ABSTRACT

Although tobacco consumption was already proven harmful to a person’s health and to the environment, smoking of tobacco-related and vapor products is prevalent in the Philippines. As decades pass by, people become creative and develop varieties of usage and different practices for tobacco consumption which validates the fact that the tobacco industry in the Philippines is a source of income for at least 2.1 million Filipinos. Taxation measures on tobacco and its by-products is the current trend in lowering its consumption in the country. These policies were covered in various taxation measures on tobacco and its by-products.

Keywords: tobacco, tobacco-related products, vapor products, taxation measures

INTRODUCTION

Taxation plays a vital role in the development of a country. It is primarily the source of the budget of the government where it is commonly used to serve the needs and welfare of the “taxpayers.” Some of these expenditures should focus on public infrastructures, schools, roads and highways, improvement of healthcare systems, empowerment of the nation’s agriculture and many others.

But, not all taxes are meant for revenue, there are forms of taxation focused on as a government measure like Republic Act 10351 or also known as the “Sin Tax Reform Law.” It was based on Republic Act 8240 of 1997 wherein it was a measure to control the demand for distilled spirits, wines, fermented liquor and cigars and cigarettes to address the different public health issues these products cause. This is the reason why this policy is also called the “Sin Tax.”

The implementation of this law affected most of the tobacco industry, starting from the farmer/growers, manufactures/processors and the end consumers. This paper will talk about the different implications and effects of the incorporation of new tax increases on tobacco products to the tobacco industry. This paper will also analyze the possible recommendations to improve not just the healthcare and livelihood, but the long-term welfare of the end consumers, manufactures and especially the farmer/growers of tobacco here in the Philippines.

PHILIPPINE TOBACCO INDUSTRY: ITS HISTORICAL BACKGROUND

The Philippines is undeniably very rich in various minerals and natural resources. It is one of the mega-biodiverse countries in the world with different unique species of flora and fauna. Speaking of flora, the Philippines ranked 5th in the world with the number of remarkable plant species (Convention on Biological Diversity, n.d.). These are one of the main reasons why many countries, based on history, sought to hegemonize and colonize the country.

In the 333 years of the Spanish colonization era, we could say that the Philippines was thoroughly immersed in the Spaniard’s way of life. The indigenous Filipinos were constrained to adapt to these social, political, economic and cultural habits and practices they brought in the country. To date, we could still recognize these Spaniard influences that we adapted like in the aspects of food, language, fiestas, and growing of different crops like tobacco.

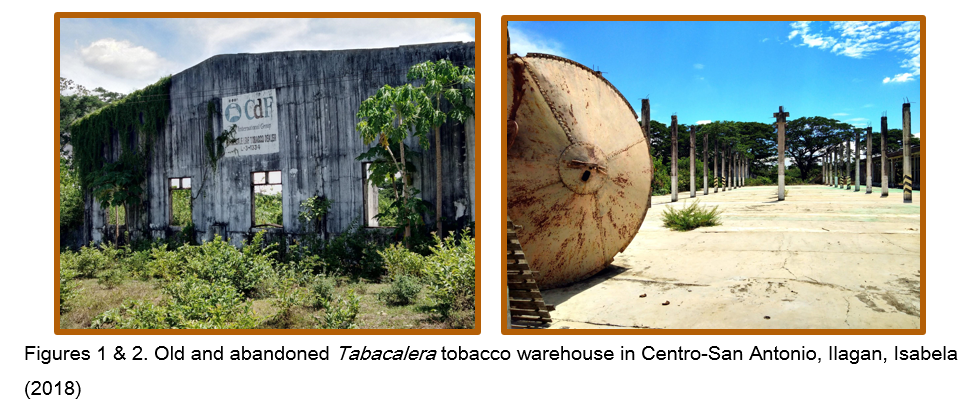

Compañia General de Tabacos de Filipinas or well-known as “Tabacalera” is the premiere tobacco company that nourished the industry of tobacco in the Philippines in 1881 (Tabacalera Incorporada, 2017). Tabacalera is one of the oldest tobacco companies in the world. According to the company, they also established the first and oldest tobacco factory in Asia located in the Philippines. The first tobacco seeds in the Philippines came from Cuba through Spanish galleon ships and it was distributed by Catholic friars in 1592 (Tabacalera Incorporada, 2017). The company also mentioned that many of these seeds thrive well in the soil and climatic condition of Cagayan Valley, specifically, in the province of Isabela. That is why the province became the core of the tobacco industry which became the hotspot of tobacco warehouses and similar infrastructures in that time as shown in Figures 1 & 2 of its remains. It also shows why Isabela is one of the remaining notable provinces that still produces tobacco to this day (Pinoy Kollektor, 2012).

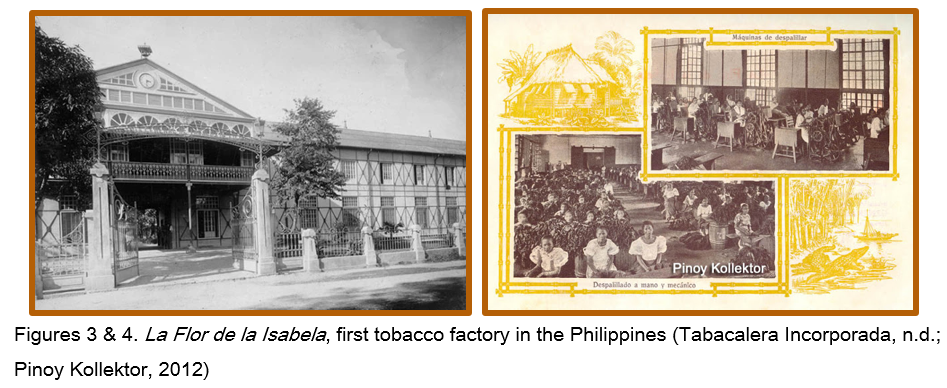

In 1887, Tabacalera established the first world-class and state-of-the-art tobacco factory at that time, the “La Flor de la Isabela” (Flower of Isabel), which is located in Manila, Philippines (Pinoy Kollektor, 2012) as shown in Figure 3. Here in this factory, the company manufactured a product the world cherished at that time, the Manila Cigar (Tabacalera Incorporada, 2017). It produced a large volume of Manila cigars, as shown in Figure 4, that exports to different countries around the world like the United States, Japan, Australia, China and especially the countries in Europe (Pinoy Kollektor, 2012). Tabacalera Incorporada cited that cigars symbolize wealth, power and success (Tabacalera Incorporada, 2017). This also became the aim of the Spaniards when they established the Tobacco Monopoly, aside from the dissemination of Catholicism, in the Philippines. Other products made by Tabacalera Incorporada is shown in Figure 5 below.

TOBACCO AND ITS VARIETIES BEING PRODUCED IN THE PHILIPPINES

General overview of the tobacco industry

Tobacco (Nicotiana tabacum) is the most widely commercially-grown crop among the classification of non-food crops in the country (National Tobacco Administration, n.d.). Tobacco is also well-known for its negative impacts on health like cancer, heart and lung diseases, diabetes, stroke and other tobacco-related diseases (Centers for Disease Control and Prevention, 2016), but still, growing and cultivation of tobacco is making a great impact and a huge part on the nation’s economy (National Tobacco Administration, n.d.). Last 2016, NTA recorded that there were only 40,982 registered tobacco farmers in the country who have their own land for tobacco cultivation (Aloria, M. et al., 2016). Overall, an estimated 2.1 million Filipino people are dependent on the tobacco industry, starting from the level of production, trading, manufacturing/processing, marketing of manufactured products, to the government sector (NTA, 2019).

Common varieties of tobacco

In the Philippines, there are three (3) varieties commonly produced: Native Tobacco, Virginia Tobacco and Burley Tobacco.

- Native Tobacco - commonly and commercially grown in the areas of Cagayan, Isabela, Nueva Vizcaya, Quirino, Ifugao, Mountain Province, Iloilo, Leyte, Negros Oriental, Capiz, Cebu, Misamis Oriental, Zamboanga del Sur, North Cotabato, South Cotabato, Maguindanao, Sarangani, Bukidnon and Davao del Sur (NTA, n.d.).

- Virginia Tobacco - the most cultivated tobacco among the three varieties, is commonly and commercially grown in the areas of Abra, Ilocos Norte, Ilocos Sur, and La Union (NTA, n.d.). This type of tobacco is commonly “flue-cured” or dried in heated barns or warehouses (Philip Morris International, n.d.).

- Burley Tobacco - the least cultivated tobacco among the three varieties, is commonly and commercially grown in the areas of Pangasinan, Tarlac, Nueva Ecija and Oriental Mindoro (NTA, n.d.). This type of tobacco is commonly “air-cured” or left to be air dried in barns or warehouses (Philip Morris International, n.d.).

STATUS OVERVIEW OF THE TOBACCO INDUSTRY

Volume of production

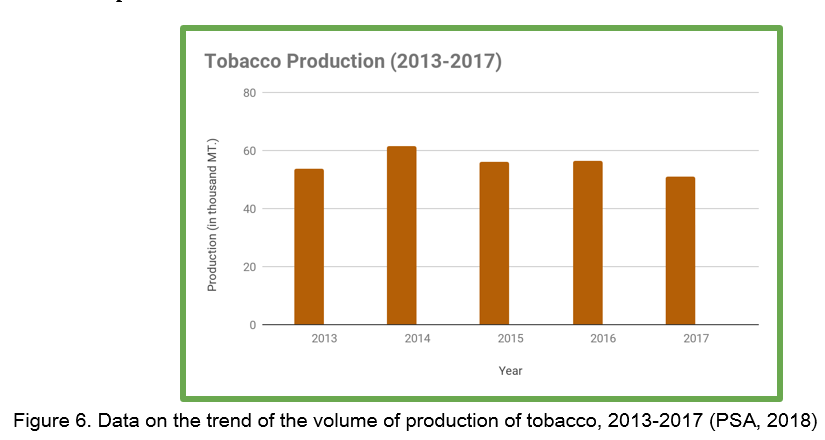

According to the data of PSA last 2018 shown in Figure 6, tobacco production decreases at an average annual rate of 0.9%. The biggest drop in production happened in 2016-2017 where it decreased from 56,457 MT to 51,024 MT, a total of 9.6% decrease in production.

Area planted

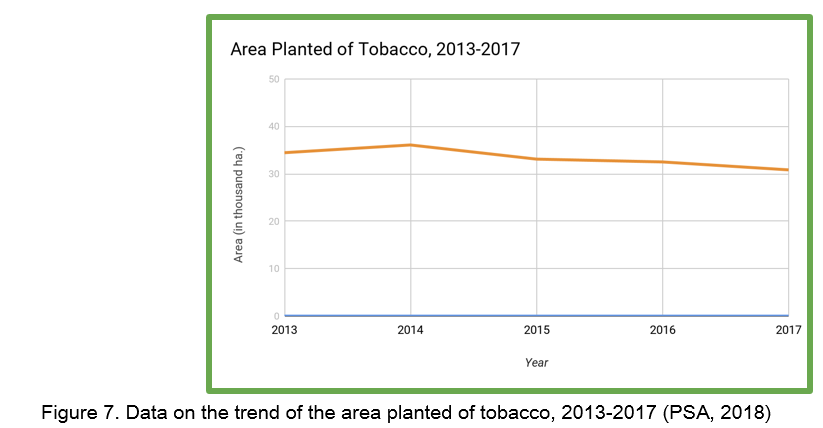

Figure 7 shows the declining trend of the area planted with tobacco in the Philippines. The highest peak was reached in 2014 with 36,082 hectares and since then, it is continuously decreasing where in 2017, it reached 30,829 hectares. Starting from 2013 up to 2017, the area planted for tobacco decreased by an average rate of 2.6%.

Production distribution

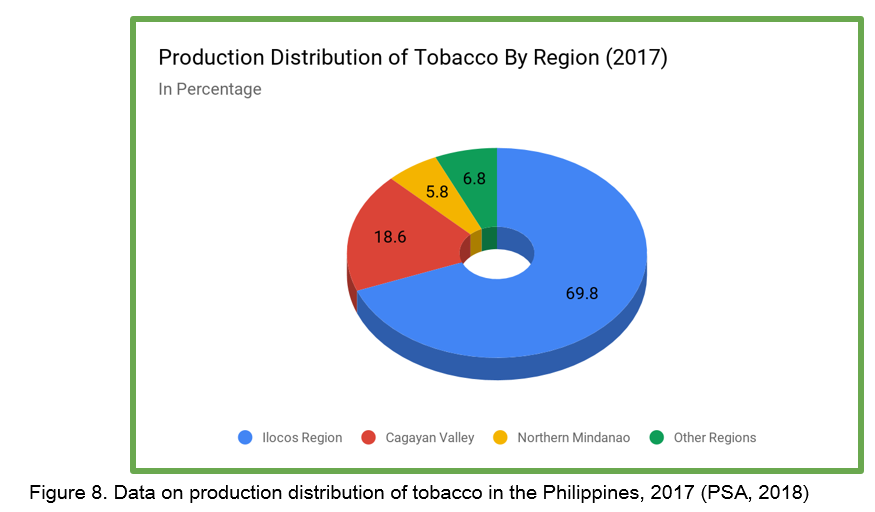

Ilocos Region is the top producer of tobacco in the country. It generated 35,640 MT of tobacco or 69.8% of the country’s overall production in 2017. The other major producing regions were Cagayan Valley and Northern Mindanao with 18.6% and 5.8% of the country’s tobacco production in 2017, respectively (Figure 8).

Production by variety

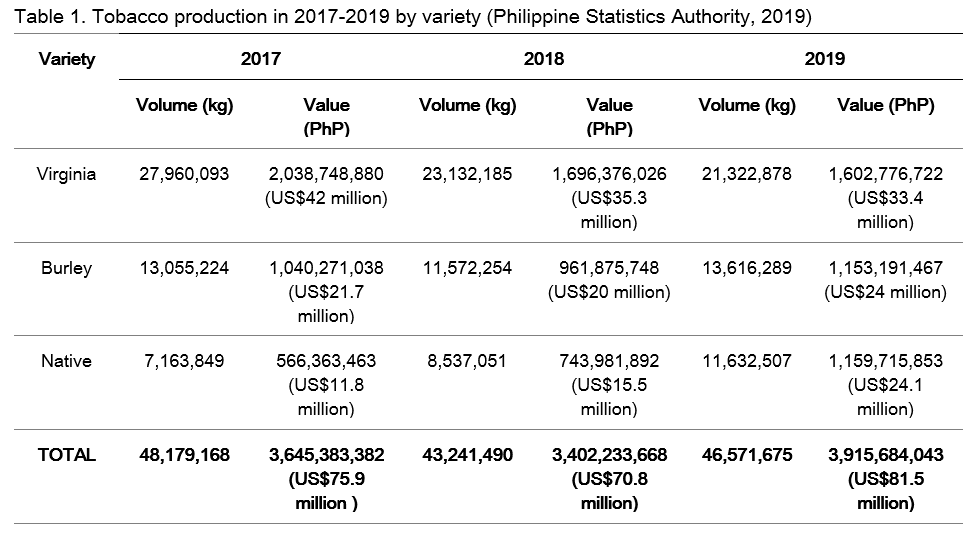

Based on the recorded data of PSA for tobacco production for the period 2013-2017, Table 1 shows that tobacco production is decreasing. From an average of 53,752 MT in 2013, it went down to 46,571 MT in 2019. The biggest drop on the volume of production of tobacco happened in 2018 when it reached 43,241 MT. However, the table below also shows the increase in production for Burley and Native tobacco due to the incentives only the growers of these varieties will receive based on the excise taxation measures imposed on different tobacco-related products wherein Virginia was not included although it was the widely-grown variety.

HEALTH-RELATED EFFECTS OF TOBACCO: CONSUMPTION & CULTIVATION

Tobacco consumption effects on consumers

Although the tobacco industry plays a vital role in the national economy, the downside is its significant effects to human health and wellness. According to the World Health Organization (WHO), the usage of tobacco and its by-products causes about 8 million deaths per year worldwide (World Health Organization, 2020). More than 7 million people of these tallied deaths were direct tobacco users while the remaining deaths, with an estimate of 1.2 million people, were caused by “second-hand smoke” or the indirect tobacco users who inhaled the smoke product coming from the direct tobacco users (World Health Organization, 2020).

These deaths are commonly caused by lung cancer, cardiovascular diseases, pulmonary illnesses and other tobacco-related diseases (Novotny, 2015). WHO also emphasized that these tobacco-related deaths might increase to 8 million deaths per year worldwide by the end of 2030.

Tobacco cultivation effects on farmers/growers

The risks and negative impacts of tobacco are not only felt by its end users but also by the primary producers. The tobacco farmers and farm workers are basically exposed to uncured tobacco which may result in having the “Green Tobacco Sickness” (National Institute for Occupational Safety and Health, 2015). It is a type of nicotine poisoning that causes nausea, vomiting, pallor, dizziness, headaches, increased perspiration, chills, abdominal pain, diarrhea, increased salivation, prostration, weakness, breathlessness, and occasional lowering of blood pressure (Fotedar, S. & Fotedar V., 2017).

To lessen, if not to prevent, these harmful effects of tobacco to farmers, the concerned government agencies and the tobacco manufacturing companies should provide personal protective equipment (PPE) such as water-resistant clothing, chemical-resistant gloves, plastic aprons, and rain suits with boots to workers. Trainings and seminars on the proper use of PPEs and how to properly protect workers/farmers against poisoning from nicotine and exposure to other chemicals used in the cultivation (e.g. pesticide and insecticides) and during the curing process (Fotedar, S. and Fotedar V., 2017).

TOBACCO TAXATION POLICIES IN THE PHILIPPINES[1]

Trend of policies and amendments

Taxation measures on Tobacco and its by-products is the current initiative in lowering the consumption of tobacco in the Philippines. Basically, these policies being passed and imposed from the past years were amendments to the National Internal Revenue Code or the “Tax Code” that tackled the tax being imposed on tobacco and its by-products. Before the enactment of Republic Act (RA)10351 or the “Sin Tax Reform Law” last 2013, the notable policies in relation to the taxation on tobacco are the Republic Act 8424 of 1997 or the “Tax Reform Act of 1997” and the Republic Act 9334 of 2004 or “An Act Increasing the Excise Tax Rates Imposed on Alcohol and Tobacco Products”. Both of these policies are amendments on the National Internal Revenue Code that aims to increase the tax imposed on tobacco products.

Republic Act 8424 (Tax Reform Act of 1997)

During the administration of former President Fidel V. Ramos, RA 8240 was signed and enacted. It increased the tax imposed on all tobacco products to Php 0.75 (US$0.016) per kg except for the products made for chewing where its tax is also increased to Php 0.60 (US$0.012) per kg. For cigars, it was increased to Php 1.00 (US$0.021) per piece. For cigarettes packed by hand, it was increased to Php 0.40 (US$0.01) per pack, consisting of 30 pieces. For cigarettes packed by machine consisting of 20 pieces per pack, it was classified into (4) four categories: if NRP or “Net Retail Price” is below Php 5.00 (US$0.10) per pack, tax was increased to Php 1.00 (US$0.021) per pack ; if NRP is between Php 5.00 - Php 6.50 (US$0.10-0.14) per pack, tax was increased to Php 5.00 (US$0.10) per pack ; if NRP is in the range of Php 6.50 - Php 10.00 (US$0.14-0.21) per pack, tax was increased to Php 8.00 (US$0.17) per pack and lastly, if NRP is Php 10.00 (US$0.21) and above, the tax rate was increased to Php 12.00 (US$0.25) per pack.

Republic Act 9334 of 2004 (an Act increasing the excise tax rates imposed on alcohol and tobacco products)

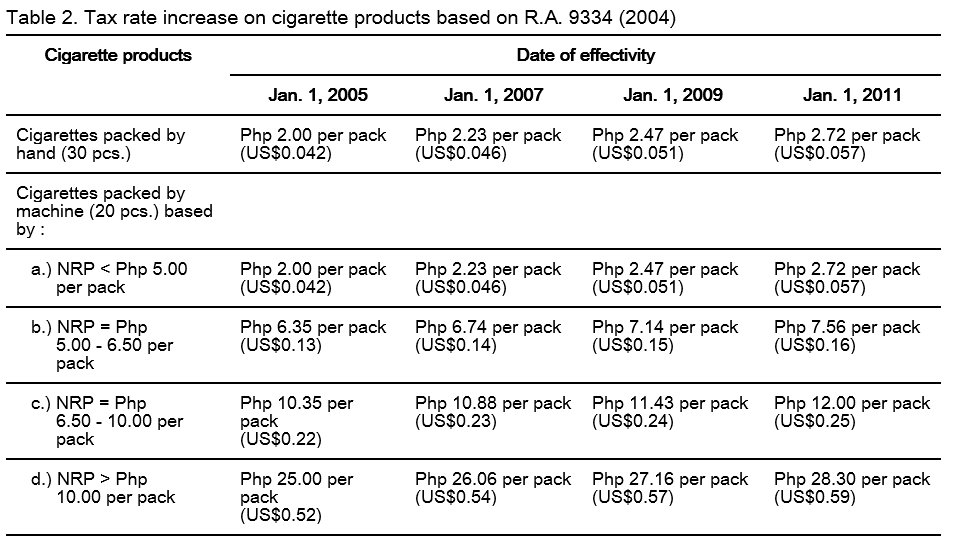

Republic Act 9334 was signed and enacted during former President Gloria Macapagal Arroyo administration. It increased the tax imposed on all tobacco products to Php 1.00 (US$0.021) per kg except for the products made for chewing where its tax is also increased to Php 0.79 (US$0.016) per kg. For cigars, it is now based on ad valorem taxation or a form of excise tax based on the selling price or other specified value of the goods. If the NRP of cigar is less than Php 500.00 (US$10.41), it has a tax of 10% but if the NRP of cigar is more than Php 500.00 (US$10.41), the tax is 15% of the NRP + Php 50.00 (US$10.41). For the case of cigarettes, the taxes charged are presented in Table 2.

Republic Act 10351 (Sin Tax Reform Law of 2012)

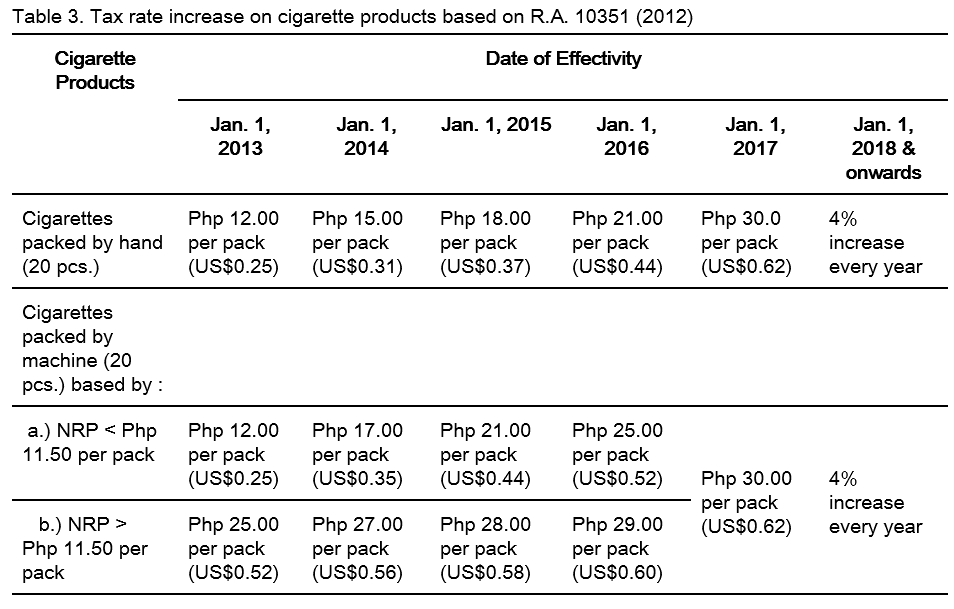

During the administration of former President Benigno Aquino III, RA 10351, officially known as the “Sin Tax Reform Law” or popularly known as the “Sin Tax Law,” was signed and enacted. This amendment emphasizes another increase on the tax rates of tobacco and its by-products. It increased the tax rate on all tobacco products to Php 1.75 (US$0.036) per kg except the products made for chewing where its tax rate also increased to Php 1.50 (US$0.031) per kg. For cigars, it is still based on an ad valorem form of taxation and it was increased to 20% of the NRP but they also added a specific tax of Php 5.00 (US$0.10) per piece of cigar, aside from the ad valorem tax, with an increase of 4% in the next coming year. For the case of cigarettes, the taxes charged are presented in Table 3.

Republic Act 109631 of 2017 (Tax Reform for Acceleration and Inclusion Law)

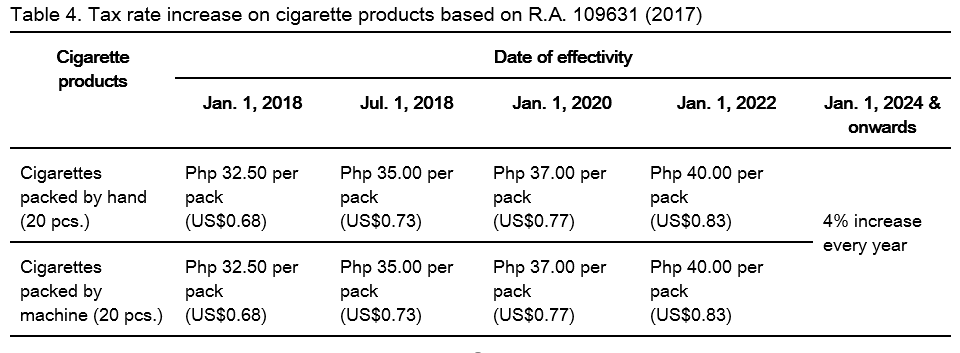

During the current administration of President Rodrigo Duterte, Republic Act 109631, otherwise known as the “Tax Reform for Acceleration and Inclusion Law” or popularly known as the “TRAIN Law” was signed and enacted. The new law did not include an increased tax rate for tobacco and cigars but emphasized more on the increased tax rate on cigarette products (Table 4).

Republic Act 11346 of 2019 (Tobacco Tax Law)

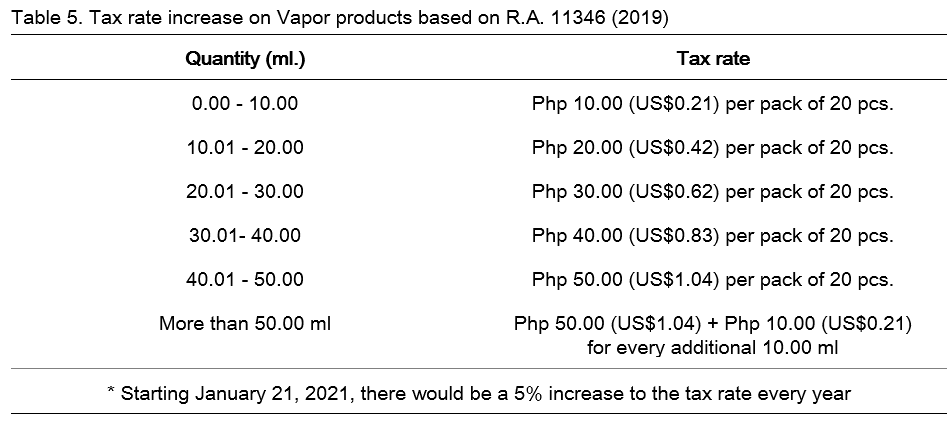

Another law was signed and enacted during President Duterte’s administration - Republic Act 11346 otherwise known as the “An Act Increasing the Excise Tax on Tobacco Products, Imposing Excise Tax on Heated Tobacco Products and Vapor Products, Increasing the Penalties for Violations of Provisions on Articles Subject to Excise Tax, and Earmarking a Portion of the Total Excise Tax Collection From Sugar-sweetened Beverages, Alcohol, Tobacco, Heated Tobacco and Vapor Products for Universal Health Care” or popularly known as the “Tobacco Tax Law of 2018. RA 11346 introduced two (2) new classifications of tobacco-related products to be taxed: (1) the “Heated Tobacco Products” and (2) “Vapor Products”. Heated-tobacco products are the popularly known electronic cigarettes or “e-cigarettes” while Vapor Products are juice/liquid-based smoking mediums which are popularly known as “vapes.” Heated-tobacco products have a tax rate of Php 10.00 (US$0.21) per pack (20 pieces) with an increase of 5% each succeeding year starting January 1, 2021. For Vapor products, Table 5 presents the rates of tax.

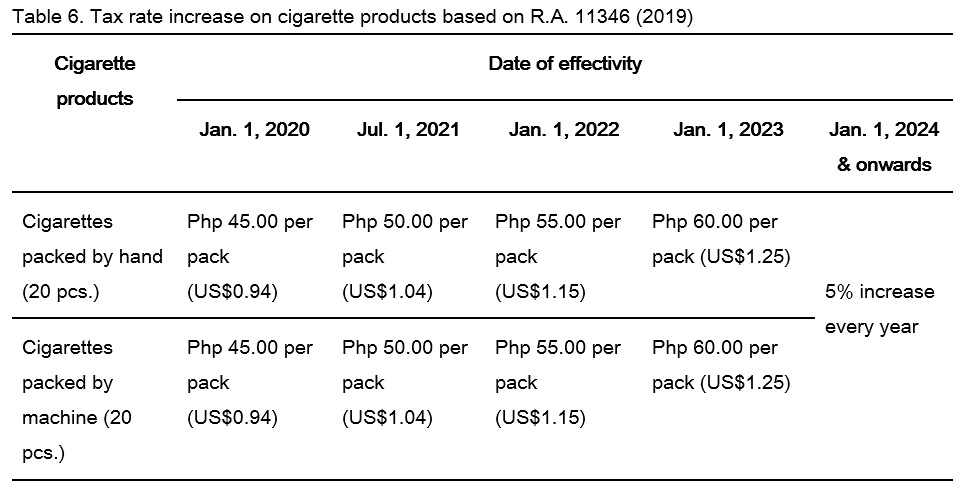

For cigars, it would have a tax rate of 20% ad valorem tax of the NRP. Adding to that, it would have an additional Php 5.00 (US$0.10) specific tax per piece of cigar. These tax rates will be increased to 5% on January 1, 2024. Table 6 shows the tax rates to be charged to cigarette products.

IMPLICATIONS AND EFFECTS OF TAX MEASURES ON THE TOBACCO INDUSTRY[1]

As an action for tobacco-related health problems

The Department of Health (DOH) emphasized on the alarming tobacco-related health problems in the Philippines. It has recorded 117,000 deaths yearly due to tobacco-related illnesses. DOH added that this figure might increase due to the increasing number of smokers in the country with 250,000 new smokers recorded annually (Aurelio, J., Ramos, M. & Yap, DJ, 2019). According to the last Global Adult Tobacco Survey: Philippine Report in 2015, the average age of Filipino smokers ranged from 15 to 34 years old with an average daily consumption of 11 cigarettes (DOH & PSA, 2015). Smoking usually starts during teenage years, prior to becoming actively employed and earning. Hence, many government and non-government agencies around the world are focused on lessening the tobacco consumption of an individual through taxation measures. Increasing taxes on tobacco products are considered viable measures in reducing the consumption of tobacco and its by-products (TobaccoFreeKids.Org, 2017). Due to higher taxes imposed on tobacco products, the prices of these products also increase thereby discouraging increased consumption. It will be a way to lessen the number of potential smokers, and the quantity being consumed among smokers (TobaccoFreeKids.Org, 2017).

As a source of government revenue

According to the Department of Finance Undersecretary Karl Kendrick Chua, DOF estimated around Php 332.3 billion (US$6.92 billion) collection from excise taxes on tobacco-related and vapor products (DOF, 2020). In 2015, the government earning from tobacco-related products was at least Php 143.5 billion (US$2.99 billion) which increased to Php 269 billion (US$5.60 billion) in 2019, an 87.5% increase in government revenue (DOF, 2020). DOF further indicated that during the period 2020-2024, the government is expected to collect an estimated revenue of Php 137.2 billion (US$2.86 billion) due to the enactment of RA 11346 or the Tobacco Tax Law of 2019.

As support to the tobacco farmers/growers

According to RA11346 or the Tobacco Tax Law of 2019, five percent (5%) of the revenues but not exceeding Php 4 billion (US$83.3 million), collected from the excise taxes imposed on different tobacco-related products shall be received by the Native and Burley tobacco-producing provinces annually. This 5% of revenue collection shall have the following distribution: 50% for the provincial government of the tobacco-producing province, and the remaining 50% be divided among the municipalities under that province based on the percentage volume of tobacco produced every year.

The law clearly states that the revenues collected shall be used to empower the livelihood of the tobacco growers, farmers and workers. It specifically emphasized that it shall be used for the following:

- Programs that will provide inputs, training, and other support for tobacco farmers who shift to production of agricultural products other than tobacco including, but not limited to, high-value crops, spices, rice, corn, sugarcane, coconut, livestock and fisheries;

- Programs that will provide financial support for tobacco farmers who are displaced or who cease to produce tobacco;

- Cooperative programs to assist tobacco farmers in planting alternative crops or implementing other livelihood projects:

- Livelihood programs and projects that will promote, enhance, and develop the tourism potential of tobacco-growing provinces;

- Infrastructure projects such as farm-to-market roads, bridges, schools, hospitals, rural health facilities and irrigation systems; and

- Agro-industrial projects that will enable tobacco farmers to be involved in the management and subsequent ownership of projects, such as post-harvest and secondary processing like cigarette-manufacturing and by-product utilization.

As support to the National healthcare system

In addition to the 5% tax revenues that shall be given to the tobacco-producing provinces, 50% of the total annual excise tax revenue collected on tobacco products shall be divided into: (1) 80% to the Philippine Health Insurance Corporation for the implementation of RA 11223 or the “Universal Health Care Law of 2019”, and (2) the remaining 20%, shall be distributed nationwide for medical assistance, for the Health Facilities Enhancement Program (HFEP) and other annual requirements based on the decisions of the DOH. Further, according to R.A. 11346, the revenue collected from the excise taxes from HTPs or heated-tobacco products and vapor products are separated from the tobacco, cigars and cigarette products. Tax collections from HTPs and vapor products shall be distributed similarly to revenue collected from tobacco products.

SUMMARY ANALYSIS AND RECOMMENDATIONS

Although tobacco consumption is proven harmful to a person’s health and the environment, smoking of tobacco-related and vapor products is prevalent in the country and the world in general. As decades pass by, people become creative and develop varieties of usage and different practices for tobacco consumption. Tobacco also significantly contributes to the economy of the Philippines which has served as the main source of income to at least 2.1 million Filipinos.

The Philippines has enacted various laws pertaining to taxation measures on tobacco and its by-products. The aim is to reduce consumption and prevent potential increase of smokers in the country while maintaining a certain level of government revenues. The law should also support the welfare of the farmers through the provision of production inputs, trainings and financial support especially for those who cease from tobacco farming. However, some concerns on the policy implementation are posted such as only the native and burley tobacco-producing provinces will receive the support/assistance according to the Tobacco Taxation Law of 2019. It should be noted that according to the data of the National Tobacco Administration, Virginia tobacco is the most cultivated variety of tobacco in the country. Further, farmgate prices of tobacco are decreasing causing declining area planted to tobacco and decreased income of farmers. Policies on taxation should provide support to producers and farmers such that they will be also protected from the harmful health impacts related to production of tobacco products.

REFERENCES

Aloria, M. & et al. (2016). “The Economics of Tobacco Farming in the Philippines”. Retrieved from https://aer.ph/industrialpolicy/wp-content/uploads/2016/09/

Aurelio, J., Ramos, M. & Yap, DJ. (2019). “Philippines: House, Senate agree on tobacco tax increase”. Retrieved from https://seatca.org/philippines-house-senate-agree-on-tobacco-tax-increase/

Bredenkamp, C., Iglesias, R. & Kaiser, K. (2016). “Sin Tax Reform in the Philippines: Transforming Public Finance, Health, and Governance for More Inclusive Development”. Retrieved from https://openknowledge.worldbank.org/bitstream/handle/10986/24617/9781464...

Casorla, A. & et al. (2012). “The Economics of Tobacco and Tobacco Taxation in the Philippines”. Retrieved from https://www.tobaccofreekids.org/assets/global/pdfs/en/Philippines_tobacc...

Center for Disease Control and Prevention. (2016) “Smoking and Tobacco use: Health effects”. Retrieved from https://www.cdc.gov/tobacco/basic_information/health_effects/index.htm#:....

Convention on Biological Diversity. (N.d.) “Philippines - Main Details”. Retrieved from

https://www.cbd.int/countries/profile/?country=ph

Department of Health & Philippine Statistics Authority. (2015). “Global Adult Tobacco Survey: Philippines Country Report 2015”. Retrieved from https://www.who.int/tobacco/surveillance/survey/gats/phl_country_report....

Fotedar, S. & Fotedar V. (2017). “Green Tobacco Sickness : A Brief Overview”. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5868082/

National Institute for Occupational Safety and Health. (2015). “Recommended Practices: Green Tobacco Sickness”. Retrieved from https://www.cdc.gov/niosh/docs/2015-104/

National Tobacco Administration. (2019). “Tobacco Industry Performance”. Retrieved from https://nta.da.gov.ph/publications_industry.html

Novotny, T. & et al. (2015). “The environmental and health impacts of tobacco agriculture, cigarette manufacture and consumption”. Retrieved from https://www.who.int/bulletin/volumes/93/12/15-152744.pdf

Official Gazette. (1997). “Republic Act 8424”. Retrieved from https://www.officialgazette.gov.ph/1997/12/11/republic-act-no-8424/

Official Gazette. (2012). “Republic Act 10351”. Retrieved from https://www.officialgazette.gov.ph/2012/12/19/republic-act-no-10351/

Official Gazette. (2012). “Sin Tax”. Retrieved from https://www.officialgazette.gov.ph/sin-tax/

Official Gazette. (2019). “Republic Act 11346”. Retrieved from https://www.officialgazette.gov.ph/2019/07/25/republic-act-no-11346/

Philip Morris International. (N.d.). “Tobacco Farming”. Retrieved from https://www.pmi.com/who-we-are/tobacco-facts/tobacco-farming-ancuring#:~....

Philippine Statistics Authority. (2018). “Crop Statistics of the Philippines: 2013-2017”. Retrieved from https://psa.gov.ph/sites/default/files/Crops%20Statistics%20of%20the%20P...

Pino Kollektor. (2012). “La Flor De la Iasbela Cigars and Cigarettes”. Retrieved from http://pinoykollektor.blogspot.com/2012/04/la-flor-de-la-isabela-cigars-...

Sison, Norman. (2019). “From Mexican import to 'Pinas troublemaker: the tabako through time”. Retrieved from https://news.abs-cbn.com/ancx/culture/spotlight/02/01/19/the-tabako-thro...

Tabacalera Incorporada (2017) “Tabacalera: 130 years of cigars and Philippine history”. Retrieved from https://tabacalera.com.ph/blogs/news/tabacalera-130-years-of-cigars-and-....

Tax Reform: Department of Finance. (2019). “Republic Act 10963”. Retrieved from https://taxreform.dof.gov.ph/bills/republict-act-10963-tax-reform-for-ac...

Tax Reform: Department of Finance. (2019). “Republic Act 11346”. Retrieved from https://taxreform.dof.gov.ph/bills/republic-act-no-11346-tobacco-tax-law...

Tax Reform: Department of Finance. (2020). “‘Sin Tax’ collections almost double to P269.1-B in 2019”. Retrieved from https://taxreform.dof.gov.ph/news_and_updates/sin-tax-collections-almost...

The LawPhil Project. (2004). “Republic Act 9334”. Retrieved from https://lawphil.net/statutes/repacts/ra2004/ra_9334_2004.html

TobaccoFreeKids.org. (2017). “Tobacco Tax Success Story: Philippines”. Retrieved from https://www.tobaccofreekids.org/assets/global/pdfs/en/success_Philippine...

[1] The conversion rate used for the currency values mentioned was US$1.00 = Php 48.03.

Taxation Policies: Implications on the Philippine Tobacco Industry

ABSTRACT

Although tobacco consumption was already proven harmful to a person’s health and to the environment, smoking of tobacco-related and vapor products is prevalent in the Philippines. As decades pass by, people become creative and develop varieties of usage and different practices for tobacco consumption which validates the fact that the tobacco industry in the Philippines is a source of income for at least 2.1 million Filipinos. Taxation measures on tobacco and its by-products is the current trend in lowering its consumption in the country. These policies were covered in various taxation measures on tobacco and its by-products.

Keywords: tobacco, tobacco-related products, vapor products, taxation measures

INTRODUCTION

Taxation plays a vital role in the development of a country. It is primarily the source of the budget of the government where it is commonly used to serve the needs and welfare of the “taxpayers.” Some of these expenditures should focus on public infrastructures, schools, roads and highways, improvement of healthcare systems, empowerment of the nation’s agriculture and many others.

But, not all taxes are meant for revenue, there are forms of taxation focused on as a government measure like Republic Act 10351 or also known as the “Sin Tax Reform Law.” It was based on Republic Act 8240 of 1997 wherein it was a measure to control the demand for distilled spirits, wines, fermented liquor and cigars and cigarettes to address the different public health issues these products cause. This is the reason why this policy is also called the “Sin Tax.”

The implementation of this law affected most of the tobacco industry, starting from the farmer/growers, manufactures/processors and the end consumers. This paper will talk about the different implications and effects of the incorporation of new tax increases on tobacco products to the tobacco industry. This paper will also analyze the possible recommendations to improve not just the healthcare and livelihood, but the long-term welfare of the end consumers, manufactures and especially the farmer/growers of tobacco here in the Philippines.

PHILIPPINE TOBACCO INDUSTRY: ITS HISTORICAL BACKGROUND

The Philippines is undeniably very rich in various minerals and natural resources. It is one of the mega-biodiverse countries in the world with different unique species of flora and fauna. Speaking of flora, the Philippines ranked 5th in the world with the number of remarkable plant species (Convention on Biological Diversity, n.d.). These are one of the main reasons why many countries, based on history, sought to hegemonize and colonize the country.

In the 333 years of the Spanish colonization era, we could say that the Philippines was thoroughly immersed in the Spaniard’s way of life. The indigenous Filipinos were constrained to adapt to these social, political, economic and cultural habits and practices they brought in the country. To date, we could still recognize these Spaniard influences that we adapted like in the aspects of food, language, fiestas, and growing of different crops like tobacco.

Compañia General de Tabacos de Filipinas or well-known as “Tabacalera” is the premiere tobacco company that nourished the industry of tobacco in the Philippines in 1881 (Tabacalera Incorporada, 2017). Tabacalera is one of the oldest tobacco companies in the world. According to the company, they also established the first and oldest tobacco factory in Asia located in the Philippines. The first tobacco seeds in the Philippines came from Cuba through Spanish galleon ships and it was distributed by Catholic friars in 1592 (Tabacalera Incorporada, 2017). The company also mentioned that many of these seeds thrive well in the soil and climatic condition of Cagayan Valley, specifically, in the province of Isabela. That is why the province became the core of the tobacco industry which became the hotspot of tobacco warehouses and similar infrastructures in that time as shown in Figures 1 & 2 of its remains. It also shows why Isabela is one of the remaining notable provinces that still produces tobacco to this day (Pinoy Kollektor, 2012).

In 1887, Tabacalera established the first world-class and state-of-the-art tobacco factory at that time, the “La Flor de la Isabela” (Flower of Isabel), which is located in Manila, Philippines (Pinoy Kollektor, 2012) as shown in Figure 3. Here in this factory, the company manufactured a product the world cherished at that time, the Manila Cigar (Tabacalera Incorporada, 2017). It produced a large volume of Manila cigars, as shown in Figure 4, that exports to different countries around the world like the United States, Japan, Australia, China and especially the countries in Europe (Pinoy Kollektor, 2012). Tabacalera Incorporada cited that cigars symbolize wealth, power and success (Tabacalera Incorporada, 2017). This also became the aim of the Spaniards when they established the Tobacco Monopoly, aside from the dissemination of Catholicism, in the Philippines. Other products made by Tabacalera Incorporada is shown in Figure 5 below.

TOBACCO AND ITS VARIETIES BEING PRODUCED IN THE PHILIPPINES

General overview of the tobacco industry

Tobacco (Nicotiana tabacum) is the most widely commercially-grown crop among the classification of non-food crops in the country (National Tobacco Administration, n.d.). Tobacco is also well-known for its negative impacts on health like cancer, heart and lung diseases, diabetes, stroke and other tobacco-related diseases (Centers for Disease Control and Prevention, 2016), but still, growing and cultivation of tobacco is making a great impact and a huge part on the nation’s economy (National Tobacco Administration, n.d.). Last 2016, NTA recorded that there were only 40,982 registered tobacco farmers in the country who have their own land for tobacco cultivation (Aloria, M. et al., 2016). Overall, an estimated 2.1 million Filipino people are dependent on the tobacco industry, starting from the level of production, trading, manufacturing/processing, marketing of manufactured products, to the government sector (NTA, 2019).

Common varieties of tobacco

In the Philippines, there are three (3) varieties commonly produced: Native Tobacco, Virginia Tobacco and Burley Tobacco.

STATUS OVERVIEW OF THE TOBACCO INDUSTRY

Volume of production

According to the data of PSA last 2018 shown in Figure 6, tobacco production decreases at an average annual rate of 0.9%. The biggest drop in production happened in 2016-2017 where it decreased from 56,457 MT to 51,024 MT, a total of 9.6% decrease in production.

Area planted

Figure 7 shows the declining trend of the area planted with tobacco in the Philippines. The highest peak was reached in 2014 with 36,082 hectares and since then, it is continuously decreasing where in 2017, it reached 30,829 hectares. Starting from 2013 up to 2017, the area planted for tobacco decreased by an average rate of 2.6%.

Production distribution

Ilocos Region is the top producer of tobacco in the country. It generated 35,640 MT of tobacco or 69.8% of the country’s overall production in 2017. The other major producing regions were Cagayan Valley and Northern Mindanao with 18.6% and 5.8% of the country’s tobacco production in 2017, respectively (Figure 8).

Production by variety

Based on the recorded data of PSA for tobacco production for the period 2013-2017, Table 1 shows that tobacco production is decreasing. From an average of 53,752 MT in 2013, it went down to 46,571 MT in 2019. The biggest drop on the volume of production of tobacco happened in 2018 when it reached 43,241 MT. However, the table below also shows the increase in production for Burley and Native tobacco due to the incentives only the growers of these varieties will receive based on the excise taxation measures imposed on different tobacco-related products wherein Virginia was not included although it was the widely-grown variety.

HEALTH-RELATED EFFECTS OF TOBACCO: CONSUMPTION & CULTIVATION

Tobacco consumption effects on consumers

Although the tobacco industry plays a vital role in the national economy, the downside is its significant effects to human health and wellness. According to the World Health Organization (WHO), the usage of tobacco and its by-products causes about 8 million deaths per year worldwide (World Health Organization, 2020). More than 7 million people of these tallied deaths were direct tobacco users while the remaining deaths, with an estimate of 1.2 million people, were caused by “second-hand smoke” or the indirect tobacco users who inhaled the smoke product coming from the direct tobacco users (World Health Organization, 2020).

These deaths are commonly caused by lung cancer, cardiovascular diseases, pulmonary illnesses and other tobacco-related diseases (Novotny, 2015). WHO also emphasized that these tobacco-related deaths might increase to 8 million deaths per year worldwide by the end of 2030.

Tobacco cultivation effects on farmers/growers

The risks and negative impacts of tobacco are not only felt by its end users but also by the primary producers. The tobacco farmers and farm workers are basically exposed to uncured tobacco which may result in having the “Green Tobacco Sickness” (National Institute for Occupational Safety and Health, 2015). It is a type of nicotine poisoning that causes nausea, vomiting, pallor, dizziness, headaches, increased perspiration, chills, abdominal pain, diarrhea, increased salivation, prostration, weakness, breathlessness, and occasional lowering of blood pressure (Fotedar, S. & Fotedar V., 2017).

To lessen, if not to prevent, these harmful effects of tobacco to farmers, the concerned government agencies and the tobacco manufacturing companies should provide personal protective equipment (PPE) such as water-resistant clothing, chemical-resistant gloves, plastic aprons, and rain suits with boots to workers. Trainings and seminars on the proper use of PPEs and how to properly protect workers/farmers against poisoning from nicotine and exposure to other chemicals used in the cultivation (e.g. pesticide and insecticides) and during the curing process (Fotedar, S. and Fotedar V., 2017).

TOBACCO TAXATION POLICIES IN THE PHILIPPINES[1]

Trend of policies and amendments

Taxation measures on Tobacco and its by-products is the current initiative in lowering the consumption of tobacco in the Philippines. Basically, these policies being passed and imposed from the past years were amendments to the National Internal Revenue Code or the “Tax Code” that tackled the tax being imposed on tobacco and its by-products. Before the enactment of Republic Act (RA)10351 or the “Sin Tax Reform Law” last 2013, the notable policies in relation to the taxation on tobacco are the Republic Act 8424 of 1997 or the “Tax Reform Act of 1997” and the Republic Act 9334 of 2004 or “An Act Increasing the Excise Tax Rates Imposed on Alcohol and Tobacco Products”. Both of these policies are amendments on the National Internal Revenue Code that aims to increase the tax imposed on tobacco products.

Republic Act 8424 (Tax Reform Act of 1997)

During the administration of former President Fidel V. Ramos, RA 8240 was signed and enacted. It increased the tax imposed on all tobacco products to Php 0.75 (US$0.016) per kg except for the products made for chewing where its tax is also increased to Php 0.60 (US$0.012) per kg. For cigars, it was increased to Php 1.00 (US$0.021) per piece. For cigarettes packed by hand, it was increased to Php 0.40 (US$0.01) per pack, consisting of 30 pieces. For cigarettes packed by machine consisting of 20 pieces per pack, it was classified into (4) four categories: if NRP or “Net Retail Price” is below Php 5.00 (US$0.10) per pack, tax was increased to Php 1.00 (US$0.021) per pack ; if NRP is between Php 5.00 - Php 6.50 (US$0.10-0.14) per pack, tax was increased to Php 5.00 (US$0.10) per pack ; if NRP is in the range of Php 6.50 - Php 10.00 (US$0.14-0.21) per pack, tax was increased to Php 8.00 (US$0.17) per pack and lastly, if NRP is Php 10.00 (US$0.21) and above, the tax rate was increased to Php 12.00 (US$0.25) per pack.

Republic Act 9334 of 2004 (an Act increasing the excise tax rates imposed on alcohol and tobacco products)

Republic Act 9334 was signed and enacted during former President Gloria Macapagal Arroyo administration. It increased the tax imposed on all tobacco products to Php 1.00 (US$0.021) per kg except for the products made for chewing where its tax is also increased to Php 0.79 (US$0.016) per kg. For cigars, it is now based on ad valorem taxation or a form of excise tax based on the selling price or other specified value of the goods. If the NRP of cigar is less than Php 500.00 (US$10.41), it has a tax of 10% but if the NRP of cigar is more than Php 500.00 (US$10.41), the tax is 15% of the NRP + Php 50.00 (US$10.41). For the case of cigarettes, the taxes charged are presented in Table 2.

Republic Act 10351 (Sin Tax Reform Law of 2012)

During the administration of former President Benigno Aquino III, RA 10351, officially known as the “Sin Tax Reform Law” or popularly known as the “Sin Tax Law,” was signed and enacted. This amendment emphasizes another increase on the tax rates of tobacco and its by-products. It increased the tax rate on all tobacco products to Php 1.75 (US$0.036) per kg except the products made for chewing where its tax rate also increased to Php 1.50 (US$0.031) per kg. For cigars, it is still based on an ad valorem form of taxation and it was increased to 20% of the NRP but they also added a specific tax of Php 5.00 (US$0.10) per piece of cigar, aside from the ad valorem tax, with an increase of 4% in the next coming year. For the case of cigarettes, the taxes charged are presented in Table 3.

Republic Act 109631 of 2017 (Tax Reform for Acceleration and Inclusion Law)

During the current administration of President Rodrigo Duterte, Republic Act 109631, otherwise known as the “Tax Reform for Acceleration and Inclusion Law” or popularly known as the “TRAIN Law” was signed and enacted. The new law did not include an increased tax rate for tobacco and cigars but emphasized more on the increased tax rate on cigarette products (Table 4).

Republic Act 11346 of 2019 (Tobacco Tax Law)

Another law was signed and enacted during President Duterte’s administration - Republic Act 11346 otherwise known as the “An Act Increasing the Excise Tax on Tobacco Products, Imposing Excise Tax on Heated Tobacco Products and Vapor Products, Increasing the Penalties for Violations of Provisions on Articles Subject to Excise Tax, and Earmarking a Portion of the Total Excise Tax Collection From Sugar-sweetened Beverages, Alcohol, Tobacco, Heated Tobacco and Vapor Products for Universal Health Care” or popularly known as the “Tobacco Tax Law of 2018. RA 11346 introduced two (2) new classifications of tobacco-related products to be taxed: (1) the “Heated Tobacco Products” and (2) “Vapor Products”. Heated-tobacco products are the popularly known electronic cigarettes or “e-cigarettes” while Vapor Products are juice/liquid-based smoking mediums which are popularly known as “vapes.” Heated-tobacco products have a tax rate of Php 10.00 (US$0.21) per pack (20 pieces) with an increase of 5% each succeeding year starting January 1, 2021. For Vapor products, Table 5 presents the rates of tax.

For cigars, it would have a tax rate of 20% ad valorem tax of the NRP. Adding to that, it would have an additional Php 5.00 (US$0.10) specific tax per piece of cigar. These tax rates will be increased to 5% on January 1, 2024. Table 6 shows the tax rates to be charged to cigarette products.

IMPLICATIONS AND EFFECTS OF TAX MEASURES ON THE TOBACCO INDUSTRY[1]

As an action for tobacco-related health problems

The Department of Health (DOH) emphasized on the alarming tobacco-related health problems in the Philippines. It has recorded 117,000 deaths yearly due to tobacco-related illnesses. DOH added that this figure might increase due to the increasing number of smokers in the country with 250,000 new smokers recorded annually (Aurelio, J., Ramos, M. & Yap, DJ, 2019). According to the last Global Adult Tobacco Survey: Philippine Report in 2015, the average age of Filipino smokers ranged from 15 to 34 years old with an average daily consumption of 11 cigarettes (DOH & PSA, 2015). Smoking usually starts during teenage years, prior to becoming actively employed and earning. Hence, many government and non-government agencies around the world are focused on lessening the tobacco consumption of an individual through taxation measures. Increasing taxes on tobacco products are considered viable measures in reducing the consumption of tobacco and its by-products (TobaccoFreeKids.Org, 2017). Due to higher taxes imposed on tobacco products, the prices of these products also increase thereby discouraging increased consumption. It will be a way to lessen the number of potential smokers, and the quantity being consumed among smokers (TobaccoFreeKids.Org, 2017).

As a source of government revenue

According to the Department of Finance Undersecretary Karl Kendrick Chua, DOF estimated around Php 332.3 billion (US$6.92 billion) collection from excise taxes on tobacco-related and vapor products (DOF, 2020). In 2015, the government earning from tobacco-related products was at least Php 143.5 billion (US$2.99 billion) which increased to Php 269 billion (US$5.60 billion) in 2019, an 87.5% increase in government revenue (DOF, 2020). DOF further indicated that during the period 2020-2024, the government is expected to collect an estimated revenue of Php 137.2 billion (US$2.86 billion) due to the enactment of RA 11346 or the Tobacco Tax Law of 2019.

As support to the tobacco farmers/growers

According to RA11346 or the Tobacco Tax Law of 2019, five percent (5%) of the revenues but not exceeding Php 4 billion (US$83.3 million), collected from the excise taxes imposed on different tobacco-related products shall be received by the Native and Burley tobacco-producing provinces annually. This 5% of revenue collection shall have the following distribution: 50% for the provincial government of the tobacco-producing province, and the remaining 50% be divided among the municipalities under that province based on the percentage volume of tobacco produced every year.

The law clearly states that the revenues collected shall be used to empower the livelihood of the tobacco growers, farmers and workers. It specifically emphasized that it shall be used for the following:

As support to the National healthcare system

In addition to the 5% tax revenues that shall be given to the tobacco-producing provinces, 50% of the total annual excise tax revenue collected on tobacco products shall be divided into: (1) 80% to the Philippine Health Insurance Corporation for the implementation of RA 11223 or the “Universal Health Care Law of 2019”, and (2) the remaining 20%, shall be distributed nationwide for medical assistance, for the Health Facilities Enhancement Program (HFEP) and other annual requirements based on the decisions of the DOH. Further, according to R.A. 11346, the revenue collected from the excise taxes from HTPs or heated-tobacco products and vapor products are separated from the tobacco, cigars and cigarette products. Tax collections from HTPs and vapor products shall be distributed similarly to revenue collected from tobacco products.

SUMMARY ANALYSIS AND RECOMMENDATIONS

Although tobacco consumption is proven harmful to a person’s health and the environment, smoking of tobacco-related and vapor products is prevalent in the country and the world in general. As decades pass by, people become creative and develop varieties of usage and different practices for tobacco consumption. Tobacco also significantly contributes to the economy of the Philippines which has served as the main source of income to at least 2.1 million Filipinos.

The Philippines has enacted various laws pertaining to taxation measures on tobacco and its by-products. The aim is to reduce consumption and prevent potential increase of smokers in the country while maintaining a certain level of government revenues. The law should also support the welfare of the farmers through the provision of production inputs, trainings and financial support especially for those who cease from tobacco farming. However, some concerns on the policy implementation are posted such as only the native and burley tobacco-producing provinces will receive the support/assistance according to the Tobacco Taxation Law of 2019. It should be noted that according to the data of the National Tobacco Administration, Virginia tobacco is the most cultivated variety of tobacco in the country. Further, farmgate prices of tobacco are decreasing causing declining area planted to tobacco and decreased income of farmers. Policies on taxation should provide support to producers and farmers such that they will be also protected from the harmful health impacts related to production of tobacco products.

REFERENCES

Aloria, M. & et al. (2016). “The Economics of Tobacco Farming in the Philippines”. Retrieved from https://aer.ph/industrialpolicy/wp-content/uploads/2016/09/

Aurelio, J., Ramos, M. & Yap, DJ. (2019). “Philippines: House, Senate agree on tobacco tax increase”. Retrieved from https://seatca.org/philippines-house-senate-agree-on-tobacco-tax-increase/

Bredenkamp, C., Iglesias, R. & Kaiser, K. (2016). “Sin Tax Reform in the Philippines: Transforming Public Finance, Health, and Governance for More Inclusive Development”. Retrieved from https://openknowledge.worldbank.org/bitstream/handle/10986/24617/9781464...

Casorla, A. & et al. (2012). “The Economics of Tobacco and Tobacco Taxation in the Philippines”. Retrieved from https://www.tobaccofreekids.org/assets/global/pdfs/en/Philippines_tobacc...

Center for Disease Control and Prevention. (2016) “Smoking and Tobacco use: Health effects”. Retrieved from https://www.cdc.gov/tobacco/basic_information/health_effects/index.htm#:....

Convention on Biological Diversity. (N.d.) “Philippines - Main Details”. Retrieved from

https://www.cbd.int/countries/profile/?country=ph

Department of Health & Philippine Statistics Authority. (2015). “Global Adult Tobacco Survey: Philippines Country Report 2015”. Retrieved from https://www.who.int/tobacco/surveillance/survey/gats/phl_country_report....

Fotedar, S. & Fotedar V. (2017). “Green Tobacco Sickness : A Brief Overview”. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5868082/

National Institute for Occupational Safety and Health. (2015). “Recommended Practices: Green Tobacco Sickness”. Retrieved from https://www.cdc.gov/niosh/docs/2015-104/

National Tobacco Administration. (2019). “Tobacco Industry Performance”. Retrieved from https://nta.da.gov.ph/publications_industry.html

Novotny, T. & et al. (2015). “The environmental and health impacts of tobacco agriculture, cigarette manufacture and consumption”. Retrieved from https://www.who.int/bulletin/volumes/93/12/15-152744.pdf

Official Gazette. (1997). “Republic Act 8424”. Retrieved from https://www.officialgazette.gov.ph/1997/12/11/republic-act-no-8424/

Official Gazette. (2012). “Republic Act 10351”. Retrieved from https://www.officialgazette.gov.ph/2012/12/19/republic-act-no-10351/

Official Gazette. (2012). “Sin Tax”. Retrieved from https://www.officialgazette.gov.ph/sin-tax/

Official Gazette. (2019). “Republic Act 11346”. Retrieved from https://www.officialgazette.gov.ph/2019/07/25/republic-act-no-11346/

Philip Morris International. (N.d.). “Tobacco Farming”. Retrieved from https://www.pmi.com/who-we-are/tobacco-facts/tobacco-farming-ancuring#:~....

Philippine Statistics Authority. (2018). “Crop Statistics of the Philippines: 2013-2017”. Retrieved from https://psa.gov.ph/sites/default/files/Crops%20Statistics%20of%20the%20P...

Pino Kollektor. (2012). “La Flor De la Iasbela Cigars and Cigarettes”. Retrieved from http://pinoykollektor.blogspot.com/2012/04/la-flor-de-la-isabela-cigars-...

Sison, Norman. (2019). “From Mexican import to 'Pinas troublemaker: the tabako through time”. Retrieved from https://news.abs-cbn.com/ancx/culture/spotlight/02/01/19/the-tabako-thro...

Tabacalera Incorporada (2017) “Tabacalera: 130 years of cigars and Philippine history”. Retrieved from https://tabacalera.com.ph/blogs/news/tabacalera-130-years-of-cigars-and-....

Tax Reform: Department of Finance. (2019). “Republic Act 10963”. Retrieved from https://taxreform.dof.gov.ph/bills/republict-act-10963-tax-reform-for-ac...

Tax Reform: Department of Finance. (2019). “Republic Act 11346”. Retrieved from https://taxreform.dof.gov.ph/bills/republic-act-no-11346-tobacco-tax-law...

Tax Reform: Department of Finance. (2020). “‘Sin Tax’ collections almost double to P269.1-B in 2019”. Retrieved from https://taxreform.dof.gov.ph/news_and_updates/sin-tax-collections-almost...

The LawPhil Project. (2004). “Republic Act 9334”. Retrieved from https://lawphil.net/statutes/repacts/ra2004/ra_9334_2004.html

TobaccoFreeKids.org. (2017). “Tobacco Tax Success Story: Philippines”. Retrieved from https://www.tobaccofreekids.org/assets/global/pdfs/en/success_Philippine...

[1] The conversion rate used for the currency values mentioned was US$1.00 = Php 48.03.