp. 114-115, 124-127.

Agricultural Research Group. 2010. Research for agricultural industry. Sangakusha Publications (Japan). pp. 34-37,

Nobuko Yoshiki. 2012. Encyclopedia for Correct Anti-aging care. Takahashi Shoten Publications (Japan). pp. 100-115.

Nobuko Yoshiki, Miyoji Okabe, Makiko Oda. 2012. Correct Skin Care Encyclopedia. Takahashi Shoten Publications (Japan). pp. 86-95.

Date submitted: September 10, 2019

Reviewed, edited and uploaded: October 24, 2019 |

The Dragon Fruit Industry and Import Situation in Japan

ABSTRACT

Tropical fruits are getting more and more popular in Japan. Historically banana is the top imported product in Japan. Due to local production of tropical fruits such as mango, Japanese consumers have more chances to purchase tropical fruits. According to the government's statistics of fruits import, dragon fruit does not appear on the list as its current imported quantity is much less than that of others. In the case of vegetables, lots of varieties of tomatoes are distributed in Japan. Primary value of popular tomato is its brix, which is one of the preferences of Japanese consumers. In order to meet those demands, Japanese growers are developing new varieties to make their business profitable. Distributors are promoting those high value products as “fruit tomato.” In terms of distribution, JA, Japan Agricultural Cooperatives, has been handling fruits and vegetables in the local market in Japan. This conventional distribution system is still a major channel in Japan, however, imported materials are mainly procured by large trading companies and those products are distributed through distributors. In both cases, distribution channel takes longer to reach the consumers. Although banana is the top imported tropical fruit in Japan, avocado shows remarkable growth record in the last decade. Compounded annual growth rate of avocado import is more than 10%. Major reason for this growth is that variety of recipe is introduced to consumers and longer shelf life supports lead time of product distribution in Japan. Based on the current situation of popular fruits and vegetables, key success factor to develop dragon fruit market in Japan is to control quality, brix, shelf life, distribution channel and price.

Keywords: Quality control, brix, shelf life, market development, distribution, promotion, nutrition

INTRODUCTION

Historically, bananas have been the top imported tropical fruit in Japan and it has played a significant role in the importation of fruits in the country. In the last 10 years, domestic mango production in Miyazaki prefecture was getting popular in Japan and this has also contributed to the development of the mango market. It was produced under temperature control in winter season, therefore, the cost is much higher than that of imported materials. On the other hand, avocado import has been growing and stable market is created in Japan. Avocado is currently a commodity product in Japan. If we look at dragon fruit, the imported materials from Vietnam are sold in the market, however, the quantity is much smaller than that of other tropical fruits. In order to develop the Japan market, marketing strategies are needed to attract consumers. In this paper, several successful cases are introduced that are all applicable to the development of the dragon fruit market. The survey in this paper was conducted by the government database, Japan tropical fruit market research and literature published in Japan. In terms of financial data for imported fruit volume and/or value, the information was extracted from the database as well as reports provided by the government office and associated organizations. With respect to agricultural market conditions, distribution channels etc. were referred to literature published in Japan. In this report, market survey was conducted to provide the real situation in the market place which will affect consumers’ decision making.

MATERIALS AND METHODS

This survey was conducted by the research in the market place in Japan, literature published in Japan and government database. In terms of financial data for imported fruit volume and/or value, the information was extracted from database as well as reports provided by government office and other related organizations. With regard to agricultural market conditions, distribution channels etc. were referred to literature published in Japan. In this report, market survey was conducted to provide the real situation in the market place which will affect consumers’ decision making. In terms of price information, the data was extracted from market place as well as available e-commerce market information.

RESULTS AND DISCUSSIOINS

Tropical fruit industry overview in Japan

The table below below shows the volume trend of imported fruits since 2004. All fruits imported volume has been fluctuating since 2004. Although current volume is lower level of last 10 years, the volume is still more than 1,600,000 metric tons. It represents significant volume of fruits which are imported to Japan.

In the category of imported fruits, banana covers significant part of entire volume. As far as tropical fruits are concerned, banana has a significant part of the volume. This is due primarily to the fact that banana is available all- year round, reasonable price, easy to eat, etc. The volume has been declining in recent years, but this is in line with the general trend of all imported fruits in Japan. Pineapple ranks second in terms of largest volume, but it is 19.6% of the banana volume. Other major imported fruits are mainly belonging to the citrus families.

Second major imported tropical fruit is pineapple and the market is stable in the last 10 years, although the volume is much lower than banana.

The following chart represents three typical tropical fruits in Japan. Avocado is increasing due to the variety of recipe. In the last 10 years, avocado shows significant increase in the Japanese market. Key drivers for this growth are due primarily to variety of recipe and nutrition. Market penetration of avocado has been done through marketing activities mostly initiated by suppliers as well as recognition of value of avocado by consumers.

At the same time, local production is challenging due to avocado’s sensitivity for cold temperature and this situation results in high dependency on imported products. Currently local producer is limited in Japan, even though some prefectures are focused strategically on avocado, there is also production on mandarine orange field, which has been considered as traditional domestic fruit. Based on the current condition, majority of avocado consumption is supported by imported materials.

In terms of variety, cavendish ranks first for banana. Major reason is that the product is available all- year round, it has a reasonable price, easy to eat, etc. These factors are making banana popular in Japan. At the same time, functionality or nutrition, i.e., “Polyphenol”, etc. is also a driver to generate a big demand. Due to variety of other products, the volume has declined.

After the introduction to Japan, imported volume of avocado has been increasing significantly. It appears that the reason is similar to that of banana, which has something to do with nutrition. According to the nutrition facts, avocado contains vitamin E. In addition, avocado has a variety of recipes to cook. Therefore, consumers can use this material for their daily meals. From the growers stand point, avocado planting is getting popular as the product demand is increasing.

The avocados which are distributed in Japan are mainly imported from Mexico and the variety is Haas. Mango is not increasing although mango related processed foods are very typical e.g. cake, pudding, syrup, etc. In Japan, domestic mango has been popular after Miyazaki prefecture developed local brand. The resale price is around JPY 8,000 – 10,000 per piece (approx. US$ 76.19 – 95.24 at 1US$ = 105JPY). The success factor is to promote to Japanese customers by presenting their appearance and taste. The President of Miyazaki prefecture himself promoted this original brand on a TV program and it boosted the sales in the domestic market. Papaya volume is not so significant. Normally at the supermarket, matured papaya is sold. Okinawa area has variety of recipe for fresh papaya, however, in other areas, fresh papaya recipe is not so popular. The following represents major varieties of banana, avocado and mango. Due to the expansion of direct trading by supermarket, the varieties are increasing.

For instance, popular mango variety is Irwin due to the fact that this variety fits Japanese preference. However, premium supermarket promotes other varieties imported from Thailand e.g. nam doc mai, mahachano, etc. Tropical fruits are imported to Japan through the year. If we look at the supermarket, we can easily find banana (Philippines), pineapple (Hawaii), avocado (Mexico), mango (Brazil), etc. The following table represents major seasons for domestic tropical fruits in Okinawa. To export tropical fruits to the Japanese market, these seasons need to be considered to compete along with other domestic products. The following table represents a comparison of major tropical fruits available in the Japanese market. In this analysis, quality difference is not considered among domestic products. In the currency conversion, Japanese Yen is converted to US$ at 1/105.

Imported products are not necessarily more expensive than domestic products. For instance, avocado is cheaper than domestic product. One factor is the zero tariff and this can be an advantage of imported avocado’s promotion. In the case of pineapple, domestic one is sold at JPY300 (approx. US$2.86 at 1US$ = 105JPY) at direct retail shop at Ishigaki island of Okinawa. This price is slightly lower than that of Philippines’ one sold at premium supermarket in Tokyo. However, domestic product at Ishigaki island is a commodity product compared to the Philippines’ high value product. For instance, papaya (2 pieces package) imported from Philippines is sold at JPY398 (US$3.79) vs. Ishigaki island’ (one piece) is at around JPY350-650 (US$3.33 – 6.19 at 1US$ = 105JPY). Domestic mango price is still high due primarily to warming cost at green house except Okinawa area (e.g. Miyazaki). At the premium supermarket, discounted price of domestic mango (variety is Irwin) is JPY1,990 (US$18.95 at 1US$= 105JPY). The following pictures show imported dragon fruit at premium supermarkets in Tokyo and domestic one at the local market in Okinawa. The retail price of imported one is JPY298 (apprx. US$2.84 at 1US$ = 105JPY), which is much lower than that of domestic one. Price of domestic dragon fruit is JPY400-500 (approx. US$3.81-4.76 at 1US$ = 105JPY). This is due to production volume of dragon fruit in Japan is small.

In terms of processed tropical fruit, popular product is canned pineapple and it has been distributed in Japan since the 1960s to 1970s In the case of pineapple, domestic canned pineapple was produced in Okinawa in the 1960s. Due to free trade momentum, regulation of frozen pineapple imported to Japan was released in the 1970s The other case of processed food is bottled coconut oil. At the supermarket in Tokyo, three types of products are sold – regular coconut oil, organic coconut oil and virgin coconut oil. Retail price is JPY790, JPY 1,600 and JPY1,980. Variety of imported mango has been varied and not only Irwin from Brazil but also nam doc mai and mahachano from Thailand are available at premium supermarket. Currently durian is also available at the local retail shop in Tokyo. The price of one durian is JPY2,500 (approx. US$23.81 at 1US$ = 105JPY). Currently, trading volume of durian is small, however, as there is a demand in Japanese market, durian can be a competitive tropical fruit product from exporters’ stand point. In addition, local production is not so easy even in Okinawa, therefore, there is no competition with local producers in Japan.

Market situation of dragon fruit business in Japan

Dragon fruit is being distributed in the Japanese market, however, the quantity is much smaller than other top 10 products. Due to its lower volume, detailed information such as import volume as well as import value of dragon fruit, varieties, etc. are not available. Local production of dragon fruit is limited to a couple of prefectures. The following are the places where the heavy concentration of dragon fruit production are in Japan.

Current consumption of dragon fruit is small in the Japanese market, however, it shows there is a potential market for this product depending upon the value of this fruit. Based on the nature of the product, dragon fruit is a commodity just like avocado. Key success factor is to add value in the product. This topic is also covered in the section of Best practices of the fruit industry in Japan. Dragon fruit is already distributed in Japan through trading companies. In order to expand the dragon fruit market, branding is important to make consumers recognize the product. Major influencer in Japan is women and particularly the younger generation is creating trend to make products grow. Those customers are contributors. In order to develop the dragon fruit market in Japan, the following has to be addressed:

Recent trend of agriculture in Japan

Currently, domestic producers can supply various tropical fruit which is produced in a warming green house. For instance, mango is produced even in Hokkaido, which is most northern part in Japan. Additionally, global warming trend is gradually affecting fruit production in Japan. Planting areas of mandarin orange, apple, cherry, etc. is shifting to northern part of Japan. Major agricultural newspaper introduces farmers’ activities for tropical fruits planting in Japan. On the other hand, some farmers are intended to generate more profits, therefore, those farmers are developing their own market and making more profit. If we look at the growth of the avocado market, long shelf life, variety of recipe and nutrition are the keys for success. The Ministry of Agriculture, Forestry and Fishery (MAFF) is recommending risk management for food safety based on scientific approach. They mentioned that ideal steps are collection and analysis of food safety information. One other thing we need to consider is that many Japanese consumers prefer domestic products.

The following data shows the proportion is increasing in the last three years. In order to improve food safety, the number of farmers in Japan who adopt GAP is increasing. This certification is to assure that the farm is well managed in terms of cultivation, production and house keeping at the farmer’s site. It generated reliability for the goods produced by that farmer and consumers look at this certification as one criterion. Although global GAP is the most popular, Japanese GAP is being well known by farmers is Japan. According to the report published by Ministry of Agriculture, Forestry and Fishery (MAFF), the number of producers have been adopting GAP. In addition, the report recommended that farmers should adopt GAP in order to pursue food safety. They mentioned that GAP is pretty important particularly in the production process. They also explained that GAP adoption leads not only to food safety but labor safety, competitiveness, quality improvement, management improvement and efficiency. In the case of Japan, GAP certification has been varied from farmers union, local government, distributors and other private groups. Therefore, MAFF implemented a guideline in 2010 to clarify common platform of GAP.

This situation means Japanese growers are recognizing that Japanese GAP certification will add more value on their products from a distribution perspective. For instance, general merchandising store in Japan is promoting food by disclosing visible information of producers with certification i.e. Organic JAS (Japanese Agricultural Standard). Given the fact that more than 2500 locations have already adopted GAP certification and it has been common process among agriculturists in Japan, imported fruits should also have GAP certification in the exporting country.

Food communication project (FCP) was developed by Ministry of Agriculture, Forestry and Fishery (MAFF) in order to improve reliability of food. The purpose of this project is to visualize the food supply chain and to provide information to consumers related to stakeholders in the supply chain process. As of May 28, 2018, 1,998 organizations participated in this initiative. According to the concept of FCP, food suppliers should comply with factory audit process, public relations, etc. to present credibility, which will convince consumers that the food is reliable. This initiative has been modified to be in line with global standard of Global Food Safety Initiative (GFSI).

Distribution channels in Japan

Historically the Japanese market has been controlled by Japan cooperatives. This organization has been purchasing products from growers and maintains product quality. In the case of Japan, long distribution channel is a challenge for fresh fruits.

Conventionally distribution channels in Japan primarily consist of Co-op with market and direct distribution channels by wholesalers. Co-op has been providing variety of support to farmers not only for cultivation but also for financing for daily operations. From the farmers’ perspective, the Co-op has an important value as they are the sole purchaser as well as distributor of agricultural goods. Additionally, financial support is provided. Therefore, small-sized farmers still rely on the Co-op system. Recently big supermarket is procuring products directly from the farmers. The reduction of supply chain process can provide consumers with fresh foods. It also guarantees that the products are produced by reliable growers which are visible to consumers. From a financial stand point, value chain reduction can generate more profits to suppliers.

Other distribution channels are local farmers markets located in each prefecture in Japan. At this point in time, more than 15,000 markets exist. Major network is a market place network along with national routes, managed by Ministry of Land and Transportation. This network is called by “Michi no eki”. This facility normally has gas station, restaurant, café, gardening shop as well as farmers market, which is sourced from local production area.

In order to develop the distribution channel of tropical fruit, original approach for market access is needed other than conventional distribution such as JA (Japan Agricultural Cooperative). Additionally, it is important to establish direct relationship with market or resellers to develop direct distribution channel to earn profit. This approach is able to seek opportunities to develop profitable and sustainable distribution channel.

Currently more and more growers are trying to promote their products via internet shop. Given the fact that more and more consumers search products via internet, the research for e-commerce of tropical fruit is also necessary.

Import conditions

The following tables show tariff range by major crop for year-round and seasonal production of dragon fruit. The tariff varies from crop to crop and country to country as there are special treatments between Japan and other exporting countries. The difference of tariff can be an advantage of retail price of imported tropical fruits. The possible impact of specific products can be seen in the price difference section.

For other tropical fruits such as guava, mango and mangosteen, tariff is the same as avocado. There is no description whether the product is fresh or dried.

In terms of phytosanitary requirement, there was an amendment of fumigant usage for imported fruit. Due to revision of the Food Sanitation Law in 2003, positive list was developed in 2006 in order to prevent food distribution if the residual value of pesticide is exceeding the criterion. New standard was developed for fumigants such as methyl bromide, hydrocyanic acid and aluminum phosphide. For the pesticides which were listed in the above initiative, Food Safety Committee developed Acceptable Daily Intake (ADI) for pesticide according to the investigation by Ministry of Agriculture, Forestry and Fishery (MAFF) as well as evaluation of residual value by Ministry of Health, Labor and Welfare (MHLW). Residue criterion was determined by the ADI. In 2011, there was an amendment of Phytosanitary Law to be in accordance with international rule. Additionally, positive list was implemented to be able to conduct pest risk analysis. Japan has been participating in the implementation for International Standards for Phytosanitary Measures (ISPM). In 2013, Ministry of Health, Labor and Welfare (MHLW) announced that investigation should be conducted for specific fruits. With respect to monitoring, frequency is 30% for imported document submissions. In addition, traders who violated the rule need to perform self-investigation. This task continues for one year or up to 60 investigations.

Supply chain management

Optimazation of supply chain is a key to deliver fresh fruits from the source location to the market. In order to keep the freshness of dragon fruit, air shipment will be necessary to transport to Japan. This means air freight needs to be managed within product price. Location of Vietnam has a benefit as the distance is shorter than that of Brazil, for mango, and Mexico for avocado.

Packaging is an important aspect to distribute products in the Japanese market. Same as domestic products, fresh fruits are carefully packed and controlled by high level of quality. With respect to packaging, most of consumer products are contained in a clean package. At the same time, source location is indicated. At the premium supermarkets in Japan, local fruits and tropical fruits are sold together, therefore, customers can easily compare the products from various stand points. In the case of tropical fruits, some domestic products are also available so that attractiveness is an important factor for promoting import materials.

Customer-oriented strategy is shown at the packaging style of imported tropical fruit at famous premium supermarkets located in Tokyo. GMO papaya from Hawaii is packed in a plastic bag by one piece. Mangosteen from Thailand is packed with foam bag with five pieces. These appearances show consumers high quality, safe and premium products. At the same premium supermarket, avocado is carefully wrapped with foam bag and sold at JPY228 per piece, which is approx. US$2.17 (at 1US$ = 105JPY).

If you look at the domestic fruit, high value grape is wrapped with a foam bag and packed in a plastic case with a paper base. Grape is a sensitive product so that high value one is treated with care. Retail price for this product is JPY890 – JPY990 (approx.US$8.48 – US$9.43 at 1US$ = 105JPY). Japanese customers are very specific about quality and safety. These factors are much more important than price competitiveness. Ministry of Agriculture, Forestry and Fishery (MAFF) reported initiatives related to food safety and risk management processes.

Consumers’ preferences

Japanese consumers prefer clean and safe products. Farmers are very sensitive to ship products to the market as the appearance is one of important criteria for food distribution in Japan. If there are some damages, the price significantly goes down. In addition, Japanese local fruits are carefully grown and packed to deliver to the consumers. Appearance is one of the keys to attract Japanse consumers. At the same time, Japanese find lots of value of fruits on high brix. At the retail shop, high brix is emphasized as this is one of key values of fruit in Japanese market. Particularly after the disaster in 2011, Japanese consumers are more and more food safety conscious. The criteria are radiation level, treatment by agrochemical and chemical fertilizers, etc. Tracking system and visibility are necessary in order to penetrate into Japanese consumer market. Therefore, food safety is also an important aspect.

After the disaster happened in March 2011, Japanese consumers are much conscious about radiation effect and source location of the products. To meet those customers focus, food suppliers are conducting investigation of radiation level, disclosing traceability of the products such as producer, location, chemical usage, etc. Another case is mandarin orange from Australia. 6 pieces are sold at JPY398 (approx. US$3.79 at 1US$ = 105JPY). Product related information is provided on the tags and it says some chemicals are used. This action is one of disclosure of the production processes to consumers. Due to this situation, many consumers can easily search product information and evaluation. In addition, rumors can easily be spread to many people, therefore, suppliers activities are always watched by the consumers. When the products are imported to Japan, post-harvest treatment is one of key successful factors. At the same time, Japanese consumers are specific for the chemical treatment, contained chemical level needs to as minimal as possible and it has to be disclosed to make the product reliable.

Best practices in Japan’s fruit industry

In the fruit market in Japan, kiwi fruit is would be the best practice in terms of marketing. One famous brand is promoting a couple of varieties. This brand has lots of exposures in the market place. In order to aquire costomers’ interest, promotional activities are necessary. If we look at avocado, Japanese consumers have a variety of recipes to enjoy this fruit. It is imported as tropical fruit, currently it is used for cooking. Some Japanese prefer to eat avocado with soy source and “wasabi,” which is traditional spicy paste used for sushi. Given the fact that new recipes have been developed in Japan, tropical fruit suppliers need to provide information on how to cook, how to eat, etc. More importantly, suppliers have to sell recipes, not the material.

Traditional popular tropical fruits are also sold at high value. Banana from Philippines and Ecuador is packed on a single piece basis or a couple of pieces. Pineapples from the Philippines are packed in a plastic bag and advertised as “high brix.” There are fruit gift shops in the big cities and major department stores have a premium fruit shop. At those shops, most of the demands are social gifts by corporation and/or individuals. Due to the nature of customers’ purchasing purposes, retail price are high compared to premium supermarkets. According to the website of popular fruit gift shop (“Sembikiya”), domestic melons and/or mangoes are sold at around JPY5,000 - 10,000 (approx. US$47.62 – US$95.24 at 1US$ = 105JPY). At the premium supermarket, most of the customers are housewives. It appears that the purpose of the purchase is for daily use or for special occasions rather than as gifts. The retail price is lower than that of fruit gift shop, but the price is still higher than that of the regular market. If the product quality meets consumers’ needs, growers and/or suppliers are able to earn more profit. For instance, Mexican avocado is sold at more than US$2 at premium super market. Japanese consumers are more and more food safety conscious particularly after the disaster in 2011. Tracking system and visibility are necessary in order to penetrate into Japanese consumer market. This situation would be a burden to exporters to Japanese market, yet high quality and safe products can be accepted at higher value to the demanding consumers, which is positive to growers. In order to pursue these initiatives, the following aspects will be needed:

From different perspective, marketing effort is an important factor to make tropical fruits more popular in Japan. In addition to functionality and nutrition of tropical fruit, promotional activity is a key element in order to penetrate the product into the Japanese market. In order to promote the products efficiently, media strategy needs to be developed such as social network system. Visibility in production process is also critical to assure quality control. At the same time, traceability is to convince safety-conscious customers.

CONCLUSION

Based on the current situation of the tropical fruit industry in Japan, key successful factors are to define dragon fruit position in the tropical fruit market in Japan. In order to make this happen, best practices of popular imported fruits in Japan need to be applied to dragon fruit. If this business development process is completed, it is anticipated that dragon fruit will be exposed to the market place and attract demanding customers in Japan. In order to develop dragon fruit business in Japan, promotional activities need to be managed properly. There are different types of promotions depending on the fruits. For instance, bananas have been the top the tropical fruit market in Japan. Banana is a typical commodity product; however, premium product is also developed by high quality and high brix. In the case of avocado, import volume has been significantly increased due to variety of recipe and nutrition. Avocado market has been developed without specific suppliers’ promotion. One other typical case is kiwi fruit. This product is promoted by one single brand and the brand name was established. In terms of product positioning, due to the nature of dragon fruit, product position is assumed to be imported mango and papaya. Depending upon the quality, premium grade can be developed in the market. Although banana and avocado are commodities in the Japanese market, premium product is also available with higher brix, higher quality, etc. For supply chain, due to the nature of the fresh fruits optimization of supply chain needs to be focused. Air shipment can keep freshness of the product but the cost will be added on the product price. In order to make a profitable business, efficient supply chain management should be the key. In quality control, because of the consumers’ preferences, higher level of quality control is important to develop the market in Japan. It means stable quality control will sustain customers and will acquire new customers. At the same time, quality assurance is critical in order to supply quality material to high value market in Japan, quality assurance is important when material is produced in Vietnam. In terms of distribution in Japan, most of local fruits are distributed through cooperatives network, but the margin for growers are limited compared to direct distribution. In order to make a profit, direct distribution needs to be considered. The dragon fruit industry will be established in Japan under a robust and dynamic marketing strategy activities emphasizing nutrition, quality control to increase brix and supply chain to support the fruit shelflife.

REFERENCES

Ministry of Agriculture, Forestry and Fishery. 2013. Report for food, agriculture and farm, 2013. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2014. Report for food, agriculture and farm, 2014. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2015. Report for food, agriculture and farm, 2015. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2016. Report for food, agriculture and farm, 2016. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2017. Report for food, agriculture and farm, 2017. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2018. Report for food, agriculture and farm, 2018. Norin Toukei Kyoukai Publications (Japan).

Ministry of Agriculture, Forestry and Fishery. 2018. Report for food, agriculture and farm, 2014. Nikkei Insatsu Publications (Japan). pp. 40-122.

Ministry of Finance. 2014. Annual data for imported materials. http://www.customs.go.jp/toukei/info/tsdl.htm.

Almanac of Tropical Fruits. 2009. Foundation of Marine Exhibition Memorial Park. Publications of Marine Exhibition Memorial Park Foundation (Japan). pp. 144-146.

Association of fruit importation. 2014. Annual data for imported fruits. http://www.fruits-nisseikyo.or.jp/index.html.

Yoshiko Kagawa. 2012. Food nutrition content 2012. Women College of Nutrition Publications (Japan). pp. 88-89.

Japan GAP Association. 2012. Public guidebook for JGAP. Publications of Japan GAP Association. pp. 2-31, 102-135.

Hironori Yagi. 2010. A book for understanding of agriculture by professional. Natsume Publications (Japan). pp. 144-151.

Kimie Tsukuba. 2009. To better understand for agricultural trend and structures. Shuwa System Publications (Japan). pp. 114-115, 124-127.

Agricultural Research Group. 2010. Research for agricultural industry. Sangakusha Publications (Japan). pp. 34-37,

Nobuko Yoshiki. 2012. Encyclopedia for Correct Anti-aging care. Takahashi Shoten Publications (Japan). pp. 100-115.

Nobuko Yoshiki, Miyoji Okabe, Makiko Oda. 2012. Correct Skin Care Encyclopedia. Takahashi Shoten Publications (Japan). pp. 86-95.

Reviewed, edited and uploaded: October 24, 2019