Sung-Jae Chun

Public-Service Advocate of Korea

FTA compensation for income loss will be given to sorghum, potato, sweet potato, Korean native calf and compensation for closure will be given to Korean native calf. This is the first case of compensation for food crops since the implementation of the FTA compensation policy in 2004. The compensation will be allocated until the end of the year following the applications from the farm.

The Ministry of Agriculture, Food and Rural Affairs (Minister LEE Dong-Phil, hereinafter ‘MAFRA’) has announced on May 29th, 2014 that it has planned for the FTA Compensation for Income Loss on sorghum, potato, sweet potato, Korean native calf and compensation for closure on Korean native calf. The Compensation for Income Loss is paid with being based on the 「Special Act On Assistance To Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements」. The certain amount (90%) of the declined price is being preserved by the government when the price of domestic agricultural products declines (90%) due to the increase of imports by the implementation of the FTA. Meanwhile, the Compensation for Closure is paid with being based on 「Special Act On Assistance To Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements」. Three years of net gain is being preserved by the government when the farmer closes down due to the rapid increase of imports by the implementation of the FTA.

According to MAFRA, ‘Support Committee for Farmers Upon the Implementation of the FTA (hereinafter ‘Support Committee’)’ have opened the 1st Meeting in 2014 on May 29th and decided on the items for Compensation for Income Loss and for Closure upon the implementation of the FTA last year. Additionally, the items for FTA compensation are reviewed by the Support Committee based on the analysis by ‘Support Center for Farmers Upon the Implementation of the FTA (hereinafter ‘Support Center’)’.

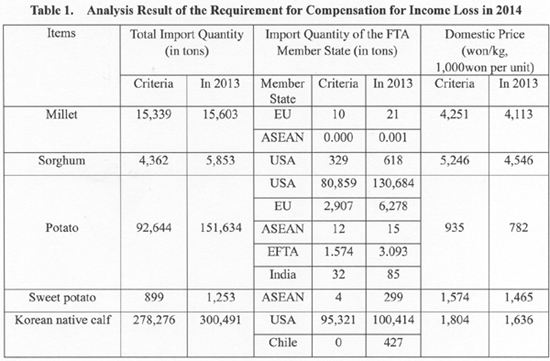

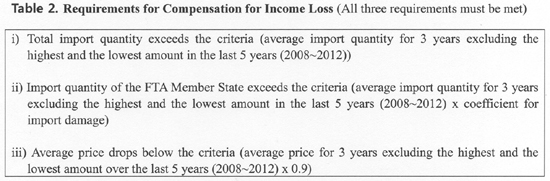

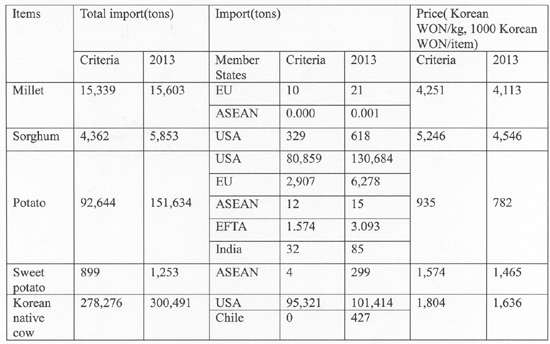

In case of Compensation for Income Loss, based on the analysis by Support Center on import quantity in 2013 and domestic price, millet, sorghum, potato, sweet potato and Korean native cow have all fulfilled the requirements of Table 2 like following table 1.

Since the implementation of the Compensation for Income Loss upon Korea-Chile FTA in 2004, the policy was first put into effect last year on Korean native cows and calves. It was the first time that the policy is applied upon food crops like millet, sorghum, potato and sweet potato.

Moreover, Support Committee has confirmed the Contribution Ratio of Import (CRI) in order to only reflect the effect of increase in import on the decrease in price according to the purpose of the law upon calculating the amount of direct payment. The CRI means the contribution ration of increase in import on the decrease in price. In January 2013, when the Support Committee calculated the amount of direct payment, it has decided to apply the CRI excluding the decrease in price caused by the increase in domestic supply and to only apply the decrease in price by FTA importation. Accordingly, the 1st Support Committee has reviewed and decided the level of contribution to be the following: millet 0.0%; sorghum 13.4%; potato 36.0%; sweet potato 0.55%; Korean native cows 31.0%. This will be applied when deciding the amount of direct payment. The related formula is as follows.

*Direct payment for income loss = (production area x national average production per area unit) x [(base price – average price in 2013) x 0.9] x coordination factor

** Coordination factor = (available amount of subsidy / requested amount of compensation) x Contribution Ratio of Import (CRI)

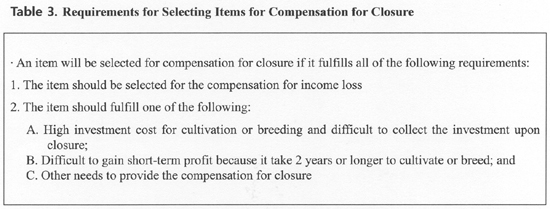

Furthermore, Support Committee has reviewed and decided to include Korean native cows on compensation for closure. Such measure is based on the law that items for compensation for closure should be chosen among the items for compensation for income loss. Among the items for compensation for income loss, food crops such as millet, sorghum, potato and sweet potato do not need large investment costs such as cost of equipment and since they are perennial crops, they are not eligible for compensation for closure. Compensation for Closure is targeted for farms with breeding cows and is limited to farms in which cows for breeding are closed for business. However, the size of the compensation for closure will consider factors such as the appropriate number of Korean native cows, budget size and priorities for support and apply them upon yearly support plans. Table 3 shows Requirements for Selecting Items for Compensation for Closure.

MAFRA will announce the selected items by the middle of June and upon the application of farms, analysis and review by the local government, the compensation for income loss and closure will be allocated by December. However, since the compensation for income loss cannot go over the subsidy limit by WTO Agreements on Agriculture, the unit cost of payment and budget required cost will be finalized on December by the review of the Support Committee figuring out the total amount of the payment after receiving the farmer’s applications.

According to the officials from MAFRA, since compensation for income loss was first allocated last year, the ministry will distribute compensation for income loss on food crops such as sorghum, potato and sweet potato without delay. Furthermore, the ministry will proceed with the backup measures on the FTA to minimize the damage on agricultural and fishery products as the FTA expands.

Reference Materials for FTA Compensation for Income Loss and Closure

Reference 1 The Result of the Selection of Items for FTA Compensation for Income Loss

□ (Investigation and Analyzing Agency) Korea Rural Economic Institute* (Center for FTA Farmer’s Support)

* Reviewed and decided by Supporting Committee for FTA Farmers and designated by the Minister (March 8, 2012)

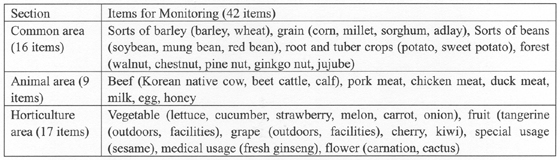

□ (Items for Investigation) 42 items subjected to monitoring

* Items for monitoring: The items designated by the Minister because of a considerable impact on domestic market upon FTA implementation (9 animal products, 17 horticultural and herbal products, 16 cereals, etc.).

Items for investigation and analysis by Center for FTA Farmer’s Support

□ (The Result of the Analysis) 5 items have fulfilled the requirements for FTA Compensation for Income Loss (millet, sorghum, potato, sweet potato, Korean native cow).

[Annex 1] Summary of the Compensation for Income Loss

□ (Purpose) The purpose of the Compensation for Income Loss is to preserve certain amount of the price decline of items that suffered decline in price due to rapid increase of import quantities upon FTA implementation.

□ (Subjected items) Agricultural and fishery products in which tariff is being reduced or abolished or those products subjected to the increase in tariff rate quota

□ (Criteria of provision) All of the following three requirements should be fulfilled to receive compensation

① (Price Requirement) The subject’s average price of the year drops lower than 90% of the average price for 3 years excluding the highest and the lowest amount over the last 5 years

② (Total import quantity requirement) Total import quantity of the year exceeds the average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

③ (Import quantity requirement) Import quantity from the Member State exceeds the average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

* {average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years(2008~2012)} x (coefficient for import damage)

□ (Calculation Method) production area x national average production per area unit x unit cost of payment x coordination factor

○ (livestock industry) number of shipment (出荷) x unit cost of payment x coordination factor

○ (unit cost of payment*) 90% of the difference between the standard price and average price of the year

* {(average price for 3 years excluding the highest and the lowest amount in the last 5 years) x 0.9} – average price of the year} x 0.9

○ (coordination factor) = (available amount of subsidy / requested amount of compensation) x Contribution Ratio of Import(CRI) *

* The amount of influence the increase of import quantity on the decline of price of the item

[Annex 2] Details of the Requirement of the Compensation for Income Loss

□ (1st Requirement) Tariff should be reduced or abolished according to the agreement or tariff rate quota should be increased (Sub-paragraph 1, paragraph 2, article 4, Enforcement Decree of the Special Act on Assistance following the FTA)

□ (2nd Requirement) The total amount of import on the year should be larger than the standard amount of import upon the implementation of the agreement (Sub-paragraph 2, paragraph 1, article 7, the Special Act on Assistance following the FTA)

① Total amount of import: the amount of import worldwide

② The standard amount of import: average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

□ (3rd Requirement) The total amount of import from the Member State of the agreement of the year should be larger than the standard amount of import upon the implementation of the agreement (Sub-paragraph 2, paragraph 1, article 7, the Special Act on Assistance following the FTA)

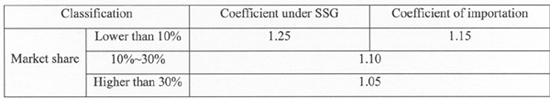

① The standard amount of import: (average import quantity for 3 years excluding the highest and the lowest amount in the last 5 years} x (Coefficient of importation (收入發動係數))

② Coefficient of importation: Considering the special emergency tariff standard coefficient for agricultural and livestock products in the Enforcement Decree of the Customs Act (Orders from the Minister, August 24, 2011), the Coefficient of importation is decided according to the market share.

□ (4th Requirement) The average price of the item of the year falls lower than the standard price upon the implementation of the agreement (Sub-paragraph 1, paragraph 1, article 7, the Special Act on Assistance following the FTA)

① Standard price: average price for 3 years excluding the highest and the lowest amount in the last 5 years x 90%

[Annex 3] Summary of the Support for Closure

□ (Purpose) Compensation for Closure is allocated to items in which it is difficult to cultivate and raise due to the implementation of FTA

○ Criteria for selection, criteria for allocation, calculation method, allocation procedure and implementation period will be stipulated in the enforcement decree.

□ (Criteria for selection) The item should be among the items for compensation for income loss and should be regarded as appropriate for compensation for closure*

*① It takes large amount of investment cost and is difficult to collect the cost upon closure, ② it takes 2 years to cultivate, raise and feed therefore is difficult to earn profit over a short period of time, ③ other needs for support

□ (Criteria for allocation) in case which the farmers or fishermen demolish or discard the place of business, land, trees or fishing boats, fishing gears and other facilities that have been in use before the implementation.

○ However, if it falls under each sub-paragraph of paragraph 1, article 7 in the enforcement decree,* the compensation is not given.

*① the item is not produced for longer than a year prior to the notification of the items ②the items are demolished or discarded due to reasons other than agricultural or fishery work such as construction of buildings or roads, ③ cases in which the Minister has recognized such as compensation is given by another Act

○ The details of the requirement is decided by the Minister after the Supporting Committee’s review.

□ (Calculation Method) area of demolition or discard x yearly net gain per unit square meter x 3 years

○ livestock = unit shipment of livestock x yearly net gain per each unit x 3 years

□ (Implementation period) 5 years since the implementation of Korea-EU FTA (July 1, 2011~2016).

This is the news release of Ministry of Agriculture, Food and Rural Affairs of Korea.

|

Date submitted: July 16, 2014

Reviewed, edited and uploaded: July 18, 2014

|

The First Case of FTA Compensation for Income Loss on Food Crops in Korea

Sung-Jae Chun

Public-Service Advocate of Korea

FTA compensation for income loss will be given to sorghum, potato, sweet potato, Korean native calf and compensation for closure will be given to Korean native calf. This is the first case of compensation for food crops since the implementation of the FTA compensation policy in 2004. The compensation will be allocated until the end of the year following the applications from the farm.

The Ministry of Agriculture, Food and Rural Affairs (Minister LEE Dong-Phil, hereinafter ‘MAFRA’) has announced on May 29th, 2014 that it has planned for the FTA Compensation for Income Loss on sorghum, potato, sweet potato, Korean native calf and compensation for closure on Korean native calf. The Compensation for Income Loss is paid with being based on the 「Special Act On Assistance To Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements」. The certain amount (90%) of the declined price is being preserved by the government when the price of domestic agricultural products declines (90%) due to the increase of imports by the implementation of the FTA. Meanwhile, the Compensation for Closure is paid with being based on 「Special Act On Assistance To Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements」. Three years of net gain is being preserved by the government when the farmer closes down due to the rapid increase of imports by the implementation of the FTA.

According to MAFRA, ‘Support Committee for Farmers Upon the Implementation of the FTA (hereinafter ‘Support Committee’)’ have opened the 1st Meeting in 2014 on May 29th and decided on the items for Compensation for Income Loss and for Closure upon the implementation of the FTA last year. Additionally, the items for FTA compensation are reviewed by the Support Committee based on the analysis by ‘Support Center for Farmers Upon the Implementation of the FTA (hereinafter ‘Support Center’)’.

In case of Compensation for Income Loss, based on the analysis by Support Center on import quantity in 2013 and domestic price, millet, sorghum, potato, sweet potato and Korean native cow have all fulfilled the requirements of Table 2 like following table 1.

Since the implementation of the Compensation for Income Loss upon Korea-Chile FTA in 2004, the policy was first put into effect last year on Korean native cows and calves. It was the first time that the policy is applied upon food crops like millet, sorghum, potato and sweet potato.

Moreover, Support Committee has confirmed the Contribution Ratio of Import (CRI) in order to only reflect the effect of increase in import on the decrease in price according to the purpose of the law upon calculating the amount of direct payment. The CRI means the contribution ration of increase in import on the decrease in price. In January 2013, when the Support Committee calculated the amount of direct payment, it has decided to apply the CRI excluding the decrease in price caused by the increase in domestic supply and to only apply the decrease in price by FTA importation. Accordingly, the 1st Support Committee has reviewed and decided the level of contribution to be the following: millet 0.0%; sorghum 13.4%; potato 36.0%; sweet potato 0.55%; Korean native cows 31.0%. This will be applied when deciding the amount of direct payment. The related formula is as follows.

*Direct payment for income loss = (production area x national average production per area unit) x [(base price – average price in 2013) x 0.9] x coordination factor

** Coordination factor = (available amount of subsidy / requested amount of compensation) x Contribution Ratio of Import (CRI)

Furthermore, Support Committee has reviewed and decided to include Korean native cows on compensation for closure. Such measure is based on the law that items for compensation for closure should be chosen among the items for compensation for income loss. Among the items for compensation for income loss, food crops such as millet, sorghum, potato and sweet potato do not need large investment costs such as cost of equipment and since they are perennial crops, they are not eligible for compensation for closure. Compensation for Closure is targeted for farms with breeding cows and is limited to farms in which cows for breeding are closed for business. However, the size of the compensation for closure will consider factors such as the appropriate number of Korean native cows, budget size and priorities for support and apply them upon yearly support plans. Table 3 shows Requirements for Selecting Items for Compensation for Closure.

MAFRA will announce the selected items by the middle of June and upon the application of farms, analysis and review by the local government, the compensation for income loss and closure will be allocated by December. However, since the compensation for income loss cannot go over the subsidy limit by WTO Agreements on Agriculture, the unit cost of payment and budget required cost will be finalized on December by the review of the Support Committee figuring out the total amount of the payment after receiving the farmer’s applications.

According to the officials from MAFRA, since compensation for income loss was first allocated last year, the ministry will distribute compensation for income loss on food crops such as sorghum, potato and sweet potato without delay. Furthermore, the ministry will proceed with the backup measures on the FTA to minimize the damage on agricultural and fishery products as the FTA expands.

References

Reference Materials for FTA Compensation for Income Loss and Closure

Reference 1 The Result of the Selection of Items for FTA Compensation for Income Loss

□ (Investigation and Analyzing Agency) Korea Rural Economic Institute* (Center for FTA Farmer’s Support)

* Reviewed and decided by Supporting Committee for FTA Farmers and designated by the Minister (March 8, 2012)

□ (Items for Investigation) 42 items subjected to monitoring

* Items for monitoring: The items designated by the Minister because of a considerable impact on domestic market upon FTA implementation (9 animal products, 17 horticultural and herbal products, 16 cereals, etc.).

Items for investigation and analysis by Center for FTA Farmer’s Support

□ (The Result of the Analysis) 5 items have fulfilled the requirements for FTA Compensation for Income Loss (millet, sorghum, potato, sweet potato, Korean native cow).

[Annex 1] Summary of the Compensation for Income Loss

□ (Purpose) The purpose of the Compensation for Income Loss is to preserve certain amount of the price decline of items that suffered decline in price due to rapid increase of import quantities upon FTA implementation.

□ (Subjected items) Agricultural and fishery products in which tariff is being reduced or abolished or those products subjected to the increase in tariff rate quota

□ (Criteria of provision) All of the following three requirements should be fulfilled to receive compensation

① (Price Requirement) The subject’s average price of the year drops lower than 90% of the average price for 3 years excluding the highest and the lowest amount over the last 5 years

② (Total import quantity requirement) Total import quantity of the year exceeds the average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

③ (Import quantity requirement) Import quantity from the Member State exceeds the average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

* {average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years(2008~2012)} x (coefficient for import damage)

□ (Calculation Method) production area x national average production per area unit x unit cost of payment x coordination factor

○ (livestock industry) number of shipment (出荷) x unit cost of payment x coordination factor

○ (unit cost of payment*) 90% of the difference between the standard price and average price of the year

* {(average price for 3 years excluding the highest and the lowest amount in the last 5 years) x 0.9} – average price of the year} x 0.9

○ (coordination factor) = (available amount of subsidy / requested amount of compensation) x Contribution Ratio of Import(CRI) *

* The amount of influence the increase of import quantity on the decline of price of the item

[Annex 2] Details of the Requirement of the Compensation for Income Loss

□ (1st Requirement) Tariff should be reduced or abolished according to the agreement or tariff rate quota should be increased (Sub-paragraph 1, paragraph 2, article 4, Enforcement Decree of the Special Act on Assistance following the FTA)

□ (2nd Requirement) The total amount of import on the year should be larger than the standard amount of import upon the implementation of the agreement (Sub-paragraph 2, paragraph 1, article 7, the Special Act on Assistance following the FTA)

① Total amount of import: the amount of import worldwide

② The standard amount of import: average import quantity for 3 years excluding the highest and the lowest amount over the last 5 years

□ (3rd Requirement) The total amount of import from the Member State of the agreement of the year should be larger than the standard amount of import upon the implementation of the agreement (Sub-paragraph 2, paragraph 1, article 7, the Special Act on Assistance following the FTA)

① The standard amount of import: (average import quantity for 3 years excluding the highest and the lowest amount in the last 5 years} x (Coefficient of importation (收入發動係數))

② Coefficient of importation: Considering the special emergency tariff standard coefficient for agricultural and livestock products in the Enforcement Decree of the Customs Act (Orders from the Minister, August 24, 2011), the Coefficient of importation is decided according to the market share.

□ (4th Requirement) The average price of the item of the year falls lower than the standard price upon the implementation of the agreement (Sub-paragraph 1, paragraph 1, article 7, the Special Act on Assistance following the FTA)

① Standard price: average price for 3 years excluding the highest and the lowest amount in the last 5 years x 90%

[Annex 3] Summary of the Support for Closure

□ (Purpose) Compensation for Closure is allocated to items in which it is difficult to cultivate and raise due to the implementation of FTA

○ Criteria for selection, criteria for allocation, calculation method, allocation procedure and implementation period will be stipulated in the enforcement decree.

□ (Criteria for selection) The item should be among the items for compensation for income loss and should be regarded as appropriate for compensation for closure*

*① It takes large amount of investment cost and is difficult to collect the cost upon closure, ② it takes 2 years to cultivate, raise and feed therefore is difficult to earn profit over a short period of time, ③ other needs for support

□ (Criteria for allocation) in case which the farmers or fishermen demolish or discard the place of business, land, trees or fishing boats, fishing gears and other facilities that have been in use before the implementation.

○ However, if it falls under each sub-paragraph of paragraph 1, article 7 in the enforcement decree,* the compensation is not given.

*① the item is not produced for longer than a year prior to the notification of the items ②the items are demolished or discarded due to reasons other than agricultural or fishery work such as construction of buildings or roads, ③ cases in which the Minister has recognized such as compensation is given by another Act

○ The details of the requirement is decided by the Minister after the Supporting Committee’s review.

□ (Calculation Method) area of demolition or discard x yearly net gain per unit square meter x 3 years

○ livestock = unit shipment of livestock x yearly net gain per each unit x 3 years

□ (Implementation period) 5 years since the implementation of Korea-EU FTA (July 1, 2011~2016).

This is the news release of Ministry of Agriculture, Food and Rural Affairs of Korea.

Date submitted: July 16, 2014

Reviewed, edited and uploaded: July 18, 2014