ABSTRAT

Over the past two decades, the world economy has become more globalized. Agribusiness in developing countries has been gradually exposed to harsh challenges from foreign competitors in the local market. The capacity building of agribusiness firms has been critical to diminish and neutralize the influence of multinational corporations. In this paper, I will introduce the progress that Korea has been through in the establishment of a public institution in order to facilitate open innovation in the agricultural sector. It is said that Korea has just passed first step into technology-based agribusiness era. Many innovative approaches are being tested in the field including strong support for startup, which is mainly driven by the government’s policy for creative economy activation. The experiences are worth sharing especially in countries that are seeking ways to increase productivity of research and development (R&D). In addition, the future strategy will be presented based on the Korean experiences in order to move forward from traditional agriculture to technology-based agribusiness.

Keywords: Technology transfer, commercialization, open innovation, research and development, creative economy

INTRODUCTION

Agriculture is the world's largest business that one-third of the population rely on their livelihood as an important source of income. Small-scale and subsistence farmers produce most of the food consumed on very small plots of land. However, agribusiness is quite different especially in a heavily industrialized country, such as Korea.

Over the past two decades after the Uruguay round ratified, the world economy has become more globalized. Agribusiness in developing countries has been gradually exposed to harsh challenges from foreign competitors in the local market. The capacity building of agribusiness firms locally based has been crucial to diminish and neutralize the influence of multinational corporations. A great amount of pressure has been put on research institutions, policy making groups, and enterprises, which a new research and development (R&D) scheme should be in place in time.

It is quite common in most countries that agricultural technologies have largely been created and disseminated by public institutions. The major clients of the technology were the extension workers who provide consulting service to farmers. “Role of agricultural extension in a commercialized agricultural system is different from such service in substance farming system. In commercialized agriculture, the extension service will mainly concentrate on the resourceful big farmer, with favorable environmental conditions and higher socio-economic status (Mahaliyanaarachchi and Bandara 2006).” In the past, private enterprises were not the first concern of the public institutions as a customer of technology. The research area of public institutes was mostly focused on the increase of agricultural productivity for the small-scale and subsistence farmers. That kind of approach might not be valid after the domestic market has been widely opened to the global one. This is because agricultural products were already overflowed in the market. New strategy should be in place soon.

The Korean government has continually expanded investments in R&D to realize the innovation of agribusiness. However, that was not enough to achieve the goals of the investments. There was a huge gap between institutions and enterprises in terms of technology transfer and commercialization. The government made a decision to reform the technology transferring scheme from public institutions to the private sector. A new organization, the Foundation of Agricultural Technology Transfer and Commercialization (FACT), has been established in 2009 as a part of institutional reform. There is no argument against the fact that FACT has been in force for seven years, more R&D projects are targeting to market needs, which result in the increased number of technology commercialization from public institutions to private companies in agribusiness.

In the aspect of technology transfer and commercialization, huge improvement has been noticed after FACT played a role in the field of research and business development (R&BD). In this paper, I will introduce the progress that Korea has been through to establish institutional body for open innovation in the agricultural business sector, and discuss the achievements that FACT has made for the transition from traditional agriculture to technology-based agribusiness. However, many questions still remain especially those that posit that technology-based approach has made any difference in term of competitiveness of agricultural products against imported ones, and that newly founded agribusiness firms armored with market-oriented technologies are helpful to maintain agricultural communities in rural areas, and so on.

TREND OF R&D INVESTMENT IN THE AGRICULTURAL SECTOR

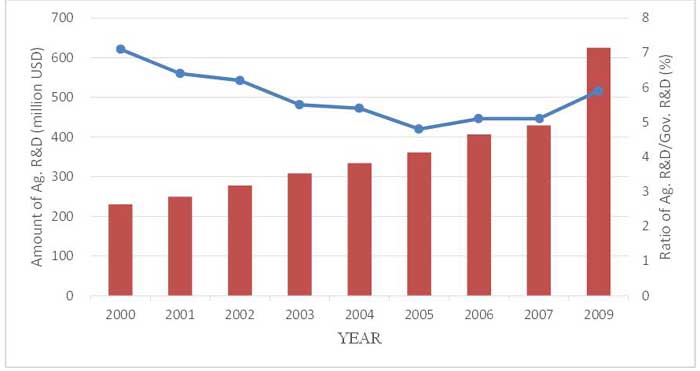

The R&D budget funded to the agricultural sector has been increased up to US$625 million dollars in 2009. The portion of the R&D budget in agricultural sector was mostly over 5% of total R&D budget of Korean government (Fig. 1). Most of the R&D fund in the agricultural sector has flowed into public research institutes. In 2007, the fund that public institutes used in the agriculture and fishery sector was over 73.7%, which was about US$366 million dollars. Nevertheless, the output of R&D investments was far from the expectation of farmers as well as policy makers (Lee 2010).

The Ministry of Agriculture, Food and Rural Affairs (MiAFRA) assessed the R&D investment that was used by the public research institutes in response to the public criticism about lower performance of R&D comparing to the budget invested. In light of the finding by the assessment, MiAFRA concluded that technology commercialization improved a lot but not good enough to meet the public expectation. At that time, the researchers in public institutes might not be concerned about the commercial use of their R&D output, which resulted in lower technology transfer ratio from public to private sector. The government had a lot of pressure to reform national R&D system in the agricultural sector.

As a part of an institutional reform, nine institutes covering sectoral and regional research areas under the Rural Development Administration (RDA) were merged into four in 2008, each of which covers agriculture, crop, horticulture, and livestock science, respectively. However, the research fund was intact. The R&D investments in the agricultural sector increased by an average of 7.7% per year from 2008 to 2014, which was 5.3% of the total government budget in the agricultural sector in 2014 (Lee, et al. 2014). One more thing we should bear in mind was that new organization, the Foundation of Agricultural Technology Commercialization and Transfer (FACT), was established in 2009. The main function of FACT was the technology commercialization in the agricultural sector. At that time, not many people noticed what FACT would bring into agriculture.

Fig. 1. Changes of agricultural R&D budget and the ratio of Agricultural R&D to governmental R&D budget.

Open Innovation

It is inevitable to face increased competition in the domestic and international agricultural markets. Small and medium-sized farms and agribusinesses are undergoing a transformation of their business model and competition strategy. In the perspective of researchers, innovative technical knowledge has been more critical to support local farmers who are competing for the share of the local market against multinational companies. The technologies which help to enhance the productivity of crop and reducing labor time of work would be critical to maintain competitiveness in agribusiness (Mysore 2015).

“Open innovation is a paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology (Chesbrough 2003).” The establishment of FACT is a part of open innovation in agricultural business. Because most of research in the agricultural sector has been done by government institutes and the recipients of technology are not government but private companies.

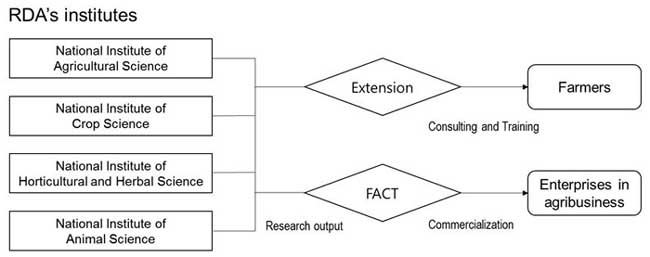

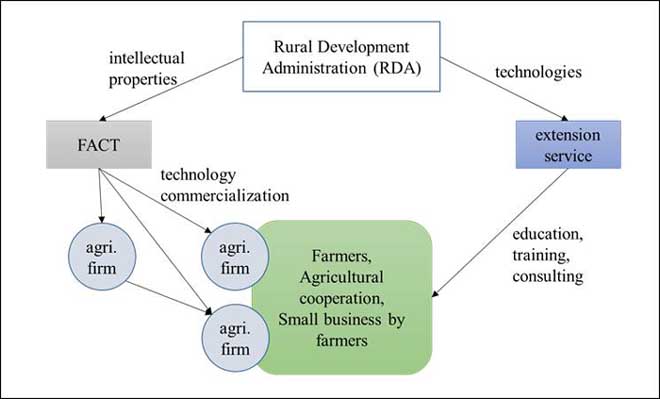

Most of the companies in agribusiness barely had the capability to perform their own research for securing competitiveness in the local market at the time that FACT just started its assigned mission. So they had to incorporate technologies from the outside that they needed for innovation. FACT has a clear role to commercialize the technologies that are developed in the RDA’s research institute (Fig. 2).

Open innovation normally occurred based on the intellectual property (IP), such as patents, copyrights, and industrial designs from research institutes and universities. But some intervention is required to make it happen in the technology market. Normally a technology licensing organization (TLO) is a key player to do technology commercialization. A TLO is a corporation, which obtains patents for university and research institute and licenses out those technologies to private companies. In the agricultural sector, we had to find a different approach not as an intermediary such as TLO. We believed that TLO model was not good enough to help private companies in agribusiness, because the companies in the agribusiness sector were small and mostly dependent on labor intensive business model.

Fig. 2. Technology transfer scheme of RDA’s institute and the role of FACT.

FACILITATING SMALL BUSINESSES IN THE AGRIBUSINESS SECTOR

One of the major roles of FACT is its being a technology transfer conduit from the research output from RDA’s institutes to private enterprises as a function of TLO. However, there is some problems to be solved before FACT does actual technology commercialization. The TLO unit of FACT should classify the technologies first as favorable technologies and that many companies are able to be interested in. Researchers produced many patents as a research output but only few were valuable commercially until FACT came into the picture.

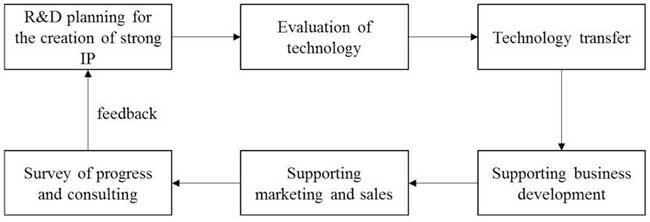

Fig. 3. Life cycle approach to support the enterprises that licensed technologies from RDA.

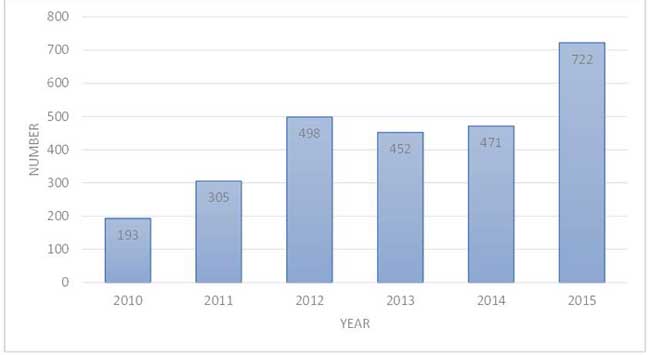

At first we created technology commercialization scheme, what it called, life cycle supporting approach. It includes strong IP creation, evaluation of technology, technology transfer, and so on (Fig. 3). With these kinds of full cycle support to private enterprises, the number of companies that are interested in RDA’s patents gradually increased. In 2010, the IPs which transferred to private companies was 193. However, since the supporting scheme for technology commercialization has actively initiated with a substantial budget after the year of 2012, the IPs transferred were tripled, and it was over 700 just in five years (Fig. 4).

Fig. 4. Number of patents transferred to private enterprises by FACT.

Technology commercialization packages are following;

- R&D planning for the creation of strong IPs.

IPs are most critical in the technology commercialization process. Without any business potentials of a patent such as improving productivity, reducing labor cost, enhancing functionality, and so on, it would be infertile that we are doing any effort to transfer technologies. To achieve this goal, we dispatch certified patent attorneys and market experts to the research labs of RDA’s institutes. These experts provide consultation services to the researchers in order to help produce market accessible patents.

- Evaluation of technology.

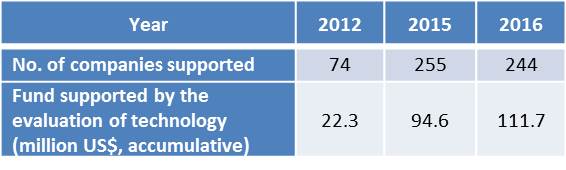

Every year RDA’s institutes produce over 400 patents. It is hard to classify even for the experts which technologies would be valuable or not. So we introduced a screening step to classify patents, experts on technology evaluation assess each technology following the criteria of economic value, technological innovativeness, and market accessibility. This kind of approach improves the success rate of technology commercialization. The evaluation of technology has another possibility that can be a channel to host investment and finance to the companies with valued technologies. Through the evaluation of technology, 244 of small companies have been supported by US$111.7 million for five years accumulatively since 2012 (Table 1).

- Technology transfer.

In this step, the most important objective is how we can find appropriate customers who want the IPs which are assessed as valuable. FACT hosts many events, it’s more like a technology roadshow, to disseminate the information as a form of sale material kit (SMK).

- Supporting business development.

This is the most critical step. Not many companies in agribusiness have enough potential to make a test product with the technologies transferred through FACT. The company that obtained technology needs to further develop to make test or final products. FACT supports the company with funds for further development of the technologies as well as consulting with experts who the customers want to have.

- Supporting market access in local as well as global business.

One more obstacle is to approach the market. At the beginning of marketing of a new product, a small company is not able to penetrate the conventional market, even worse, there is no market to sell. FACT has several programs to introduce these newly developed products to buyers and consumers. The company joined FACT’s technology commercialization supporting program which has a right to apply the events that FACT takes part in as a partner for marketing and demonstration.

- Consultation and survey.

Finally, we regularly check the progress of commercialization of technology transferred, which is done by dispatching a consultant to each company that obtained IPs from FACT. In this step, we provide any support they need including technical, financial, legal problem consulting, and so on. One more thing I want to note is that we collect the problems to be solved for better market approach from companies and then transfer feedback to the research labs with this process.

Table 1. The amount of fund supported to companies through the evaluation of technology.

START-UP BOOM BY COMPETITION PROGRAM

To facilitate open innovation, new enterprises should be entering into business in the agricultural sector. Domestic as well as global market in food and agricultural sector offer tremendous opportunities for business creation and economic growth.

Recently, Korea has been through lower economic growth as well as higher youth unemployment. Conventional businesses that lead the economy like shipbuilding, steel and automotive industry were struggling against global competition. The Korean government suggests a solution to drive to reform job creation and create a startup economy system from scratch.

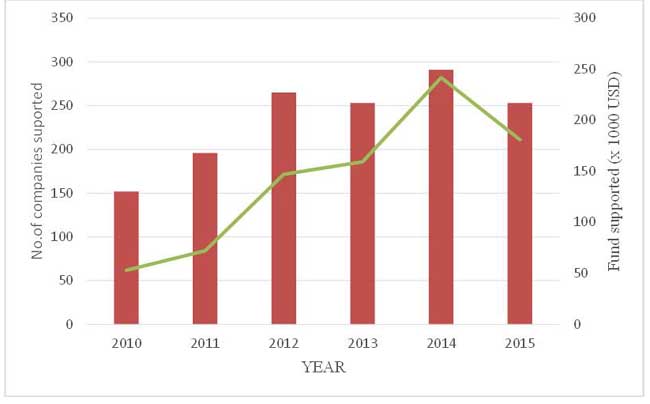

As part of creative economy program, the Korean government hosts “K-startup grand challenge program.” MiAFRA, as a part of the creative economy program. It introduces the agribusiness entrepreneurship competition, “agribusiness startup challenge”, to promote entrepreneurship among young people who have business ideas. They are thus encouraged to start a business in the agricultural sector. There were 990 members of teams which took part in “the 1st agribusiness startup challenge 2015”. Many ideas and business models were proposed, some of which won the reward among the competition and had the opportunity to transform the idea into business. Averagely, over 200 companies at the early stage are supported by FACT’s startup incubation program (Fig. 5).

There was some controversial quarrel between experts about the methodology like the “startup challenge” that the Korean government adopted for encouraging creative economy. Nevertheless, we believed that this kind of approach in agribusiness was quite helpful to make people understand that we could make a difference to adopt new idea and innovative technology in agricultural sector as well as agriculture is at least not only for farmers, but also for everyone who have any idea to make a change. In addition, it showed that agriculture and rural area could be a basecamp for people with entrepreneurship. In the consequence of these efforts, the funds from venture capital starts to flow into the agricultural sector.

Fig. 5. The number of companies supported by FACT’s startup incubation program.

ACHIEVEMENT AND RESTRICTION

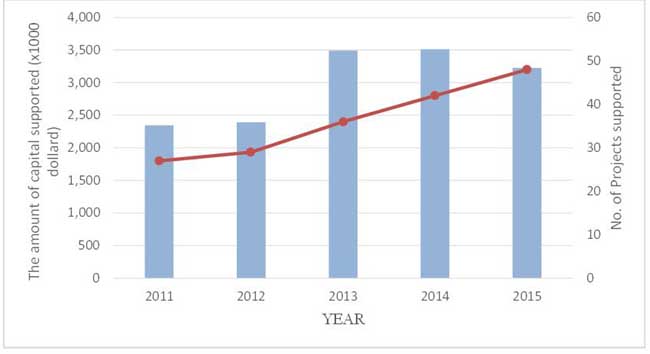

Apparently, numbers are telling many facts. After FACT started its business since 2010, an average of 38 of small companies are supported every year to make test products that were applied with RDA’s patents (Fig. 6). The fund to be supported as whole is about US$3 million dollars per year on average, which excludes the fund used for market access and R&D commercialization planning.

Supporting companies rather than farmers were not accepted as a policy to facilitate agricultural development in agricultural communities. However, the active participation of FACT into agribusiness gradually changes the thoughts of farmers that improving agriculture should support them and those that are only closely related to business. More farmers are now thinking that the more participation from non-agricultural sector could be more beneficial to revitalize agriculture and the rural areas.

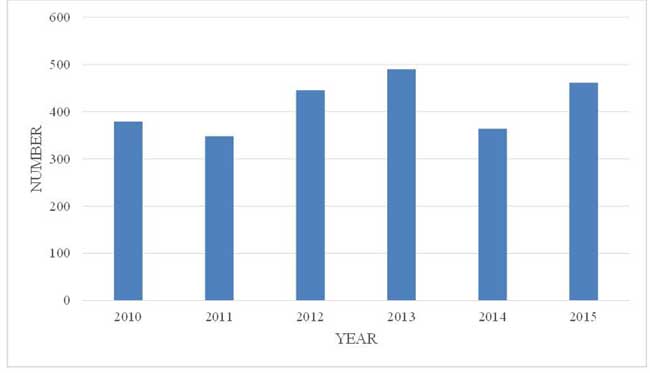

However, the number of patents from RDA’s institutes has not been changed a lot between 2010 and 2015, which on average, is about 415 (Fig. 7). It is believed that this number of patents would be the maximum we can acquire in quantity. It implies that any attempt to increase the number of patents would not be fruitful. Nevertheless, there is still a lot of possibility that we can focus on the quality to give more influence to agribusiness. Actually FACT has been concentrating on having big-output of technology transfer, symbolically over US$100,000 of royalty. At the beginning, there was no patent with royalty over US$100,000, but it was over six of royalty contract in 2005, which was the output of the effort that we pursue- a big-output of technology transfer.

Fig. 6. Number of projects supported by FACT as a part of technology commercialization.

Fig. 7. Number of patents produced by RDA’s institutes.

Organizational reform is a critical point to send a signal to the agricultural industry, such as the establishment of FACT and merging of institutes which resulted in facilitating technology commercialization and research activities focused on commercialization. The number of paper produced in the agricultural sector increased by an average of 18% per year from 2009. Patents were more dramatic, which increased by an average of 31% per year. However, technology transfer was not matched with other factors, it was only about 5.7 % of increase per year in the same period of time (Table 2). It implies that the output of research increased quantitatively, and that the impact it had on agribusiness still remained as it was.

Table 2. R&D output of public research institutes in agriculture and the fishery sector (Kim 2012).

There is a big challenge: how do we overcome this barrier on the way to technology commercialization? It was partly attributed to the fact that this result comes from not only RDA’s institute, but also universities and private institutes. More analysis would be needed to make a conclusion, but it is strongly suggested that we should be concerned on quality rather than quantity of research.

FUTURE CHALLENGE-SMALL AND MEDIUM BUSINESS DEVELOPMENT IN THE AGRICULTURAL SECTOR

These days new technologies have been playing an important role in innovation of agricultural production system, especially in smart-farm, digital agriculture, climate sustainable agriculture, and so on. These newly emerging technologies are the core of businesses that require intensive R&D performance in the agricultural sector. The companies in the new technology sector normally have a lot of interests in acquiring advanced technologies through open innovation process. This is why FACT has been monitoring the technology-based small-business firms.

Test-Bed, a facility to support the ventures

However, it is not easy to make a good relationship between venture companies and the technology transferring organization (TTO). Because normally, venture companies are prone to insist it’s their technology as a core competitive weapon that they need to be successful and win in their businesses. However, they don’t have enough facilities to perform field tests at the early stages of their businesses. Normally the facilities that support the field test for verifying credibility of a product is called test-bed. Most companies not only need test-bed, but also analysis and test service such as chemical analysis and machinery tests. If TTO can provide these kinds of facilities and services for venture companies, it would be helpful to comprise ecosystem of technology-intensive companies surrounding TTO. FACT is starting a project to build a test-bed for smart farm and new type of machinery such as drone and agricultural robots.

It is a big challenge of a TTO, such as FACT, to provide needs that a venture company asks to support its development of a new product armored with innovative technologies. It is not possible that only the technologies developed by public institutes can meet the need of venture companies. So it is another challenge: how to make a collaboration network for technology transfer covering private companies, universities, and public institutes. FACT actually succeeded in such collaboration network, but we are facing another obstacle. Other players have only been interested in selling their technologies that are not quite attractive in the technology market.

Conflict with extension service

In case of Korea, there is a strong extension system throughout the country so that FACT can just focus on the support of private enterprises. Over 150 of extension service centers distributed throughout the country provide education, training, and consulting services to farmers. However, some questions still remains.

Apparently there is no overlap zone to work between two organizational bodies, extension system and TTO. However, many companies that FACT support are doing business with farmers and agricultural cooperatives (Fig. 8). Recently, the extension center starts to support small businesses and cooperatives by farmers as well. Many discussions are ongoing below the table to seek best solutions to make synergy, but it might not be seen to be sorted out in the near future. In addition, some famers’ organizations are criticizing FACT about the activities that facilitate participation of companies into agricultural production, what we called corporate farming. But it is clear that FACT is an organization that supports enterprises to do a business with farmers, and not to do actual farming. We believe that the more healthy ecosystem of agricultural firms surrounding farms, the better sustainable farming system we will have for the future generation.

Fig. 8. The flow of technology from RDA to farmers

Toward Technology cooperation network in Asia

Korea is not a country with strong agricultural background, even though it was an agricultural country about half a century ago. We are largely dependent on foreign imports of cereals, oilseed, and feedstuffs. It is about over 70% of our total domestic consumption. As explained at the beginning, Korea is investing a huge amount of R&D funds to develop new technologies including high-yielding seeds, small-size agricultural machineries, agro-chemicals and materials. Unfortunately, we do not have agricultural background to produce crops economically in which the new technology is applied, because of market size restriction. One policy to overcome this barrier is to collaborate with other countries which have favorable agricultural environment. Another is to expand agricultural value chain to the Asia Pacific region.

It would be favorable if we can make partnership with countries which have strong agricultural background. Many technologies developed in Korea and its outputs could assist the partner’s agricultural industry, improving production with new technologies by sharing experiences, transferring new technologies between the countries with complementary economic structure in agriculture.

CONCLUSION

In agriculture the public sector still has a role to play, particularly in managing the new knowledge, disseminating new technologies to farmers by the extension system, leading technology commercialization, and promoting businesses of private companies based on rural areas. The world economy has become more globalized and liberalized, which has promoted private investments in agricultural technology development. The technologies developed in the public research institutes could be commercialized through the open innovation process. In the process, TTO should play a role in technology transfer and commercialization. Any country that wants to adopt open innovation as a development plan toward a technology based company driven agricultural reform can refer to the Korea’s case.

FACT has many functionalities to promote agricultural industry, transferring technologies from public institutes to private companies, planning business model development with the partnership of privates companies, providing incubation service programs to companies during their early stages, and booming startup in agricultural sector. With these results we have reached a conclusion that the foundation of a TTO is critical to enter into technology driven agribusiness era. In addition, it is more important to build a supporting package for the companies that are transferred technologies from FACT, bringing successful technology commercialization to agribusiness.

It is a big challenge for us to build an agricultural business ecosystem, a strongly interconnected relationship between farmers and private companies. It is aimed to backup farmers by supporting private companies doing businesses with farms in rural villages. However, some concerns are raised about rapid changes from conventional farming to corporate farming that is caused by the ability to accept new technologies. It should be noted that the first concern of technology commercialization is to promote the sustainable development of rural economy not the business itself. The importance of private companies doing businesses with farms has been increased as the economy becomes more globalized and liberalized. Appropriate organizational and legal system to enforce the role of private companies in the agricultural sector should be in place before starting the technology commercialization as an innovation measure.

REFERENCES

Chesbrough, H.W. 2003. Open Innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business School Press. ISBN 978-1578518371.

Kim, M.S. 2012. Performance analysis report of R&D investment in agriculture and fishery, IPET. (In Korean)

Lee, M.K., S.H. Kim, Y.S. Hwang, and S.H. Yun. 2014. Measures to improve agricultural R&D governance efficiency and expand private investment. KREI. 2014. (In Korean)

Lee, S.H. 2010. Current status of R&D in agriculture and fishery and its policy implication, STEPI. (In Korean)

Mahaliyanaarachchi, R.P. and R.M.A.S. Bandara. 2006. Commercialization of agriculture and role of agricultural extension, Sabaragamuwa University, 6(1): 12-22.

Mysore, S. 2015. Technology commercialization through licensing: Experiences and lessons-A case study from Indian horticulture sector, J. of Intellectual Property Rights, 20: 363-374.

| Submitted as a resource paper for the FFTC –MARDI International Workshop on “Effective IP Protection and Commercialization Strategies for Agricultural Innovation”, Oct. 18-20, MARDI Headquaters, Serdang, Selangor, Malaysia |

Current Progress and Future Strategy of Technology Commercialization in the Agricultural Sector of Korea: An International Perspective

ABSTRAT

Over the past two decades, the world economy has become more globalized. Agribusiness in developing countries has been gradually exposed to harsh challenges from foreign competitors in the local market. The capacity building of agribusiness firms has been critical to diminish and neutralize the influence of multinational corporations. In this paper, I will introduce the progress that Korea has been through in the establishment of a public institution in order to facilitate open innovation in the agricultural sector. It is said that Korea has just passed first step into technology-based agribusiness era. Many innovative approaches are being tested in the field including strong support for startup, which is mainly driven by the government’s policy for creative economy activation. The experiences are worth sharing especially in countries that are seeking ways to increase productivity of research and development (R&D). In addition, the future strategy will be presented based on the Korean experiences in order to move forward from traditional agriculture to technology-based agribusiness.

Keywords: Technology transfer, commercialization, open innovation, research and development, creative economy

INTRODUCTION

Agriculture is the world's largest business that one-third of the population rely on their livelihood as an important source of income. Small-scale and subsistence farmers produce most of the food consumed on very small plots of land. However, agribusiness is quite different especially in a heavily industrialized country, such as Korea.

Over the past two decades after the Uruguay round ratified, the world economy has become more globalized. Agribusiness in developing countries has been gradually exposed to harsh challenges from foreign competitors in the local market. The capacity building of agribusiness firms locally based has been crucial to diminish and neutralize the influence of multinational corporations. A great amount of pressure has been put on research institutions, policy making groups, and enterprises, which a new research and development (R&D) scheme should be in place in time.

It is quite common in most countries that agricultural technologies have largely been created and disseminated by public institutions. The major clients of the technology were the extension workers who provide consulting service to farmers. “Role of agricultural extension in a commercialized agricultural system is different from such service in substance farming system. In commercialized agriculture, the extension service will mainly concentrate on the resourceful big farmer, with favorable environmental conditions and higher socio-economic status (Mahaliyanaarachchi and Bandara 2006).” In the past, private enterprises were not the first concern of the public institutions as a customer of technology. The research area of public institutes was mostly focused on the increase of agricultural productivity for the small-scale and subsistence farmers. That kind of approach might not be valid after the domestic market has been widely opened to the global one. This is because agricultural products were already overflowed in the market. New strategy should be in place soon.

The Korean government has continually expanded investments in R&D to realize the innovation of agribusiness. However, that was not enough to achieve the goals of the investments. There was a huge gap between institutions and enterprises in terms of technology transfer and commercialization. The government made a decision to reform the technology transferring scheme from public institutions to the private sector. A new organization, the Foundation of Agricultural Technology Transfer and Commercialization (FACT), has been established in 2009 as a part of institutional reform. There is no argument against the fact that FACT has been in force for seven years, more R&D projects are targeting to market needs, which result in the increased number of technology commercialization from public institutions to private companies in agribusiness.

In the aspect of technology transfer and commercialization, huge improvement has been noticed after FACT played a role in the field of research and business development (R&BD). In this paper, I will introduce the progress that Korea has been through to establish institutional body for open innovation in the agricultural business sector, and discuss the achievements that FACT has made for the transition from traditional agriculture to technology-based agribusiness. However, many questions still remain especially those that posit that technology-based approach has made any difference in term of competitiveness of agricultural products against imported ones, and that newly founded agribusiness firms armored with market-oriented technologies are helpful to maintain agricultural communities in rural areas, and so on.

TREND OF R&D INVESTMENT IN THE AGRICULTURAL SECTOR

The R&D budget funded to the agricultural sector has been increased up to US$625 million dollars in 2009. The portion of the R&D budget in agricultural sector was mostly over 5% of total R&D budget of Korean government (Fig. 1). Most of the R&D fund in the agricultural sector has flowed into public research institutes. In 2007, the fund that public institutes used in the agriculture and fishery sector was over 73.7%, which was about US$366 million dollars. Nevertheless, the output of R&D investments was far from the expectation of farmers as well as policy makers (Lee 2010).

The Ministry of Agriculture, Food and Rural Affairs (MiAFRA) assessed the R&D investment that was used by the public research institutes in response to the public criticism about lower performance of R&D comparing to the budget invested. In light of the finding by the assessment, MiAFRA concluded that technology commercialization improved a lot but not good enough to meet the public expectation. At that time, the researchers in public institutes might not be concerned about the commercial use of their R&D output, which resulted in lower technology transfer ratio from public to private sector. The government had a lot of pressure to reform national R&D system in the agricultural sector.

As a part of an institutional reform, nine institutes covering sectoral and regional research areas under the Rural Development Administration (RDA) were merged into four in 2008, each of which covers agriculture, crop, horticulture, and livestock science, respectively. However, the research fund was intact. The R&D investments in the agricultural sector increased by an average of 7.7% per year from 2008 to 2014, which was 5.3% of the total government budget in the agricultural sector in 2014 (Lee, et al. 2014). One more thing we should bear in mind was that new organization, the Foundation of Agricultural Technology Commercialization and Transfer (FACT), was established in 2009. The main function of FACT was the technology commercialization in the agricultural sector. At that time, not many people noticed what FACT would bring into agriculture.

Fig. 1. Changes of agricultural R&D budget and the ratio of Agricultural R&D to governmental R&D budget.

Open Innovation

It is inevitable to face increased competition in the domestic and international agricultural markets. Small and medium-sized farms and agribusinesses are undergoing a transformation of their business model and competition strategy. In the perspective of researchers, innovative technical knowledge has been more critical to support local farmers who are competing for the share of the local market against multinational companies. The technologies which help to enhance the productivity of crop and reducing labor time of work would be critical to maintain competitiveness in agribusiness (Mysore 2015).

“Open innovation is a paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology (Chesbrough 2003).” The establishment of FACT is a part of open innovation in agricultural business. Because most of research in the agricultural sector has been done by government institutes and the recipients of technology are not government but private companies.

Most of the companies in agribusiness barely had the capability to perform their own research for securing competitiveness in the local market at the time that FACT just started its assigned mission. So they had to incorporate technologies from the outside that they needed for innovation. FACT has a clear role to commercialize the technologies that are developed in the RDA’s research institute (Fig. 2).

Open innovation normally occurred based on the intellectual property (IP), such as patents, copyrights, and industrial designs from research institutes and universities. But some intervention is required to make it happen in the technology market. Normally a technology licensing organization (TLO) is a key player to do technology commercialization. A TLO is a corporation, which obtains patents for university and research institute and licenses out those technologies to private companies. In the agricultural sector, we had to find a different approach not as an intermediary such as TLO. We believed that TLO model was not good enough to help private companies in agribusiness, because the companies in the agribusiness sector were small and mostly dependent on labor intensive business model.

Fig. 2. Technology transfer scheme of RDA’s institute and the role of FACT.

FACILITATING SMALL BUSINESSES IN THE AGRIBUSINESS SECTOR

One of the major roles of FACT is its being a technology transfer conduit from the research output from RDA’s institutes to private enterprises as a function of TLO. However, there is some problems to be solved before FACT does actual technology commercialization. The TLO unit of FACT should classify the technologies first as favorable technologies and that many companies are able to be interested in. Researchers produced many patents as a research output but only few were valuable commercially until FACT came into the picture.

Fig. 3. Life cycle approach to support the enterprises that licensed technologies from RDA.

At first we created technology commercialization scheme, what it called, life cycle supporting approach. It includes strong IP creation, evaluation of technology, technology transfer, and so on (Fig. 3). With these kinds of full cycle support to private enterprises, the number of companies that are interested in RDA’s patents gradually increased. In 2010, the IPs which transferred to private companies was 193. However, since the supporting scheme for technology commercialization has actively initiated with a substantial budget after the year of 2012, the IPs transferred were tripled, and it was over 700 just in five years (Fig. 4).

Fig. 4. Number of patents transferred to private enterprises by FACT.

Technology commercialization packages are following;

IPs are most critical in the technology commercialization process. Without any business potentials of a patent such as improving productivity, reducing labor cost, enhancing functionality, and so on, it would be infertile that we are doing any effort to transfer technologies. To achieve this goal, we dispatch certified patent attorneys and market experts to the research labs of RDA’s institutes. These experts provide consultation services to the researchers in order to help produce market accessible patents.

Every year RDA’s institutes produce over 400 patents. It is hard to classify even for the experts which technologies would be valuable or not. So we introduced a screening step to classify patents, experts on technology evaluation assess each technology following the criteria of economic value, technological innovativeness, and market accessibility. This kind of approach improves the success rate of technology commercialization. The evaluation of technology has another possibility that can be a channel to host investment and finance to the companies with valued technologies. Through the evaluation of technology, 244 of small companies have been supported by US$111.7 million for five years accumulatively since 2012 (Table 1).

In this step, the most important objective is how we can find appropriate customers who want the IPs which are assessed as valuable. FACT hosts many events, it’s more like a technology roadshow, to disseminate the information as a form of sale material kit (SMK).

This is the most critical step. Not many companies in agribusiness have enough potential to make a test product with the technologies transferred through FACT. The company that obtained technology needs to further develop to make test or final products. FACT supports the company with funds for further development of the technologies as well as consulting with experts who the customers want to have.

One more obstacle is to approach the market. At the beginning of marketing of a new product, a small company is not able to penetrate the conventional market, even worse, there is no market to sell. FACT has several programs to introduce these newly developed products to buyers and consumers. The company joined FACT’s technology commercialization supporting program which has a right to apply the events that FACT takes part in as a partner for marketing and demonstration.

Finally, we regularly check the progress of commercialization of technology transferred, which is done by dispatching a consultant to each company that obtained IPs from FACT. In this step, we provide any support they need including technical, financial, legal problem consulting, and so on. One more thing I want to note is that we collect the problems to be solved for better market approach from companies and then transfer feedback to the research labs with this process.

Table 1. The amount of fund supported to companies through the evaluation of technology.

START-UP BOOM BY COMPETITION PROGRAM

To facilitate open innovation, new enterprises should be entering into business in the agricultural sector. Domestic as well as global market in food and agricultural sector offer tremendous opportunities for business creation and economic growth.

Recently, Korea has been through lower economic growth as well as higher youth unemployment. Conventional businesses that lead the economy like shipbuilding, steel and automotive industry were struggling against global competition. The Korean government suggests a solution to drive to reform job creation and create a startup economy system from scratch.

As part of creative economy program, the Korean government hosts “K-startup grand challenge program.” MiAFRA, as a part of the creative economy program. It introduces the agribusiness entrepreneurship competition, “agribusiness startup challenge”, to promote entrepreneurship among young people who have business ideas. They are thus encouraged to start a business in the agricultural sector. There were 990 members of teams which took part in “the 1st agribusiness startup challenge 2015”. Many ideas and business models were proposed, some of which won the reward among the competition and had the opportunity to transform the idea into business. Averagely, over 200 companies at the early stage are supported by FACT’s startup incubation program (Fig. 5).

There was some controversial quarrel between experts about the methodology like the “startup challenge” that the Korean government adopted for encouraging creative economy. Nevertheless, we believed that this kind of approach in agribusiness was quite helpful to make people understand that we could make a difference to adopt new idea and innovative technology in agricultural sector as well as agriculture is at least not only for farmers, but also for everyone who have any idea to make a change. In addition, it showed that agriculture and rural area could be a basecamp for people with entrepreneurship. In the consequence of these efforts, the funds from venture capital starts to flow into the agricultural sector.

Fig. 5. The number of companies supported by FACT’s startup incubation program.

ACHIEVEMENT AND RESTRICTION

Apparently, numbers are telling many facts. After FACT started its business since 2010, an average of 38 of small companies are supported every year to make test products that were applied with RDA’s patents (Fig. 6). The fund to be supported as whole is about US$3 million dollars per year on average, which excludes the fund used for market access and R&D commercialization planning.

Supporting companies rather than farmers were not accepted as a policy to facilitate agricultural development in agricultural communities. However, the active participation of FACT into agribusiness gradually changes the thoughts of farmers that improving agriculture should support them and those that are only closely related to business. More farmers are now thinking that the more participation from non-agricultural sector could be more beneficial to revitalize agriculture and the rural areas.

However, the number of patents from RDA’s institutes has not been changed a lot between 2010 and 2015, which on average, is about 415 (Fig. 7). It is believed that this number of patents would be the maximum we can acquire in quantity. It implies that any attempt to increase the number of patents would not be fruitful. Nevertheless, there is still a lot of possibility that we can focus on the quality to give more influence to agribusiness. Actually FACT has been concentrating on having big-output of technology transfer, symbolically over US$100,000 of royalty. At the beginning, there was no patent with royalty over US$100,000, but it was over six of royalty contract in 2005, which was the output of the effort that we pursue- a big-output of technology transfer.

Fig. 6. Number of projects supported by FACT as a part of technology commercialization.

Fig. 7. Number of patents produced by RDA’s institutes.

Organizational reform is a critical point to send a signal to the agricultural industry, such as the establishment of FACT and merging of institutes which resulted in facilitating technology commercialization and research activities focused on commercialization. The number of paper produced in the agricultural sector increased by an average of 18% per year from 2009. Patents were more dramatic, which increased by an average of 31% per year. However, technology transfer was not matched with other factors, it was only about 5.7 % of increase per year in the same period of time (Table 2). It implies that the output of research increased quantitatively, and that the impact it had on agribusiness still remained as it was.

Table 2. R&D output of public research institutes in agriculture and the fishery sector (Kim 2012).

There is a big challenge: how do we overcome this barrier on the way to technology commercialization? It was partly attributed to the fact that this result comes from not only RDA’s institute, but also universities and private institutes. More analysis would be needed to make a conclusion, but it is strongly suggested that we should be concerned on quality rather than quantity of research.

FUTURE CHALLENGE-SMALL AND MEDIUM BUSINESS DEVELOPMENT IN THE AGRICULTURAL SECTOR

These days new technologies have been playing an important role in innovation of agricultural production system, especially in smart-farm, digital agriculture, climate sustainable agriculture, and so on. These newly emerging technologies are the core of businesses that require intensive R&D performance in the agricultural sector. The companies in the new technology sector normally have a lot of interests in acquiring advanced technologies through open innovation process. This is why FACT has been monitoring the technology-based small-business firms.

Test-Bed, a facility to support the ventures

However, it is not easy to make a good relationship between venture companies and the technology transferring organization (TTO). Because normally, venture companies are prone to insist it’s their technology as a core competitive weapon that they need to be successful and win in their businesses. However, they don’t have enough facilities to perform field tests at the early stages of their businesses. Normally the facilities that support the field test for verifying credibility of a product is called test-bed. Most companies not only need test-bed, but also analysis and test service such as chemical analysis and machinery tests. If TTO can provide these kinds of facilities and services for venture companies, it would be helpful to comprise ecosystem of technology-intensive companies surrounding TTO. FACT is starting a project to build a test-bed for smart farm and new type of machinery such as drone and agricultural robots.

It is a big challenge of a TTO, such as FACT, to provide needs that a venture company asks to support its development of a new product armored with innovative technologies. It is not possible that only the technologies developed by public institutes can meet the need of venture companies. So it is another challenge: how to make a collaboration network for technology transfer covering private companies, universities, and public institutes. FACT actually succeeded in such collaboration network, but we are facing another obstacle. Other players have only been interested in selling their technologies that are not quite attractive in the technology market.

Conflict with extension service

In case of Korea, there is a strong extension system throughout the country so that FACT can just focus on the support of private enterprises. Over 150 of extension service centers distributed throughout the country provide education, training, and consulting services to farmers. However, some questions still remains.

Apparently there is no overlap zone to work between two organizational bodies, extension system and TTO. However, many companies that FACT support are doing business with farmers and agricultural cooperatives (Fig. 8). Recently, the extension center starts to support small businesses and cooperatives by farmers as well. Many discussions are ongoing below the table to seek best solutions to make synergy, but it might not be seen to be sorted out in the near future. In addition, some famers’ organizations are criticizing FACT about the activities that facilitate participation of companies into agricultural production, what we called corporate farming. But it is clear that FACT is an organization that supports enterprises to do a business with farmers, and not to do actual farming. We believe that the more healthy ecosystem of agricultural firms surrounding farms, the better sustainable farming system we will have for the future generation.

Fig. 8. The flow of technology from RDA to farmers

Toward Technology cooperation network in Asia

Korea is not a country with strong agricultural background, even though it was an agricultural country about half a century ago. We are largely dependent on foreign imports of cereals, oilseed, and feedstuffs. It is about over 70% of our total domestic consumption. As explained at the beginning, Korea is investing a huge amount of R&D funds to develop new technologies including high-yielding seeds, small-size agricultural machineries, agro-chemicals and materials. Unfortunately, we do not have agricultural background to produce crops economically in which the new technology is applied, because of market size restriction. One policy to overcome this barrier is to collaborate with other countries which have favorable agricultural environment. Another is to expand agricultural value chain to the Asia Pacific region.

It would be favorable if we can make partnership with countries which have strong agricultural background. Many technologies developed in Korea and its outputs could assist the partner’s agricultural industry, improving production with new technologies by sharing experiences, transferring new technologies between the countries with complementary economic structure in agriculture.

CONCLUSION

In agriculture the public sector still has a role to play, particularly in managing the new knowledge, disseminating new technologies to farmers by the extension system, leading technology commercialization, and promoting businesses of private companies based on rural areas. The world economy has become more globalized and liberalized, which has promoted private investments in agricultural technology development. The technologies developed in the public research institutes could be commercialized through the open innovation process. In the process, TTO should play a role in technology transfer and commercialization. Any country that wants to adopt open innovation as a development plan toward a technology based company driven agricultural reform can refer to the Korea’s case.

FACT has many functionalities to promote agricultural industry, transferring technologies from public institutes to private companies, planning business model development with the partnership of privates companies, providing incubation service programs to companies during their early stages, and booming startup in agricultural sector. With these results we have reached a conclusion that the foundation of a TTO is critical to enter into technology driven agribusiness era. In addition, it is more important to build a supporting package for the companies that are transferred technologies from FACT, bringing successful technology commercialization to agribusiness.

It is a big challenge for us to build an agricultural business ecosystem, a strongly interconnected relationship between farmers and private companies. It is aimed to backup farmers by supporting private companies doing businesses with farms in rural villages. However, some concerns are raised about rapid changes from conventional farming to corporate farming that is caused by the ability to accept new technologies. It should be noted that the first concern of technology commercialization is to promote the sustainable development of rural economy not the business itself. The importance of private companies doing businesses with farms has been increased as the economy becomes more globalized and liberalized. Appropriate organizational and legal system to enforce the role of private companies in the agricultural sector should be in place before starting the technology commercialization as an innovation measure.

REFERENCES

Chesbrough, H.W. 2003. Open Innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business School Press. ISBN 978-1578518371.

Kim, M.S. 2012. Performance analysis report of R&D investment in agriculture and fishery, IPET. (In Korean)

Lee, M.K., S.H. Kim, Y.S. Hwang, and S.H. Yun. 2014. Measures to improve agricultural R&D governance efficiency and expand private investment. KREI. 2014. (In Korean)

Lee, S.H. 2010. Current status of R&D in agriculture and fishery and its policy implication, STEPI. (In Korean)

Mahaliyanaarachchi, R.P. and R.M.A.S. Bandara. 2006. Commercialization of agriculture and role of agricultural extension, Sabaragamuwa University, 6(1): 12-22.

Mysore, S. 2015. Technology commercialization through licensing: Experiences and lessons-A case study from Indian horticulture sector, J. of Intellectual Property Rights, 20: 363-374.