ABSTRACT

Starting from January 2022, Japanese quail has officially become designated as poultry by the Ministry of Agriculture (MOA) of Taiwan, a year that has been called Taiwan's "First Year of Japanese Quail" by the related industry. Japanese quail eggs are also one of the few exported products in livestock and poultry products of Taiwan, but the past literature has not analyzed the current export situation and market opportunities of Taiwan's Japanese quail egg industry yet. Therefore, the purpose of this study is to explore the current export situation of Taiwan's Japanese quail egg industry, analyze the channel structure of Taiwan's quail egg export market, the strengths, weaknesses, opportunities, and threats of Japanese quail egg export, as well as the suggestions for production, processing, and export.

Keywords: Japanese Quail Egg, Market Opportunity, Market Channel Structure, Import Regulation

INTRODUCTION

In 2021, the overall output value of Taiwan's Japanese quail egg industry accounted for approximately US$18.70 million, with an export performance of 899 metric tons. To legalize its development, the Ministry of Agriculture announced that Japanese quail will be included in the poultry designated by the Livestock Law from January 2022, and the industry also designated this year as the "First Year of Japanese Quail" in Taiwan. The traceability management and food processing of Japanese quail eggs were also strengthened to promote export. However, in recent years, short-term and long-term risks such as COVID-19, Highly Pathogenic Avian Influenza (HPAI), and climate change have imposed an impact on the production and export of Taiwan's quail egg industry. Moreover, previous literature has not analyzed Taiwan's Japanese quail egg industry's current export situation and market opportunities. To this end, the purpose of this study is to explore the current export situation of Taiwan's Japanese quail egg industry, analyze the channel structure of its export market, as well as the strengths, weaknesses, opportunities, and threats of export, and propose suggestions for production, processing, and export in the end.

CURRENT SITUATION OF EXPORTING JAPANESE QUAIL EGGS IN TAIWAN

Current situation of export

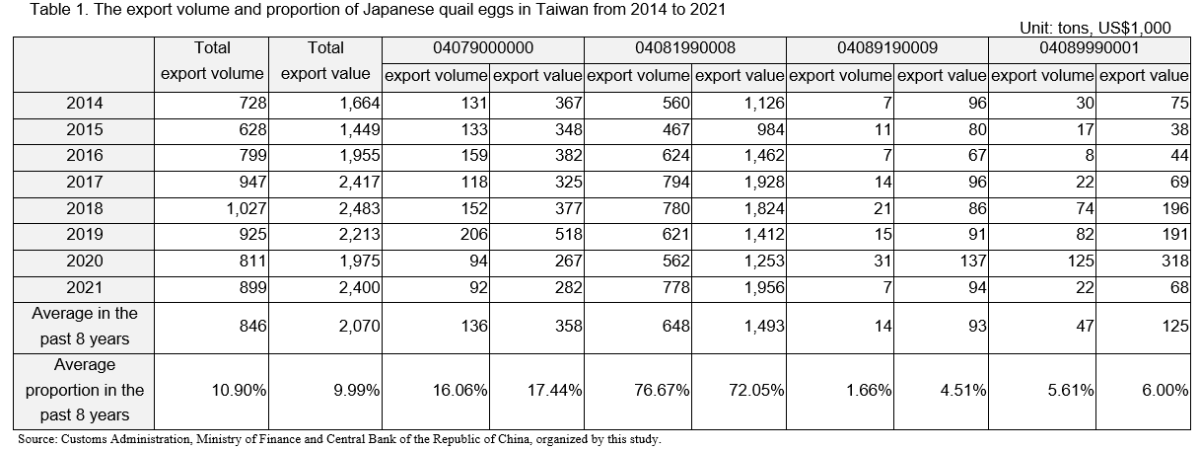

Due to the current low output value and export value of quail eggs in Taiwan compared to other poultry products and the fact that the four H.S. Codes for Japanese quail eggs also include duck eggs and other poultry egg products, there is no independent code to directly clarify and obtain its export data. Therefore, on October 13, 2022, the author of this study requested the Ministry of Agriculture to assist in collecting the export volume of Japanese quail eggs in Taiwan from the Customs Administration, Ministry of Finance in the past eight years (2014-2021). The H.S. Code for export quantity, value, and exporting countries are 04079900000 (Birds' eggs, in shell, preserved or cooked), 0408919009 (Other birds' eggs, not in shell, dried), 04081990008 (Other similar articles), and 040899990001 (Other similar articles), respectively.

In the past eight years, the export volume of quail eggs in Taiwan accounted for 12.50% of its domestic production, and the export value accounted for 11.35% of its domestic output value. In the past eight years, the export volume of quail eggs in Taiwan has been the highest among other similar articles (04081990008), accounting for 76.67% of the total export volume, followed by the categories of Birds' eggs, in shell, preserved or cooked (0407900000), accounting for 16.06%, the Other similar articles (04089990001), accounting for 5.61%, and the other birds' eggs, not in shell, dried (04089190009), accounting for 1.66%, as shown in Table 1.

Situation of major exporting countries

(1) Birds' eggs, in shell, preserved or cooked (040790000): Singapore (89%), Australia (4%), United States (4%).

(2) Other birds' eggs, not in shell, dried (0408919009): United States (56%), Hong Kong (45%), Australia (3%), Singapore (2%).

(3) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

(4) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

Import tariffs of major export markets

(1) Birds' eggs, in shell, preserved or cooked (040790000): MFN tariffs in Singapore and Australia are zero, while in the United States, they are 2.8 cents per dozen.

(2) Other birds' eggs, not in shell, dried (04089190009): The MFN tariff in the United States is 47.6 cents per kilogram, while Hong Kong, Australia, and Singapore have zero tariff.

(3) Other similar articles (04081990008): The MFN tariffs in the United States and Canada are C$1.52/kg (approximately US$1.14/kg) and US$9.7/kg, respectively. The MFN tariff for the United Arab Emirates is 5%, while Australia has zero tariff. In addition, according to the CPTPP tariff reduction schedule, Australia has zero tariff, while Canada adopts a tariff quota with zero in-quota tariff and C$1.52/kg out-of-quota tariff.

(4) Other similar articles (040899990001): The MFN tariffs of the United States and Canada are C$1.52/kg (approximately US$1.14/kg) and US$9.7/kg, respectively. The MFN tariff in the United Arab Emirates is 5%, and Australia has zero tariff.

INDUSTRY INTERVIEWS AND KEY TOPICS

This study uses in-depth interviews and open-ended questions to interview the opinions of three domestic Japanese quail egg export sellers in Taiwan. The interview outline focuses on the methods and product types of obtaining raw materials for Japanese quail egg processing products, the channel structure of various export markets, the internal advantages, and disadvantages of Japanese quail egg industry export, as well as external opportunities and threats and the best export opportunity model strategy and suggestions.

INTERVIEW RESULTS

Method of obtaining raw materials and product types for Japanese quail egg processed products

The main ways for Taiwanese quail egg exporters to obtain raw eggs include self-raising, contract acquisition, and verbal contract acquisition. In terms of the product package for export, iron quail eggs, and braised quail eggs are mainly packaged in a vacuum package at room temperature, while processed Japanese quail eggs are mainly packaged in refrigerated or room temperature soft cans and tin cans.

Analysis of the channel structure of the export market

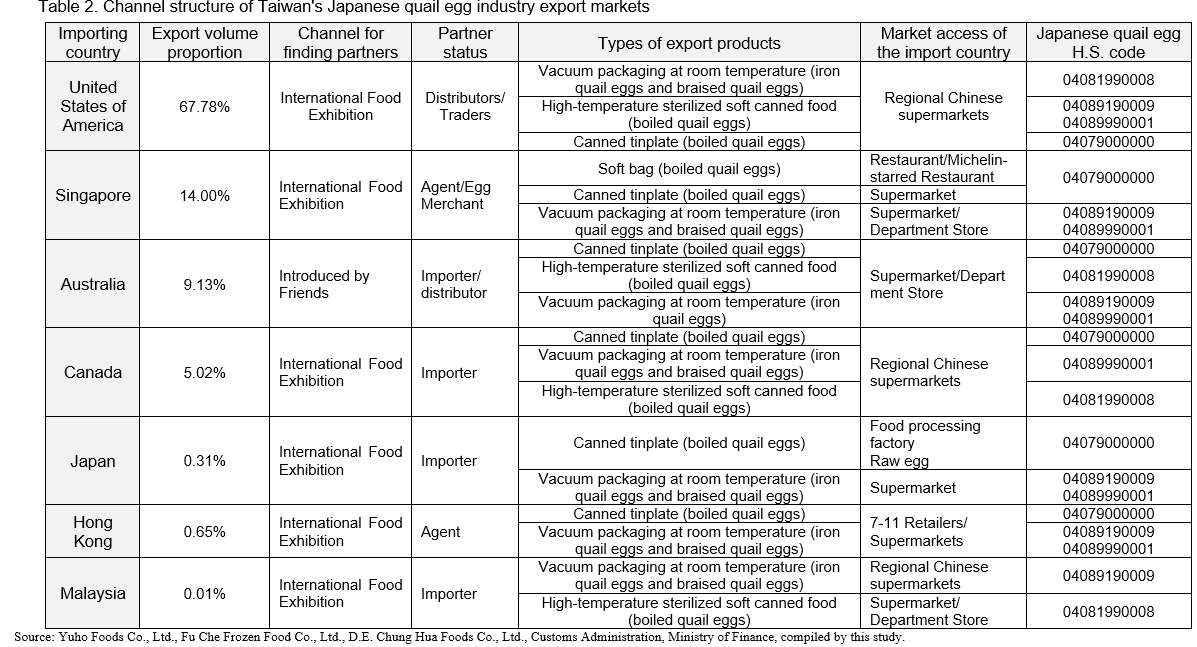

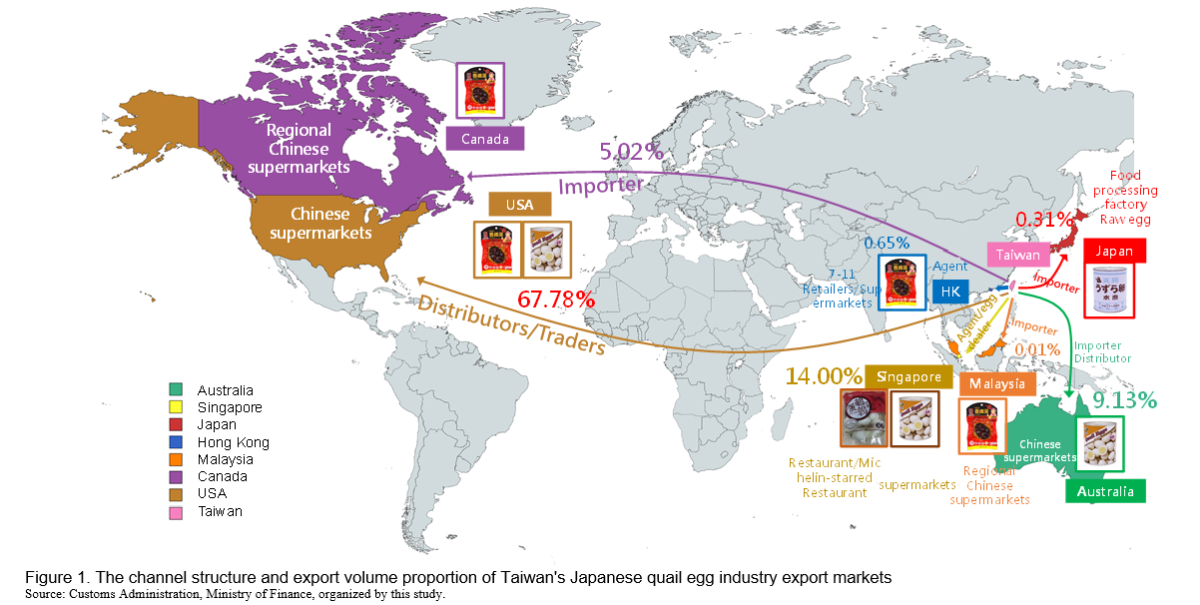

This study investigates the channels for finding partners, the identities of partners, the types of export products, market channels in importing countries, Japanese quail egg export tax numbers, and other relevant information obtained through interviews with export businesses. Combined with the Japanese quail egg export volume, export value, and export country data obtained by the Customs Administration, Ministry of Finance, the study summarizes the information in Table 2. Based on the information disclosed in Table 2, a channel structure diagram of Taiwan's Japanese quail egg industry's export market is drawn, As shown in Figure 1.

SWOT analysis of Japanese quail egg export in Taiwan

Based on the interview results, this study examines the production and sales supply chain of Taiwan's Japanese quail egg industry and integrates the strengths, weaknesses, opportunities, and threats of Japanese quail egg export, as shown in Table 3.

Table 3. SWOT Analysis of Japanese quail egg export in Taiwan

|

Strengths

|

Weaknesses

|

- High safety: Japanese quail eggs have high nutritional value and a good taste. Veterinary drugs are not applied during the production process, and there is no worry about veterinary drug residues.

- High quality: The operator collaborates with feed companies to develop feed formulas that replace animal protein such as meat and bone meal and fish meal with whole plant protein, reducing the risk of Salmonella contamination in feed raw materials, and effectively reducing the egg breaking rate when boiled quail eggs are shelled.

- Excellent processing technology: The processing technology of boiled Japanese quail eggs is excellent and can meet many specific requirements of Japanese food processing factories for boiled Japanese quail eggs, including strict regulations such as a yield rate of over 99% for eggshells, no foreign objects (inserted shells, eggshell debris), and 100 eggs per package (the quantity should be just enough, not one more or less).

|

- Insufficient production and supply: Since the production capacity of most Japanese quail farms has not been maximized and the equipment is not automated, the domestic supply of Japanese quail eggs is insufficient.

- Insufficient legal processing plants and equipment automation: Due to insufficient legal processing plants and equipment automation, the problem of insufficient labor force and increased production capacity cannot be solved.

- Climate change and epidemics have led to a decrease in egg production rates: In recent years, domestic climate change and the outbreak of avian influenza have led to a decrease in egg production rates for laying Japanese quails.

- Production costs have increased: This year, global energy, feed prices, and container prices have risen, leading to an increase in the cost of raising egg-laying Japanese quails.

- Breeding problems lead to a decrease in the quality and yield of Japanese quail eggs: long-term inbreeding problems in domestic laying quails will lead to a reduction in the quality and yield of quail eggs, inability to reduce the size of quail eggs, and a decrease in the disease resistance of breeding quails.

|

|

Opportunities

|

Threats

|

- Government policy support: This year marks the First Year of Japanese Quail, and Japanese quail has become a designated poultry under the Animal Husbandry Law. The government provides subsidies for automation equipment in breeding farms, processing factories, and entrusts research units to assist in the stages of breeding, processing, and export. This will be an opportunity for domestic businesses to transform and enhance their competitiveness.

- Great global market demand: The demand for Japanese quail eggs worldwide is increasing year by year (Vision Market Research, 2022)

- Global epidemic outbreak: Japan and South Korea have ongoing outbreaks of avian influenza, resulting in a demand for quail egg imports.

- Stable demand in the main market: The demand in the US export market is large and stable.

- Cost increase of competitor: Competitor China's production cost increases

|

- The transfer of export orders continues: Insufficient production leads to delays in foreign orders or orders' transfer to Vietnam and Thailand, resulting in a loss of market share.

- Low price competition for imports in the Japanese market: Faced with lower price competition from Vietnam and Thailand in the Japanese market.

- High tariff competitive disadvantage in the Japanese market: Taiwan has a competitive disadvantage of high tariffs in the Japanese market (21.3%).

- Increased risk of export barrier: Due to excessive reliance on importers from the country to provide information on import regulations, export businesses are unable to proactively grasp the import rules of various export markets, which can lead to an increased risk of export barriers.

|

Source: compiled by this study.

CONCLUSIONS

To achieve the goal of expanding export sales, this study adopts the concept of the agricultural industry value chain proposed by Chen (2015) to examine the production and sales supply chain of the entire Japanese quail egg industry and uses SWOT analysis to examine and analyze the strengths, weaknesses, opportunities, and threats of Taiwan's Japanese quail egg export sales, and proposes suggestions for production, processing, and export areas.

Production aspect

(1) Strengthen breeding to avoid inbreeding in order to stabilize the quality of Japanese quail eggs, enhance the resistance of breeding birds to disease and reduce the size of quail eggs in order to meet the demand of the Japanese market;

(2) Aim for nutritional precision to stabilize the quality of Japanese quail eggs and to reduce the specifications (size and weight);

(3) Refine the proportion of feed ingredients to reduce production costs;

(4) Modularize farms and barn automation and equip with smart facilities to reduce production costs and increase capacity.

Processing aspect

(1) Automate processing plant equipment to enhance production efficiency and quality yield;

(2) Upgrade processing technology to extend shelf life and product safety; and

(3) Strengthen the diversified development and application of products (fresh eggs, processed eggs, health products, etc.) and cooperation with other industries.

Export sales aspect

The import regulations and special regulations of each export market should be accurately and quickly grasped, and the individual requirements of importers should be met. If Taiwan’s brand can be established, and if Taiwan can smoothly join the CPTPP or negotiate a bilateral free trade agreement, this will help the existing export industry to expand into a diversified international market, as well as help the new export industry to open the international market.

REFERENCES

Chen, Baoji, 2015, Innovative Thinking in Agriculture - Constructing a New Value Chain Agriculture, Agricultural Politics and Agricultural Situation, Vol. 271.

Vision Market Research, 2022, Global Quail Eggs Market Report - Market Size, Share, Growth, Latest News and Trends, Current Strategies Adopted, Demand and Supply, Industry and Competitors Analysis, Impact of COVID-19 And Forecast 2021-2028.

Study on the Current Export Situation and Market Opportunities of Taiwan's Japanese Quail Egg Industry

ABSTRACT

Starting from January 2022, Japanese quail has officially become designated as poultry by the Ministry of Agriculture (MOA) of Taiwan, a year that has been called Taiwan's "First Year of Japanese Quail" by the related industry. Japanese quail eggs are also one of the few exported products in livestock and poultry products of Taiwan, but the past literature has not analyzed the current export situation and market opportunities of Taiwan's Japanese quail egg industry yet. Therefore, the purpose of this study is to explore the current export situation of Taiwan's Japanese quail egg industry, analyze the channel structure of Taiwan's quail egg export market, the strengths, weaknesses, opportunities, and threats of Japanese quail egg export, as well as the suggestions for production, processing, and export.

Keywords: Japanese Quail Egg, Market Opportunity, Market Channel Structure, Import Regulation

INTRODUCTION

In 2021, the overall output value of Taiwan's Japanese quail egg industry accounted for approximately US$18.70 million, with an export performance of 899 metric tons. To legalize its development, the Ministry of Agriculture announced that Japanese quail will be included in the poultry designated by the Livestock Law from January 2022, and the industry also designated this year as the "First Year of Japanese Quail" in Taiwan. The traceability management and food processing of Japanese quail eggs were also strengthened to promote export. However, in recent years, short-term and long-term risks such as COVID-19, Highly Pathogenic Avian Influenza (HPAI), and climate change have imposed an impact on the production and export of Taiwan's quail egg industry. Moreover, previous literature has not analyzed Taiwan's Japanese quail egg industry's current export situation and market opportunities. To this end, the purpose of this study is to explore the current export situation of Taiwan's Japanese quail egg industry, analyze the channel structure of its export market, as well as the strengths, weaknesses, opportunities, and threats of export, and propose suggestions for production, processing, and export in the end.

CURRENT SITUATION OF EXPORTING JAPANESE QUAIL EGGS IN TAIWAN

Current situation of export

Due to the current low output value and export value of quail eggs in Taiwan compared to other poultry products and the fact that the four H.S. Codes for Japanese quail eggs also include duck eggs and other poultry egg products, there is no independent code to directly clarify and obtain its export data. Therefore, on October 13, 2022, the author of this study requested the Ministry of Agriculture to assist in collecting the export volume of Japanese quail eggs in Taiwan from the Customs Administration, Ministry of Finance in the past eight years (2014-2021). The H.S. Code for export quantity, value, and exporting countries are 04079900000 (Birds' eggs, in shell, preserved or cooked), 0408919009 (Other birds' eggs, not in shell, dried), 04081990008 (Other similar articles), and 040899990001 (Other similar articles), respectively.

In the past eight years, the export volume of quail eggs in Taiwan accounted for 12.50% of its domestic production, and the export value accounted for 11.35% of its domestic output value. In the past eight years, the export volume of quail eggs in Taiwan has been the highest among other similar articles (04081990008), accounting for 76.67% of the total export volume, followed by the categories of Birds' eggs, in shell, preserved or cooked (0407900000), accounting for 16.06%, the Other similar articles (04089990001), accounting for 5.61%, and the other birds' eggs, not in shell, dried (04089190009), accounting for 1.66%, as shown in Table 1.

Situation of major exporting countries

(1) Birds' eggs, in shell, preserved or cooked (040790000): Singapore (89%), Australia (4%), United States (4%).

(2) Other birds' eggs, not in shell, dried (0408919009): United States (56%), Hong Kong (45%), Australia (3%), Singapore (2%).

(3) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

(4) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

Import tariffs of major export markets

(1) Birds' eggs, in shell, preserved or cooked (040790000): MFN tariffs in Singapore and Australia are zero, while in the United States, they are 2.8 cents per dozen.

(2) Other birds' eggs, not in shell, dried (04089190009): The MFN tariff in the United States is 47.6 cents per kilogram, while Hong Kong, Australia, and Singapore have zero tariff.

(3) Other similar articles (04081990008): The MFN tariffs in the United States and Canada are C$1.52/kg (approximately US$1.14/kg) and US$9.7/kg, respectively. The MFN tariff for the United Arab Emirates is 5%, while Australia has zero tariff. In addition, according to the CPTPP tariff reduction schedule, Australia has zero tariff, while Canada adopts a tariff quota with zero in-quota tariff and C$1.52/kg out-of-quota tariff.

(4) Other similar articles (040899990001): The MFN tariffs of the United States and Canada are C$1.52/kg (approximately US$1.14/kg) and US$9.7/kg, respectively. The MFN tariff in the United Arab Emirates is 5%, and Australia has zero tariff.

INDUSTRY INTERVIEWS AND KEY TOPICS

This study uses in-depth interviews and open-ended questions to interview the opinions of three domestic Japanese quail egg export sellers in Taiwan. The interview outline focuses on the methods and product types of obtaining raw materials for Japanese quail egg processing products, the channel structure of various export markets, the internal advantages, and disadvantages of Japanese quail egg industry export, as well as external opportunities and threats and the best export opportunity model strategy and suggestions.

INTERVIEW RESULTS

Method of obtaining raw materials and product types for Japanese quail egg processed products

The main ways for Taiwanese quail egg exporters to obtain raw eggs include self-raising, contract acquisition, and verbal contract acquisition. In terms of the product package for export, iron quail eggs, and braised quail eggs are mainly packaged in a vacuum package at room temperature, while processed Japanese quail eggs are mainly packaged in refrigerated or room temperature soft cans and tin cans.

Analysis of the channel structure of the export market

This study investigates the channels for finding partners, the identities of partners, the types of export products, market channels in importing countries, Japanese quail egg export tax numbers, and other relevant information obtained through interviews with export businesses. Combined with the Japanese quail egg export volume, export value, and export country data obtained by the Customs Administration, Ministry of Finance, the study summarizes the information in Table 2. Based on the information disclosed in Table 2, a channel structure diagram of Taiwan's Japanese quail egg industry's export market is drawn, As shown in Figure 1.

SWOT analysis of Japanese quail egg export in Taiwan

Based on the interview results, this study examines the production and sales supply chain of Taiwan's Japanese quail egg industry and integrates the strengths, weaknesses, opportunities, and threats of Japanese quail egg export, as shown in Table 3.

Table 3. SWOT Analysis of Japanese quail egg export in Taiwan

Strengths

Weaknesses

Opportunities

Threats

Source: compiled by this study.

CONCLUSIONS

To achieve the goal of expanding export sales, this study adopts the concept of the agricultural industry value chain proposed by Chen (2015) to examine the production and sales supply chain of the entire Japanese quail egg industry and uses SWOT analysis to examine and analyze the strengths, weaknesses, opportunities, and threats of Taiwan's Japanese quail egg export sales, and proposes suggestions for production, processing, and export areas.

Production aspect

(1) Strengthen breeding to avoid inbreeding in order to stabilize the quality of Japanese quail eggs, enhance the resistance of breeding birds to disease and reduce the size of quail eggs in order to meet the demand of the Japanese market;

(2) Aim for nutritional precision to stabilize the quality of Japanese quail eggs and to reduce the specifications (size and weight);

(3) Refine the proportion of feed ingredients to reduce production costs;

(4) Modularize farms and barn automation and equip with smart facilities to reduce production costs and increase capacity.

Processing aspect

(1) Automate processing plant equipment to enhance production efficiency and quality yield;

(2) Upgrade processing technology to extend shelf life and product safety; and

(3) Strengthen the diversified development and application of products (fresh eggs, processed eggs, health products, etc.) and cooperation with other industries.

Export sales aspect

The import regulations and special regulations of each export market should be accurately and quickly grasped, and the individual requirements of importers should be met. If Taiwan’s brand can be established, and if Taiwan can smoothly join the CPTPP or negotiate a bilateral free trade agreement, this will help the existing export industry to expand into a diversified international market, as well as help the new export industry to open the international market.

REFERENCES

Chen, Baoji, 2015, Innovative Thinking in Agriculture - Constructing a New Value Chain Agriculture, Agricultural Politics and Agricultural Situation, Vol. 271.

Vision Market Research, 2022, Global Quail Eggs Market Report - Market Size, Share, Growth, Latest News and Trends, Current Strategies Adopted, Demand and Supply, Industry and Competitors Analysis, Impact of COVID-19 And Forecast 2021-2028.