Mohd Hafizudin bin Zakaria

Economic and Technology Management Research Centre, MARDI

Persiaran MARDI-UPM, 43400 Serdang, Selangor, Malaysia

Email: apis@mardi.gov.my

Introduction

The use of herbs and spices in daily life was pioneered over hundreds of centuries ago around the world. In China, They are known for their ginseng-based products and health practices, and their recognized medicine known as sinseh. In India, Nepal, and Sri Lanka, their communities are proud with the practice of ayurvedic medicine that could bring vibrant and healthy lives. The Indonesian community is known for their jamu, which is a must in their food intakes since childhood. In Malaysia, herbs and spices are prominent in the Malay community and are often used in daily dishes. There are about 2,000 species of herbs grown in Malaysia which have been reportedly used as medicines and in therapies by many strata of the society and generation (Bidin & Latiff, 1995). According to Soepadmo (1992), there are more than 1,200 species grown in Peninsular Malaysia while more than 2,000 species can be found in Sabah and Sarawak. Most herbal plants are found growing wild in forests, and some are cultivated in home yards.

Currently, there are several herbs which have been cultivated for commercial purposes, such as Kaemprefis galanga, Orthosiphon Stamineus, Aloe vera and Morinda citrifolia. According to the Malaysian Herbal Corporation, the value of industry in Malaysia is about RM17 billion in 2013. Thus, the growing market of herbal industry offers an opportunity as wealth creation, especially to farmers and young generations. The herbal industry offers a high rate of return on investment, and great opportunities to compete in the global markets. People could invest in the production of raw materials or in downstream activities. There are various types of herbal products in both global and domestic markets. The herbal products can be divided into eight main types such as medicines (phytomedicines), nutraceuticals, cosmetics, functional foods, dietary supplements, personal care, flavors and fragrance and botany.

Industrial development

Malaysia has been recognized as a country that has significantly contributed to the herbal industry due to its richness with various biological heritage in medicinal and flowering plant species. According to a report published by the Food and Agriculture Organization (FAO), Malaysia ranked 12th in the world and ranked 4th in Asia as the most biodiverse country. The market value of the herbal industry in Malaysia is projected to reach RM32 billion in 2020, with the annual growth rate between 8% - 15%.

Policies on herbs

The Malaysian government has acknowledged the herbal industry as one of the most promising industries in the future. In addition, this industry is also very much interrelated with the development of agriculture, pharmaceuticals, life science, health care and food. In fact, all Malaysian Development Plans, beginning from the Third Malaysian Plan to the Tenth Malaysian Plan, have policies related to herbal industry. The emphasis on policies related to herbs and spices industries has also been discussed from the First to the Third Industrial Master Plan, the first to the third National Agricultural Policy, National Agro-Food Policy (NAFP)), Science and Technology Policy, Biodiversity Policy, National Traditional and Complementary Medicine Policy, and the National Key Economic Area (NKEA). A herb development secretariat was established under the Ministry of Agriculture and Agro-based Industry, and its function is to coordinate the planning and the development of the herbal industry in Malaysia. Recently, the secretariat was upgraded as the Division of Herbal Development under the same ministry on 15 October 2014. It was emphasized under the NAFP and NKEA that Malaysia will produce and develop high quality herbal products. The production and productivity of high quality herbs are further enhanced with the establishment of the Cluster Development Areas and Permanent Food Production Park (TKPM) especially for herbs and spices in the East Coast Economic Regions (ECER) including Lembaga Kemajuan Kelantan Selatan (KESEDAR) or the South Kelantan Development Authority and Lembaga Kemajuan Terengganu Tengah (KETENGAH) or the Central Terengganu Development Authority.

Production

According to the statistics published by the Department of Agriculture Malaysia, the areas cultivated with herbal crops are around 354 hectares in 2008 and have grown to 1,047 hectares in 2013 with the annual growth rate of 24.2%. Consistant with the increase in cultivated areas, the production of herbs has also increased to 6,905 tons in 2013 with the annual growth rate of 26.9% as shown in Table 1.

Table 1. Planted area and production of herbs* in Malaysia

|

Item

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

Annual

Growth Rate (%)

|

|

Planted Area (Hectares)

|

354

|

578

|

638

|

1,198

|

1,041

|

1,047

|

24.2

|

|

Production (Tones)

|

2,101

|

2,800

|

3,891

|

8,911

|

6,228

|

6,905

|

26.9

|

*Kaemprefis galanga, Orthosiphon stamineus, Aloe vera, Indian pennywort, Morinda citrifolia, Tea tree, Cymbophogon nardus, Eurycoma longifolia, Betel vine

Source: Agrofood Statistic 2013, Ministry of Agriculture and Agro-based Industry

Meanwhile, the planted areas for major spices in Malaysia were 4,535 hectares in 2008 and increased to 5,499 hectares in 2013 with the annual growth rate of 3.9%. However, the productions of major spices decreased to 33,782 tons in 2013 with annual growth rate -1.44% as shown in Table 2.

Table 2. Planted area and production of major spices* in Malaysia

|

Item

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

Annual growth rate (%)

|

|

Planted Area (Hectares)

|

4,535

|

4,899

|

4,889

|

5,178

|

4,880

|

5,499

|

3.9

|

|

Production (Tones)

|

36,303

|

40,350

|

30,032

|

33,349

|

40,409

|

33,782

|

-1.44

|

*Hot chili, ginger, tumeric, greater galangal, musklime, lime, nutmeg, lemon grass

Source: Agrofood Statistics 2013, Ministry of Agriculture and Agro-based Industry

Trade

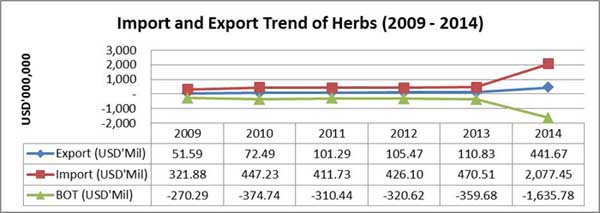

The rapid development of the herbal industry in Malaysia is reflected by its trade. The trade values of herbs between 2009 and 2014 showed an annual growth rate of 45% for imports and 54% for exports. The highest values of imports and exports were recorded in 2014 amounted to USD2077 million and US$441.7 million, respectively. Figure 1 shows the import and export trend of herbs in 2009 until 2014.

Fig. 1. Trends of herbal import and export.

Source: Comtrade Database, 2015

The import and export value indicate that Malaysia is a net importer of herbal products, and most of the imported materials are used in local markets. It also indicates the opportunity of the herbal industry in Malaysia. The value and volume of the raw materials utilized by the domestic herbal industry are huge and they come from many sources notably China, Singapore and India (mostly imported by Chinese, Malay and Indian traditional medicine traders). It is timely for Malaysia to develop a comprehensive master plan that can reduce the importation and increase the exportation, improve the balance of trade in nature.

Supply chains

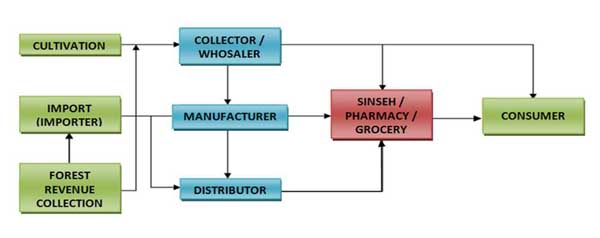

The supply chains of herbs in Malaysia consist of four stages. Generally, the supply of herbs in Malaysia comes from domestic production (cultivated by farmers), forest revenue collection (wild herbs) and imports. The collectors/wholesalers, manufactures or distributors followed by grocery, pharmacy and sinseh represent the marketing and retail sector. Consumer could either obtain herbs and herb products from wholesalers or/and retailers. Figure 2 shows the supply chain of herbs in Malaysia.

Fig. 2. Supply chain of herbs in Malaysia

Source: Surveyed by MARDI, 2010

Issues and challenges

The issues and challenges faced by the herbal industry in Malaysia can be classified into six categories as follows:

Insufficient raw materials

The critical issue pertaining to the herbal industry is insufficient supply of raw materials of some type of herbs for processing industry. Most herbs are obtained from local forests and the rest are imported from neighbouring countries and as far as from China and India. The local production is generally more expensive than imported ones due to higher cost of inputs, especially the labor cost.

Inconsistent quality of raw materials

A study by MARDI in 2002 found that about 50% of herbal entrepreneurs imported their raw materials for processing requirements. Although the prices of imported raw materials are cheaper than the local ones, the quality of the materials are usually inconsistent and low.

Limited cultivation area

The supply of wild herbs started to diminish due to excessive collection. Thus, the price of wild herbs is increasing from time to time. Cultivation of herbs is a smart way to sustain the supply of raw materials and ensure the survival of the herbal industry. However, competition in land use with other sectors has limited cultivation area for herbal crops. Furthermore, herbal crops require special environment for them to grow better.

Technology application not optimum

Inspite of the many technologies that have been developed by research institutions and universities, many of them remained in the laboratories due to lack of technology transfer. Many entrepreneurs and farmers are still practicing conventional methods in planting herbs and in processing herb-based products.

Lack focus on high-value herbal products

Lack of knowledge and information about new technologies has contributed to the production of low quality herbal products; thus they are uncompetitive in nature. The awareness toward high quality products by local consumers, and abundance of supply of herbal products from overseas has intensified the competition in local markets.

Lack of investments from large companies

Modern herbal industry is relatively new in Malaysia. Most companies involved inn the herb industry are small and medium industries (SME). The involvement of big companies in the herbal industry, is still minimal. The government provides many incentives to attract large companies to invest in the herbal industry. It is projected that more than 500big companies will invest in the herbal industry by 2020.

Conclusion

The herbal and spices industry is indeed a long-established industry in the world. However, the modern herbal industry is relatively still in its infancy stage in Malaysia. The future of this industry is very promising and is projected to generate new source of wealth for the nation. At the same time, this industry is still facing many issues and challenges that could prevent it to grow faster. Thus, the industry must be revived as Malaysia has all the advantages with its richness in herbs and spices. The increasing awareness among people about organic plants and traditional medicines is a good starting point to further expand and improve the productivity and development of the herbal industry in Malaysia, which has a good potential now and in the future. In order to enhance the development of the industry, right policy direction, provision of adequate and sufficient resources, research and development and market information must be put in place by the Ministry of Agriculture and Agrobased Industry.

Reference

Agrofood Statistics 2013, Ministry of Agriculture and Agro-based Industry.

Bidin, Latiff (1995). The status of terrestrial biodiversity in Malaysia. In : A. H. Zakri (Ed.). Prospects in biodiversity prospecting. Genetic Society of Malaysia & Universiti Kebangsaan Malaysia. Ms. 59-76.

Dasar Agro-Makanan Negara 2011 – 2020 (2011). Kementerian Pertanian Malaysia dan Industri Asas Tani, Putrajaya.

International Trade Statistics Database, http://comtrade.un.org/. Access on Jan 2015.

Soepadmo, E. (1992). Conservation Status of Medicinal Plants in Peninsular Malaysia. In Khozirah Shaari, Azizol Abd. Kadir & Abd. Razak Mohd. Ali, (Ed.). Medicinal Products from Tropical Rain Forests, FRIM, Kuala Lumpur, Malaysia: 13−23.

|

Date submitted: March 20, 2015

Reviewed, edited and uploaded: March 20, 2015

|

Review of Policies and Issues in the Malaysian Herbal Industry

Mohd Hafizudin bin Zakaria

Economic and Technology Management Research Centre, MARDI

Persiaran MARDI-UPM, 43400 Serdang, Selangor, Malaysia

Email: apis@mardi.gov.my

Introduction

The use of herbs and spices in daily life was pioneered over hundreds of centuries ago around the world. In China, They are known for their ginseng-based products and health practices, and their recognized medicine known as sinseh. In India, Nepal, and Sri Lanka, their communities are proud with the practice of ayurvedic medicine that could bring vibrant and healthy lives. The Indonesian community is known for their jamu, which is a must in their food intakes since childhood. In Malaysia, herbs and spices are prominent in the Malay community and are often used in daily dishes. There are about 2,000 species of herbs grown in Malaysia which have been reportedly used as medicines and in therapies by many strata of the society and generation (Bidin & Latiff, 1995). According to Soepadmo (1992), there are more than 1,200 species grown in Peninsular Malaysia while more than 2,000 species can be found in Sabah and Sarawak. Most herbal plants are found growing wild in forests, and some are cultivated in home yards.

Currently, there are several herbs which have been cultivated for commercial purposes, such as Kaemprefis galanga, Orthosiphon Stamineus, Aloe vera and Morinda citrifolia. According to the Malaysian Herbal Corporation, the value of industry in Malaysia is about RM17 billion in 2013. Thus, the growing market of herbal industry offers an opportunity as wealth creation, especially to farmers and young generations. The herbal industry offers a high rate of return on investment, and great opportunities to compete in the global markets. People could invest in the production of raw materials or in downstream activities. There are various types of herbal products in both global and domestic markets. The herbal products can be divided into eight main types such as medicines (phytomedicines), nutraceuticals, cosmetics, functional foods, dietary supplements, personal care, flavors and fragrance and botany.

Industrial development

Malaysia has been recognized as a country that has significantly contributed to the herbal industry due to its richness with various biological heritage in medicinal and flowering plant species. According to a report published by the Food and Agriculture Organization (FAO), Malaysia ranked 12th in the world and ranked 4th in Asia as the most biodiverse country. The market value of the herbal industry in Malaysia is projected to reach RM32 billion in 2020, with the annual growth rate between 8% - 15%.

Policies on herbs

The Malaysian government has acknowledged the herbal industry as one of the most promising industries in the future. In addition, this industry is also very much interrelated with the development of agriculture, pharmaceuticals, life science, health care and food. In fact, all Malaysian Development Plans, beginning from the Third Malaysian Plan to the Tenth Malaysian Plan, have policies related to herbal industry. The emphasis on policies related to herbs and spices industries has also been discussed from the First to the Third Industrial Master Plan, the first to the third National Agricultural Policy, National Agro-Food Policy (NAFP)), Science and Technology Policy, Biodiversity Policy, National Traditional and Complementary Medicine Policy, and the National Key Economic Area (NKEA). A herb development secretariat was established under the Ministry of Agriculture and Agro-based Industry, and its function is to coordinate the planning and the development of the herbal industry in Malaysia. Recently, the secretariat was upgraded as the Division of Herbal Development under the same ministry on 15 October 2014. It was emphasized under the NAFP and NKEA that Malaysia will produce and develop high quality herbal products. The production and productivity of high quality herbs are further enhanced with the establishment of the Cluster Development Areas and Permanent Food Production Park (TKPM) especially for herbs and spices in the East Coast Economic Regions (ECER) including Lembaga Kemajuan Kelantan Selatan (KESEDAR) or the South Kelantan Development Authority and Lembaga Kemajuan Terengganu Tengah (KETENGAH) or the Central Terengganu Development Authority.

Production

According to the statistics published by the Department of Agriculture Malaysia, the areas cultivated with herbal crops are around 354 hectares in 2008 and have grown to 1,047 hectares in 2013 with the annual growth rate of 24.2%. Consistant with the increase in cultivated areas, the production of herbs has also increased to 6,905 tons in 2013 with the annual growth rate of 26.9% as shown in Table 1.

Table 1. Planted area and production of herbs* in Malaysia

Item

2008

2009

2010

2011

2012

2013

Annual

Growth Rate (%)

Planted Area (Hectares)

354

578

638

1,198

1,041

1,047

24.2

Production (Tones)

2,101

2,800

3,891

8,911

6,228

6,905

26.9

*Kaemprefis galanga, Orthosiphon stamineus, Aloe vera, Indian pennywort, Morinda citrifolia, Tea tree, Cymbophogon nardus, Eurycoma longifolia, Betel vine

Source: Agrofood Statistic 2013, Ministry of Agriculture and Agro-based Industry

Meanwhile, the planted areas for major spices in Malaysia were 4,535 hectares in 2008 and increased to 5,499 hectares in 2013 with the annual growth rate of 3.9%. However, the productions of major spices decreased to 33,782 tons in 2013 with annual growth rate -1.44% as shown in Table 2.

Table 2. Planted area and production of major spices* in Malaysia

Item

2008

2009

2010

2011

2012

2013

Annual growth rate (%)

Planted Area (Hectares)

4,535

4,899

4,889

5,178

4,880

5,499

3.9

Production (Tones)

36,303

40,350

30,032

33,349

40,409

33,782

-1.44

*Hot chili, ginger, tumeric, greater galangal, musklime, lime, nutmeg, lemon grass

Source: Agrofood Statistics 2013, Ministry of Agriculture and Agro-based Industry

Trade

The rapid development of the herbal industry in Malaysia is reflected by its trade. The trade values of herbs between 2009 and 2014 showed an annual growth rate of 45% for imports and 54% for exports. The highest values of imports and exports were recorded in 2014 amounted to USD2077 million and US$441.7 million, respectively. Figure 1 shows the import and export trend of herbs in 2009 until 2014.

Fig. 1. Trends of herbal import and export.

Source: Comtrade Database, 2015

The import and export value indicate that Malaysia is a net importer of herbal products, and most of the imported materials are used in local markets. It also indicates the opportunity of the herbal industry in Malaysia. The value and volume of the raw materials utilized by the domestic herbal industry are huge and they come from many sources notably China, Singapore and India (mostly imported by Chinese, Malay and Indian traditional medicine traders). It is timely for Malaysia to develop a comprehensive master plan that can reduce the importation and increase the exportation, improve the balance of trade in nature.

Supply chains

The supply chains of herbs in Malaysia consist of four stages. Generally, the supply of herbs in Malaysia comes from domestic production (cultivated by farmers), forest revenue collection (wild herbs) and imports. The collectors/wholesalers, manufactures or distributors followed by grocery, pharmacy and sinseh represent the marketing and retail sector. Consumer could either obtain herbs and herb products from wholesalers or/and retailers. Figure 2 shows the supply chain of herbs in Malaysia.

Fig. 2. Supply chain of herbs in Malaysia

Source: Surveyed by MARDI, 2010

Issues and challenges

The issues and challenges faced by the herbal industry in Malaysia can be classified into six categories as follows:

Insufficient raw materials

The critical issue pertaining to the herbal industry is insufficient supply of raw materials of some type of herbs for processing industry. Most herbs are obtained from local forests and the rest are imported from neighbouring countries and as far as from China and India. The local production is generally more expensive than imported ones due to higher cost of inputs, especially the labor cost.

Inconsistent quality of raw materials

A study by MARDI in 2002 found that about 50% of herbal entrepreneurs imported their raw materials for processing requirements. Although the prices of imported raw materials are cheaper than the local ones, the quality of the materials are usually inconsistent and low.

Limited cultivation area

The supply of wild herbs started to diminish due to excessive collection. Thus, the price of wild herbs is increasing from time to time. Cultivation of herbs is a smart way to sustain the supply of raw materials and ensure the survival of the herbal industry. However, competition in land use with other sectors has limited cultivation area for herbal crops. Furthermore, herbal crops require special environment for them to grow better.

Technology application not optimum

Inspite of the many technologies that have been developed by research institutions and universities, many of them remained in the laboratories due to lack of technology transfer. Many entrepreneurs and farmers are still practicing conventional methods in planting herbs and in processing herb-based products.

Lack focus on high-value herbal products

Lack of knowledge and information about new technologies has contributed to the production of low quality herbal products; thus they are uncompetitive in nature. The awareness toward high quality products by local consumers, and abundance of supply of herbal products from overseas has intensified the competition in local markets.

Lack of investments from large companies

Modern herbal industry is relatively new in Malaysia. Most companies involved inn the herb industry are small and medium industries (SME). The involvement of big companies in the herbal industry, is still minimal. The government provides many incentives to attract large companies to invest in the herbal industry. It is projected that more than 500big companies will invest in the herbal industry by 2020.

Conclusion

The herbal and spices industry is indeed a long-established industry in the world. However, the modern herbal industry is relatively still in its infancy stage in Malaysia. The future of this industry is very promising and is projected to generate new source of wealth for the nation. At the same time, this industry is still facing many issues and challenges that could prevent it to grow faster. Thus, the industry must be revived as Malaysia has all the advantages with its richness in herbs and spices. The increasing awareness among people about organic plants and traditional medicines is a good starting point to further expand and improve the productivity and development of the herbal industry in Malaysia, which has a good potential now and in the future. In order to enhance the development of the industry, right policy direction, provision of adequate and sufficient resources, research and development and market information must be put in place by the Ministry of Agriculture and Agrobased Industry.

Reference

Agrofood Statistics 2013, Ministry of Agriculture and Agro-based Industry.

Bidin, Latiff (1995). The status of terrestrial biodiversity in Malaysia. In : A. H. Zakri (Ed.). Prospects in biodiversity prospecting. Genetic Society of Malaysia & Universiti Kebangsaan Malaysia. Ms. 59-76.

Dasar Agro-Makanan Negara 2011 – 2020 (2011). Kementerian Pertanian Malaysia dan Industri Asas Tani, Putrajaya.

International Trade Statistics Database, http://comtrade.un.org/. Access on Jan 2015.

Soepadmo, E. (1992). Conservation Status of Medicinal Plants in Peninsular Malaysia. In Khozirah Shaari, Azizol Abd. Kadir & Abd. Razak Mohd. Ali, (Ed.). Medicinal Products from Tropical Rain Forests, FRIM, Kuala Lumpur, Malaysia: 13−23.

Date submitted: March 20, 2015

Reviewed, edited and uploaded: March 20, 2015