ABSTRACT

This paper aims to demonstrate the important role and contribution of agricultural cooperatives in improving marketing efficiency for selected agricultural commodities in the Philippines. It presents evidences from the cases of Sorosoro Ibaba Development Cooperative (SIDC) and Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC), two agri-based cooperatives involved in production and marketing of hogs and cacao beans, respectively. The study reveals how these cooperatives, regardless of the size of their operations, successfully empower small and weak farmers by increasing their participation in the agricultural value chain and enhancing their access to more lucrative and dynamic markets through collective action. Their cooperative approach in marketing has shown positive impacts on the efficiency of the marketing system for hogs and cacao beans as they enable their farmer-members to attain vertical integration, economies of scale in production and marketing, bargaining power in the markets, and value addition for their products. As SIDC and SIFMPC have both maintained a good market position and massive participation in their respective commodity chains, farmers are able to reap more economic gains than what they would otherwise earn as individual producers. Overall, this study validates that a cooperative can be a key driver for improving marketing efficiency and for enabling small farmers to take advantage of the economic opportunities associated with it. The success stories of SIDC and SIFMPC provide a cooperative enterprise model that is worthy for replication in the country and in other parts of the world. However, adequate resources and investment capacities to support their operations must be ensured in order for the cooperatives, especially the micro cooperatives, to perform productively, competitively and sustainably. The success of the two case cooperatives is seen in the experiences of many micro and small cooperatives which are often saddled by limited resources and are unable to undertake efficient business operations.

Keywords: agricultural cooperatives, marketing efficiency, market intermediaries, supply chain, vertical integration

INTRODUCTION

Efficiency is one of the most important goals in agricultural and food marketing. It directly affects food security, particularly the economic and physical access to food of households. Efficient and effective flow of food from production point (farmers) to consumption point (consumers) can facilitate the availability, accessibility and affordability of adequate food to consumers (Pabuayon et al. 2014). Every market actor (e.g. farmer, market intermediaries and consumers) in an agricultural marketing system plays a key role in performing marketing functions and providing marketing services that contribute to achieving efficient marketing process at different sub-markets (e.g., farm, assembly or wholesale, and retail market). The marketing services such as transport, processing, storage, grading, packaging, wholesaling and retailing are often provided by market intermediaries like traders, assemblers, processors, wholesalers, truckers and shippers, marketing and bargaining cooperatives, and retailers. These services normally entail costs, risks, and payments for the managerial services and risk-taking done by the market intermediary, which often become a source of market inefficiencies. The inefficiencies even become more likely as more market intermediaries are involved in performing the marketing functions.

Marketing efficiency can benefit all the key actors in a market chain. Technically, an efficient marketing system is achieved when the resulting marketing costs (including losses) are minimized and the profits or returns of market intermediaries are reasonable – that is, the marketing margin is just enough to cover the costs of marketing services and there are no unreasonable profits generated by the market intermediaries (Pabuayon et al. 2013). In this case, the marketing margin should not be lower than the marketing costs and to what the market actors would otherwise get from the alternative use of their capital and labor. Otherwise, there will be no economic incentives for them to provide the marketing services and instead, might just shift to other economic activities. Some of the apparent indicators of an efficient marketing system are the higher prices received by farmers, the affordable food products or lower prices paid by consumers, and the profitable business operations and more investments for market intermediaries.

In the Philippines, the marketing system of agricultural commodities faces several issues and challenges that indicate inefficiencies, which are becoming even more challenging as the economy approaches the ASEAN economic integration this 2015. Some of the common issues are: (i) the low prices received by farmers for their produce; (ii) the multiple layers of market intermediaries in agricultural supply chains; and (iii) the limited access to profitable markets (e.g., institutional and export markets). Of all the market actors in the agricultural marketing chain, the small farmers are often the most affected by these problems.

About 91% of more than 5 million farmers in the country are small farmers, who usually belong to the marginalized rural sector and are vulnerable to the rapid changes in the market environment and marketing conditions. Because most of them experience poor economies of scale and bargaining power, limited capacity and resources, and lack of access to market information, small farmers are often exploited by dominant groups and constrained from having significant participation and good market position in the supply and value chains of agricultural products. This is not to mention other socio-economic, cultural and political factors that also affect farmers’ marketing efficiency. Their weakness as individual small-scale farmers prevents them from expanding their operations, accessing markets beyond their localities, and generating better and fairer income for their families.

As early as 1970s, organization of small farmers into self-help groups like farmers’ associations and cooperatives has been identified as a key strategy for improving the production and marketing performance of small farmers in the Philippines. Over the years, the potential of cooperatives as a viable and sustainable form of enterprise has been increasingly recognized worldwide. In the ASEAN Economic Community (AEC) Blueprint crafted in 2008, agricultural cooperatives have been particularly identified as a means of enhancing market access for agricultural products and empowering farmers. The blueprint thus calls for the promotion of agricultural cooperatives in the ASEAN region and for strengthening strategic alliance and business linkages among these cooperatives. In 2012, the International Cooperative Alliance (ICA) also developed its Blueprint strategy for cooperatives – the “2020 Vision”, which envisions cooperatives as builders of sustainability in the 2020 and to be the acknowledged leader in economic, social and environmental sustainability, the model preferred by people as well as the fastest growing form of enterprise. The significant role of cooperatives in enhancing livelihoods and productivity of smallholder family farmers has also been reemphasized during the International Year of Family Farming in 2014.

Despite the increasing advancement of the global agenda for promoting cooperatives as vehicle for development, the role and contribution of cooperatives in agricultural marketing development are often understated. One of the reasons for this is the dearth in empirical evidences showcasing the success and potentials of agricultural cooperatives in contributing to marketing efficiency.

This paper aims to demonstrate the success of selected Philippine agri-based cooperatives in improving marketing efficiency and particularly, in mainstreaming small farmers in an efficient marketing system. It presents evidences from the case of two of the country’s successful cooperatives, namely, Sorosoro Ibaba Development Cooperative (SIDC) and Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC).

METHODOLOGY

This study conducted a rapid analysis of two selected agri-based cooperatives in the Philippines using the case study method. Case study method is “a systematic inquiry into an event or a set of related events to describe or explain the phenomenon of interest” (Bromley, 1990). It involves either the use of focused stories based on real-life situations or carefully crafted hypothetical or disguised versions of events rooted in actual experiences to illustrate a particular set of learning objectives. For this study, focused stories of SIDC and SIFMPC were used. These two cooperatives were purposely selected to represent both the large and the micro cooperatives in the country production and/or marketing of agricultural commodities as their main business activity. SIDC operates at a large scale while SIFMPC has small-scale operations.

Both secondary and primary data were used in this study. The secondary data mostly came from existing literature on agricultural supply and value chains and cooperatives and from the annual financial reports of the case cooperatives. Primary data were gathered through key informant interviews with the cooperative leaders and managers and personal interviews with member representatives of the cooperatives.

The analysis of the case cooperatives is highly descriptive and qualitative. Due to insufficient data, it does not involve quantitative investigation of its profitability margins and marketing efficiency, which is the major limitation of this study. At present, there are still limited research studies that made in-depth and quantifiable analysis of the marketing efficiency for agricultural commodities produced and sold through cooperative marketing. Thus, conduct of further studies that aim to measure financial and economic efficiencies of agricultural cooperatives is suggested. A more comprehensive supply and value chain analysis for agricultural commodities handled by cooperatives is also good to explore.

RESULTS AND DISCUSSION

Overview of the Philippine Cooperative Sector

In the Philippines, cooperative may have at least one of the three core functions of cooperatives: (i) marketing – extending control of members’ products through processing, distribution and sale; (ii) purchasing – providing affordable supplies and goods or (iii) service – providing needed services. With the multidimensionality of their functions that serve the needs of the cooperative members and their communities, cooperatives have become an increasingly important sector in the Philippine economy.

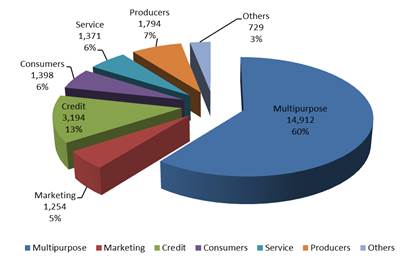

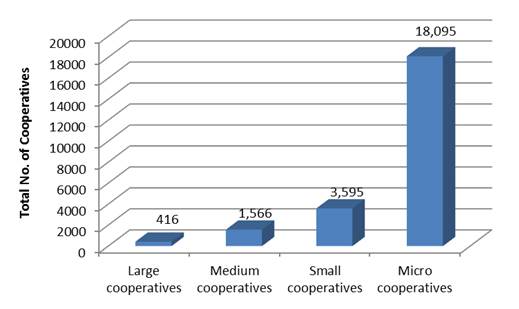

From merely 1,142 cooperatives in 1985, the total number of cooperatives in the country already reached 24,652 in 2014 (CDA 2014). The majority (73%) of these cooperatives are categorized as multipurpose cooperatives and credit cooperatives (Fig. 1). At least 57% of the cooperatives are micro cooperatives, that is – having less than US$66,667 (or PhP3.0 million) total worth of assets (Fig. 2). The total cooperative membership increased to almost 12.7 million in 2013, which comprised almost a quarter (23.8%) already of the country’s total population ages 20 years old and above. In the same year, the whole cooperative sector had an estimated total volume of business of US$9.9 billion (PhP437.6 billion), which comprised about 4% of the country’s gross domestic product (GDP). As of 2014, Philippine cooperatives generated direct employment for at least 290,662 individuals in the country.

Fig. 1. Types of cooperative by function/purpose, Philippines, 2014 (n=24,652)

Source: CDA (2014)

For agricultural cooperatives alone, it is unfortunate that the Philippines’ cooperative sector does not have yet a detailed and disaggregated statistical database available. The categorization of cooperatives according to purpose, membership, and to kind of service provided, as specified in the Philippine Cooperative Code of 2008 (Republic Act 9520), does not include a specific type for “agricultural cooperative.” Cooperatives that are engaged in agricultural activities may fall under different categories like producers cooperative, agrarian reform cooperative, marketing cooperative, credit cooperative, multipurpose cooperative, and so on, depending on their key business activities and on their registration with the Cooperative and Development Authority (CDA). However, it can be conservatively estimated that there are more than 2,000 cooperatives or at least 8% of all cooperatives in the Philippines that are into agriculture- and fisheries-related activities based on the total number of agrarian reform cooperatives, producers cooperatives, fishermen cooperatives, and dairy cooperatives nationwide (CDA 2014). This estimate is expected to be much higher if the number of agri-based multipurpose cooperatives can also be identified.

Fig. 2. Categories of cooperative by total value of assets, Philippines, 2013

Source: CDA (2014)

In spite of the lack of exhaustive statistical records on the presence of agri-based cooperatives in the country, there have been attempts to study the performance, potentials and contributions of the cooperatives in agricultural and rural development. Several research works and case studies such as those conducted by Castillo (2003), Manalili (2003), Araullo (2006), Geron (2014) and Quilloy (2015a) provided evidences of the important role of cooperatives in agriculture. These studies focused mainly on demonstrating the involvement of cooperatives in agricultural production and marketing, linking farmers to markets through cooperative, market integration and value chain upgrading through cooperative, and competitiveness and comparative advantage of cooperative as an enterprise.

To add to the body of literature on agri-based cooperatives, the following sections highlight the success of two selected cooperatives in contributing to marketing efficiency within the supply and value chains for agricultural commodities in the country. Particularly, the cases of SIDC and SIFMPC are presented to give light to how a cooperative can help small farmers enhance their participation in an efficient agricultural marketing chain, improve their efficiency through collective action, and most importantly, augment their farm incomes while at the same time providing household consumers with access to affordable goods.

Vertical Integration in Hog Meat Marketing Chain: The Case of Sorosoro Ibaba Development Cooperative (SIDC)

One of the strategies to improve marketing efficiency is to minimize costs incurred in moving a commodity between market players from the production point to the consumption point. It can be rationally postulated that with fewer players involved in the chain, the marketing channel through which the product has to pass will be shorter and thus, will result in less transaction costs. These transaction costs may arise from disagreements in conducting business between market players, unpredictability of the industry’s operating environment, non-standardized products, and uncertainties in product quality (FAO 2002). An effective strategy to avoid transaction costs is to do vertical integration in commodity chains.

Vertical integration occurs when the ownership or control of the complementary business activities at different stages of production and marketing processes is put under a common organization or single management of a firm to reduce the cost and increase the profitability of production of the product or service (Berlin 2001). This would mean expansion of the activities of a firm until it controls all the levels of the supply chain. The market integration may involve a firm integrating backward into the input supply system, forward into the distribution system, or both.

In the Philippines, vertical integration has become an important feature of the livestock industries. Given its capital-intensive nature, integration of marketing functions becomes a necessary goal for hog businesses in order to gain better profit as it can ensure reliability of supply, provide economies of scale, and facilitate product quality management and standardization in business operations. However, in the occurrence of vertical integration, small family farms or backyard hog raisers often face threats from the large farms and big private business enterprises that usually have the huge capacity to integrate their operations and dominate the chain. The risks of smallholders being crowded out and having limited product value share are not far from happening if big corporations have started to control the whole marketing system of an agricultural commodity.

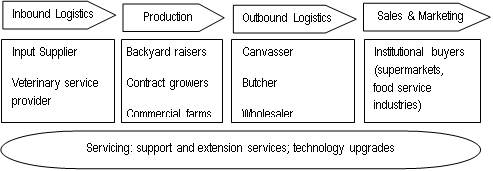

A general hog industry value chain in the Philippines (as depicted in Cagayan Valley, the country’s top swine producing province) can be divided into the following segments (Fig. 3):

-

Inbound logistics, which involves input supply, particularly of feeds, piglets, and veterinary services

-

Production, which are subdivided into five segments of farm operations from birth to pre-slaughter: (a) farrow to wean; (b) wean to feeder; (c) farrow to feeder; (d) feeder to finish; and (e) farrow to finish.

-

Outbound logistics, which involves slaughtering, packing, processing and distribution to slaughterhouses and food supply companies

-

Sales and marketing, which encompasses in-home consumption of pork (supermarkets and restaurants) and out-of-home consumption (food service); and

-

Servicing, which includes support and extension services like education and training and technology upgrades.

Fig. 3. Hog value chain map, Cagayan Valley, Philippines, 2013

Source: Adopted from Perez (2014) with some modifications

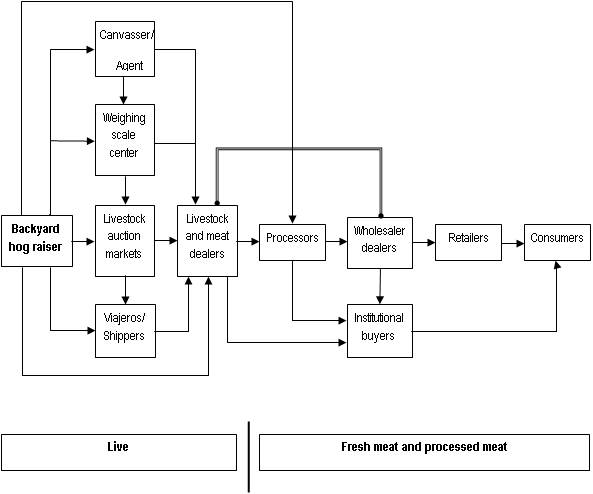

The participation of a backyard hog raiser in the hog value chain usually ends as early as on the production stage. Normally, backyard raisers maintain a piggery, provide the needed labor, and then sell live hogs to canvasser, weighing scale center and butchers, wholesalers and meat dealers, processors, or auction markets (Fig. 4). Many small farmers are also into contract growing for commercial farms and corporations. With their small scale production, they often cannot buy inputs in bulk on cash basis, thereby augmenting their cost of production. Moreover, with their limited capabilities to do value-adding activities on the product and consequently, with their limited participation in the value chain, returns from sales are also expected to be limited.

On the other hand, a large commercial hog enterprise plays many roles in a value chain. Its operations are often integrated from feed milling and breeding up to processing and marketing and distribution, thereby enabling the firm, particularly its investors or stockholders, to generate higher profits from its business activities. Unlike small scale hog raisers, large corporations can afford to purchase inputs in bulk on cash basis and operate with economies of scale and bargaining power, thus enabling them to lower production costs and to generate higher level of profitability. Likewise, given their access to facilities, infrastructure, and human resources, they are able to perform value addition on their hogs, which allow them to sell their products in different forms (e.g. fresh meat, processed meat, etc.) with a price premium. As

Fig. 4. Marketing channel of live animal, meat and meat products

Source: Esplana and Abao (2009)

these firms dominate the chain, the challenge for backyard hog raisers to have greater participation in more profitable levels of the chain and to compete or cooperate with other market players becomes greater.

On the other hand, a large commercial hog enterprise plays many roles in a value chain. Its operations are often integrated from feed milling and breeding up to processing and marketing and distribution, thereby enabling the firm, particularly its investors or stockholders, to generate higher profits from its business activities. Unlike small scale hog raisers, large corporations can afford to purchase inputs in bulk on cash basis and operate with economies of scale and bargaining power, thus enabling them to lower production costs and to generate higher level of profitability. Likewise, given their access to facilities, infrastructure, and human resources, they are able to perform value addition on their hogs, which allow them to sell their products in different forms (e.g. fresh meat, processed meat, etc.) with a price premium As these firms dominate the chain, the challenge for backyard hog raisers to have greater participation in more profitable levels of the chain and to compete or cooperate with other market players becomes greater.

It is in this light that agricultural cooperatives have been recognized as the more inclusive or pro-smallholder alternative to large investor-owned firms (IOFs) involved in livestock industries. Unlike IOFs, cooperatives are owned, controlled and financed by its farmer-members. The cooperative approach towards production and marketing enables small farmers to have stronger capacity to vertically integrate its business activities instead of limiting their participation in the value chain at production level only. As member-owners of the cooperative, farmers also equitably receive returns from the cooperative’s net surplus based on their use or patronage of products and services of the cooperative, rather than on their capital share or investment in the cooperative.

Sorosoro Ibaba Development Cooperative or SIDC is the biggest and most successful agricultural cooperative in the Philippines, which demonstrates vertical integration in its hog business activities. SIDC is based in Batangas City, Philippines and has been operating since 1978. As of 2012, the cooperative has 7,882 regular members and 9,599 associate members from more than 100 villages (barangays) in Batangas and from other provinces in Region IV-A (CALABARZON) and nearby regions. Its key business activities include feed milling; hog raising, contract growing, marketing and related hog products and services; credit services; merchandizing of other agricultural and non-agricultural products and providing other services to members.

With the main goal of developing and offering “competitive quality products and services, adopting technologically advanced systems to build prosperous lives and strengthen the spiritual and social development of stakeholders” (SIDC 2013), SIDC continues to improve its businesses through vertical integration. From operating a goods store in 1978, the cooperative has significantly expanded its business activities in a manner that controls a series of stages of the hog supply chain – from feed milling and input supplying to contract growing and retail marketing.

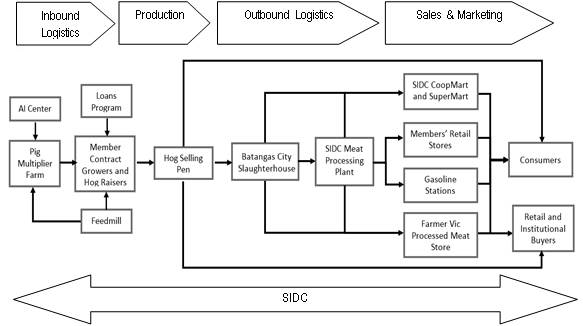

Under vertical integration, SIDC performs the interrelated business activities of feeds production, hog breeding, hog fattening, slaughtering, meat processing and selling, among others (Fig. 5). These activities are complemented with enabling mechanisms that the cooperative provides such as credit and technical services (e.g., veterinary services, trainings and seminars). The credit program enables its members to start their own hog business livelihood through provision of loans for hog pen construction and for purchase of piglets, feeds and medicines.

At the early stage of the chain, SIDC’s backwardly integrated by breeding its own high-grade piglets from F1 gilts and high-grade boars maintained in the cooperative’s pig multiplier farm. It has its own artificial insemination center (AIC) to provide the gilts with high-quality semen and veterinary supplies and services. The piglets are then distributed to its member-contract growers and to its member-hog raisers who raise hogs in the cooperative’s communal farm. SIDC makes its own feeds and supplies other inputs, which are made available to the members at SIDC’s stores and AIC.

In terms of forward integration, the cooperative serves as a sure market for the produce of its member contract growers and hog raisers. Once the hogs are ready for slaughter, members can bring them to SIDC’s hog selling pen for sale to the cooperative at a competitive buying price and also to external buyers. The live hogs

Fig. 5. SIDC’s feed-to-food hog industry chain, 2012

Source: Adopted from Quilloy (2015a) with some modifications

purchased by SIDC are sold either as fresh meat or processed meat. SIDC manages a government-owned slaughterhouse to slaughter the hogs and used to operate a meat processing plant (until 2013), where the meat are consolidated and prepared for processing or for direct sale to consumers and institutional buyers. From the meat processing plant, the fresh meat and processed meat are distributed to different SIDC store outlets—which include Farmer Vic Meat Store (which operated only until 2010), SIDC’s CoopMart and CoopSupermart, gasoline stations, and members’ retail stores—for sale to institutional and retail buyers and consumers.

From provision of capital and supply of inputs to meat processing and selling, SIDC has acted as a vertically integrated enterprise that makes it much easier and viable for its members to participate in and access income opportunities at all stages of the chain. The opportunity to add value to the commodity and to access more profitable markets through the cooperative enables the small hog raisers to receive higher profit as individual and additional returns in the form of patronage refund and services as an organized group.

Low cost of information is also achieved within SIDC since its suppliers and customers are both members of the cooperative. Working in the same value chain configuration allows for more efficient flow of adequate information on marketing and prices, unlike in IOFs where suppliers and customers are often outside the owner-management circle.

On the consumer side, the vertical integration of SIDC reduces transaction costs as middlemen (e.g. traders, processors and wholesalers) are eliminated and where expenses involved in transacting with other business firms and forgone opportunities that arise due to bargaining and disagreements are avoided. Lastly, controlling the value chain under one cooperative enterprise also ensures the quality of meat produced for the consumers and the reasonable pricing of the products for its member-consumers and other households in their communities.

Linking Farmers to Export Market: The Case of Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC)

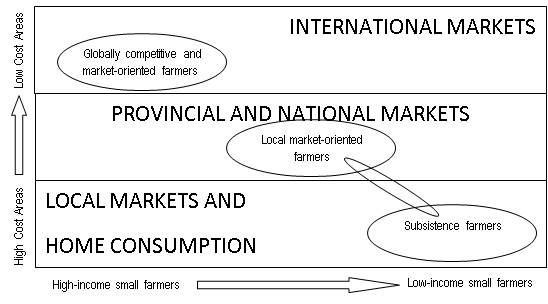

Many individual small farmers in the Philippines cannot access lucrative and competitive markets at provincial, national or export levels. As defined by Torero (2011) in his framework of farmers and markets interrelation (Fig. 6), subsistence farmers at local market level are the ones with the lowest farm income because of the high costs involved in production and marketing. Conversely, globally competitive and market-oriented farmers generate the highest farm income as they operate at the lowest cost and achieve sufficient scale for efficiency in production and marketing.

Due to their limited resources and capacity, small farmers generally lack access to physical infrastructure (e.g., roads, postharvest facilities, ICT, etc.) and institutions, which are critical elements for reducing transaction costs and marketing risks in the exchange process between producers and consumers. particularly in terms of producing adequate volume of commodity that meet the food safety and quality standards, As a result, “market efficiency gap” or the “difference between what markets are actually achieving under current conditions and what they could achieve if markets where working correctly” is often experienced by small farmers (Torero 2011). They struggle in participating in dynamic markets and their opportunities to maximize their returns are inhibited.

Fig. 6. Interrelationship between farmers and markets

Source: Torero (2011)

Here is where cooperatives could play a crucial role as a market institution. In marketing, farmers’ cooperatives can potentially bridge market efficiency gaps by linking smallholders to markets through collective action. Take the case of small cacao farmers in one of the top cacao producing regions in the Philippines, Davao City, and how a micro cooperative named Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC) has helped integrate its farmer-members into to the global supply chain of cacao beans.

SIFMPC is organized in 2009 by a group of small cacao farmers based in Calinan District, Davao City, Philippines. It is mainly engaged in the production and marketing of cacao beans, wherein it serves as a supplier to different buyers in the domestic and international markets. With its operations, the cooperative envisions to build “a community where stakeholder-farmers have attained sustainable development in terms of socioeconomic and environmental protection” (SIFMPC 2014). In 2012, there were already 100 cacao farmers who have joined the cooperative.

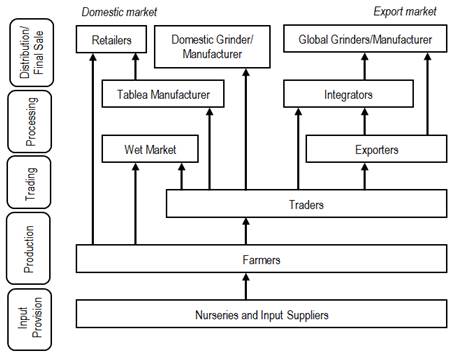

In a supply chain without cooperative’s participation, individual small farmers normally do not have direct access to integrators, exporters and international grinders and chocolate manufacturers. The flow of cacao beans would be from farmers to the traders, who then sell the cacao wet beans either to commercial tablea[2] producers or to integrators for processing and/or for export to global grinders and chocolate manufacturers (Fig. 7a).

Fig. 7a. Supply chain of cacao beans without cooperative, Philippines

Source: DA (2014)

As of 2014, there are 12 exporters cum grinders/processors based in Davao Region. These exporters buy beans in large volume and sell them primarily to global grinders and manufacturers or sometimes, to integrators if they find it more profitable than exporting beans directly themselves. Exporters are generally hesitant in dealing with individual small farmers due to high transaction costs it entails. Some traders sell the beans domestically to local grinders and artisanal and domestic chocolate manufacturers, whose products are then distributed for sale to institutional buyers, specialty stores and other domestic market outlets. Tablea producers and some farmers who make their own tableas directly sell to the retailers for sale to end consumers.

Small farmers’ participation in the supply chain typically covers only cacao production and then ends at local trader’s level, wherein traders buy their produce through spot market sales at a price they dictate. The farmers are price-takers, who often do not have bargaining power over the trader who finances their production expenses. Some traders even take advantage of the lack of access to price information of farmers and tend to manipulate prices when transacting in remote areas.

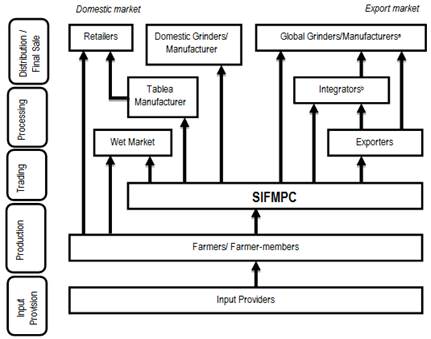

The limited access of small farmers to dynamic markets is primarily due to low volume of harvests and lack of form utility added to the cacao beans which do not meet the buyers’ requirements. However, with the presence of cooperative in the chain, small farmers can have access to more lucrative markets like the export market. As shown in Fig. 7b, farmers who are members SIFMPC can directly sell their cacao beans to integrators, trader-exporters, and global grinders and international chocolate manufacturers.

Fig. 7b. Supply chain of cacao beans with cooperative, Davao City, Philippines

aAskinosie Chocolate

bPuentespina Orchids and Tropical Plants; Kennemer Foods International, Inc.

Source: Adopted from Quilloy (2015b) with some modifications

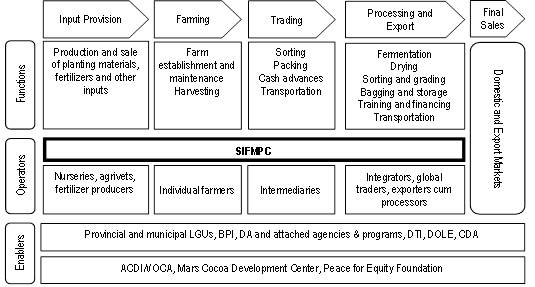

Through collective action, SIFMPC is able to participate and capture economic opportunities in the global value chain of cacao beans. It mainly acts as an assembler or consolidator of the produce of its farmer-members, wherein it purchases a specified volume of quality cacao beans from its members and other cacao farmers in the village whom they pay on a cash basis. The cacao beans purchased by SIFMPC are either sold as wet beans or processed into fermented and dried beans to meet the demands of the buyers and to command higher prices from its buyers. The beans are sold to the global traders or exporters, integrators and global grinders and chocolate manufacturers as well as to domestic grinders and local cocoa product manufacturers (Fig. 7b).

Fig. 8 further illustrates the involvement of the cooperative in the whole chain of marketing processes for cacao beans. SIFMPC gives farmers access to processing facilities, capacity building trainings, financial service and other resources needed to enable them to do value addition on their commodities and, consequently, to enhance the quality of cacao beans and farmers’ productivity. The networks and linkages of SIFMPC with government and non-government organizations and donor agencies have supported the development of facilities and infrastructure of the cooperative as well as the human capabilities of its members. The values formation and cooperative education seminars conducted by SIFMPC taught its farmer-members the practice of “honest selling” — members delivering only the “good beans” to the cooperative based on agreed standards.

In terms of value addition, SIFMPC performs processing and sorting and grading of cacao beans to ensure uniform standards and quality and premium price for its beans. All the good beans are consolidated and prepared for fermentation and drying, which are done by well-trained farmer-members and laborers of the cooperative using its own facilities. After drying, the beans are sorted and graded based on its moisture content using shedder and tool kit equipment. Only Class A dried beans are sold for export. The beans are carefully packed by class and are weighed using a well-calibrated weighing scale. The packed beans are stored until they are scheduled for quality inspection by the buyer. After passing the quality requirements of the buyer, the required volume of dried beans are hauled and transported to cooperative’s buying station for buyer’s pick-up or for delivery to the port of cargo shipment, if it is intended for export. The proper standard processing and marketing procedures of SIFMPC maintain the high quality standards of its beans, which enables it to compete successfully with other bean suppliers in Davao region.

SIFMPC’s collective action also results in economies of scale in production and marketing, which allows for expansion of the cooperative operations at a relatively lower cost. Likewise, the size of operations of SIFMPC allows for more bargaining power in terms of procuring inputs, availing services and negotiating prices for its inputs and outputs, thereby fostering productivity and efficiency in its marketing. Its collective strategy has also been effective in fostering an efficient flow and sharing of information, particularly on prices of beans, among the cooperative members and other farmers in the village. Like in the case of SIDC, low cost of information has been made possible in the case of SIFMPC by the fact that the bean suppliers (who are the cooperative members) and the buyer (which is the Cooperative) are all within the same value chain configuration.

Fig. 8. Value Chain Map for SIFMPC Cacao Beans, 2013

Source: Quilloy (2015b)

CONCLUSIONS

The case of SIDC and SIFMPC exemplifies the significant role and contribution of cooperatives in improving agricultural marketing efficiency, particularly of small-scale farmers in the Philippines. Through collective action, these two cooperatives have served as successful instrument for empowering small farmers in terms of improving their farm productivity and economic opportunities and enhancing their participation in the value chains of their commodities and their access to more lucrative and dynamic markets locally and abroad. Particularly, the cooperative marketing approach has shown positive impacts on the efficiency of the marketing system for hogs and cacao beans as cooperatives enable the achievement of vertical integration, economies of scale in production and marketing, bargaining power in the markets, and value addition for their products.

The findings of this study also reveal that regardless of the size of operations, cooperatives can perform efficiently in a marketing system and open better income opportunities to its farmer-members. SIDC and SIFMPC have both maintained a good market position and massive participation in the supply chain of hogs and cacao beans, respectively, thereby allowing them to reap more economic gains from its operations. Their high competitiveness with other existing industries and manufacturers, which are offshoots of their high quality production, has brought them to a higher level in the value chain.

SIDC and SIFMPC are just two of the many cooperatives in the Philippines that effectively empower small farmers through promotion of marketing efficiency. Their success stories provide a cooperative enterprise model that is worthy for replication in the country and in other parts of the world. However, adequate resources and investment capacities to support their operations must be ensured in order for the cooperatives, especially the micro cooperatives, to perform productively, competitively and sustainably. The success of the two case cooperatives is seen in the experiences of many micro and small cooperatives which are often saddled by limited resources and are unable to undertake efficient business operations.

REFERENCES

-

Araullo, D.B. 2006. Agricultural Cooperatives in the Philippines: Innovations and Opportunities in the 21st Century. Paper presented during the 2006 FFTC-NACF International Seminar on Agricultural Cooperatives in Asia: Innovations and Opportunities in the 21st Century, 11-15 September, Seoul, Korea.

-

Berlin, M. 2001. "We control the vertical": three theories of the firm. Federal Reserve Bank of Philadelphia Business Review (Third Quarter): 13 - 22.

-

Bromley, D.B. 1990. Academic Contributions to Psychological Counseling: A Philosophy of Science for the Study of Individual Cases. Counseling Psychology Quarterly, 3(3), 299-307.

-

Castillo, E.T., J.P. Baskiñas, W.D. Medina, A.L. Albano, A.B. Peria, and A.C. Manila. 2003. Cooperativism in Agriculture: The Case of Top Four Cooperatives in Region IV, Philippines. Philippine APEC Study Center Network, Makati City, Philippines. 23 January 2008. Available online: http://pascn.pids.gov.ph/files/Discussions%20Papers/2003/2003-01.pdf

-

CDA. 2014. Cooperative Development Authority Selected Statistics. Available online: http://cda.gov.ph/resources/updates/statistics

-

DA. 2014. “Value Chain Analysis and Competitiveness Strategy: Cocoa Bean - Mindanao” by Department of Agriculture, 2014, Philippine Rural Development Project (PRDP) I-PLAN Component: Mindanao Cluster. Available online: http://www.drive.daprdp.net/pdf/vca/mindanao/Cacao%20Beans%20VCA%20%28MI...

-

Esplana E.R. and L.N.B. Abao. 2009. Strategic Agribusiness Development Plan Findings of Livestock Situation Report. Paper presented at Davao Region Stakeholders Consultative Workshop Apo View Hotel, 10 June, Davao City, Philippines.

-

FAO. 2002. Some Issues Associated with the Livestock Industries of the Asia-Pacific Region. RAP publication no. 2002/06. FAO Regional Office for Asia and the Pacific - Animal Production and Health Commission for Asia and the Pacific, Bangkok, Thailand.

-

Geron, R.B. 2014. Role of Cooperatives in Agricultural Supply Chains. Paper presented during the Roundtable Discussion on Food Security: Marketing and Postharvest, 1 October 2014, Quezon City, Philippines.

-

ICA.2013. Blueprint for a Co-operative Decade. Brussels, January. Available online:http://www.uk.coop/sites/storage/public/downloads/ica_blueprint_-_final_...

-

Manalili, N.M. 2003. Linking Farmers to Markets through Cooperatives Vegetables Supply Chain Redesign Options for Kapatagan, Mindanao, Philippines. Paper presented at the Australian Agricultural and Resource Economics Society Conference, 11-14 February, Perth, WA.

-

Pabuayon, Isabelita M., Salvador P. Catelo, Agnes C. Rola and Tirso B. Paris Jr. 2013. Agricultural Policy: Perspectives from the Philippines and Other Developing Countries. University of the Philippines Press. Diliman, Quezon City.

-

Pabuayon, I.M., A.C. Cuevas, K.P. Quilloy, JA. Delos Reyes, and F.Q. Arrienda Jr. 2014. Marketing, Trade and Distribution Issues as They Affect Food Security: Framework and Empirical Evidence. Paper presented during the Roundtable Discussion on Food Security: Marketing and Postharvest 1 October 2014, Quezon City, Philippines.

-

Perez, R. 2014. Value Chain Improvement of Swine in Region 02. Paper presented during the 2014 International Conference on Public Administration and Governance Reforms and Innovations, 9-11 October 2014, Davao City, Philippines

-

Philippine Cooperative Code of 2008 (RA 9520) (Philippines).

-

Quilloy, K.P. 2015a. “Performance of the Sorosoro Ibaba Development Cooperative and Subasta Integrated Farmers Multipurpose Cooperative, Philippines.” Journal of Economics, Management & Agricultural Development 1(1): 72-84.

-

--- 2015b. “Empowering Small Farmers through Cooperative: The Success Story of Subasta Integrated Farmers Multi-Purpose Cooperative.” International Review of Management and Business Research 4(1): 361-375.

-

Torero, M. 2011. A Framework for Linking Small Farmers to Markets. Paper presented during the Conference on New Directions for Smallholder Agriculture, 24-25 January, IFAD HQ, Rome, Italy.

-

SIDC. 2013. 2012 Annual Report of Sorosoro Ibaba Development Cooperative. Batangas City, Philippines.

-

SIFMPC. 2012. 2012 Annual Report of SIFMPC. Davao City, Philippines.

|

Submitted as a resource paper for the FFTC-NACF International Seminar on Improving Food Marketing Efficiency—the Role of Agricultural Cooperatives, Sept. 14-18, NACF, Seoul, Korea |

[1] Country paper presented at the International Seminar on Improving Food Marketing Efficiency: The Role of Agricultural Cooperatives, held on September 14 – 18, 2015 at the National Agricultural Cooperative Federation, Seoul, South Korea.

[2] Tablea is a traditional Filipino cocoa (dark chocolate) drink molded from pure (raw and untreated) chocolate liquor (a thick, liquid chocolate paste ground from roasted fermented cacao beans).

Improving Marketing Efficiency through Agricultural Cooperatives: Successful Cases in the Philippines

ABSTRACT

This paper aims to demonstrate the important role and contribution of agricultural cooperatives in improving marketing efficiency for selected agricultural commodities in the Philippines. It presents evidences from the cases of Sorosoro Ibaba Development Cooperative (SIDC) and Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC), two agri-based cooperatives involved in production and marketing of hogs and cacao beans, respectively. The study reveals how these cooperatives, regardless of the size of their operations, successfully empower small and weak farmers by increasing their participation in the agricultural value chain and enhancing their access to more lucrative and dynamic markets through collective action. Their cooperative approach in marketing has shown positive impacts on the efficiency of the marketing system for hogs and cacao beans as they enable their farmer-members to attain vertical integration, economies of scale in production and marketing, bargaining power in the markets, and value addition for their products. As SIDC and SIFMPC have both maintained a good market position and massive participation in their respective commodity chains, farmers are able to reap more economic gains than what they would otherwise earn as individual producers. Overall, this study validates that a cooperative can be a key driver for improving marketing efficiency and for enabling small farmers to take advantage of the economic opportunities associated with it. The success stories of SIDC and SIFMPC provide a cooperative enterprise model that is worthy for replication in the country and in other parts of the world. However, adequate resources and investment capacities to support their operations must be ensured in order for the cooperatives, especially the micro cooperatives, to perform productively, competitively and sustainably. The success of the two case cooperatives is seen in the experiences of many micro and small cooperatives which are often saddled by limited resources and are unable to undertake efficient business operations.

Keywords: agricultural cooperatives, marketing efficiency, market intermediaries, supply chain, vertical integration

INTRODUCTION

Efficiency is one of the most important goals in agricultural and food marketing. It directly affects food security, particularly the economic and physical access to food of households. Efficient and effective flow of food from production point (farmers) to consumption point (consumers) can facilitate the availability, accessibility and affordability of adequate food to consumers (Pabuayon et al. 2014). Every market actor (e.g. farmer, market intermediaries and consumers) in an agricultural marketing system plays a key role in performing marketing functions and providing marketing services that contribute to achieving efficient marketing process at different sub-markets (e.g., farm, assembly or wholesale, and retail market). The marketing services such as transport, processing, storage, grading, packaging, wholesaling and retailing are often provided by market intermediaries like traders, assemblers, processors, wholesalers, truckers and shippers, marketing and bargaining cooperatives, and retailers. These services normally entail costs, risks, and payments for the managerial services and risk-taking done by the market intermediary, which often become a source of market inefficiencies. The inefficiencies even become more likely as more market intermediaries are involved in performing the marketing functions.

Marketing efficiency can benefit all the key actors in a market chain. Technically, an efficient marketing system is achieved when the resulting marketing costs (including losses) are minimized and the profits or returns of market intermediaries are reasonable – that is, the marketing margin is just enough to cover the costs of marketing services and there are no unreasonable profits generated by the market intermediaries (Pabuayon et al. 2013). In this case, the marketing margin should not be lower than the marketing costs and to what the market actors would otherwise get from the alternative use of their capital and labor. Otherwise, there will be no economic incentives for them to provide the marketing services and instead, might just shift to other economic activities. Some of the apparent indicators of an efficient marketing system are the higher prices received by farmers, the affordable food products or lower prices paid by consumers, and the profitable business operations and more investments for market intermediaries.

In the Philippines, the marketing system of agricultural commodities faces several issues and challenges that indicate inefficiencies, which are becoming even more challenging as the economy approaches the ASEAN economic integration this 2015. Some of the common issues are: (i) the low prices received by farmers for their produce; (ii) the multiple layers of market intermediaries in agricultural supply chains; and (iii) the limited access to profitable markets (e.g., institutional and export markets). Of all the market actors in the agricultural marketing chain, the small farmers are often the most affected by these problems.

About 91% of more than 5 million farmers in the country are small farmers, who usually belong to the marginalized rural sector and are vulnerable to the rapid changes in the market environment and marketing conditions. Because most of them experience poor economies of scale and bargaining power, limited capacity and resources, and lack of access to market information, small farmers are often exploited by dominant groups and constrained from having significant participation and good market position in the supply and value chains of agricultural products. This is not to mention other socio-economic, cultural and political factors that also affect farmers’ marketing efficiency. Their weakness as individual small-scale farmers prevents them from expanding their operations, accessing markets beyond their localities, and generating better and fairer income for their families.

As early as 1970s, organization of small farmers into self-help groups like farmers’ associations and cooperatives has been identified as a key strategy for improving the production and marketing performance of small farmers in the Philippines. Over the years, the potential of cooperatives as a viable and sustainable form of enterprise has been increasingly recognized worldwide. In the ASEAN Economic Community (AEC) Blueprint crafted in 2008, agricultural cooperatives have been particularly identified as a means of enhancing market access for agricultural products and empowering farmers. The blueprint thus calls for the promotion of agricultural cooperatives in the ASEAN region and for strengthening strategic alliance and business linkages among these cooperatives. In 2012, the International Cooperative Alliance (ICA) also developed its Blueprint strategy for cooperatives – the “2020 Vision”, which envisions cooperatives as builders of sustainability in the 2020 and to be the acknowledged leader in economic, social and environmental sustainability, the model preferred by people as well as the fastest growing form of enterprise. The significant role of cooperatives in enhancing livelihoods and productivity of smallholder family farmers has also been reemphasized during the International Year of Family Farming in 2014.

Despite the increasing advancement of the global agenda for promoting cooperatives as vehicle for development, the role and contribution of cooperatives in agricultural marketing development are often understated. One of the reasons for this is the dearth in empirical evidences showcasing the success and potentials of agricultural cooperatives in contributing to marketing efficiency.

This paper aims to demonstrate the success of selected Philippine agri-based cooperatives in improving marketing efficiency and particularly, in mainstreaming small farmers in an efficient marketing system. It presents evidences from the case of two of the country’s successful cooperatives, namely, Sorosoro Ibaba Development Cooperative (SIDC) and Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC).

METHODOLOGY

This study conducted a rapid analysis of two selected agri-based cooperatives in the Philippines using the case study method. Case study method is “a systematic inquiry into an event or a set of related events to describe or explain the phenomenon of interest” (Bromley, 1990). It involves either the use of focused stories based on real-life situations or carefully crafted hypothetical or disguised versions of events rooted in actual experiences to illustrate a particular set of learning objectives. For this study, focused stories of SIDC and SIFMPC were used. These two cooperatives were purposely selected to represent both the large and the micro cooperatives in the country production and/or marketing of agricultural commodities as their main business activity. SIDC operates at a large scale while SIFMPC has small-scale operations.

Both secondary and primary data were used in this study. The secondary data mostly came from existing literature on agricultural supply and value chains and cooperatives and from the annual financial reports of the case cooperatives. Primary data were gathered through key informant interviews with the cooperative leaders and managers and personal interviews with member representatives of the cooperatives.

The analysis of the case cooperatives is highly descriptive and qualitative. Due to insufficient data, it does not involve quantitative investigation of its profitability margins and marketing efficiency, which is the major limitation of this study. At present, there are still limited research studies that made in-depth and quantifiable analysis of the marketing efficiency for agricultural commodities produced and sold through cooperative marketing. Thus, conduct of further studies that aim to measure financial and economic efficiencies of agricultural cooperatives is suggested. A more comprehensive supply and value chain analysis for agricultural commodities handled by cooperatives is also good to explore.

RESULTS AND DISCUSSION

Overview of the Philippine Cooperative Sector

In the Philippines, cooperative may have at least one of the three core functions of cooperatives: (i) marketing – extending control of members’ products through processing, distribution and sale; (ii) purchasing – providing affordable supplies and goods or (iii) service – providing needed services. With the multidimensionality of their functions that serve the needs of the cooperative members and their communities, cooperatives have become an increasingly important sector in the Philippine economy.

From merely 1,142 cooperatives in 1985, the total number of cooperatives in the country already reached 24,652 in 2014 (CDA 2014). The majority (73%) of these cooperatives are categorized as multipurpose cooperatives and credit cooperatives (Fig. 1). At least 57% of the cooperatives are micro cooperatives, that is – having less than US$66,667 (or PhP3.0 million) total worth of assets (Fig. 2). The total cooperative membership increased to almost 12.7 million in 2013, which comprised almost a quarter (23.8%) already of the country’s total population ages 20 years old and above. In the same year, the whole cooperative sector had an estimated total volume of business of US$9.9 billion (PhP437.6 billion), which comprised about 4% of the country’s gross domestic product (GDP). As of 2014, Philippine cooperatives generated direct employment for at least 290,662 individuals in the country.

Fig. 1. Types of cooperative by function/purpose, Philippines, 2014 (n=24,652)

Source: CDA (2014)

For agricultural cooperatives alone, it is unfortunate that the Philippines’ cooperative sector does not have yet a detailed and disaggregated statistical database available. The categorization of cooperatives according to purpose, membership, and to kind of service provided, as specified in the Philippine Cooperative Code of 2008 (Republic Act 9520), does not include a specific type for “agricultural cooperative.” Cooperatives that are engaged in agricultural activities may fall under different categories like producers cooperative, agrarian reform cooperative, marketing cooperative, credit cooperative, multipurpose cooperative, and so on, depending on their key business activities and on their registration with the Cooperative and Development Authority (CDA). However, it can be conservatively estimated that there are more than 2,000 cooperatives or at least 8% of all cooperatives in the Philippines that are into agriculture- and fisheries-related activities based on the total number of agrarian reform cooperatives, producers cooperatives, fishermen cooperatives, and dairy cooperatives nationwide (CDA 2014). This estimate is expected to be much higher if the number of agri-based multipurpose cooperatives can also be identified.

Fig. 2. Categories of cooperative by total value of assets, Philippines, 2013

Source: CDA (2014)

In spite of the lack of exhaustive statistical records on the presence of agri-based cooperatives in the country, there have been attempts to study the performance, potentials and contributions of the cooperatives in agricultural and rural development. Several research works and case studies such as those conducted by Castillo (2003), Manalili (2003), Araullo (2006), Geron (2014) and Quilloy (2015a) provided evidences of the important role of cooperatives in agriculture. These studies focused mainly on demonstrating the involvement of cooperatives in agricultural production and marketing, linking farmers to markets through cooperative, market integration and value chain upgrading through cooperative, and competitiveness and comparative advantage of cooperative as an enterprise.

To add to the body of literature on agri-based cooperatives, the following sections highlight the success of two selected cooperatives in contributing to marketing efficiency within the supply and value chains for agricultural commodities in the country. Particularly, the cases of SIDC and SIFMPC are presented to give light to how a cooperative can help small farmers enhance their participation in an efficient agricultural marketing chain, improve their efficiency through collective action, and most importantly, augment their farm incomes while at the same time providing household consumers with access to affordable goods.

Vertical Integration in Hog Meat Marketing Chain: The Case of Sorosoro Ibaba Development Cooperative (SIDC)

One of the strategies to improve marketing efficiency is to minimize costs incurred in moving a commodity between market players from the production point to the consumption point. It can be rationally postulated that with fewer players involved in the chain, the marketing channel through which the product has to pass will be shorter and thus, will result in less transaction costs. These transaction costs may arise from disagreements in conducting business between market players, unpredictability of the industry’s operating environment, non-standardized products, and uncertainties in product quality (FAO 2002). An effective strategy to avoid transaction costs is to do vertical integration in commodity chains.

Vertical integration occurs when the ownership or control of the complementary business activities at different stages of production and marketing processes is put under a common organization or single management of a firm to reduce the cost and increase the profitability of production of the product or service (Berlin 2001). This would mean expansion of the activities of a firm until it controls all the levels of the supply chain. The market integration may involve a firm integrating backward into the input supply system, forward into the distribution system, or both.

In the Philippines, vertical integration has become an important feature of the livestock industries. Given its capital-intensive nature, integration of marketing functions becomes a necessary goal for hog businesses in order to gain better profit as it can ensure reliability of supply, provide economies of scale, and facilitate product quality management and standardization in business operations. However, in the occurrence of vertical integration, small family farms or backyard hog raisers often face threats from the large farms and big private business enterprises that usually have the huge capacity to integrate their operations and dominate the chain. The risks of smallholders being crowded out and having limited product value share are not far from happening if big corporations have started to control the whole marketing system of an agricultural commodity.

A general hog industry value chain in the Philippines (as depicted in Cagayan Valley, the country’s top swine producing province) can be divided into the following segments (Fig. 3):

Fig. 3. Hog value chain map, Cagayan Valley, Philippines, 2013

Source: Adopted from Perez (2014) with some modifications

The participation of a backyard hog raiser in the hog value chain usually ends as early as on the production stage. Normally, backyard raisers maintain a piggery, provide the needed labor, and then sell live hogs to canvasser, weighing scale center and butchers, wholesalers and meat dealers, processors, or auction markets (Fig. 4). Many small farmers are also into contract growing for commercial farms and corporations. With their small scale production, they often cannot buy inputs in bulk on cash basis, thereby augmenting their cost of production. Moreover, with their limited capabilities to do value-adding activities on the product and consequently, with their limited participation in the value chain, returns from sales are also expected to be limited.

On the other hand, a large commercial hog enterprise plays many roles in a value chain. Its operations are often integrated from feed milling and breeding up to processing and marketing and distribution, thereby enabling the firm, particularly its investors or stockholders, to generate higher profits from its business activities. Unlike small scale hog raisers, large corporations can afford to purchase inputs in bulk on cash basis and operate with economies of scale and bargaining power, thus enabling them to lower production costs and to generate higher level of profitability. Likewise, given their access to facilities, infrastructure, and human resources, they are able to perform value addition on their hogs, which allow them to sell their products in different forms (e.g. fresh meat, processed meat, etc.) with a price premium. As

Fig. 4. Marketing channel of live animal, meat and meat products

Source: Esplana and Abao (2009)

these firms dominate the chain, the challenge for backyard hog raisers to have greater participation in more profitable levels of the chain and to compete or cooperate with other market players becomes greater.

On the other hand, a large commercial hog enterprise plays many roles in a value chain. Its operations are often integrated from feed milling and breeding up to processing and marketing and distribution, thereby enabling the firm, particularly its investors or stockholders, to generate higher profits from its business activities. Unlike small scale hog raisers, large corporations can afford to purchase inputs in bulk on cash basis and operate with economies of scale and bargaining power, thus enabling them to lower production costs and to generate higher level of profitability. Likewise, given their access to facilities, infrastructure, and human resources, they are able to perform value addition on their hogs, which allow them to sell their products in different forms (e.g. fresh meat, processed meat, etc.) with a price premium As these firms dominate the chain, the challenge for backyard hog raisers to have greater participation in more profitable levels of the chain and to compete or cooperate with other market players becomes greater.

It is in this light that agricultural cooperatives have been recognized as the more inclusive or pro-smallholder alternative to large investor-owned firms (IOFs) involved in livestock industries. Unlike IOFs, cooperatives are owned, controlled and financed by its farmer-members. The cooperative approach towards production and marketing enables small farmers to have stronger capacity to vertically integrate its business activities instead of limiting their participation in the value chain at production level only. As member-owners of the cooperative, farmers also equitably receive returns from the cooperative’s net surplus based on their use or patronage of products and services of the cooperative, rather than on their capital share or investment in the cooperative.

Sorosoro Ibaba Development Cooperative or SIDC is the biggest and most successful agricultural cooperative in the Philippines, which demonstrates vertical integration in its hog business activities. SIDC is based in Batangas City, Philippines and has been operating since 1978. As of 2012, the cooperative has 7,882 regular members and 9,599 associate members from more than 100 villages (barangays) in Batangas and from other provinces in Region IV-A (CALABARZON) and nearby regions. Its key business activities include feed milling; hog raising, contract growing, marketing and related hog products and services; credit services; merchandizing of other agricultural and non-agricultural products and providing other services to members.

With the main goal of developing and offering “competitive quality products and services, adopting technologically advanced systems to build prosperous lives and strengthen the spiritual and social development of stakeholders” (SIDC 2013), SIDC continues to improve its businesses through vertical integration. From operating a goods store in 1978, the cooperative has significantly expanded its business activities in a manner that controls a series of stages of the hog supply chain – from feed milling and input supplying to contract growing and retail marketing.

Under vertical integration, SIDC performs the interrelated business activities of feeds production, hog breeding, hog fattening, slaughtering, meat processing and selling, among others (Fig. 5). These activities are complemented with enabling mechanisms that the cooperative provides such as credit and technical services (e.g., veterinary services, trainings and seminars). The credit program enables its members to start their own hog business livelihood through provision of loans for hog pen construction and for purchase of piglets, feeds and medicines.

At the early stage of the chain, SIDC’s backwardly integrated by breeding its own high-grade piglets from F1 gilts and high-grade boars maintained in the cooperative’s pig multiplier farm. It has its own artificial insemination center (AIC) to provide the gilts with high-quality semen and veterinary supplies and services. The piglets are then distributed to its member-contract growers and to its member-hog raisers who raise hogs in the cooperative’s communal farm. SIDC makes its own feeds and supplies other inputs, which are made available to the members at SIDC’s stores and AIC.

In terms of forward integration, the cooperative serves as a sure market for the produce of its member contract growers and hog raisers. Once the hogs are ready for slaughter, members can bring them to SIDC’s hog selling pen for sale to the cooperative at a competitive buying price and also to external buyers. The live hogs

Fig. 5. SIDC’s feed-to-food hog industry chain, 2012

Source: Adopted from Quilloy (2015a) with some modifications

purchased by SIDC are sold either as fresh meat or processed meat. SIDC manages a government-owned slaughterhouse to slaughter the hogs and used to operate a meat processing plant (until 2013), where the meat are consolidated and prepared for processing or for direct sale to consumers and institutional buyers. From the meat processing plant, the fresh meat and processed meat are distributed to different SIDC store outlets—which include Farmer Vic Meat Store (which operated only until 2010), SIDC’s CoopMart and CoopSupermart, gasoline stations, and members’ retail stores—for sale to institutional and retail buyers and consumers.

From provision of capital and supply of inputs to meat processing and selling, SIDC has acted as a vertically integrated enterprise that makes it much easier and viable for its members to participate in and access income opportunities at all stages of the chain. The opportunity to add value to the commodity and to access more profitable markets through the cooperative enables the small hog raisers to receive higher profit as individual and additional returns in the form of patronage refund and services as an organized group.

Low cost of information is also achieved within SIDC since its suppliers and customers are both members of the cooperative. Working in the same value chain configuration allows for more efficient flow of adequate information on marketing and prices, unlike in IOFs where suppliers and customers are often outside the owner-management circle.

On the consumer side, the vertical integration of SIDC reduces transaction costs as middlemen (e.g. traders, processors and wholesalers) are eliminated and where expenses involved in transacting with other business firms and forgone opportunities that arise due to bargaining and disagreements are avoided. Lastly, controlling the value chain under one cooperative enterprise also ensures the quality of meat produced for the consumers and the reasonable pricing of the products for its member-consumers and other households in their communities.

Linking Farmers to Export Market: The Case of Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC)

Many individual small farmers in the Philippines cannot access lucrative and competitive markets at provincial, national or export levels. As defined by Torero (2011) in his framework of farmers and markets interrelation (Fig. 6), subsistence farmers at local market level are the ones with the lowest farm income because of the high costs involved in production and marketing. Conversely, globally competitive and market-oriented farmers generate the highest farm income as they operate at the lowest cost and achieve sufficient scale for efficiency in production and marketing.

Due to their limited resources and capacity, small farmers generally lack access to physical infrastructure (e.g., roads, postharvest facilities, ICT, etc.) and institutions, which are critical elements for reducing transaction costs and marketing risks in the exchange process between producers and consumers. particularly in terms of producing adequate volume of commodity that meet the food safety and quality standards, As a result, “market efficiency gap” or the “difference between what markets are actually achieving under current conditions and what they could achieve if markets where working correctly” is often experienced by small farmers (Torero 2011). They struggle in participating in dynamic markets and their opportunities to maximize their returns are inhibited.

Fig. 6. Interrelationship between farmers and markets

Source: Torero (2011)

Here is where cooperatives could play a crucial role as a market institution. In marketing, farmers’ cooperatives can potentially bridge market efficiency gaps by linking smallholders to markets through collective action. Take the case of small cacao farmers in one of the top cacao producing regions in the Philippines, Davao City, and how a micro cooperative named Subasta Integrated Farmers Multipurpose Cooperative (SIFMPC) has helped integrate its farmer-members into to the global supply chain of cacao beans.

SIFMPC is organized in 2009 by a group of small cacao farmers based in Calinan District, Davao City, Philippines. It is mainly engaged in the production and marketing of cacao beans, wherein it serves as a supplier to different buyers in the domestic and international markets. With its operations, the cooperative envisions to build “a community where stakeholder-farmers have attained sustainable development in terms of socioeconomic and environmental protection” (SIFMPC 2014). In 2012, there were already 100 cacao farmers who have joined the cooperative.

In a supply chain without cooperative’s participation, individual small farmers normally do not have direct access to integrators, exporters and international grinders and chocolate manufacturers. The flow of cacao beans would be from farmers to the traders, who then sell the cacao wet beans either to commercial tablea[2] producers or to integrators for processing and/or for export to global grinders and chocolate manufacturers (Fig. 7a).

Fig. 7a. Supply chain of cacao beans without cooperative, Philippines

Source: DA (2014)

As of 2014, there are 12 exporters cum grinders/processors based in Davao Region. These exporters buy beans in large volume and sell them primarily to global grinders and manufacturers or sometimes, to integrators if they find it more profitable than exporting beans directly themselves. Exporters are generally hesitant in dealing with individual small farmers due to high transaction costs it entails. Some traders sell the beans domestically to local grinders and artisanal and domestic chocolate manufacturers, whose products are then distributed for sale to institutional buyers, specialty stores and other domestic market outlets. Tablea producers and some farmers who make their own tableas directly sell to the retailers for sale to end consumers.

Small farmers’ participation in the supply chain typically covers only cacao production and then ends at local trader’s level, wherein traders buy their produce through spot market sales at a price they dictate. The farmers are price-takers, who often do not have bargaining power over the trader who finances their production expenses. Some traders even take advantage of the lack of access to price information of farmers and tend to manipulate prices when transacting in remote areas.

The limited access of small farmers to dynamic markets is primarily due to low volume of harvests and lack of form utility added to the cacao beans which do not meet the buyers’ requirements. However, with the presence of cooperative in the chain, small farmers can have access to more lucrative markets like the export market. As shown in Fig. 7b, farmers who are members SIFMPC can directly sell their cacao beans to integrators, trader-exporters, and global grinders and international chocolate manufacturers.

Fig. 7b. Supply chain of cacao beans with cooperative, Davao City, Philippines

aAskinosie Chocolate

bPuentespina Orchids and Tropical Plants; Kennemer Foods International, Inc.

Source: Adopted from Quilloy (2015b) with some modifications

Through collective action, SIFMPC is able to participate and capture economic opportunities in the global value chain of cacao beans. It mainly acts as an assembler or consolidator of the produce of its farmer-members, wherein it purchases a specified volume of quality cacao beans from its members and other cacao farmers in the village whom they pay on a cash basis. The cacao beans purchased by SIFMPC are either sold as wet beans or processed into fermented and dried beans to meet the demands of the buyers and to command higher prices from its buyers. The beans are sold to the global traders or exporters, integrators and global grinders and chocolate manufacturers as well as to domestic grinders and local cocoa product manufacturers (Fig. 7b).

Fig. 8 further illustrates the involvement of the cooperative in the whole chain of marketing processes for cacao beans. SIFMPC gives farmers access to processing facilities, capacity building trainings, financial service and other resources needed to enable them to do value addition on their commodities and, consequently, to enhance the quality of cacao beans and farmers’ productivity. The networks and linkages of SIFMPC with government and non-government organizations and donor agencies have supported the development of facilities and infrastructure of the cooperative as well as the human capabilities of its members. The values formation and cooperative education seminars conducted by SIFMPC taught its farmer-members the practice of “honest selling” — members delivering only the “good beans” to the cooperative based on agreed standards.

In terms of value addition, SIFMPC performs processing and sorting and grading of cacao beans to ensure uniform standards and quality and premium price for its beans. All the good beans are consolidated and prepared for fermentation and drying, which are done by well-trained farmer-members and laborers of the cooperative using its own facilities. After drying, the beans are sorted and graded based on its moisture content using shedder and tool kit equipment. Only Class A dried beans are sold for export. The beans are carefully packed by class and are weighed using a well-calibrated weighing scale. The packed beans are stored until they are scheduled for quality inspection by the buyer. After passing the quality requirements of the buyer, the required volume of dried beans are hauled and transported to cooperative’s buying station for buyer’s pick-up or for delivery to the port of cargo shipment, if it is intended for export. The proper standard processing and marketing procedures of SIFMPC maintain the high quality standards of its beans, which enables it to compete successfully with other bean suppliers in Davao region.

SIFMPC’s collective action also results in economies of scale in production and marketing, which allows for expansion of the cooperative operations at a relatively lower cost. Likewise, the size of operations of SIFMPC allows for more bargaining power in terms of procuring inputs, availing services and negotiating prices for its inputs and outputs, thereby fostering productivity and efficiency in its marketing. Its collective strategy has also been effective in fostering an efficient flow and sharing of information, particularly on prices of beans, among the cooperative members and other farmers in the village. Like in the case of SIDC, low cost of information has been made possible in the case of SIFMPC by the fact that the bean suppliers (who are the cooperative members) and the buyer (which is the Cooperative) are all within the same value chain configuration.

Fig. 8. Value Chain Map for SIFMPC Cacao Beans, 2013

Source: Quilloy (2015b)

CONCLUSIONS

The case of SIDC and SIFMPC exemplifies the significant role and contribution of cooperatives in improving agricultural marketing efficiency, particularly of small-scale farmers in the Philippines. Through collective action, these two cooperatives have served as successful instrument for empowering small farmers in terms of improving their farm productivity and economic opportunities and enhancing their participation in the value chains of their commodities and their access to more lucrative and dynamic markets locally and abroad. Particularly, the cooperative marketing approach has shown positive impacts on the efficiency of the marketing system for hogs and cacao beans as cooperatives enable the achievement of vertical integration, economies of scale in production and marketing, bargaining power in the markets, and value addition for their products.

The findings of this study also reveal that regardless of the size of operations, cooperatives can perform efficiently in a marketing system and open better income opportunities to its farmer-members. SIDC and SIFMPC have both maintained a good market position and massive participation in the supply chain of hogs and cacao beans, respectively, thereby allowing them to reap more economic gains from its operations. Their high competitiveness with other existing industries and manufacturers, which are offshoots of their high quality production, has brought them to a higher level in the value chain.