ORIGINAL DOCUMENT

「日EU・EPAにおける品目ごとの農林水産物への影響について」(Written in Japanese) http://www.maff.go.jp/j/kanbo/eu_epa/attach/pdf/index-7.pdf accessed November 4, 2017

「日EU・EPAにおける品目ごとの農林水産物への影響について(総括表)」(Written in Japanese) http://www.maff.go.jp/j/kanbo/eu_epa/attach/pdf/index-10.pdf accessed November 4, 2017

EXPLANATORY NOTES FOR TRANSLATION

The following is a partial translation of the document entitled Impact of Japan-EU EPA on Agricultural, Forestry and Fishery Products by Commodities. Translated are evaluation on beef, pork, and dairy products, which the document expects to be affected in the long term, and a summary table. The three commodities are sequenced in the same order as the original document.

This is the first time that the Japanese government published evaluation on the impact of Japan-EU Economic Partnership Agreement (JEEPA) on domestic products. The evaluation is based on an agreement in principle between Japan and EU on the main elements of JEEPA, which was reached on July 6, 2017. As such, the nature of the evaluation is tentative. The whole evaluation is qualitative and does not include quantitative estimation.

TRANSLATION

BEEF

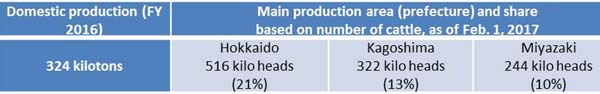

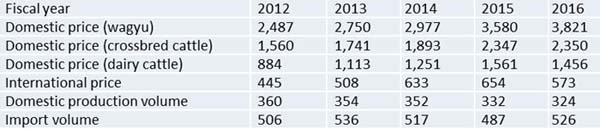

Basic data

Price, production volume and import volume (Yen/kg, kilotons)

Tariff rates 38.5%

Summary of border measures

Based on the result of consultation with countries concerned in the Uruguay Round, provisional tariff rate is set at 38.5% which is lower than conventional tariff (50%).

Results of negotiation

Results of analysis

- Australia and the USA account for around 90% of import (530 kilotons). Import from EU was 985 kilotons even at its record high on fiscal 2015.

- Tariff elimination was avoided and long period for tariff reduction was acquired. Safeguard will be introduced.

- Among domestic beef (wagyu, crossbred, and dairy cattle), wagyu and crossbred cattle are differentiated from imported beef in terms of quality and price. Then the extent of competition with imported beef is expected to be small.

- Hence, rapid increase in import is not expected for the time being.

- On the other hand, EU accounts for about 10% of beef production volume in the world and the potential capacity to export is large. Besides, EU is strongly oriented toward expansion of export to Japan with entry into force of EPA. Therefore, in the long term and along with the reduction of tariff, there is a concern over decline in price of domestically produced beef as a whole with focus on dairy cattle competing with imported beef. Hence, as regards domestic production of beef cattle, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

PORK

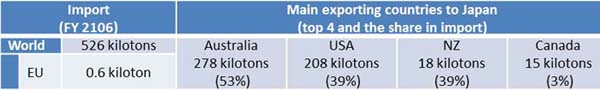

Basic data

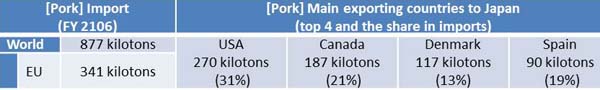

|

[Pork] Price, production volume and import volume (Yen/kg, kilotons)

|

|

Fiscal year

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Domestic price

|

629

|

713

|

847

|

771

|

754

|

|

International price

|

526

|

529

|

556

|

532

|

526

|

|

Domestic production volume

|

907

|

917

|

875

|

888

|

894

|

|

Import volume

|

760

|

744

|

816

|

826

|

877

|

|

[Ham and bacon] Price, production volume and import volume

(Yen/kg, kilotons)

|

|

Fiscal year

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Domestic production volume

|

522

|

534

|

536

|

535

|

541

|

|

Import volume

|

241

|

254

|

229

|

228

|

225

|

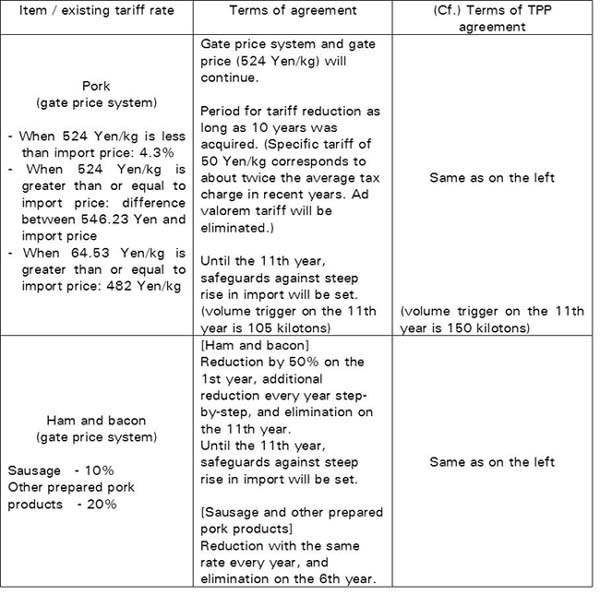

Tariff rates (summary of border measures)

[Pork] (gate price system)

- When 524 Yen/kg is less than import price: 4.3%

- When 524 Yen/kg is greater than or equal to import price: difference between 546.23 Yen and import price

- When 64.53 Yen/kg is greater than or equal to import price: 482 Yen/kg

[Ham and bacon] (gate price system)

- When 897.59 Yen/kg is less than import price: 8.5%

- When 897.59 Yen/kg is greater than or equal to import price: 614.85 – 0.6 x import price (Yen/kg)

[Sausage] - 10%

[Other prepared pork products] - 20%

Results of negotiation

Results of analysis

- Long period for tariff reduction was acquired; gate price system and gate price will continue; safeguards will be introduced.

- Because gate price system will continue, “combination” import, which is prevailing under the existing system, is assumed to be kept.

- Given that demand for pork outside Japan would increase rapidly, competition for purchase with other pork importing countries can be intensified.

- Hence, rapid increase in import is not expected for the time being.

- On the other hand, in the long term and along with the reduction of specific tariff, there is a undeniable possibility that low-price parts will be partly imported without “combination”. This leads to a concern over a decline in price of domestically produced pork. Hence, as regards domestic pork farming, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

- As regards ham and bacon, long period for tariff reduction was acquired and safeguards will be introduced.

- Domestic prepared pork is mainly made of imported frozen pork. Hence, import of frozen pork can act as a substitute for imported prepared pork. Therefore effect on domestic pork is expected to be limited.

MILK AND DAIRY PRODUCTS

Basic data

|

Domestic production (FY 2016)

|

Main production regions and the share

based on raw milk production of FY 2016

|

|

7,346 kilotons

|

Hokkaido

3,896 kilotons

(54%)

|

Kanto

1,171 kilotons

(16%)

|

Kyushu

640 kilotons

(9%)

|

Price, production volume and import volume (Yen/kg, kilotons)

|

Fiscal Year

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Domestic price (skimmed milk powder)

|

591

|

600

|

619

|

650

|

650

|

|

Domestic price (butter)

|

1,150

|

1,178

|

1,208

|

1,268

|

1,254

|

|

International price (skimmed milk powder)

|

314

|

421

|

426

|

324

|

275

|

|

International price (butter)

|

280

|

470

|

464

|

434

|

384

|

|

Domestic raw milk production volume

|

7,607

|

7,447

|

7,331

|

7,407

|

7,346

|

|

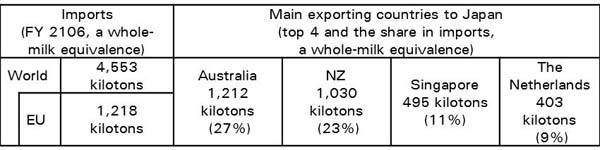

Import volume of dairy products

|

4,195

|

4,057

|

4,425

|

4,633

|

4,553

|

Note: CIF price(Average price in ‘Trade of Statistics Japan’)

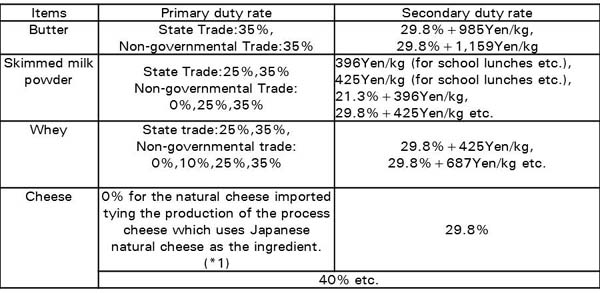

Tariff rates(Tariff-rate Quote)

.jpg)

Summary of border measures

- Under the state trading system and tariff rate quota, the impact of imports on domestic demand is being mitigated.

- Natural cheese destined as an ingredient for processed cheese (*1) is imported to Japan duty free up to 2.5 times the amount of the Japanese domestic natural cheese production used for processed cheese. This institutional framework creates the demand for Japanese natural cheese.

.jpg)

Results of negotiation

.jpg)

.jpg)

Results of analysis

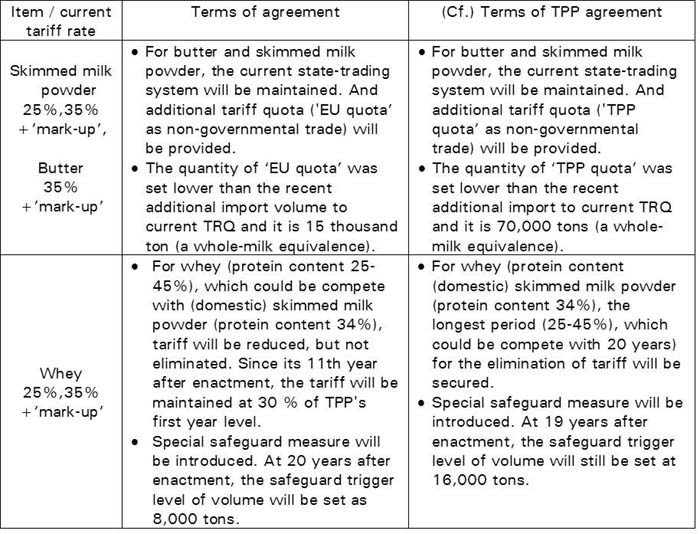

-For butter and skimmed milk powder etc., the current state-trading system will be maintained. And additional tariff quota (non-governmental trade) will be introduced, although the quantity of the tariff quota is less than the recent additional import volume to current TRQ. Secondary duty rate will be maintained as current high level.

- For whey, tariff will be reduced, but not eliminated. Since the 11th year after enactment, the tariff will be maintained at 30 % of TPP's first year level. And special safeguard measure will be introduced against a surge in imports.

-For ‘soft cheese' (camembert, processed cheese etc.), the elimination of tariff was avoided, and single tariff quota will be introduced. For ripened hard cheese (cheddar, gouda, etc.), the long term for the elimination of tariff will be secured.

- As a result, for the time being, it looks like there will be no rapid increase of import, and thus the negative effect will be avoided, on the domestic supply and demand of dairy products including drinking milk.

- On the other hand, in the long period, the reduction and the elimination of tariff in whey and cheese could cause the decrease in the price level of domestic skimmed milk powder and butter. And thus the price of raw milk, which is destined for dairy products (exclusive fresh products) would decrease. Therefore, it is necessary that farm income stabilization measure should be reconsidered also in light of the state of TPP. Also after necessary stocktaking in the light of examination of the past result, the measure to strengthen the dairy sector should be enacted. At the same time, in order to make Japanese cheese more competitive, promotion is necessary to produce lower cost and higher quality of raw milk for cheese and for the whole dairy industry, and to produce lower cost. The dairy industry should be able to produce higher quality of branded cheese.

Note: Commodities exempted from tariff reduction and elimination such as rice, laver, kombu , and wakame (Undaria pinnatifida) and hijiki (Sargassum fusiforme) are not examined.

Impact of Japan-EU EPA on Agricultural, Forestry and Fishery Products by Commodities

ORIGINAL DOCUMENT

「日EU・EPAにおける品目ごとの農林水産物への影響について」(Written in Japanese) http://www.maff.go.jp/j/kanbo/eu_epa/attach/pdf/index-7.pdf accessed November 4, 2017

「日EU・EPAにおける品目ごとの農林水産物への影響について(総括表)」(Written in Japanese) http://www.maff.go.jp/j/kanbo/eu_epa/attach/pdf/index-10.pdf accessed November 4, 2017

EXPLANATORY NOTES FOR TRANSLATION

The following is a partial translation of the document entitled Impact of Japan-EU EPA on Agricultural, Forestry and Fishery Products by Commodities. Translated are evaluation on beef, pork, and dairy products, which the document expects to be affected in the long term, and a summary table. The three commodities are sequenced in the same order as the original document.

This is the first time that the Japanese government published evaluation on the impact of Japan-EU Economic Partnership Agreement (JEEPA) on domestic products. The evaluation is based on an agreement in principle between Japan and EU on the main elements of JEEPA, which was reached on July 6, 2017. As such, the nature of the evaluation is tentative. The whole evaluation is qualitative and does not include quantitative estimation.

TRANSLATION

BEEF

Basic data

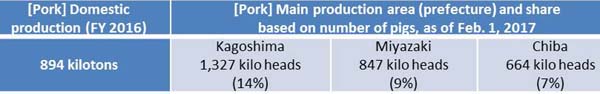

Price, production volume and import volume (Yen/kg, kilotons)

Tariff rates 38.5%

Summary of border measures

Based on the result of consultation with countries concerned in the Uruguay Round, provisional tariff rate is set at 38.5% which is lower than conventional tariff (50%).

Results of negotiation

Results of analysis

- Australia and the USA account for around 90% of import (530 kilotons). Import from EU was 985 kilotons even at its record high on fiscal 2015.

- Tariff elimination was avoided and long period for tariff reduction was acquired. Safeguard will be introduced.

- Among domestic beef (wagyu, crossbred, and dairy cattle), wagyu and crossbred cattle are differentiated from imported beef in terms of quality and price. Then the extent of competition with imported beef is expected to be small.

- Hence, rapid increase in import is not expected for the time being.

- On the other hand, EU accounts for about 10% of beef production volume in the world and the potential capacity to export is large. Besides, EU is strongly oriented toward expansion of export to Japan with entry into force of EPA. Therefore, in the long term and along with the reduction of tariff, there is a concern over decline in price of domestically produced beef as a whole with focus on dairy cattle competing with imported beef. Hence, as regards domestic production of beef cattle, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

PORK

Basic data

[Pork] Price, production volume and import volume (Yen/kg, kilotons)

Fiscal year

2012

2013

2014

2015

2016

Domestic price

629

713

847

771

754

International price

526

529

556

532

526

Domestic production volume

907

917

875

888

894

Import volume

760

744

816

826

877

[Ham and bacon] Price, production volume and import volume

(Yen/kg, kilotons)

Fiscal year

2012

2013

2014

2015

2016

Domestic production volume

522

534

536

535

541

Import volume

241

254

229

228

225

Tariff rates (summary of border measures)

[Pork] (gate price system)

- When 524 Yen/kg is less than import price: 4.3%

- When 524 Yen/kg is greater than or equal to import price: difference between 546.23 Yen and import price

- When 64.53 Yen/kg is greater than or equal to import price: 482 Yen/kg

[Ham and bacon] (gate price system)

- When 897.59 Yen/kg is less than import price: 8.5%

- When 897.59 Yen/kg is greater than or equal to import price: 614.85 – 0.6 x import price (Yen/kg)

[Sausage] - 10%

[Other prepared pork products] - 20%

Results of negotiation

Results of analysis

- Long period for tariff reduction was acquired; gate price system and gate price will continue; safeguards will be introduced.

- Because gate price system will continue, “combination” import, which is prevailing under the existing system, is assumed to be kept.

- Given that demand for pork outside Japan would increase rapidly, competition for purchase with other pork importing countries can be intensified.

- Hence, rapid increase in import is not expected for the time being.

- On the other hand, in the long term and along with the reduction of specific tariff, there is a undeniable possibility that low-price parts will be partly imported without “combination”. This leads to a concern over a decline in price of domestically produced pork. Hence, as regards domestic pork farming, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

- As regards ham and bacon, long period for tariff reduction was acquired and safeguards will be introduced.

- Domestic prepared pork is mainly made of imported frozen pork. Hence, import of frozen pork can act as a substitute for imported prepared pork. Therefore effect on domestic pork is expected to be limited.

MILK AND DAIRY PRODUCTS

Basic data

Domestic production (FY 2016)

Main production regions and the share

based on raw milk production of FY 2016

7,346 kilotons

Hokkaido

3,896 kilotons

(54%)

Kanto

1,171 kilotons

(16%)

Kyushu

640 kilotons

(9%)

Price, production volume and import volume (Yen/kg, kilotons)

Fiscal Year

2012

2013

2014

2015

2016

Domestic price (skimmed milk powder)

591

600

619

650

650

Domestic price (butter)

1,150

1,178

1,208

1,268

1,254

International price (skimmed milk powder)

314

421

426

324

275

International price (butter)

280

470

464

434

384

Domestic raw milk production volume

7,607

7,447

7,331

7,407

7,346

Import volume of dairy products

4,195

4,057

4,425

4,633

4,553

Note: CIF price(Average price in ‘Trade of Statistics Japan’)

Tariff rates(Tariff-rate Quote)

Summary of border measures

- Under the state trading system and tariff rate quota, the impact of imports on domestic demand is being mitigated.

- Natural cheese destined as an ingredient for processed cheese (*1) is imported to Japan duty free up to 2.5 times the amount of the Japanese domestic natural cheese production used for processed cheese. This institutional framework creates the demand for Japanese natural cheese.

Results of negotiation

Results of analysis

-For butter and skimmed milk powder etc., the current state-trading system will be maintained. And additional tariff quota (non-governmental trade) will be introduced, although the quantity of the tariff quota is less than the recent additional import volume to current TRQ. Secondary duty rate will be maintained as current high level.

- For whey, tariff will be reduced, but not eliminated. Since the 11th year after enactment, the tariff will be maintained at 30 % of TPP's first year level. And special safeguard measure will be introduced against a surge in imports.

-For ‘soft cheese' (camembert, processed cheese etc.), the elimination of tariff was avoided, and single tariff quota will be introduced. For ripened hard cheese (cheddar, gouda, etc.), the long term for the elimination of tariff will be secured.

- As a result, for the time being, it looks like there will be no rapid increase of import, and thus the negative effect will be avoided, on the domestic supply and demand of dairy products including drinking milk.

- On the other hand, in the long period, the reduction and the elimination of tariff in whey and cheese could cause the decrease in the price level of domestic skimmed milk powder and butter. And thus the price of raw milk, which is destined for dairy products (exclusive fresh products) would decrease. Therefore, it is necessary that farm income stabilization measure should be reconsidered also in light of the state of TPP. Also after necessary stocktaking in the light of examination of the past result, the measure to strengthen the dairy sector should be enacted. At the same time, in order to make Japanese cheese more competitive, promotion is necessary to produce lower cost and higher quality of raw milk for cheese and for the whole dairy industry, and to produce lower cost. The dairy industry should be able to produce higher quality of branded cheese.

Summary Table

1. Impacts on agricultural, forestry and fishery products by commodities (28 commodities)

Impact

Commodity

Direction of Countermeasures

1

Particular effect is not expected

Azuki bean

Additional enhancement of competitiveness is needed.

Tea

Additional enhancement of competitiveness is needed.

Scallop

Additional enhancement of competitiveness is needed.

Remaining 11 commodities (barley, kidney beans, groundnuts, pine apple, konnyaku potato (or konjac corm), chicken meat, sardine (Sardinops melanostictus), cod (Gadus macrocephalus), squid (Todarodes pacificus, Ommastrephes bartramii, and Loligo bleekeri), trout and salmon, eel)

2

Impact is expected to be limited

Orange

There is a concern that prices of domestically-produced Unshu mikan (or Satsuma mandarin) and the juice will decline in the long term. Hence measures for strengthening of the sector such as productivity enhancement need to be conducted, after necessary stocktaking in the light of examination of the past results.

Hen eggs

There is a concern that price of domestically-produced hen eggs will decline in the long term. Hence measures for strengthening of the sector such as productivity enhancement need to be conducted, after necessary stocktaking in the light of examination of the past results.

Caranginae

There is a concern that domestic price will decline in the long term. Hence measures for strengthening of the sector such as productivity enhancement need to be conducted, after necessary stocktaking in the light of examination of the past results.

Remaining 4 commodities (apple, processed tomato, mackerel, bonito & tuna)

3

While increase in wheat import is not expected, there is a concern over increase in import of wheat products

Wheat

There is a concern that import of wheat products such as pasta and confectionery produced in EU will increase and domestic prices will decline. Hence it is necessary to

take necessary measures from view of ensuring consistency of border measures and staple supply of raw material crops produced domestically. Additional enhancement of competitiveness is also needed.

While particular effect on production of sugar cane and sugar beet is not expected, there is a concern over increase in import of sugar preparation

Sugar

There is a concern that import of less expensive sugar will increase and that will cause problem for stable operation of sugar price adjustment program. Hence it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP. Additional enhancement of competitiveness is also needed.

While impact on starch made from domestically produced potatoes is expected to be limited, there is a concern over price decline in starch made of domestic potato in the long term

Starch

While impact on starch made from domestically produced potatoes is expected to be limited, there is a concern over price decline in starch made of domestic potato in the long term. Hence measures for strengthening of the sector such as productivity enhancement need to be conducted, after necessary stocktaking in the light of examination of the past results.

4

Though steep increase in import is not expected for the time being, there is a concern over effects of tariff reduction in the long term

Beef

In the long term, there is a concern over decline in price of domestically produced beef as a whole with a focus on dairy breed which compete with imported beef. Hence, regarding domestic production of beef cattle, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

Pork

Corresponding to the reduction of specific tariff, there is a undeniable possibility that

low-price parts will be partly imported without “combination” in the long term. It leads to concern over decline in price of domestically produced pork. Hence, regarding domestic pork farming, strengthening measures for the sector to ensure advantage of domestic products such as reduction of production cost and improvement of quality need to be conducted, after necessary stocktaking in the light of examination of the past results. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

Milk and dairy products

In the long term, there is a concern over decline in manufacturing milk price caused by decline in price of domestically produced skimmed milk powder and cheese which compete with import. Hence, strengthening measures for the sector need to be conducted, after necessary stocktaking in the light of examination of the past results. It is also necessary to enhance competitiveness of domestic dairy products such as cheese and strengthen effort for cost reduction and quality improvement of milk for manufacturing use on the side of raw material, and to promote cost reduction, quality improvement and branding on the side of manufacturing. In addition, it is needed to give necessary consideration to farm income stabilization measures in light of the state of TPP.

Structural laminated wood

In the long term, there is a concern over effect of tariff reduction. Hence, comprehensive strengthening measures including upstream and downstream sectors need to be considered, after necessary stocktaking in the light of examination of the past results.

Note: Commodities exempted from tariff reduction and elimination such as rice, laver, kombu , and wakame (Undaria pinnatifida) and hijiki (Sargassum fusiforme) are not examined.

2. Exports of agricultural, forestry and fishery products produced in Japan (8 key commodities)

Impact

Commodity

Direction of Countermeasures

Expansion of export is expected in the future

Key commodities (aquatic products (scallops and Japanese amberjack), beef, condiments, ingredients specific to Japan (like yuzu), rice, green tea, alcoholic beverages, and flowers and ornamental plants)

Expansion of export with a focus on demand from the restaurant industry is expected in the future.

Efforts toward solutions for challenges in circumstances of exports will be accelerated to further expand exports.

Date submitted: Nov. 15, 2017

Reviewed, edited and uploaded: Dec. 19, 2017