INTRODUCTION

The aim of this article is to review the transformation of Japan’s rice policy for the last 30 years and to clarify their features. We will focus on the change of policy from price support to direct payments to support paddy field farmers. Current policy reforms are so complicated that it is difficult to explain them by a consistent concept. However, we can put Japan’s experiences into the common context of policy reforms of developed countries, utilizing the concept of “from policy support to directs payments” forced by the agricultural agreement of the World Trade Organization (WTO)1.

We will also refer to the changing process of the Common Agricultural Policy (CAP) administered by the European Union (EU) to consider Japan’s features. We could not learn much from the CAP for shaping our own policy reforms because there are many differences between the two countries in terms of historical contexts, agricultural structures, rural societies, political cultures and so on2. However, we can utilize the CAP as a reference for evaluating Japan’s policy reform, because the CAP reform has achieved the transformation from price support to direct payments successfully and provide some kind of template of the policy reform compatible with the WTO agreement3.

In the first section, I will show the basic concept of the direct payment policy and clarify differences between Japan and the EU. And then, I will trace the process of the agricultural policy change in Japan over the last 30 years. Finally, I will investigate the consequences of this policy change focusing on changes of agricultural structure and farm organization and prospects of policy reforms in Japan4.

BASIC CONCEPT OF DIRECT PAYMENTS

The concept of the direct payment policy can be summarized into the following three features; compensation, decoupling and targeting5. “Compensation” means that governments provide payments to farmers as compensation in return for the withdrawal of support prices. It is said that governments have to compensate for the loss of farmers’ revenue or income, because farmers decided to choose farming as their occupations based on the level of support prices in the past. This is thought to be a “contract” between governments and farmers (Korenaga 1998). “Decoupling” means that payments are decoupled from production judgements of farmers and they do not influence farmers’ activities. Payments are not based on the level of current production but past records of production, revenue, income and so on. “Targeting” means that governments can limit recipients of direct payments corresponding to their policy priorities. Price supports benefit all market participants through raising prices indiscriminately, but desirable recipients for governments could be limited by directly paying to the specified group of farmers.

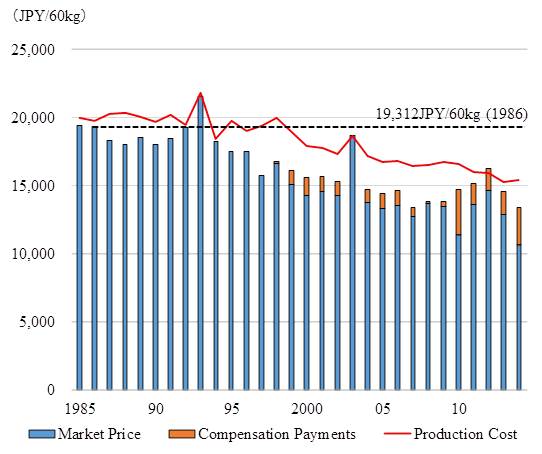

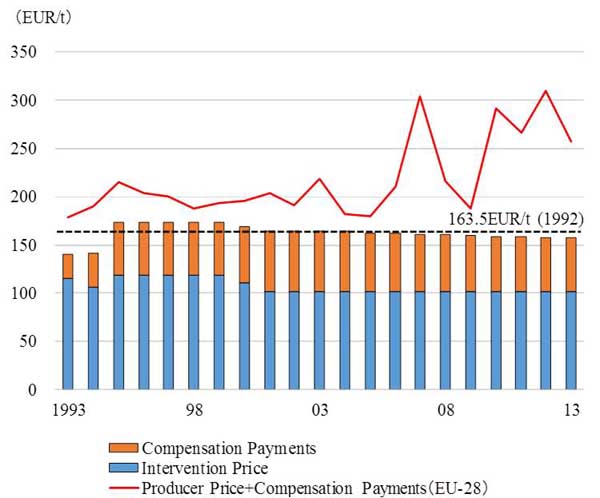

Fig. 1 and Fig. 2 show different pictures of compensation between Japan’s rice and the EU wheat. In the EU, compensation payments have sufficiently covered a gap between the reference price (intervention price in 1992 when the MacShary reform happened) and the intervention price reduced in the MacShary reform and the Agenda 2000 reform.

Fig. 1. Trends of the market price and compensation payments in Japan’s rice

Source: Nishikawa 2015. 8-9, Figure Intro.-1-2., revised

Fig. 2. Trends of the market price and compensation payments in the EU’s wheat

Source: Ibid. 8-9, Figure Intro.-1-2., revised

Furthermore, the producer revenue set by the producer price decided in the market plus compensation payments has exceeded significantly beyond the reference price because of the rise in international grain prices after late 2000s. The direct payment policy in the EU has sufficiently compensated farmers’ loss since policy reforms started. On the contrary, payments in Japan have not sufficiently covered a gap between the market price and the reference price stipulated by the 1986 price when the Japan’s government began the reform of the Food Control System through the reduction in the rice support price. There are two ways to explain this insufficient manner of the Japan’s government. First, the Japan’s government has financial deficits so huge that they cannot afford to make sufficient payments to farmers. Second, Japan’s government sets the priority on the scale expansion of paddy field farms. It is necessary to promote small farmers to quit farming and to consolidate their farmlands to large farms. We can confirm that the level of the market price plus compensation payments has been below the average production cost continuously and significantly. Generally speaking, the level of the production cost of small farms is more expensive than that of large farms. This level of compensation has made small farmers unprofitable, which has promoted them to abandon rice farming.

It is difficult to show a clear answer on whether direct payments have decoupled effects. Western scholars have pointed out that, in fact, direct payments distort production decisions of farmers including effects on factor prices such as farmland rent and price (Jongeneel and Brand, 2011). In Japan, effects on farmland rent and price are also insisted but depend on regional states. The level of the land rent and price tends to rise in regions where the demand of farmlands exceeds the supply because payments are vested in landowners while it tends to fall in regions where the supply exceeds the demand (Ando, 2010). Another study clarified that direct payments are used to provide employment for young residents in regions where depopulation and aging society have become the norm (Nishikawa, 2016a). Young workforces as a production factor have become scarcer than farmlands in Japan’s rural areas, which has made direct payments influence on the labor market. However, we need to take into consideration other elements such as structure of rural societies and cultural contexts to explain this phenomenon.

Who is targeted depends on the policy priority of governments. In the EU, farmers who practice environmentally friendly farming are subject to direct payments through the cross compliance introduced by the Agenda 2000 reform and the greening by the post-2013 reform, because the priority of the EU is agricultural environment policies. On the other hand, farmers who intend to expand their farm size are subject to policies in Japan because Japan’s government emphasizes the structural reform of the paddy agriculture.

OVERVIEW OF THE RICE POLICY CHANGE IN JAPAN

The policy which functioned as the rice price support in Japan was the Food Control Law (Shokuryo Kanri Hou) established during the World War II. The government set the producer price for compensating the production cost while setting the consumer price for easing household expenses. The philosophy of the dual prices system which the producer price exceeds consumer price generated the loss margin and contributed to the huge budgetary deficit. Since 1970s when the surplus of rice production soared, the government has tried to suppress the rise in the producer price and introduced the set-aside policy to reduce rice production. Then, the government turned to reduce the producer price and eliminated the loss margin in 1987. This change was historic, because the government reduced the producer price for the first time in 31 years, which became a starting point of the elimination of the price support of the Food Control System. Finally, the Food Control System was abolished and the new Food Law (Shokuryo Hou) was enacted in 1995. Market mechanism was introduced to the rice distribution thoroughly, which has promoted the continuous fall in the rice price.

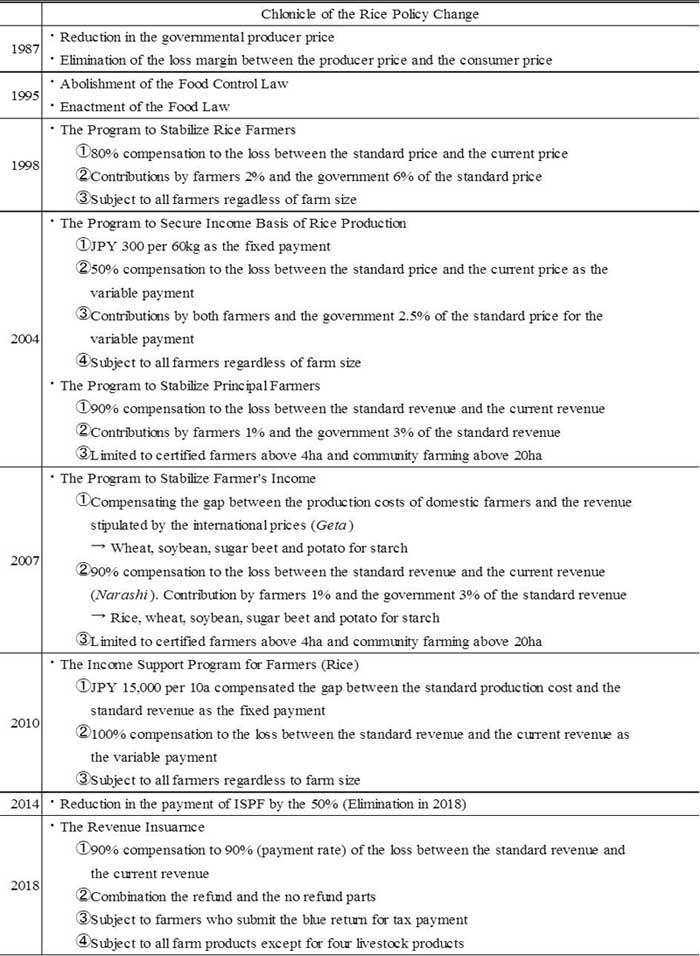

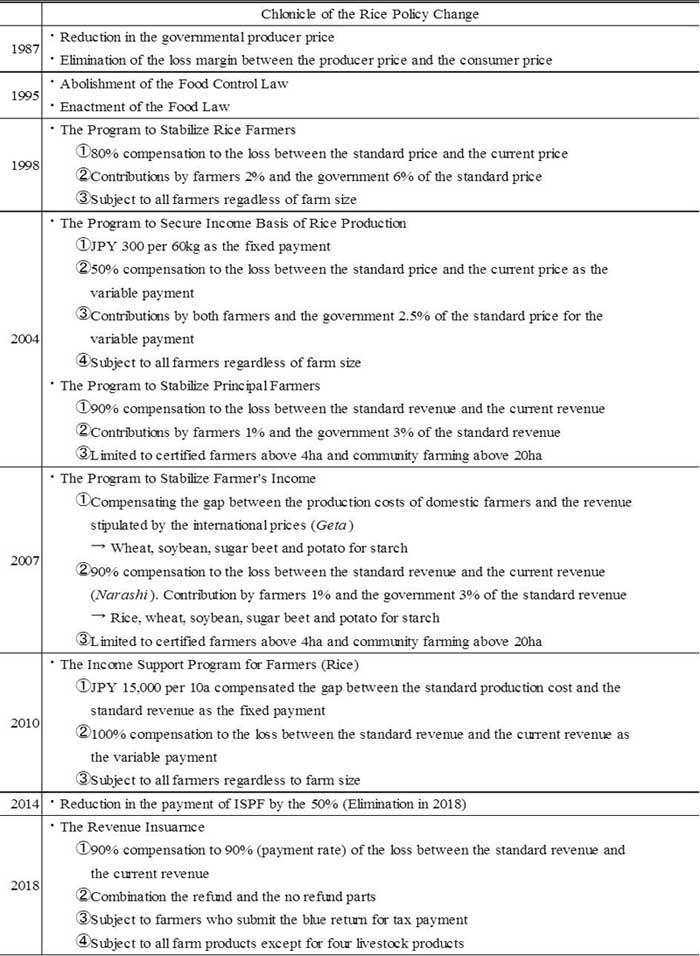

Table 1 shows the development of the direct payment policy in Japan. At first, Japan’s government hesitated to compensate for the reduction in the rice price even though this was strongly requested by farmers and their organizations. They explained that compensation payments were not necessary, because Japan’s rice market was protected by the high-rate tariff (Hirasawa, 2014) and the situation was different from the EU. However, the government decided to introduce the mitigation measure, the Program to Stabilize Rice Farmers (Inasaku Keiei Antei Taisaku), against the fall in the rice price in 1998 because the decline was huge and caused negative effects on large farmers’ managements. This measure compensated 80% of the loss between the market price of current year and the average price of past 3 years (the standard price). Farmers needed to pay 2% of the standard price to contribute for making the financial resource while the government payed 6%. The standard price of compensation moved downward because of the continuous fall in the rice price. This measure had many weak points, but this was the first and epoch-making direct payment policy for Japan’s farmers. On the other hand, the government strengthened the set-aside policy, increasing the area of diversion and subsidies for producing other crops such as wheat and soybeans, and aiming at raising the rice price to reduce the budget of compensation. The combination of direct payments and the expansion of the set-aside areas has been a marked feature of the Japan’s direct payment policy6.

Table 1. Chlonicle of the Rice Policy Change in Japan

In 2004, the government revised mitigation policies, dividing them into two measures. The first part was the Program to Secure Income Basis of Rice Production (Inasaku Shotoku Kiban Kakuho Taisaku, ISKKT) which consisted of the fixed payment paying JPY 300 (US$ 2.7 calculated at US$ 1 = JPY 110) per 60kg and the variable payment compensating for 50% of the loss between the market price of current year and the average price of past three years. The variable payment was contributed by both farmers and the government paying 2.5% of the standard rice price. All farmers regardless farm size could receive ISKKT’s payment, as this measure was placed as a compensation for the set-aside policy. The second part was the Program to Stabilize Principal Farmers (Ninaite Keiei Antei Taisaku, PSPF). This measure compensated for 90% of the loss between the rice revenue of current year and the average revenue of past three years. Farmers needed to pay 1% of the standard revenue to contribute for making the financial resource while the government payed 3%. The subject of this measure was limited to “Principal Farmers (Ninaite)7” who held above four hectares of farmlands as the certified farmers8 or above 20 hectares as the community farming entities. This was the first trial to sort out policy subjects by farm size, which clarified that the priority of the Japan’s agricultural policy was the structural reform consolidating farmlands into large farmers.

The direct payment policy developed further in 2007. The government introduced the Program to Stabilize Farmer’s Management and Income (PSFMI, Keiei Syotoku Antei Taisaku). This program covered not only rice but also wheat, soybeans, sugar beets and potatoes for starch. And, this composed of two parts. The first part was “Geta” which aimed to correct the disparity of the agricultural production between domestic and overseas conditions and covered wheat, soybeans, sugar beets and potatoes for starch. Rice was excluded because it was protected from international competition by high tariff rate, explained by the government. The amount of payment was calculated by the gap between the production costs of domestic farmers and the revenues stipulated by international price. This payment was further divided to two portions. 70% of payment was paid based on the past production records and 30% was calculated by the current volume and quality of products. The government explained that the former portion was decoupled from production and categorized to “green box” while the latter portion was categorized to “amber box” related to the current production. The second part was “Narashi” which aimed to mitigate the fluctuation of farmer’s revenue. This payment compensated for 90% of the gap between the revenue averaged by the middle three years of past five years and the revenue of current year, if the current revenue declined. The revenues of each crop were totaled and set off when the standard and the current revenue were calculated. Farmers needed to pay 1% of the standard revenue to contribute for making financial resources while the government payed 3%. As with the past PSPF, the subject of this program was limited to “Ninaite” who held above four hectares of farmlands as the certified farmers and who held above 20 hectares as the community farming entities.

The PSFMI was one of the achievements of the direct payment policy of Japan. The aspect of compensation was marginalized through which rice was excluded from “Geta” payment and the reduction in rice revenue was set off by other crops within one program. The subject of payments was limited to “Ninaite” and its standard was stipulated by farm size. However, this program was quite unpopular to farmers. The level of compensation was not enough to “stabilize farmer’s management and income” for not only small farmers who were excluded from the program but also “Ninaite.” Furthermore, it is important to notice that the majority of farmers was excluded from the program. The number of subjects was 72,431 farms in 2009, which just occupied 3.6% of all farms9. As a result, the government could not receive supports from rural areas. This was one factor that the Liberal Democratic Party (LDP) which managed administration at that time and was based on rural voters lost popularity. Thus, the LDP went out of power in the 2009 general election.

The Democratic Party of Japan (DPJ) came into power instead of the LDP. The DPJ had showed the Income Support Program for Farmers (ISPF, Kobetsu Syotoku Hosyou Seido), criticizing the LDP’s PSFMI. The DPJ government introduced the ISPF immediately after coming into power. This program was divided into the rice program and the field crops program. We will focus on the rice program to simplify an explanation. The rice program was further divided into two portions. The first portion was the fixed payment which paid JPY 15,000 (US$ 136) per 10a to farmers. It was based on the calculated gap between the production cost averaged by the middle five years of past seven years (the standard production cost) and the revenue averaged by past three years (the standard revenue). It was the first time since the Food Control Law was abolished that the production cost was used as the standard of compensation. The second portion was the variable payment which compensated for 100% of the gap between the standard revenue and the revenue of the current year. These payments are paid to all farmers regardless of farm sizes.

The DPJ’s ISPF could fundamentally transform the Japan’s direct payment policy. First, the ISPF raised the level of compensation significantly. We can confirm in Figure 1 that the level of the market price plus compensation payments increased after 2009 and even exceeded the production cost in 2012. Second, the ISPF did not restrict recipients of payments. All farmers could receive relatively sufficient compensation during the DPJ administration. However, there is a study showing that the ISPF prevented the structural change of the paddy agriculture because it improved the profitability of small farmers (Nishikawa, 2015). The DPJ administration could not keep power for more than three years because of some factors such as splits of party, the lack of governance and damages from the Great East Japan Earthquake. The LDP came back to power in 2012 and began to repel the DPJ’s policies. The LDP government decided to reduce the ISPF’s fixed payment to JPY 7,500 (US$ 68) and finally abolished it in 2017. The revenue insurance system was newly introduced from 2018 but we need enough time to evaluate its effects on farmers’ management and income.

CONSEQUENCES AND PROBLEMS OF POLICY CHANGE

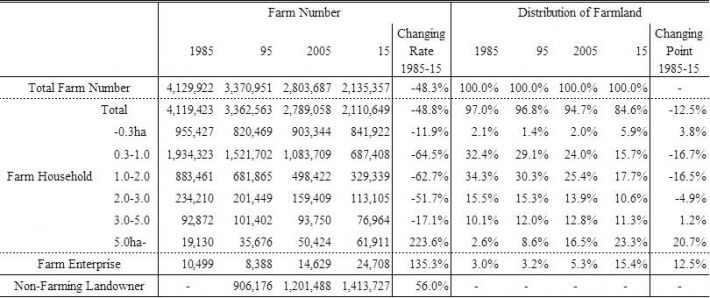

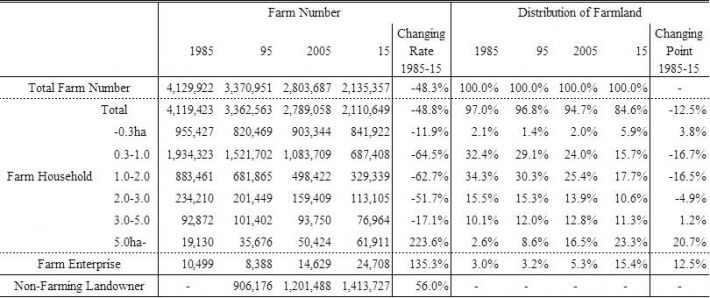

The rice policy change in Japan has resulted in two consequences: promoting the agricultural structural change and the farmer’s dependence on direct payments. Table 2 shows the change in farm household number and distribution of farmland. From 1985 when the Japan’s government began to reduce price supports to 2015, the number of farm household has almost halved. Especially, small and middle size farms between 0.3ha and 3.0ha has decreased significantly while large farms which are above 5.0ha and agricultural farm enterprises have increased by beyond 100%. The number of the non-farming landowners who retired from farming has also increased. As a result, the distribution of farmland has concentrated into large farms. Almost 40% of farmland were held by farm households above 5.0ha and agricultural farm enterprises. Most studies, including the MAFF’s official view (MAFF 2013) have pointed out that this structural change has been caused by the retirement of the Showa-digit generation who were born from 1926 to 1934 (from Showa 1 to 9 by the Japanese calendar year). However, we cannot deny that features of policy change discussed in this article have influenced on this change. The insufficient and subject-limited compensation payments have made small farmers’ profitability worse and hesitated successors of farm household to succeed their families’ farming. And, relatively generous amounts of payment to Ninaite has promoted them to expand their farm size and concentrated farmlands to them (Nishikawa, 2015).

Table 2. Change in Farm Household Numbers and Distribution of Farmland

Source: MAFF. Census of Agriculture.

Note: 1) These figures cover prefectures, excluding Hokkaido.

2) Total Farm Number = Farm Household + Farm Enterprise.

3) Changing rate of Non-Farming Landowner shows the change from 1995 to 2015.

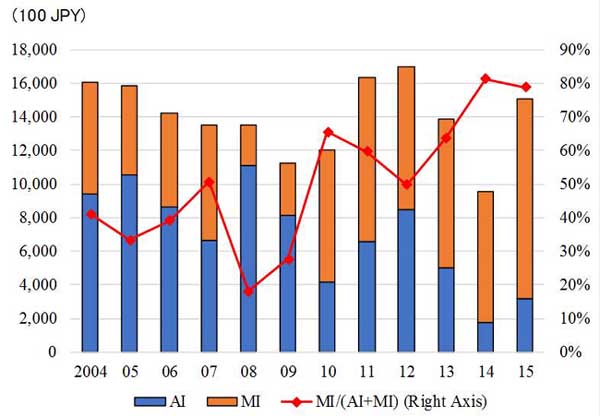

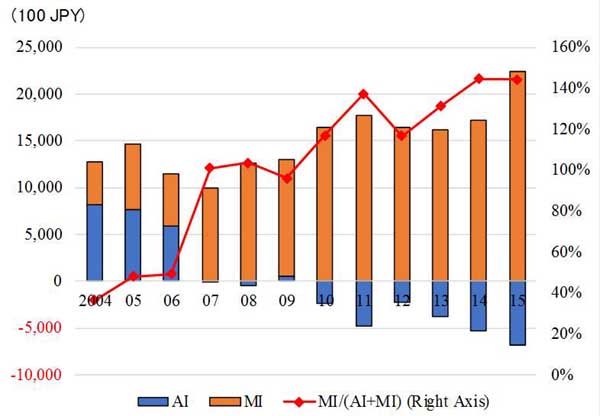

Second consequence is to make large farmers being dependent on governmental supports more deeply. Figures 3 and 4 show trends of the large farmers’ agricultural income (AI) and the miscellaneous income (MI) mainly occupied by governmental supports. Figure 3 shows farmers who operate the rice single farming, and figure 4 represents farmers who operate the multiple management. Both types of farmers managed farmlands above 20ha. Referring to Figure 3, we can confirm that MI has increased while AI has reduced. Thus, the ratio of MI to total income has rapidly risen and reached 80% in 2014. Figure 4 shows the same picture as Figure 3, but the ratio of MI has been higher than the rice single farming. As commodity prices of land crops such as wheat and soybeans were lower than rice, farmers who produced those crops have been more dependent on governmental supports to set off farming loss. The deep dependence on governmental supports causes two problems for farmers. First, large farmers have become vulnerable to policy changes. Current policy changes are so complicated and frequent that no one can predict how policy changes would influence on farmers. Not only drastic but also fine changes could cause serious damages to large farmers. The agricultural policy itself became a risk factor for farm management (Shogenzi, 2011). Second, there is a fear that famers would lose their management sense. Their revenue and income are occupied by stable governmental payments, which could make their sensitivity to the market mechanism dull (Umemoto, 2010). The deep dependence on governmental supports may kill farmers who are independent and support the vitality of Japan’s farming.

Fig. 3. Trends of Agricultural Income and Miscellaneous Income of Rice Single Farming Above 20ha

Source: MAFF. Statistics on Management by Farming Type (individual management).

Note: 1) These figures cover prefectures, excluding Hokkaido.

2) Miscellaneous Income is mainly occupied by governmental supports.

Fig. 4. Trends of Agricultural Income and Miscellaneous Income of Multiple Farming (Rice 1st Place) Above 20ha

Source: Ibid.

PROSPECTIVE OF THE RICE POLICY REFORM IN JAPAN

The priority of Japan’s rice policy is the structural reform of the paddy agriculture. It is inevitable for Japan’s agriculture to expand the average farm size and improve its competitiveness in order to cope with the severe international competition in the future. The insufficient compensation and the targeting manner of the direct payment policy have seemed to be rational to promote the structural reform of the paddy agriculture. However, the former feature has premised that the domestic rice market was isolated from abroad competitors through high rate tariff. If the tariff rate will be reduced and the domestic market will be open to abroad significantly, the Japan’s government will have to raise the level of compensation to protect Ninaite10.

We also need to pay attention to management abilities of farmers. Both public and private education systems may become important to grow independent and creative farmers under the situation of being heavily dependent on governmental payments. Functions of the cooperative extension system should be strengthened and advanced through adopting large farmers’ needs while roles of the agricultural cooperatives and private companies will expand under shrinking the extension system’s budget11.

REFERENCES

Ando, M. 2010. How the JA cope with the reform of farmland control system? Nogyo to Keizai. 76(8), 36-45 (In Japanese).

Ando, M. 2016. The process and consequence of paddy field policy development in Japan: from price support and market measure to direct payment. Journal of Rural Economics. 88(1), 26-39 (In Japanese).

Arahata, K. 2010. The Economics of the Rice Acreage Reduction Program. Nourin Tokei Shuppan (In Japanese).

Bannai, H., Nishikawa, K., Ichinose, Y. and Shimizu, T. 2015. Research studies about support system for farmers: institution of regional federations to integrally support farming guidance activities by agricultural cooperatives. Souken Report. 28 Kisoken, No.4 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20170518.pdf).

Bannai, H. and Nishikawa, K. 2018. Research Studies about support system for farmers: domestic surveys version. Souken Report. 30 Noukin, No.2 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20180711-1.pdf).

Hirasawa, A. 2014. Frame and Emerging Reform of Agricultural Policy in Japan. FFTC Agricultural Policy Platform (Food & Fertilizer Technology Center). July 2nd, 2014 (http://ap.fftc.agnet.org/ap_db.php?id=257).

Jongeneel, R. and Brand, H. 2011. Direct income support and cross-compliance. Oskam, A., Meester, G. and Silvis, H. (eds.) EU Policy for Agriculture, Food and Rural Areas. Wageningen Academic Publishers. 197-212.

Kishi, Y. 2016. Introduction. Kishi (eds.) World Direct Payment System. Norin Tokei Kyokai, 1-4 (In Japanese).

Korenaga, H. 1998. Categories and issues of the decoupling-typed agricultural policies in the EU. Nippon Agricultural Research Institute (eds.) Study of Japanese-typed Decoupling. Norin Tokei Kyokai, 25-39 (In Japanese).

Ministry of Agriculture, Forestry and Fisheries. 2013. 2013 White Paper of Agriculture, Forestry and Fisheries (In Japanese).

Nishikawa, K. 2015. “Policy Change” and Ninaite on Paddy Field Agriculture: Focusing on Tayagawa District, Chikusei-city, Ibaraki Prefecture. Norin Tokei Shuppan (In Japanese).

Nishikawa, K. 2016a. Business diversification and direct payments: an example of Sawayaka Touchi in Sera-machi, Hiroshima prefecture. Institute of Regional Science, Takasaki City University of Economics (eds.) Regeneration of Agriculture and Rural Areas under Free Trade: Challenges by Tiny People. Nihon Keizai Hyoronsya, 149-170 (In Japanese).

Nishikawa, K. 2016b. Free trade and the future of Japan’s agricultural policy. Asia Pacific Bulletin. 342, 1-2 (https://www.eastwestcenter.org/publications/free-trade-and-the-future-japan’s-agricultural-policy).

Shimizu, T., Hara, K., Nishikawa, K. and Hirasawa, A. 2018. Research Studies about support system for farmers: the US surveys version. Souken Report. 30 Noukin, No.3 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20180711-2.pdf).

Shogenzi, S. 2011. Truth of Japan’s Agriculture. Chikuma Shobo (In Japanese).

Tashiro, Y. 2012. Introduction of Agricultural and Food Issues. Otsuki Syoten (In Japanese).

Umemoto, M. 2010. Structure and management actions by principal farmers of paddy agriculture. Journal of Rural Economics. 82(2), 102-111 (In Japanese).

Date submitted: Aug. 7, 2018

Reviewed, edited and uploaded: Oct. 18, 2018

[1] The agricultural agreement of the WTO categorizes domestic support of affiliated countries into “green box,” “blue box” and “amber box.” The amber box is stipulated as policy that has trade distorting effects while those effects are minimized in the green box. The blue box includes direct payments with set-aside policies. Direct payments being subject to the review of this article are included in the green box or the blue box while price support are categorized in the amber box. The agricultural agreement requires developed countries to reduce the amount of the amber box. Thus, they have to transfer from price support to direct payments to maintain the total amount of agricultural budgets.

[2] For instance, Japan has reduced the budget for agricultural policies, while the EU has increased its amount even though both two countries started policy reforms in the late 1980s. Refer to Ando 2016, 28-29.

[3] The EU consists of many nation states and has a history of pursuing solutions which they could commonly accept. Refer to Tashiro 2012, 191.

[4] I discussed the basic concept of this article, from the price support to the direct payment, in my previous publication, Nishikawa 2015, for the first time. In this article, I discuss more deeply referring to other important publications which I did not noticed and add the new movements of Japan’s agricultural policy since then and the statistical analysis utilizing 2015 Census of Agriculture.

[5] Direct payments could be categorized into payments for compensation, less favored areas and environmentally friendly farming. Referred to Kishi 2006, the payment type being subject to the review of this article is the first one.

[6] We will just touch on the relationship between direct payments and the set-aside policy in this article. Refer to Arahata 2010 if readers would like to learn more.

[7] “Ninaite” are farmers who not only efficiently manage large scale farm units but also maintain regional societies through receiving excessive farmlands beyond the optimum size. By the English version of the FY2010 annual report, the Ministry of Agriculture, Forestry and Fisheries had expressed this terminology as “Principal Farmer”. In the FY2013 annual report, however, it expressed as “Business Farmer” because it focused on the former aspect of Ninaite. This change was influenced by the administration change to the Shinzo Abe cabinet which emphasizes the industrialization of agriculture.

[8] “The certified farmers” is authorized for their management plans by prefectural governors and can preferentially utilize policy measures such as farm finances.

[9] These figures are quoted and calculated from the MAFF’s business statistics (http://www.maff.go.jp/j/kobetu_ninaite/keiei/pdf/state.pdf) and 2005 Agricultural Census.

[10] The insufficient compensation to the decline in rice price could result in the severe resistance of Japan’s farmers against free trade negotiations. Refer to Nishikawa 2016b.

[11] Refer to Bannai et al. 2015, Bannai et al. 2018 and Shimizu et al. 2018, which are our successive studies with the Norinchukin Research Institute about the collaboration of the extension system and the agricultural cooperatives in Japan

Overview of Japan’s Rice Policy for the Last 30 Years: from Price Support to Direct Payments

INTRODUCTION

The aim of this article is to review the transformation of Japan’s rice policy for the last 30 years and to clarify their features. We will focus on the change of policy from price support to direct payments to support paddy field farmers. Current policy reforms are so complicated that it is difficult to explain them by a consistent concept. However, we can put Japan’s experiences into the common context of policy reforms of developed countries, utilizing the concept of “from policy support to directs payments” forced by the agricultural agreement of the World Trade Organization (WTO)1.

We will also refer to the changing process of the Common Agricultural Policy (CAP) administered by the European Union (EU) to consider Japan’s features. We could not learn much from the CAP for shaping our own policy reforms because there are many differences between the two countries in terms of historical contexts, agricultural structures, rural societies, political cultures and so on2. However, we can utilize the CAP as a reference for evaluating Japan’s policy reform, because the CAP reform has achieved the transformation from price support to direct payments successfully and provide some kind of template of the policy reform compatible with the WTO agreement3.

In the first section, I will show the basic concept of the direct payment policy and clarify differences between Japan and the EU. And then, I will trace the process of the agricultural policy change in Japan over the last 30 years. Finally, I will investigate the consequences of this policy change focusing on changes of agricultural structure and farm organization and prospects of policy reforms in Japan4.

BASIC CONCEPT OF DIRECT PAYMENTS

The concept of the direct payment policy can be summarized into the following three features; compensation, decoupling and targeting5. “Compensation” means that governments provide payments to farmers as compensation in return for the withdrawal of support prices. It is said that governments have to compensate for the loss of farmers’ revenue or income, because farmers decided to choose farming as their occupations based on the level of support prices in the past. This is thought to be a “contract” between governments and farmers (Korenaga 1998). “Decoupling” means that payments are decoupled from production judgements of farmers and they do not influence farmers’ activities. Payments are not based on the level of current production but past records of production, revenue, income and so on. “Targeting” means that governments can limit recipients of direct payments corresponding to their policy priorities. Price supports benefit all market participants through raising prices indiscriminately, but desirable recipients for governments could be limited by directly paying to the specified group of farmers.

Fig. 1 and Fig. 2 show different pictures of compensation between Japan’s rice and the EU wheat. In the EU, compensation payments have sufficiently covered a gap between the reference price (intervention price in 1992 when the MacShary reform happened) and the intervention price reduced in the MacShary reform and the Agenda 2000 reform.

Fig. 1. Trends of the market price and compensation payments in Japan’s rice

Source: Nishikawa 2015. 8-9, Figure Intro.-1-2., revised

Fig. 2. Trends of the market price and compensation payments in the EU’s wheat

Source: Ibid. 8-9, Figure Intro.-1-2., revised

Furthermore, the producer revenue set by the producer price decided in the market plus compensation payments has exceeded significantly beyond the reference price because of the rise in international grain prices after late 2000s. The direct payment policy in the EU has sufficiently compensated farmers’ loss since policy reforms started. On the contrary, payments in Japan have not sufficiently covered a gap between the market price and the reference price stipulated by the 1986 price when the Japan’s government began the reform of the Food Control System through the reduction in the rice support price. There are two ways to explain this insufficient manner of the Japan’s government. First, the Japan’s government has financial deficits so huge that they cannot afford to make sufficient payments to farmers. Second, Japan’s government sets the priority on the scale expansion of paddy field farms. It is necessary to promote small farmers to quit farming and to consolidate their farmlands to large farms. We can confirm that the level of the market price plus compensation payments has been below the average production cost continuously and significantly. Generally speaking, the level of the production cost of small farms is more expensive than that of large farms. This level of compensation has made small farmers unprofitable, which has promoted them to abandon rice farming.

It is difficult to show a clear answer on whether direct payments have decoupled effects. Western scholars have pointed out that, in fact, direct payments distort production decisions of farmers including effects on factor prices such as farmland rent and price (Jongeneel and Brand, 2011). In Japan, effects on farmland rent and price are also insisted but depend on regional states. The level of the land rent and price tends to rise in regions where the demand of farmlands exceeds the supply because payments are vested in landowners while it tends to fall in regions where the supply exceeds the demand (Ando, 2010). Another study clarified that direct payments are used to provide employment for young residents in regions where depopulation and aging society have become the norm (Nishikawa, 2016a). Young workforces as a production factor have become scarcer than farmlands in Japan’s rural areas, which has made direct payments influence on the labor market. However, we need to take into consideration other elements such as structure of rural societies and cultural contexts to explain this phenomenon.

Who is targeted depends on the policy priority of governments. In the EU, farmers who practice environmentally friendly farming are subject to direct payments through the cross compliance introduced by the Agenda 2000 reform and the greening by the post-2013 reform, because the priority of the EU is agricultural environment policies. On the other hand, farmers who intend to expand their farm size are subject to policies in Japan because Japan’s government emphasizes the structural reform of the paddy agriculture.

OVERVIEW OF THE RICE POLICY CHANGE IN JAPAN

The policy which functioned as the rice price support in Japan was the Food Control Law (Shokuryo Kanri Hou) established during the World War II. The government set the producer price for compensating the production cost while setting the consumer price for easing household expenses. The philosophy of the dual prices system which the producer price exceeds consumer price generated the loss margin and contributed to the huge budgetary deficit. Since 1970s when the surplus of rice production soared, the government has tried to suppress the rise in the producer price and introduced the set-aside policy to reduce rice production. Then, the government turned to reduce the producer price and eliminated the loss margin in 1987. This change was historic, because the government reduced the producer price for the first time in 31 years, which became a starting point of the elimination of the price support of the Food Control System. Finally, the Food Control System was abolished and the new Food Law (Shokuryo Hou) was enacted in 1995. Market mechanism was introduced to the rice distribution thoroughly, which has promoted the continuous fall in the rice price.

Table 1 shows the development of the direct payment policy in Japan. At first, Japan’s government hesitated to compensate for the reduction in the rice price even though this was strongly requested by farmers and their organizations. They explained that compensation payments were not necessary, because Japan’s rice market was protected by the high-rate tariff (Hirasawa, 2014) and the situation was different from the EU. However, the government decided to introduce the mitigation measure, the Program to Stabilize Rice Farmers (Inasaku Keiei Antei Taisaku), against the fall in the rice price in 1998 because the decline was huge and caused negative effects on large farmers’ managements. This measure compensated 80% of the loss between the market price of current year and the average price of past 3 years (the standard price). Farmers needed to pay 2% of the standard price to contribute for making the financial resource while the government payed 6%. The standard price of compensation moved downward because of the continuous fall in the rice price. This measure had many weak points, but this was the first and epoch-making direct payment policy for Japan’s farmers. On the other hand, the government strengthened the set-aside policy, increasing the area of diversion and subsidies for producing other crops such as wheat and soybeans, and aiming at raising the rice price to reduce the budget of compensation. The combination of direct payments and the expansion of the set-aside areas has been a marked feature of the Japan’s direct payment policy6.

Table 1. Chlonicle of the Rice Policy Change in Japan

In 2004, the government revised mitigation policies, dividing them into two measures. The first part was the Program to Secure Income Basis of Rice Production (Inasaku Shotoku Kiban Kakuho Taisaku, ISKKT) which consisted of the fixed payment paying JPY 300 (US$ 2.7 calculated at US$ 1 = JPY 110) per 60kg and the variable payment compensating for 50% of the loss between the market price of current year and the average price of past three years. The variable payment was contributed by both farmers and the government paying 2.5% of the standard rice price. All farmers regardless farm size could receive ISKKT’s payment, as this measure was placed as a compensation for the set-aside policy. The second part was the Program to Stabilize Principal Farmers (Ninaite Keiei Antei Taisaku, PSPF). This measure compensated for 90% of the loss between the rice revenue of current year and the average revenue of past three years. Farmers needed to pay 1% of the standard revenue to contribute for making the financial resource while the government payed 3%. The subject of this measure was limited to “Principal Farmers (Ninaite)7” who held above four hectares of farmlands as the certified farmers8 or above 20 hectares as the community farming entities. This was the first trial to sort out policy subjects by farm size, which clarified that the priority of the Japan’s agricultural policy was the structural reform consolidating farmlands into large farmers.

The direct payment policy developed further in 2007. The government introduced the Program to Stabilize Farmer’s Management and Income (PSFMI, Keiei Syotoku Antei Taisaku). This program covered not only rice but also wheat, soybeans, sugar beets and potatoes for starch. And, this composed of two parts. The first part was “Geta” which aimed to correct the disparity of the agricultural production between domestic and overseas conditions and covered wheat, soybeans, sugar beets and potatoes for starch. Rice was excluded because it was protected from international competition by high tariff rate, explained by the government. The amount of payment was calculated by the gap between the production costs of domestic farmers and the revenues stipulated by international price. This payment was further divided to two portions. 70% of payment was paid based on the past production records and 30% was calculated by the current volume and quality of products. The government explained that the former portion was decoupled from production and categorized to “green box” while the latter portion was categorized to “amber box” related to the current production. The second part was “Narashi” which aimed to mitigate the fluctuation of farmer’s revenue. This payment compensated for 90% of the gap between the revenue averaged by the middle three years of past five years and the revenue of current year, if the current revenue declined. The revenues of each crop were totaled and set off when the standard and the current revenue were calculated. Farmers needed to pay 1% of the standard revenue to contribute for making financial resources while the government payed 3%. As with the past PSPF, the subject of this program was limited to “Ninaite” who held above four hectares of farmlands as the certified farmers and who held above 20 hectares as the community farming entities.

The PSFMI was one of the achievements of the direct payment policy of Japan. The aspect of compensation was marginalized through which rice was excluded from “Geta” payment and the reduction in rice revenue was set off by other crops within one program. The subject of payments was limited to “Ninaite” and its standard was stipulated by farm size. However, this program was quite unpopular to farmers. The level of compensation was not enough to “stabilize farmer’s management and income” for not only small farmers who were excluded from the program but also “Ninaite.” Furthermore, it is important to notice that the majority of farmers was excluded from the program. The number of subjects was 72,431 farms in 2009, which just occupied 3.6% of all farms9. As a result, the government could not receive supports from rural areas. This was one factor that the Liberal Democratic Party (LDP) which managed administration at that time and was based on rural voters lost popularity. Thus, the LDP went out of power in the 2009 general election.

The Democratic Party of Japan (DPJ) came into power instead of the LDP. The DPJ had showed the Income Support Program for Farmers (ISPF, Kobetsu Syotoku Hosyou Seido), criticizing the LDP’s PSFMI. The DPJ government introduced the ISPF immediately after coming into power. This program was divided into the rice program and the field crops program. We will focus on the rice program to simplify an explanation. The rice program was further divided into two portions. The first portion was the fixed payment which paid JPY 15,000 (US$ 136) per 10a to farmers. It was based on the calculated gap between the production cost averaged by the middle five years of past seven years (the standard production cost) and the revenue averaged by past three years (the standard revenue). It was the first time since the Food Control Law was abolished that the production cost was used as the standard of compensation. The second portion was the variable payment which compensated for 100% of the gap between the standard revenue and the revenue of the current year. These payments are paid to all farmers regardless of farm sizes.

The DPJ’s ISPF could fundamentally transform the Japan’s direct payment policy. First, the ISPF raised the level of compensation significantly. We can confirm in Figure 1 that the level of the market price plus compensation payments increased after 2009 and even exceeded the production cost in 2012. Second, the ISPF did not restrict recipients of payments. All farmers could receive relatively sufficient compensation during the DPJ administration. However, there is a study showing that the ISPF prevented the structural change of the paddy agriculture because it improved the profitability of small farmers (Nishikawa, 2015). The DPJ administration could not keep power for more than three years because of some factors such as splits of party, the lack of governance and damages from the Great East Japan Earthquake. The LDP came back to power in 2012 and began to repel the DPJ’s policies. The LDP government decided to reduce the ISPF’s fixed payment to JPY 7,500 (US$ 68) and finally abolished it in 2017. The revenue insurance system was newly introduced from 2018 but we need enough time to evaluate its effects on farmers’ management and income.

CONSEQUENCES AND PROBLEMS OF POLICY CHANGE

The rice policy change in Japan has resulted in two consequences: promoting the agricultural structural change and the farmer’s dependence on direct payments. Table 2 shows the change in farm household number and distribution of farmland. From 1985 when the Japan’s government began to reduce price supports to 2015, the number of farm household has almost halved. Especially, small and middle size farms between 0.3ha and 3.0ha has decreased significantly while large farms which are above 5.0ha and agricultural farm enterprises have increased by beyond 100%. The number of the non-farming landowners who retired from farming has also increased. As a result, the distribution of farmland has concentrated into large farms. Almost 40% of farmland were held by farm households above 5.0ha and agricultural farm enterprises. Most studies, including the MAFF’s official view (MAFF 2013) have pointed out that this structural change has been caused by the retirement of the Showa-digit generation who were born from 1926 to 1934 (from Showa 1 to 9 by the Japanese calendar year). However, we cannot deny that features of policy change discussed in this article have influenced on this change. The insufficient and subject-limited compensation payments have made small farmers’ profitability worse and hesitated successors of farm household to succeed their families’ farming. And, relatively generous amounts of payment to Ninaite has promoted them to expand their farm size and concentrated farmlands to them (Nishikawa, 2015).

Table 2. Change in Farm Household Numbers and Distribution of Farmland

Source: MAFF. Census of Agriculture.

Note: 1) These figures cover prefectures, excluding Hokkaido.

2) Total Farm Number = Farm Household + Farm Enterprise.

3) Changing rate of Non-Farming Landowner shows the change from 1995 to 2015.

Second consequence is to make large farmers being dependent on governmental supports more deeply. Figures 3 and 4 show trends of the large farmers’ agricultural income (AI) and the miscellaneous income (MI) mainly occupied by governmental supports. Figure 3 shows farmers who operate the rice single farming, and figure 4 represents farmers who operate the multiple management. Both types of farmers managed farmlands above 20ha. Referring to Figure 3, we can confirm that MI has increased while AI has reduced. Thus, the ratio of MI to total income has rapidly risen and reached 80% in 2014. Figure 4 shows the same picture as Figure 3, but the ratio of MI has been higher than the rice single farming. As commodity prices of land crops such as wheat and soybeans were lower than rice, farmers who produced those crops have been more dependent on governmental supports to set off farming loss. The deep dependence on governmental supports causes two problems for farmers. First, large farmers have become vulnerable to policy changes. Current policy changes are so complicated and frequent that no one can predict how policy changes would influence on farmers. Not only drastic but also fine changes could cause serious damages to large farmers. The agricultural policy itself became a risk factor for farm management (Shogenzi, 2011). Second, there is a fear that famers would lose their management sense. Their revenue and income are occupied by stable governmental payments, which could make their sensitivity to the market mechanism dull (Umemoto, 2010). The deep dependence on governmental supports may kill farmers who are independent and support the vitality of Japan’s farming.

Fig. 3. Trends of Agricultural Income and Miscellaneous Income of Rice Single Farming Above 20ha

Source: MAFF. Statistics on Management by Farming Type (individual management).

Note: 1) These figures cover prefectures, excluding Hokkaido.

2) Miscellaneous Income is mainly occupied by governmental supports.

Fig. 4. Trends of Agricultural Income and Miscellaneous Income of Multiple Farming (Rice 1st Place) Above 20ha

Source: Ibid.

PROSPECTIVE OF THE RICE POLICY REFORM IN JAPAN

The priority of Japan’s rice policy is the structural reform of the paddy agriculture. It is inevitable for Japan’s agriculture to expand the average farm size and improve its competitiveness in order to cope with the severe international competition in the future. The insufficient compensation and the targeting manner of the direct payment policy have seemed to be rational to promote the structural reform of the paddy agriculture. However, the former feature has premised that the domestic rice market was isolated from abroad competitors through high rate tariff. If the tariff rate will be reduced and the domestic market will be open to abroad significantly, the Japan’s government will have to raise the level of compensation to protect Ninaite10.

We also need to pay attention to management abilities of farmers. Both public and private education systems may become important to grow independent and creative farmers under the situation of being heavily dependent on governmental payments. Functions of the cooperative extension system should be strengthened and advanced through adopting large farmers’ needs while roles of the agricultural cooperatives and private companies will expand under shrinking the extension system’s budget11.

REFERENCES

Ando, M. 2010. How the JA cope with the reform of farmland control system? Nogyo to Keizai. 76(8), 36-45 (In Japanese).

Ando, M. 2016. The process and consequence of paddy field policy development in Japan: from price support and market measure to direct payment. Journal of Rural Economics. 88(1), 26-39 (In Japanese).

Arahata, K. 2010. The Economics of the Rice Acreage Reduction Program. Nourin Tokei Shuppan (In Japanese).

Bannai, H., Nishikawa, K., Ichinose, Y. and Shimizu, T. 2015. Research studies about support system for farmers: institution of regional federations to integrally support farming guidance activities by agricultural cooperatives. Souken Report. 28 Kisoken, No.4 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20170518.pdf).

Bannai, H. and Nishikawa, K. 2018. Research Studies about support system for farmers: domestic surveys version. Souken Report. 30 Noukin, No.2 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20180711-1.pdf).

Hirasawa, A. 2014. Frame and Emerging Reform of Agricultural Policy in Japan. FFTC Agricultural Policy Platform (Food & Fertilizer Technology Center). July 2nd, 2014 (http://ap.fftc.agnet.org/ap_db.php?id=257).

Jongeneel, R. and Brand, H. 2011. Direct income support and cross-compliance. Oskam, A., Meester, G. and Silvis, H. (eds.) EU Policy for Agriculture, Food and Rural Areas. Wageningen Academic Publishers. 197-212.

Kishi, Y. 2016. Introduction. Kishi (eds.) World Direct Payment System. Norin Tokei Kyokai, 1-4 (In Japanese).

Korenaga, H. 1998. Categories and issues of the decoupling-typed agricultural policies in the EU. Nippon Agricultural Research Institute (eds.) Study of Japanese-typed Decoupling. Norin Tokei Kyokai, 25-39 (In Japanese).

Ministry of Agriculture, Forestry and Fisheries. 2013. 2013 White Paper of Agriculture, Forestry and Fisheries (In Japanese).

Nishikawa, K. 2015. “Policy Change” and Ninaite on Paddy Field Agriculture: Focusing on Tayagawa District, Chikusei-city, Ibaraki Prefecture. Norin Tokei Shuppan (In Japanese).

Nishikawa, K. 2016a. Business diversification and direct payments: an example of Sawayaka Touchi in Sera-machi, Hiroshima prefecture. Institute of Regional Science, Takasaki City University of Economics (eds.) Regeneration of Agriculture and Rural Areas under Free Trade: Challenges by Tiny People. Nihon Keizai Hyoronsya, 149-170 (In Japanese).

Nishikawa, K. 2016b. Free trade and the future of Japan’s agricultural policy. Asia Pacific Bulletin. 342, 1-2 (https://www.eastwestcenter.org/publications/free-trade-and-the-future-japan’s-agricultural-policy).

Shimizu, T., Hara, K., Nishikawa, K. and Hirasawa, A. 2018. Research Studies about support system for farmers: the US surveys version. Souken Report. 30 Noukin, No.3 (In Japanese) (https://www.nochuri.co.jp/skrepo/pdf/sr20180711-2.pdf).

Shogenzi, S. 2011. Truth of Japan’s Agriculture. Chikuma Shobo (In Japanese).

Tashiro, Y. 2012. Introduction of Agricultural and Food Issues. Otsuki Syoten (In Japanese).

Umemoto, M. 2010. Structure and management actions by principal farmers of paddy agriculture. Journal of Rural Economics. 82(2), 102-111 (In Japanese).

Date submitted: Aug. 7, 2018

Reviewed, edited and uploaded: Oct. 18, 2018

[1] The agricultural agreement of the WTO categorizes domestic support of affiliated countries into “green box,” “blue box” and “amber box.” The amber box is stipulated as policy that has trade distorting effects while those effects are minimized in the green box. The blue box includes direct payments with set-aside policies. Direct payments being subject to the review of this article are included in the green box or the blue box while price support are categorized in the amber box. The agricultural agreement requires developed countries to reduce the amount of the amber box. Thus, they have to transfer from price support to direct payments to maintain the total amount of agricultural budgets.

[2] For instance, Japan has reduced the budget for agricultural policies, while the EU has increased its amount even though both two countries started policy reforms in the late 1980s. Refer to Ando 2016, 28-29.

[3] The EU consists of many nation states and has a history of pursuing solutions which they could commonly accept. Refer to Tashiro 2012, 191.

[4] I discussed the basic concept of this article, from the price support to the direct payment, in my previous publication, Nishikawa 2015, for the first time. In this article, I discuss more deeply referring to other important publications which I did not noticed and add the new movements of Japan’s agricultural policy since then and the statistical analysis utilizing 2015 Census of Agriculture.

[5] Direct payments could be categorized into payments for compensation, less favored areas and environmentally friendly farming. Referred to Kishi 2006, the payment type being subject to the review of this article is the first one.

[6] We will just touch on the relationship between direct payments and the set-aside policy in this article. Refer to Arahata 2010 if readers would like to learn more.

[7] “Ninaite” are farmers who not only efficiently manage large scale farm units but also maintain regional societies through receiving excessive farmlands beyond the optimum size. By the English version of the FY2010 annual report, the Ministry of Agriculture, Forestry and Fisheries had expressed this terminology as “Principal Farmer”. In the FY2013 annual report, however, it expressed as “Business Farmer” because it focused on the former aspect of Ninaite. This change was influenced by the administration change to the Shinzo Abe cabinet which emphasizes the industrialization of agriculture.

[8] “The certified farmers” is authorized for their management plans by prefectural governors and can preferentially utilize policy measures such as farm finances.

[9] These figures are quoted and calculated from the MAFF’s business statistics (http://www.maff.go.jp/j/kobetu_ninaite/keiei/pdf/state.pdf) and 2005 Agricultural Census.

[10] The insufficient compensation to the decline in rice price could result in the severe resistance of Japan’s farmers against free trade negotiations. Refer to Nishikawa 2016b.

[11] Refer to Bannai et al. 2015, Bannai et al. 2018 and Shimizu et al. 2018, which are our successive studies with the Norinchukin Research Institute about the collaboration of the extension system and the agricultural cooperatives in Japan