ABSTRACT

Technology valuation offers basic data for technology transfer negotiations. To expedite technology transfers, outstanding technologies need to be invented, and transfer costs should be reasonable. One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology financing helps companies to procure business funds through technology valuation for technologies with outstanding potential. Measures for technology financing in Korea’s agriculture and food sector include interest subsidy, IP security, IP guarantee, venture capital and crowd-funding.

Keywords: Technology valuation, technology transfer, commercialization, technology financing, IP security, IP guarantee, venture capital and crowd-fund

INTRODUCTION

Technology valuation is an important factor in technology transfer. In order to facilitate the advancement and development process of high technology, a market for technology transfer must be promoted. Institutional support such as technology brokerage and exchange is necessary for active technology transfer. In the process of the technology transfer, information, especially reliable information on the value of technology is the most important factor.

The efficient technology transfer to industry and enterprise partners is increasingly a key objective for many research institutes. Successful and sustainable technology transfer strategies can lead to better cooperation between research institutes and industry. The income received from licensing out technology and forming spin-off companies can be an important factor in making research and development institutions more financially sustainable. The optimization of the technology transfer process towards value creation can lead to more successful transfers and increased income from IP assets.

Technology valuation is a tool which can be used to assist research institutes in developing technology suitable for transfer. The use of technology valuation tools can also assist in the technology transfer process itself. The results of even the most basic technology valuation approaches can provide management with key information on which to base decisions. The results can also be used to communicate the value of technology internally and outside the institute. Acting on these valuation results can add value to the IP asset and ensure the maximization of income (Miklós Bendzsel, 2011).

The problem arises because information on technology cannot be provided like general goods. Thus the role of technology valuation as a complementary measure becomes very important. There is a special need to evaluate the value of a specific technology from an impartial point of view in order to encourage technology transfer. As the market price is used for the basis of price negotiation in trading goods, an unbiased value of a specific technology must be presented and advanced for the negotiation to be carried between buyers and sellers of technology.

Accordingly, much attention has been focused on evaluating the objective value of technology in Korea including the FACT. We have been using various valuation models to perform evaluations for aiding decisions regarding investments and putting up technologies as collateral. Yet, it is difficult to promote technology trade and transfer with the usual valuation process that focuses on the technology itself. Valuation models thus far have assessed the value of technology from the perspective of the firm in possession of the technology, but such assessment is greatly influenced by the firm’s technological capability, capitalization, brand, and human resources.

However, what the market needs is the worth of technology as a product to be traded in the market, and this calls for an impartial and objective value that is not influenced by the specific company that owns it. The systems that encourage technology transfer can be generally classified into two: a simple system that just builds and offers data on the information about the technology to transfer and the other one that encourages technology transfer by making evaluations of technologies in various perspectives.

Technology valuation is also a crucial factor in technology commercialization, especially in financing. One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology valuation supports procurement of business funds for technologies with outstanding potential. Measures for technology financing in Korea’s agribusiness sector include interest subsidy, IP security, IP guarantee, venture capital, and crowd-funding.

In this paper, I will explain the methodology of technology valuation, and provide uses for technology valuation within research institutes. In addition, I’m going to introduce how technology valuation helps agribusiness firms raise funds for their businesses.

CONCEPT OF TECHNOLOGY, VALUE AND TECHNOLOGY VALUATION

Technology, which becomes the object of technology valuation, is divided into broad and narrow definitions of technology. The narrow concept of technology refers to intellectual property including patent, plant variety protection right, utility model patent, and trademark in addition to disparate technology such as know-how, trade secret, and computer software. The broad concept is not limited to individual technology but covers the firm’s total technological capability as well.

Technology is valuable as an asset and is identified as an intangible asset. Intangible assets with a technical basis are varied in character and include patent rights, trade secrets, know-how, computer software, databases, and operations guides. Intellectual property alludes to those whose possession is recognized and protected by the law, and it is comprised of trademark, copyright, patent, trade secrets and plant variety protection certificate. Technologies that are not defined as intellectual properties are mostly those that are difficult to recognize or difficult to assess their value independent of the owner (company, individual), and it is rare for such technology to become the object of valuation.

Economically speaking, the value refers to the opportunity cost, which becomes the standard of the transaction, while the market price becomes the exchange value when a perfect market is assumed. However, as the market for technology cannot be created easily, a difficulty arises in determining the exchange value of technology through the market mechanism efficiently. Accordingly, additional effort in estimating the fair market value, supposing a competitive market, is required.

Generally, the fair market value is defined as ‘the price at which willing parties, who have not been coerced and possess rational information, have agreed to trade their assets’. However, It is almost impossible to come across such a perfect deal in reality, and, thus this value assumes a transaction between both virtual buyer and seller. Particularly, it presupposes an economic or market condition occurring at a specific point of evaluation. Such fair market value is at times simply called the market value, and it assumes that the capital market is in its advanced stage where it remains in a nearly perfectly competitive form. The technology valuation attempts to estimate this market value.

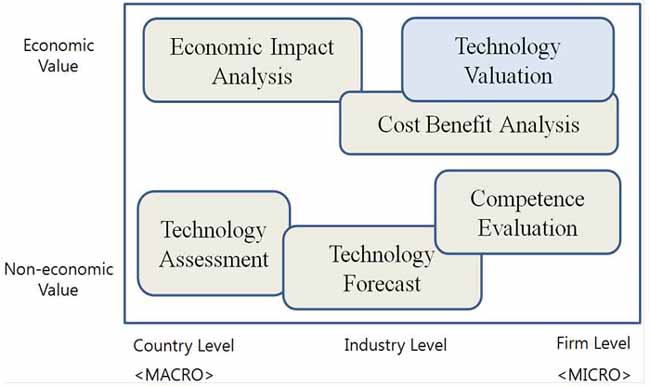

Also, while the manager of government research and development investment will find it necessary to set a priority on proposed technology development projects, the individual corporation will be interested in evaluating a technology for its economic efficiency. Various outlooks regarding technology valuation is shown in Fig. 1.

Fig. 1. Various outlooks regarding technology valuation

The content of technology valuation can vary in accordance with the perspective taken by the assessor. It is suggested that technology valuation has four aspects, each with a different theoretical basis (Seol 2000), while other research has proposed various concepts and methods of technology valuation, such as assessment of a company’s internal competence and technology forecasts for analyzing changing trends (Lee 2001). From the viewpoint of government policy, these varying technology valuation methods exhibit a strong tendency to survey technology’s environmental and socioeconomic impact, while analyzing the side effect on the industry from the macroeconomic perspective.

With so many different perspectives on technology valuation, it is very challenging to present a generally applicable technology valuation model. The difficulty is attributed to the fact that the model, the range of its variables, and the measurement range for each variable are all affected by the intent of valuation. This paper focuses on technology valuation that is represented by the monetary, economic value of the firm and its business units.

METHODOLOGY OF TECHNOLOGY VALUATION

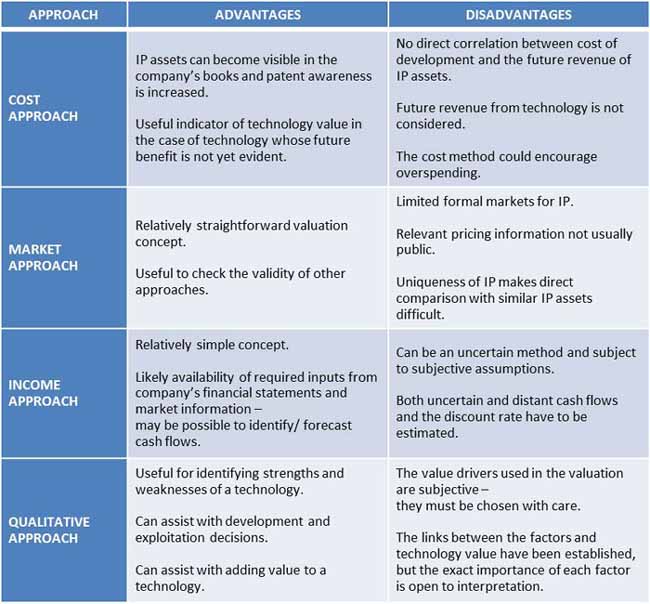

A number of approaches have been proposed for the technology valuation. Each has their own set of unique strengths and weaknesses in Table 1‘Advantages and disadvantages of valuation approaches’. To gain accurate and usable results, it is important that the valuer or appraiser selects the most appropriate method or a combination of methods for each individual case.

Methodology for valuation

Approaches to technology valuation are generally divided into quantitative and qualitative methods. Quantitative methods attempt to calculate the monetary value of the technology including patents and plant variety protection rights. Quantitative methods are divided into “cost”, “market” and “income” based approaches. On the other hand, qualitative methods provide a value guide through the rating and scoring of an IP asset based on factors that can influence its value.

Table 1. Advantages and disadvantages of valuation approaches

Cost approach

One approach to valuing technology is through calculating the costs of developing it. This way, the sum of R&D expenditures and other costs related directly to the development of the technology are taken to be its monetary value. Depending on the circumstances, it is important that all costs incurred in creating the IP are included, such as patent attorney and patent application costs.

Cost based valuation may be done historically (historic cost approach), through calculating the cost of development, at the time the technology was developed. Alternatively, a principle of substitution may be used (replacement cost and reproduction cost approaches). Here, the costs of developing a similar technology either externally or in-house are calculated at the date of the valuation.

Using the replacement cost approach is especially useful for license negotiations. A potential licensee for the technology will not pay more than the investment required to develop its own technology with similar functionality. The approach, therefore, provides a valid benchmark from which to begin negotiations.

In any technology transfer transaction, it is often the aim to negotiate an income stream which at least covers the development costs of the technology (its historical cost). If this is not possible, the R&D investment has not been a profitable one from a monetary point of view.

The cost approach gives a useful benchmark for IP value in cases where the future uses and benefits of a technology are not yet evident. The cost approach method is useful when assessing intangible assets such as software, but its weakness lies in that equal amount of investment does not always result in the same level of technology and that it does not take into account important elements such as future risks and economic benefits that can be obtained from the assets.

A crucial point is that there is no direct correlation between the cost of development and the future income potential of the technology. Simple ideas can be the most valuable, just as expensive developments can often fail or become useless. For this reason, the use of cost-based approaches for valuing technology has limited use and may only serve as a guideline for true value.

Market approach

The idea behind market approach for valuing technology is that an active market decides the accurate price of an asset. Market-based approach works by comparing the IP asset being valued to other similar IP assets which have been licensed or sold before, under similar circumstances. A technology valuation model based on the market approach method estimates the market price of a similar technology that has already been traded on the market and applies it to their assessment (Reilly and Schweihs, 1998). The price established on the market for other similar IP assets, adjusted for the specific environment, is taken to be the value.

Market-based methods value a technology by looking at recent comparable transactions (for example a licensing deal or a sale) between independent parties. The terms and prices at which these deals are made within the same industrial sector will give a good indication towards the value of the technology. Market-based methods include comparable market price approaches (comparing the subject IP with similar IP assets bought or sold) and comparable royalty rate approaches (comparing the subject IP with similar IP assets licensed).

The comparable royalty rate method is probably the more common and involves identifying and analyzing license transactions involving similar technologies. This is often aided by the fact that many sectors use industry averages as a basis for setting royalty rates in license agreements. The terms of the license and the royalty rates used in transactions related to similar IP are the basis for the comparison. From this information, important information about the value of the subject IP asset may be calculated.

While the market method is theoretically the most accurate, the information required to make such comparisons often does not exist or is not publicly available. This is because there are limited active markets for IP assets, with few comparable exchanges of IP assets between two independent parties. Even if the sale or licensing does occur in the relevant sector, the required pricing information is not usually public. Another issue is that of establishing what IP assets can be considered to be similar, for the sake of comparison. By definition, a patented technology is unique, and therefore cannot be compared per se. Only its functionality may be analyzed with respect to another technology.

Income approach

The most basic definition of ‘value’ of a technology is based on the ability of the technology to generate future income. Therefore, the value of a technology is directly related to its potential to generate a stream of income.

Income based methods measure the potential income from a technology in the future. This concept, disregarding the costs of the technology development, determines the value of the technology according to its feasibility of creating expected profit (Boer, 1999). This income stream is discounted back to the date of the valuation to give a present value for the technology. The value of the technology is properly adjusted for the risks surrounding the development and exploitation of the technology. The discount rate used in the calculations must include all of the risks that have an impact on income.

To conduct technology valuation using an income-based method, an appraiser will need to estimate: an income stream either from product sales or the licensing out of the technology, the duration of the IP asset’s useful life, and have an understanding of risk factors. These parameters are based on observations of relevant markets, including size, growth trends, market share dynamics among participants, market structure and overall market risk characteristics.

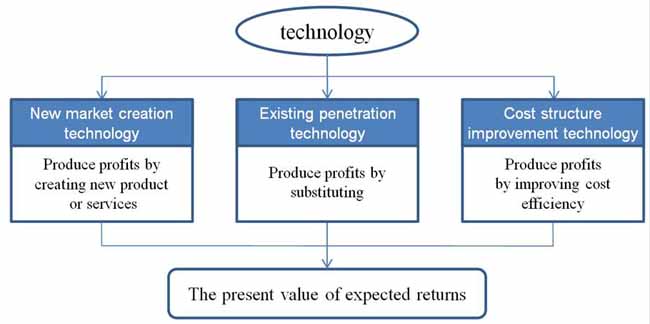

The main step of technology valuation is calculating the present value of expected returns from the technology. A classification of technologies must be made for this purpose. Fig. 2 classifies technology into three types, and the new market creation technology and existing market penetration technology are product technologies that produce profits by creating new markets or by substituting existing ones. On the other hand, cost structure improvement technology is a manufacturing technology that does not increase the revenue or the size of the market, but it improves the profitability by altering the cost structure.

Fig. 2. Classification of technologies

There are many income based valuation methods, each with variations according to the purpose of valuation and the type of industry. The most common method of the income approach is the discounted cash flow (DCF) method. It calculates the potential future cash flows during its useful life from the technology and appropriately discounts these. The result of the DCF method is the present value of the technology.

Other examples of income-based methods include the risk-adjusted net present value (rNPV) and the relief from royalty method. Those methods calculate future income in the same way as the DCF method. However, they have a clear distinction from the DCF method in terms of means to estimate the potential future income.

Income based methods are a commonly understood approach to asset valuation. They are most useful when valuing a technology that actively generates income. This method may be used with regard to the sale of products containing technology, cost savings attained through technology, or alternatively for income generated through license royalties.

Qualitative approach

Qualitative methods provide a value guide for an IP asset through the analysis and scoring of different factors related to the IP asset. These factors or “value drivers” can influence the value of the IP asset either positively and negatively. In the same way as factors such as location, numbers of rooms, nearby schools etc. affect the value of a house; a combination of value indicators related to the IP asset will determine its value.

These methods provide a non-monetary value for the technology in question. Specific factors related to the technology are chosen for analysis, particularly those which have a significant impact on the value (so-called “value drivers”). The factors are rated and scored to determine strengths and weaknesses and to create a value guide. In other words, qualitative methods provide a value guide through the rating and scoring of IP based on factors which can influence its value.

Qualitative “value driver” based approaches include those which analyze patent data, specific aspects of the patent application documentation (number or quality of claims, citations etc.). There are also qualitative approaches which analyze and score more general aspects related to the IP asset. These indicators can include aspects related to legal and IP protection backgrounds, the technology and development level, market details, financial factors and very importantly, the management competencies of the organization that will exploit it.

Quantitative valuation approaches, which are income, cost and market-based approaches, give an indication of the estimated monetary value of the patent, and this approach is often insufficient as a basis for recommending development and exploitation decisions. Qualitative evaluation methods are often used to assist decision makers here. They are most useful for comparing, categorizing and ranking technologies within a portfolio or against competitors’ technologies.

Qualitative methods examine at a micro level: the quality of intangible assets themselves; their position and importance, relative to other business drivers; the broader industry within which the business operates; the potential value for business’s competitors and potential competitors.

They are useful for assessing the uncertainties and opportunities related to individual IP assets. For example: While the outcome of a quantitative valuation may be “The IP asset is worth $500,000.”, the result of a qualitative evaluation may be “The technology is of strategic importance for an attractive market; it can be enforced efficiently but only if significant investment is received or financially stable licensees are found.” (Miklós Bendzsel 2011)

The qualitative study is used to formulate (and justify) assumptions on which the financial models, used to determine a numerical value to the IP under consideration, will be based.

USES FOR TECHNOLOGY VALUTAION WITHIN RESEARCH INSTITUES

Technology valuation tools can be used very effectively in the research institute and technology transfer environment to facilitate decision-making, adding value to IP assets, communication, and monitoring.

Decision making

During the development and exploitation phases of a technology, there are a number of key turning points. At these points, correct decisions must be made regarding the technology in question.

During the development of a technology, there are different times when managerial decisions are required. For example, the project leaders must decide at any given time whether the research is worthwhile and the development direction will bring sufficient results. If not, the research direction can be changed or the project abandoned.

At the point where there has been an innovative breakthrough in a project, decisions must be made whether the institution wishes to claim the results and take ownership of the technology. This decision involves costs and responsibilities to the institute. The potential of the technology must be considered and this greatly depends on the future industrial applicability of the research, and its ability to generate income. An understanding of value drivers is required to make such decisions. Technology valuation can be a key tool here.

If the institute wishes to claim the technology as a service invention, a patent application will usually be made. As the concept matures, the decision whether and with what strategy the technology should be protected is decided by the institute, ideally with the assistance of the research team. It could become necessary to protect the technology through moving on to further patenting phases (PCT, other patent jurisdictions). Not every invention will necessarily lead to further patent applications, and a technology valuation will provide information to make these decisions. As the PCT phase of protection involves increasing costs for the institute, only valuable technologies with potential will be considered.

Once the technology is adequately protected, technology transfer routes are usually considered. The most efficient method of generating income must be decided. The conditions of exploitation are subject to negotiations, but key elements of the negotiation process may be reinforced by information gained from conducting a technology valuation.

In order to enter a beneficial license agreement, institutes must know as accurately as possible the value of the technology concerned. Conducting a technology valuation will provide key information to assist with the licensing process by identifying problem areas, giving benchmark values, forecasting income and providing a market outlook. This information can be used in negotiating and drawing up the terms and conditions of the license contract. A reasonable technology valuation allows both the licensor and licensee to estimate ideal financial terms and thus to consider the specific needs of both parties.

Adding value to IP assets

The results of R&D have a value. Steps can be taken to increase this value by changing certain key factors surrounding and influencing the technologies. For example, an IP asset will be more valuable if ownership rights are 100% legally certain and documented if the technology has been tested at an industrial level or the right-holders have sufficient funds to enforce IP rights.

However, An IP asset will be less valuable if the ownership rights are uncertain, the technology has never been tested or the right-holders have insufficient funds to go to court in case of patent infringement. A technology valuation will help identify the key uncertainties surrounding the technology, which reduce its value. As part of the development and exploitation strategy, these issues can then be addressed and corrected.

Communication

Decisions in all development and transfer phases require the cooperation of different parties, including academic staff, research staff, students, directors, the technology transfer office (TTO), and other members of the institute hierarchy. The attributes, importance and value of the technology in question must be communicated internally for all parties to fully understand value aspects and to be able to make well-founded decisions. Often the support of different parties is required before the transfer of technology is possible. Information gained from the valuation process can help achieve this.

The importance of the technology must also be communicated externally, to potential transfer partners and parties active within the industry who will potentially obtain rights to commercialize the technology. Under certain circumstances, the results of the technology valuation may also be used to communicate the benefits of the technology to partners who have expressed an interest in licensing.

Monitoring

Technology valuation can be a useful tool to help management decide whether the investment into research has created the quantity and quality of R&D results expected. Therefore, it is a useful way to measure whether research funding is efficiently allocated to R&D projects. When accountability for expenditure at a project level is required, it is also an excellent means to convey the value of R&D results.

As public funds have been largely employed in the creation of IP, there is a substantial public expectation that benefits should accrue. The cost-benefit balance is important to many funding bodies. Successfully transferred technology can lead to an increase in regional economic development through stimulating institute-industry partnerships and the creation of new enterprises (Miklós Bendzsel, 2011).

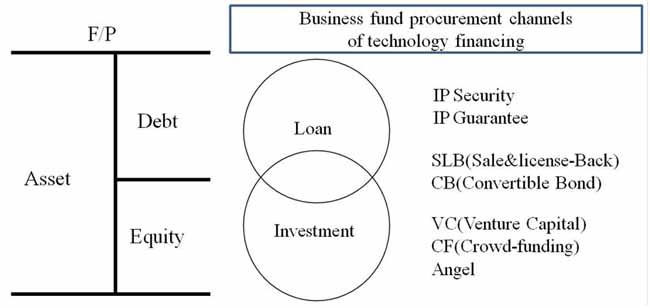

TECHNOLOGY FINANCING IN AGRIBUSINESS

One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology valuation supports procurement of business funds for technologies with outstanding potential. In a broad sense, technology financing is a high-risk enterprise financing that covers the lifecycle of start-up, research and development, and commercialization of R&D output. In a narrow sense, technology financing means loans or investments executed as a result of reports by technology appraisal institutions, not depending on the tangible collateral.

Venture capital and public funds have been used to invest in technology based start-ups or commercialization over the recent years. However, the proportion of SMEs using equity financing is quite small in Korea. Equity finance is an adequate financial instrument for technology financing. Equity finance facilitation needs to be based on technology valuation (Fig. 3).

The Korean government has been pressuring banks to expand loans for start-ups and tech firms over recent years. However, banks don’t have a complete system to evaluate technology yet. They do it subjectively, using technology evaluations by the technology credit bureaux (TCB) and technology valuations executed by technology evaluation agencies designated by the government. The FACT has carried out technology valuations for interest subsidy, IP security, IP guarantee, and venture capital. It is starting to carry out technology valuations for crowd-funding.

Fig. 3. Business fund procurement channels of technology financing

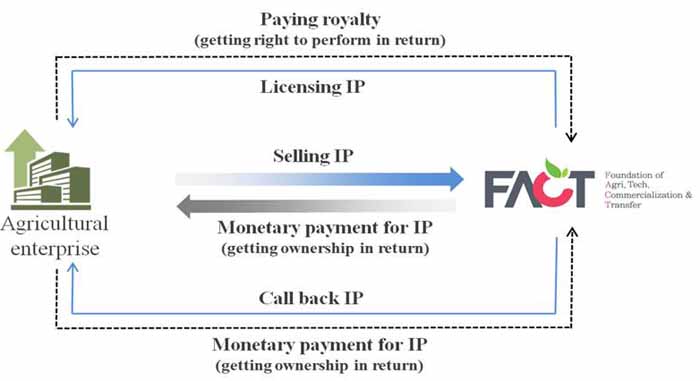

The FACT has launched the sale and license-back (SLB) as a test trial since October last year (2015). The SLB is a type of technology financing with the transaction of technologies in which new companies with good technologies but lacking in securities can efficiently procure business funds, plant variety protection rights are more suitable than patents (Fig. 4).

Fig. 4. Schematic diagram of sale and license-back

The FACT is pursuing a permanent business launch for the SLB with both the Ministry of Agriculture, Food and Rural Affairs and the Rural Development Administration. This is currently being done through a pilot project.

CONCLUSION

Technology valuation is an important factor in technology transfer and commercialization, and this is applicable to the agricultural sector. It is the Foundation of Agricultural Technology Commercialization and Transfer (FACT) that performs such technology transfer and commercialization in the field. As the only public institution for technology transfers and valuation in the agribusiness area, the FACT is thus the leader in technology transfer and commercialization in the sector. Founded in September 2009, the FACT has been regularly carrying out technology transfer. From 2010 until the present (end of August 2016), it has concluded approximately 3,300 technology transfers as a technology trading agency designated by the law (Technology transfer and commercialization promotion act).

In addition, the FACT has been carrying out technology valuation since 2011 after its designation as a technology valuation agency by the aforementioned law in 2010. Currently (until the end of August 2016), it has completed approximately 1,900 cases of qualitative technology evaluation while the number of quantitative technology valuation has reached 324 cases.

Valuation is executed using three approaches: cost, market, and income approach. Among them, the market approach is the best method and recommended preferentially. However, it is generally not available to apply because the number of technology transfers is small, and most of them are not public. In addition, it is difficult to provide comparisons for each case. In the cost approach, the value of a technology is estimated based on the cost spent on its development that has the same economic benefits, using the principle of substitution as the basis. As the cost approach doesn’t consider potential benefits in the future, its application is limited to the value estimation of technologies that can be easily replaced or are under development.

Therefore, the main approach of technology valuation in Korea has been income approach. It has usually been executed through the income approach so far. The discounted cash flow method and relief from royalty method are most widely used in Korea, including the agribusiness sector.

To expedite technology transfers, innovative technologies need to be made and the transfer price should be appropriate for the both selling and buying parties. The FACT supports the creation of strong patents, which are not only advanced in the aspect of technology but powerful to protect their rights. It also carries out technology valuation for technology transfers. Technology valuation is used for not only technology transfer but also technology commercialization. Technology valuation by the FACT is used for the estimation of fees for exclusive licensing of the government-owned patents, and transfers of university-owned technologies (including contribution in kind), etc. The FACT supports technology financing through technology valuation. The application range of technology valuation by the FACT is becoming wider.

REFERENCES

Reilly, R.F. and Schweihs, R.P. (1998) Valuing intangible assets, McGraw-Hill, New York.

Boer, F.p. (1999) The Valuation of Technology, New York: John Wiley and Sons.

Seol, S.S. (2000) A theoretical framework for the valuation of technology. Journal of Korea Technology Innovation Society, 3, 1, 5–21.

Lee, J.O. (2001) A comprehensive model of economic valuation for technology. STEPI Journal of Science and Technology Policy, 11, 2, 21–35.

Kaldos, P. (2010) The fundamentals of IP asset valuation, The innovation Handbook 2nd edition.

Chen, Yea-Mow, Stephen Barreca (2010), Cost Approach, in Catty W., et al., Guide to Fair Value under IFRS, Wiley, Ch. 2, 19-36

Miklós Bendzsel(2011), IP valuation at research institutes, Hungarian Intellectual Property Office.

OECD (2015) Chapter 9. IP-based financing of innovative firms. Enquiries into Intellectual Property’s Economic Impact.

| Submitted as a country report for the FFTC –MARDI International Workshop on “Effective IP Protection and Commercialization Strategies for Agricultural Innovation”, Oct. 18-20, MARDI Headquaters, Serdang, Selangor, Malaysia |

Valuation, Transfer and Commercialization of Agricultural Technologies in Korea

ABSTRACT

Technology valuation offers basic data for technology transfer negotiations. To expedite technology transfers, outstanding technologies need to be invented, and transfer costs should be reasonable. One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology financing helps companies to procure business funds through technology valuation for technologies with outstanding potential. Measures for technology financing in Korea’s agriculture and food sector include interest subsidy, IP security, IP guarantee, venture capital and crowd-funding.

Keywords: Technology valuation, technology transfer, commercialization, technology financing, IP security, IP guarantee, venture capital and crowd-fund

INTRODUCTION

Technology valuation is an important factor in technology transfer. In order to facilitate the advancement and development process of high technology, a market for technology transfer must be promoted. Institutional support such as technology brokerage and exchange is necessary for active technology transfer. In the process of the technology transfer, information, especially reliable information on the value of technology is the most important factor.

The efficient technology transfer to industry and enterprise partners is increasingly a key objective for many research institutes. Successful and sustainable technology transfer strategies can lead to better cooperation between research institutes and industry. The income received from licensing out technology and forming spin-off companies can be an important factor in making research and development institutions more financially sustainable. The optimization of the technology transfer process towards value creation can lead to more successful transfers and increased income from IP assets.

Technology valuation is a tool which can be used to assist research institutes in developing technology suitable for transfer. The use of technology valuation tools can also assist in the technology transfer process itself. The results of even the most basic technology valuation approaches can provide management with key information on which to base decisions. The results can also be used to communicate the value of technology internally and outside the institute. Acting on these valuation results can add value to the IP asset and ensure the maximization of income (Miklós Bendzsel, 2011).

The problem arises because information on technology cannot be provided like general goods. Thus the role of technology valuation as a complementary measure becomes very important. There is a special need to evaluate the value of a specific technology from an impartial point of view in order to encourage technology transfer. As the market price is used for the basis of price negotiation in trading goods, an unbiased value of a specific technology must be presented and advanced for the negotiation to be carried between buyers and sellers of technology.

Accordingly, much attention has been focused on evaluating the objective value of technology in Korea including the FACT. We have been using various valuation models to perform evaluations for aiding decisions regarding investments and putting up technologies as collateral. Yet, it is difficult to promote technology trade and transfer with the usual valuation process that focuses on the technology itself. Valuation models thus far have assessed the value of technology from the perspective of the firm in possession of the technology, but such assessment is greatly influenced by the firm’s technological capability, capitalization, brand, and human resources.

However, what the market needs is the worth of technology as a product to be traded in the market, and this calls for an impartial and objective value that is not influenced by the specific company that owns it. The systems that encourage technology transfer can be generally classified into two: a simple system that just builds and offers data on the information about the technology to transfer and the other one that encourages technology transfer by making evaluations of technologies in various perspectives.

Technology valuation is also a crucial factor in technology commercialization, especially in financing. One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology valuation supports procurement of business funds for technologies with outstanding potential. Measures for technology financing in Korea’s agribusiness sector include interest subsidy, IP security, IP guarantee, venture capital, and crowd-funding.

In this paper, I will explain the methodology of technology valuation, and provide uses for technology valuation within research institutes. In addition, I’m going to introduce how technology valuation helps agribusiness firms raise funds for their businesses.

CONCEPT OF TECHNOLOGY, VALUE AND TECHNOLOGY VALUATION

Technology, which becomes the object of technology valuation, is divided into broad and narrow definitions of technology. The narrow concept of technology refers to intellectual property including patent, plant variety protection right, utility model patent, and trademark in addition to disparate technology such as know-how, trade secret, and computer software. The broad concept is not limited to individual technology but covers the firm’s total technological capability as well.

Technology is valuable as an asset and is identified as an intangible asset. Intangible assets with a technical basis are varied in character and include patent rights, trade secrets, know-how, computer software, databases, and operations guides. Intellectual property alludes to those whose possession is recognized and protected by the law, and it is comprised of trademark, copyright, patent, trade secrets and plant variety protection certificate. Technologies that are not defined as intellectual properties are mostly those that are difficult to recognize or difficult to assess their value independent of the owner (company, individual), and it is rare for such technology to become the object of valuation.

Economically speaking, the value refers to the opportunity cost, which becomes the standard of the transaction, while the market price becomes the exchange value when a perfect market is assumed. However, as the market for technology cannot be created easily, a difficulty arises in determining the exchange value of technology through the market mechanism efficiently. Accordingly, additional effort in estimating the fair market value, supposing a competitive market, is required.

Generally, the fair market value is defined as ‘the price at which willing parties, who have not been coerced and possess rational information, have agreed to trade their assets’. However, It is almost impossible to come across such a perfect deal in reality, and, thus this value assumes a transaction between both virtual buyer and seller. Particularly, it presupposes an economic or market condition occurring at a specific point of evaluation. Such fair market value is at times simply called the market value, and it assumes that the capital market is in its advanced stage where it remains in a nearly perfectly competitive form. The technology valuation attempts to estimate this market value.

Also, while the manager of government research and development investment will find it necessary to set a priority on proposed technology development projects, the individual corporation will be interested in evaluating a technology for its economic efficiency. Various outlooks regarding technology valuation is shown in Fig. 1.

Fig. 1. Various outlooks regarding technology valuation

The content of technology valuation can vary in accordance with the perspective taken by the assessor. It is suggested that technology valuation has four aspects, each with a different theoretical basis (Seol 2000), while other research has proposed various concepts and methods of technology valuation, such as assessment of a company’s internal competence and technology forecasts for analyzing changing trends (Lee 2001). From the viewpoint of government policy, these varying technology valuation methods exhibit a strong tendency to survey technology’s environmental and socioeconomic impact, while analyzing the side effect on the industry from the macroeconomic perspective.

With so many different perspectives on technology valuation, it is very challenging to present a generally applicable technology valuation model. The difficulty is attributed to the fact that the model, the range of its variables, and the measurement range for each variable are all affected by the intent of valuation. This paper focuses on technology valuation that is represented by the monetary, economic value of the firm and its business units.

METHODOLOGY OF TECHNOLOGY VALUATION

A number of approaches have been proposed for the technology valuation. Each has their own set of unique strengths and weaknesses in Table 1‘Advantages and disadvantages of valuation approaches’. To gain accurate and usable results, it is important that the valuer or appraiser selects the most appropriate method or a combination of methods for each individual case.

Methodology for valuation

Approaches to technology valuation are generally divided into quantitative and qualitative methods. Quantitative methods attempt to calculate the monetary value of the technology including patents and plant variety protection rights. Quantitative methods are divided into “cost”, “market” and “income” based approaches. On the other hand, qualitative methods provide a value guide through the rating and scoring of an IP asset based on factors that can influence its value.

Table 1. Advantages and disadvantages of valuation approaches

Cost approach

One approach to valuing technology is through calculating the costs of developing it. This way, the sum of R&D expenditures and other costs related directly to the development of the technology are taken to be its monetary value. Depending on the circumstances, it is important that all costs incurred in creating the IP are included, such as patent attorney and patent application costs.

Cost based valuation may be done historically (historic cost approach), through calculating the cost of development, at the time the technology was developed. Alternatively, a principle of substitution may be used (replacement cost and reproduction cost approaches). Here, the costs of developing a similar technology either externally or in-house are calculated at the date of the valuation.

Using the replacement cost approach is especially useful for license negotiations. A potential licensee for the technology will not pay more than the investment required to develop its own technology with similar functionality. The approach, therefore, provides a valid benchmark from which to begin negotiations.

In any technology transfer transaction, it is often the aim to negotiate an income stream which at least covers the development costs of the technology (its historical cost). If this is not possible, the R&D investment has not been a profitable one from a monetary point of view.

The cost approach gives a useful benchmark for IP value in cases where the future uses and benefits of a technology are not yet evident. The cost approach method is useful when assessing intangible assets such as software, but its weakness lies in that equal amount of investment does not always result in the same level of technology and that it does not take into account important elements such as future risks and economic benefits that can be obtained from the assets.

A crucial point is that there is no direct correlation between the cost of development and the future income potential of the technology. Simple ideas can be the most valuable, just as expensive developments can often fail or become useless. For this reason, the use of cost-based approaches for valuing technology has limited use and may only serve as a guideline for true value.

Market approach

The idea behind market approach for valuing technology is that an active market decides the accurate price of an asset. Market-based approach works by comparing the IP asset being valued to other similar IP assets which have been licensed or sold before, under similar circumstances. A technology valuation model based on the market approach method estimates the market price of a similar technology that has already been traded on the market and applies it to their assessment (Reilly and Schweihs, 1998). The price established on the market for other similar IP assets, adjusted for the specific environment, is taken to be the value.

Market-based methods value a technology by looking at recent comparable transactions (for example a licensing deal or a sale) between independent parties. The terms and prices at which these deals are made within the same industrial sector will give a good indication towards the value of the technology. Market-based methods include comparable market price approaches (comparing the subject IP with similar IP assets bought or sold) and comparable royalty rate approaches (comparing the subject IP with similar IP assets licensed).

The comparable royalty rate method is probably the more common and involves identifying and analyzing license transactions involving similar technologies. This is often aided by the fact that many sectors use industry averages as a basis for setting royalty rates in license agreements. The terms of the license and the royalty rates used in transactions related to similar IP are the basis for the comparison. From this information, important information about the value of the subject IP asset may be calculated.

While the market method is theoretically the most accurate, the information required to make such comparisons often does not exist or is not publicly available. This is because there are limited active markets for IP assets, with few comparable exchanges of IP assets between two independent parties. Even if the sale or licensing does occur in the relevant sector, the required pricing information is not usually public. Another issue is that of establishing what IP assets can be considered to be similar, for the sake of comparison. By definition, a patented technology is unique, and therefore cannot be compared per se. Only its functionality may be analyzed with respect to another technology.

Income approach

The most basic definition of ‘value’ of a technology is based on the ability of the technology to generate future income. Therefore, the value of a technology is directly related to its potential to generate a stream of income.

Income based methods measure the potential income from a technology in the future. This concept, disregarding the costs of the technology development, determines the value of the technology according to its feasibility of creating expected profit (Boer, 1999). This income stream is discounted back to the date of the valuation to give a present value for the technology. The value of the technology is properly adjusted for the risks surrounding the development and exploitation of the technology. The discount rate used in the calculations must include all of the risks that have an impact on income.

To conduct technology valuation using an income-based method, an appraiser will need to estimate: an income stream either from product sales or the licensing out of the technology, the duration of the IP asset’s useful life, and have an understanding of risk factors. These parameters are based on observations of relevant markets, including size, growth trends, market share dynamics among participants, market structure and overall market risk characteristics.

The main step of technology valuation is calculating the present value of expected returns from the technology. A classification of technologies must be made for this purpose. Fig. 2 classifies technology into three types, and the new market creation technology and existing market penetration technology are product technologies that produce profits by creating new markets or by substituting existing ones. On the other hand, cost structure improvement technology is a manufacturing technology that does not increase the revenue or the size of the market, but it improves the profitability by altering the cost structure.

Fig. 2. Classification of technologies

There are many income based valuation methods, each with variations according to the purpose of valuation and the type of industry. The most common method of the income approach is the discounted cash flow (DCF) method. It calculates the potential future cash flows during its useful life from the technology and appropriately discounts these. The result of the DCF method is the present value of the technology.

Other examples of income-based methods include the risk-adjusted net present value (rNPV) and the relief from royalty method. Those methods calculate future income in the same way as the DCF method. However, they have a clear distinction from the DCF method in terms of means to estimate the potential future income.

Income based methods are a commonly understood approach to asset valuation. They are most useful when valuing a technology that actively generates income. This method may be used with regard to the sale of products containing technology, cost savings attained through technology, or alternatively for income generated through license royalties.

Qualitative approach

Qualitative methods provide a value guide for an IP asset through the analysis and scoring of different factors related to the IP asset. These factors or “value drivers” can influence the value of the IP asset either positively and negatively. In the same way as factors such as location, numbers of rooms, nearby schools etc. affect the value of a house; a combination of value indicators related to the IP asset will determine its value.

These methods provide a non-monetary value for the technology in question. Specific factors related to the technology are chosen for analysis, particularly those which have a significant impact on the value (so-called “value drivers”). The factors are rated and scored to determine strengths and weaknesses and to create a value guide. In other words, qualitative methods provide a value guide through the rating and scoring of IP based on factors which can influence its value.

Qualitative “value driver” based approaches include those which analyze patent data, specific aspects of the patent application documentation (number or quality of claims, citations etc.). There are also qualitative approaches which analyze and score more general aspects related to the IP asset. These indicators can include aspects related to legal and IP protection backgrounds, the technology and development level, market details, financial factors and very importantly, the management competencies of the organization that will exploit it.

Quantitative valuation approaches, which are income, cost and market-based approaches, give an indication of the estimated monetary value of the patent, and this approach is often insufficient as a basis for recommending development and exploitation decisions. Qualitative evaluation methods are often used to assist decision makers here. They are most useful for comparing, categorizing and ranking technologies within a portfolio or against competitors’ technologies.

Qualitative methods examine at a micro level: the quality of intangible assets themselves; their position and importance, relative to other business drivers; the broader industry within which the business operates; the potential value for business’s competitors and potential competitors.

They are useful for assessing the uncertainties and opportunities related to individual IP assets. For example: While the outcome of a quantitative valuation may be “The IP asset is worth $500,000.”, the result of a qualitative evaluation may be “The technology is of strategic importance for an attractive market; it can be enforced efficiently but only if significant investment is received or financially stable licensees are found.” (Miklós Bendzsel 2011)

The qualitative study is used to formulate (and justify) assumptions on which the financial models, used to determine a numerical value to the IP under consideration, will be based.

USES FOR TECHNOLOGY VALUTAION WITHIN RESEARCH INSTITUES

Technology valuation tools can be used very effectively in the research institute and technology transfer environment to facilitate decision-making, adding value to IP assets, communication, and monitoring.

Decision making

During the development and exploitation phases of a technology, there are a number of key turning points. At these points, correct decisions must be made regarding the technology in question.

During the development of a technology, there are different times when managerial decisions are required. For example, the project leaders must decide at any given time whether the research is worthwhile and the development direction will bring sufficient results. If not, the research direction can be changed or the project abandoned.

At the point where there has been an innovative breakthrough in a project, decisions must be made whether the institution wishes to claim the results and take ownership of the technology. This decision involves costs and responsibilities to the institute. The potential of the technology must be considered and this greatly depends on the future industrial applicability of the research, and its ability to generate income. An understanding of value drivers is required to make such decisions. Technology valuation can be a key tool here.

If the institute wishes to claim the technology as a service invention, a patent application will usually be made. As the concept matures, the decision whether and with what strategy the technology should be protected is decided by the institute, ideally with the assistance of the research team. It could become necessary to protect the technology through moving on to further patenting phases (PCT, other patent jurisdictions). Not every invention will necessarily lead to further patent applications, and a technology valuation will provide information to make these decisions. As the PCT phase of protection involves increasing costs for the institute, only valuable technologies with potential will be considered.

Once the technology is adequately protected, technology transfer routes are usually considered. The most efficient method of generating income must be decided. The conditions of exploitation are subject to negotiations, but key elements of the negotiation process may be reinforced by information gained from conducting a technology valuation.

In order to enter a beneficial license agreement, institutes must know as accurately as possible the value of the technology concerned. Conducting a technology valuation will provide key information to assist with the licensing process by identifying problem areas, giving benchmark values, forecasting income and providing a market outlook. This information can be used in negotiating and drawing up the terms and conditions of the license contract. A reasonable technology valuation allows both the licensor and licensee to estimate ideal financial terms and thus to consider the specific needs of both parties.

Adding value to IP assets

The results of R&D have a value. Steps can be taken to increase this value by changing certain key factors surrounding and influencing the technologies. For example, an IP asset will be more valuable if ownership rights are 100% legally certain and documented if the technology has been tested at an industrial level or the right-holders have sufficient funds to enforce IP rights.

However, An IP asset will be less valuable if the ownership rights are uncertain, the technology has never been tested or the right-holders have insufficient funds to go to court in case of patent infringement. A technology valuation will help identify the key uncertainties surrounding the technology, which reduce its value. As part of the development and exploitation strategy, these issues can then be addressed and corrected.

Communication

Decisions in all development and transfer phases require the cooperation of different parties, including academic staff, research staff, students, directors, the technology transfer office (TTO), and other members of the institute hierarchy. The attributes, importance and value of the technology in question must be communicated internally for all parties to fully understand value aspects and to be able to make well-founded decisions. Often the support of different parties is required before the transfer of technology is possible. Information gained from the valuation process can help achieve this.

The importance of the technology must also be communicated externally, to potential transfer partners and parties active within the industry who will potentially obtain rights to commercialize the technology. Under certain circumstances, the results of the technology valuation may also be used to communicate the benefits of the technology to partners who have expressed an interest in licensing.

Monitoring

Technology valuation can be a useful tool to help management decide whether the investment into research has created the quantity and quality of R&D results expected. Therefore, it is a useful way to measure whether research funding is efficiently allocated to R&D projects. When accountability for expenditure at a project level is required, it is also an excellent means to convey the value of R&D results.

As public funds have been largely employed in the creation of IP, there is a substantial public expectation that benefits should accrue. The cost-benefit balance is important to many funding bodies. Successfully transferred technology can lead to an increase in regional economic development through stimulating institute-industry partnerships and the creation of new enterprises (Miklós Bendzsel, 2011).

TECHNOLOGY FINANCING IN AGRIBUSINESS

One of the most important factors in commercializing a technology is the smooth procurement of business funds. Technology valuation supports procurement of business funds for technologies with outstanding potential. In a broad sense, technology financing is a high-risk enterprise financing that covers the lifecycle of start-up, research and development, and commercialization of R&D output. In a narrow sense, technology financing means loans or investments executed as a result of reports by technology appraisal institutions, not depending on the tangible collateral.

Venture capital and public funds have been used to invest in technology based start-ups or commercialization over the recent years. However, the proportion of SMEs using equity financing is quite small in Korea. Equity finance is an adequate financial instrument for technology financing. Equity finance facilitation needs to be based on technology valuation (Fig. 3).

The Korean government has been pressuring banks to expand loans for start-ups and tech firms over recent years. However, banks don’t have a complete system to evaluate technology yet. They do it subjectively, using technology evaluations by the technology credit bureaux (TCB) and technology valuations executed by technology evaluation agencies designated by the government. The FACT has carried out technology valuations for interest subsidy, IP security, IP guarantee, and venture capital. It is starting to carry out technology valuations for crowd-funding.

Fig. 3. Business fund procurement channels of technology financing

The FACT has launched the sale and license-back (SLB) as a test trial since October last year (2015). The SLB is a type of technology financing with the transaction of technologies in which new companies with good technologies but lacking in securities can efficiently procure business funds, plant variety protection rights are more suitable than patents (Fig. 4).

Fig. 4. Schematic diagram of sale and license-back

The FACT is pursuing a permanent business launch for the SLB with both the Ministry of Agriculture, Food and Rural Affairs and the Rural Development Administration. This is currently being done through a pilot project.

CONCLUSION

Technology valuation is an important factor in technology transfer and commercialization, and this is applicable to the agricultural sector. It is the Foundation of Agricultural Technology Commercialization and Transfer (FACT) that performs such technology transfer and commercialization in the field. As the only public institution for technology transfers and valuation in the agribusiness area, the FACT is thus the leader in technology transfer and commercialization in the sector. Founded in September 2009, the FACT has been regularly carrying out technology transfer. From 2010 until the present (end of August 2016), it has concluded approximately 3,300 technology transfers as a technology trading agency designated by the law (Technology transfer and commercialization promotion act).

In addition, the FACT has been carrying out technology valuation since 2011 after its designation as a technology valuation agency by the aforementioned law in 2010. Currently (until the end of August 2016), it has completed approximately 1,900 cases of qualitative technology evaluation while the number of quantitative technology valuation has reached 324 cases.

Valuation is executed using three approaches: cost, market, and income approach. Among them, the market approach is the best method and recommended preferentially. However, it is generally not available to apply because the number of technology transfers is small, and most of them are not public. In addition, it is difficult to provide comparisons for each case. In the cost approach, the value of a technology is estimated based on the cost spent on its development that has the same economic benefits, using the principle of substitution as the basis. As the cost approach doesn’t consider potential benefits in the future, its application is limited to the value estimation of technologies that can be easily replaced or are under development.

Therefore, the main approach of technology valuation in Korea has been income approach. It has usually been executed through the income approach so far. The discounted cash flow method and relief from royalty method are most widely used in Korea, including the agribusiness sector.

To expedite technology transfers, innovative technologies need to be made and the transfer price should be appropriate for the both selling and buying parties. The FACT supports the creation of strong patents, which are not only advanced in the aspect of technology but powerful to protect their rights. It also carries out technology valuation for technology transfers. Technology valuation is used for not only technology transfer but also technology commercialization. Technology valuation by the FACT is used for the estimation of fees for exclusive licensing of the government-owned patents, and transfers of university-owned technologies (including contribution in kind), etc. The FACT supports technology financing through technology valuation. The application range of technology valuation by the FACT is becoming wider.

REFERENCES

Reilly, R.F. and Schweihs, R.P. (1998) Valuing intangible assets, McGraw-Hill, New York.

Boer, F.p. (1999) The Valuation of Technology, New York: John Wiley and Sons.

Seol, S.S. (2000) A theoretical framework for the valuation of technology. Journal of Korea Technology Innovation Society, 3, 1, 5–21.

Lee, J.O. (2001) A comprehensive model of economic valuation for technology. STEPI Journal of Science and Technology Policy, 11, 2, 21–35.

Kaldos, P. (2010) The fundamentals of IP asset valuation, The innovation Handbook 2nd edition.

Chen, Yea-Mow, Stephen Barreca (2010), Cost Approach, in Catty W., et al., Guide to Fair Value under IFRS, Wiley, Ch. 2, 19-36

Miklós Bendzsel(2011), IP valuation at research institutes, Hungarian Intellectual Property Office.

OECD (2015) Chapter 9. IP-based financing of innovative firms. Enquiries into Intellectual Property’s Economic Impact.